-

S&P 500 (SPX) Bullish Elliott Wave Sequence Remains in Play

Read MoreSPX impulsive rally remains in progress and Index should see further upside. This article and video look at the Elliott Wave path.

-

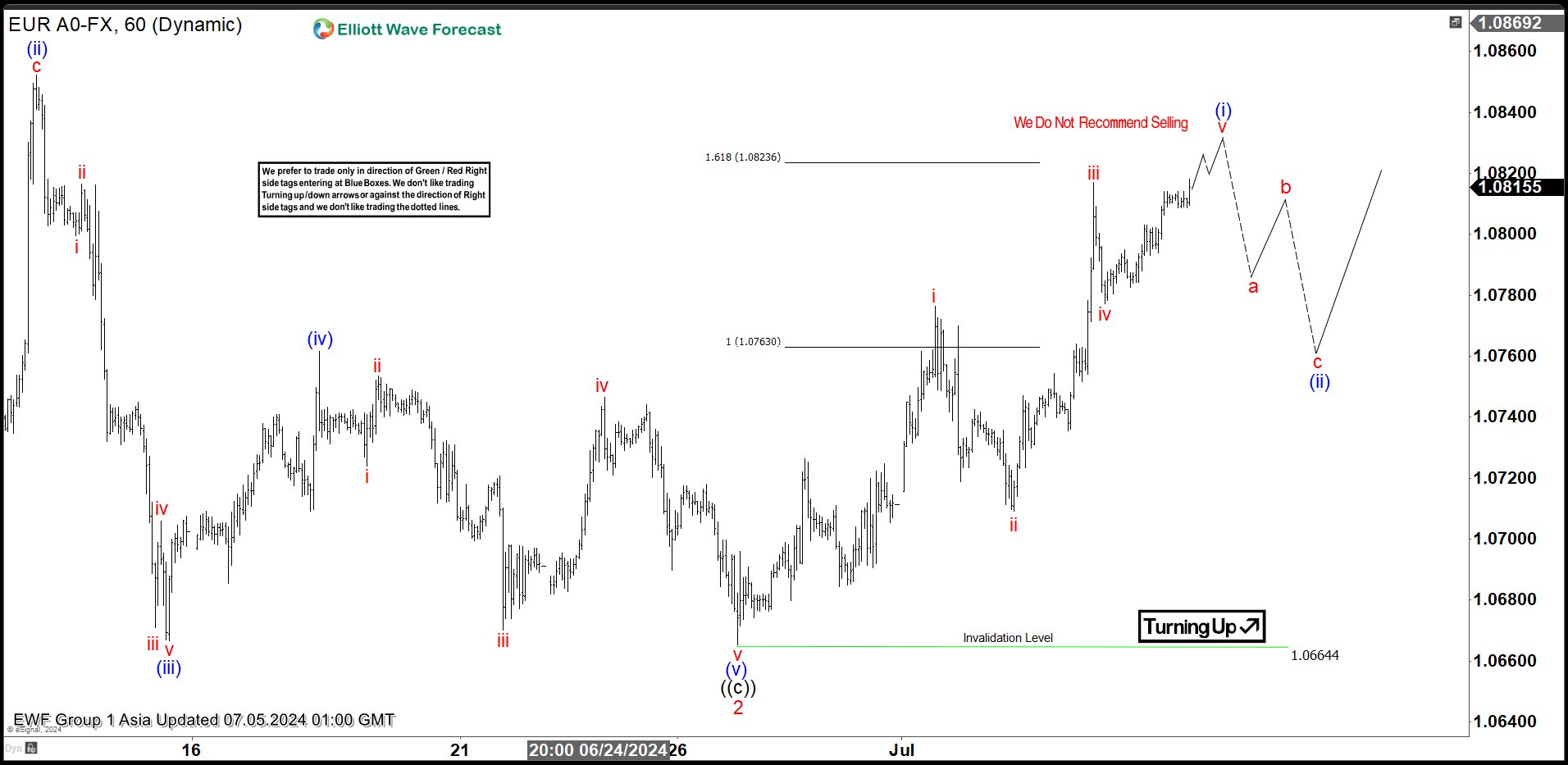

Elliott Wave Expects EURUSD to Turn Higher

Read MoreEURUSD has turned higher and expected to rally in impulsive structure. This article and video look at the Elliott Wave path for the pair.

-

Elliott Wave Intraday Looking for S&P 500 ETF (SPY) to End Wave 5

Read MoreS&P 500 ETF (SPY) extends higher in wave ((v)). This article and video look at the short term Elliott Wave path for the ETF.

-

Silver Miners ETF (SIL) Correction In Progress

Read MoreSIL (Silver Miners ETF) is a financial product designed to mirror the performance of silver mining companies. It offers investors a straightforward way to gain exposure to the silver market without directly purchasing physical silver or individual mining stocks. SIL diversifies risk by spreading investments across multiple companies within the sector, potentially providing a hedge […]

-

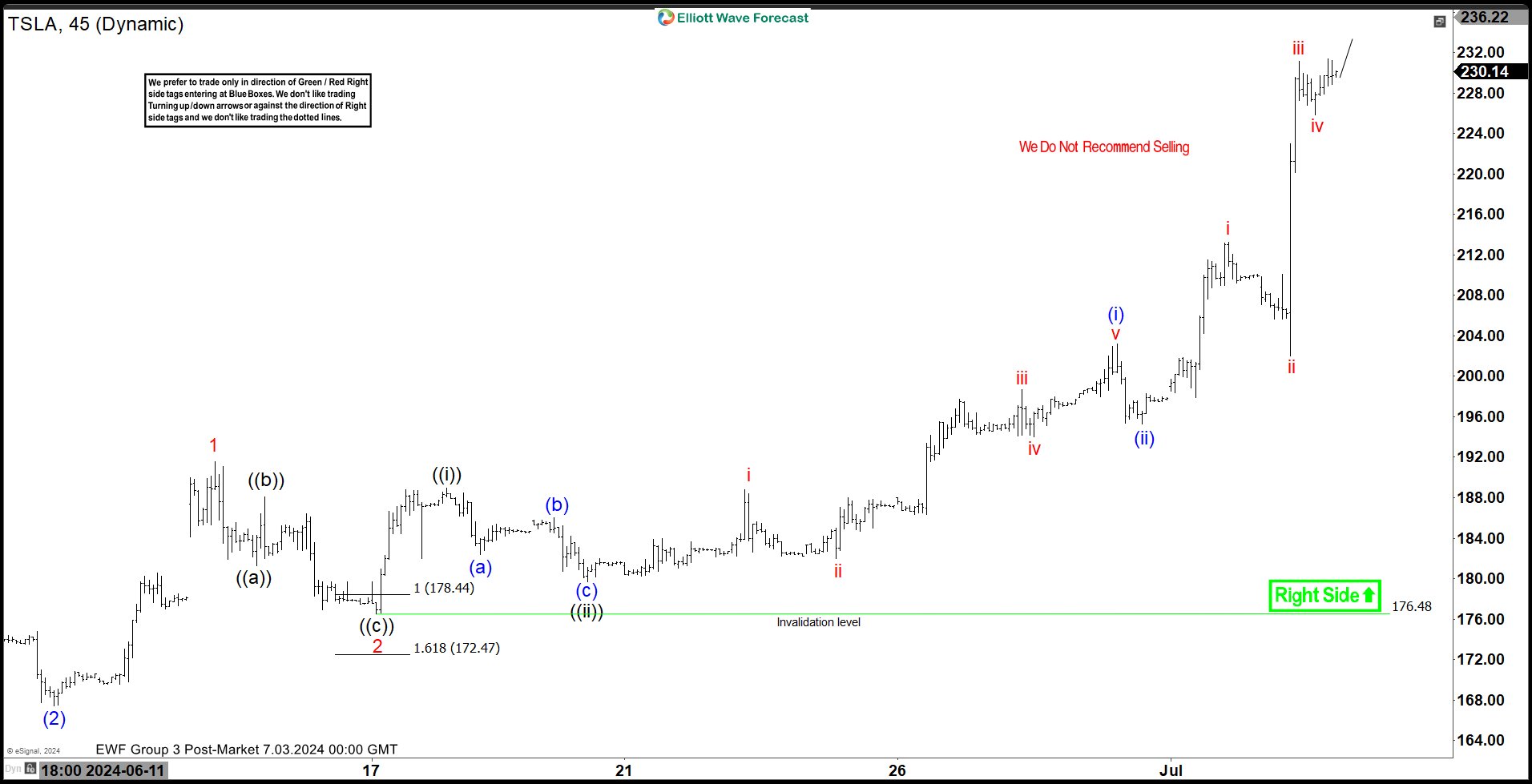

Elliott Wave Looking for New Impulsive Rally in Tesla (TSLA)

Read MoreTesla (TSLA) is rallying as an impulse from 6.12.2024 low. This article and video look at the Elliott Wave path for the stock.

-

Elliott Wave Intraday Analysis Looking for $USDCHF to Correct in Wave (2)

Read MoreUSDCHF is correcting cycle from 5.1.2024 high before turning lower. This article and video look at the Elliott Wave path for the pair.