-

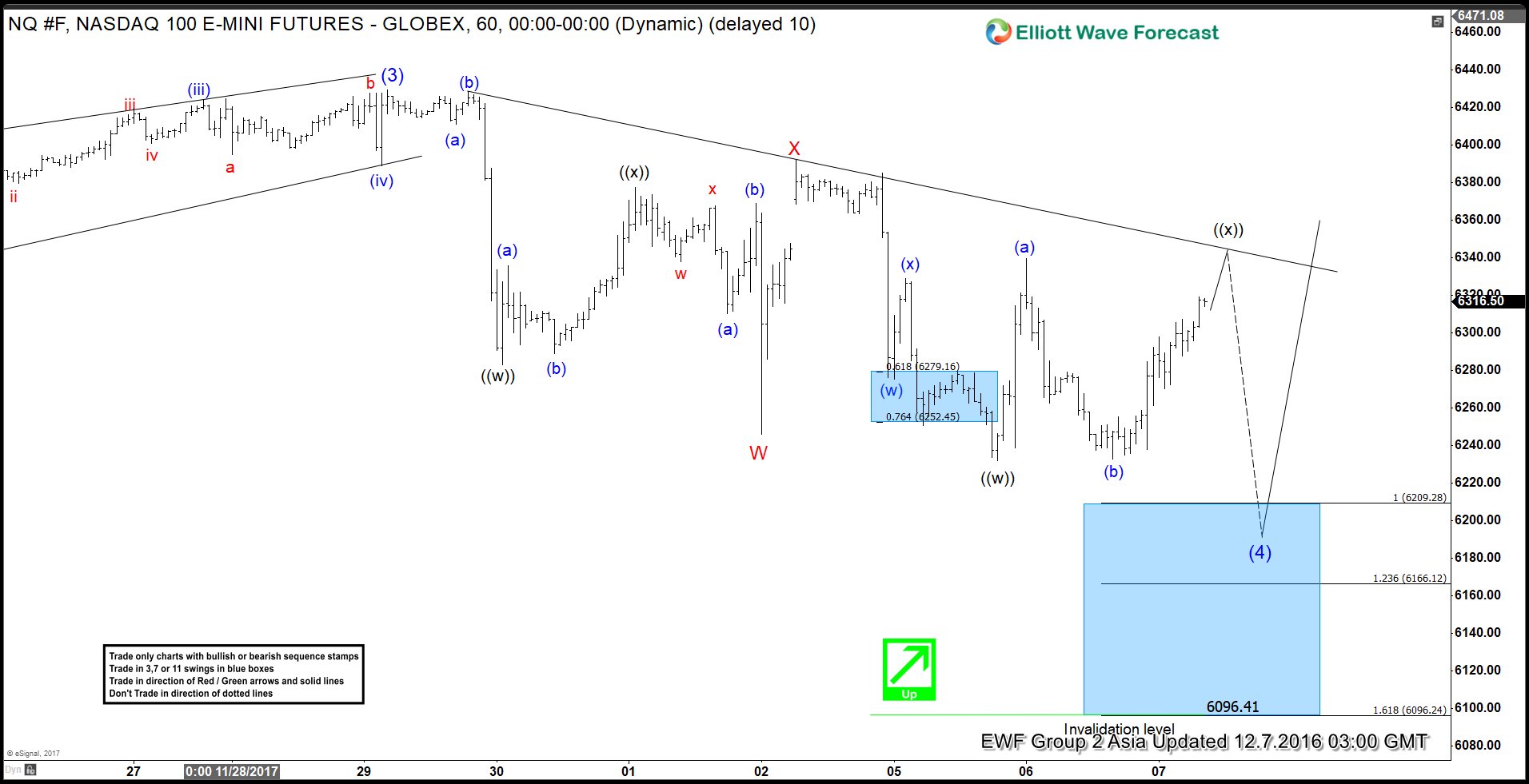

Nasdaq Elliott Wave Analysis 12-8-2017

Read MoreNasdaq Short Term Elliott Wave view suggests that Intermediate wave (3) ended at 6429.5 and Intermediate wave (4) pullback is proposed complete at 6231.75. Subdivision of Intermediate wave (4) is unfolding as a double three Elliott wave structure where Minor wave W ended at 6283, Minor wave X ended at 6391.75, and Minor wave Y of (4) ended at 6231.75. Index still needs to […]

-

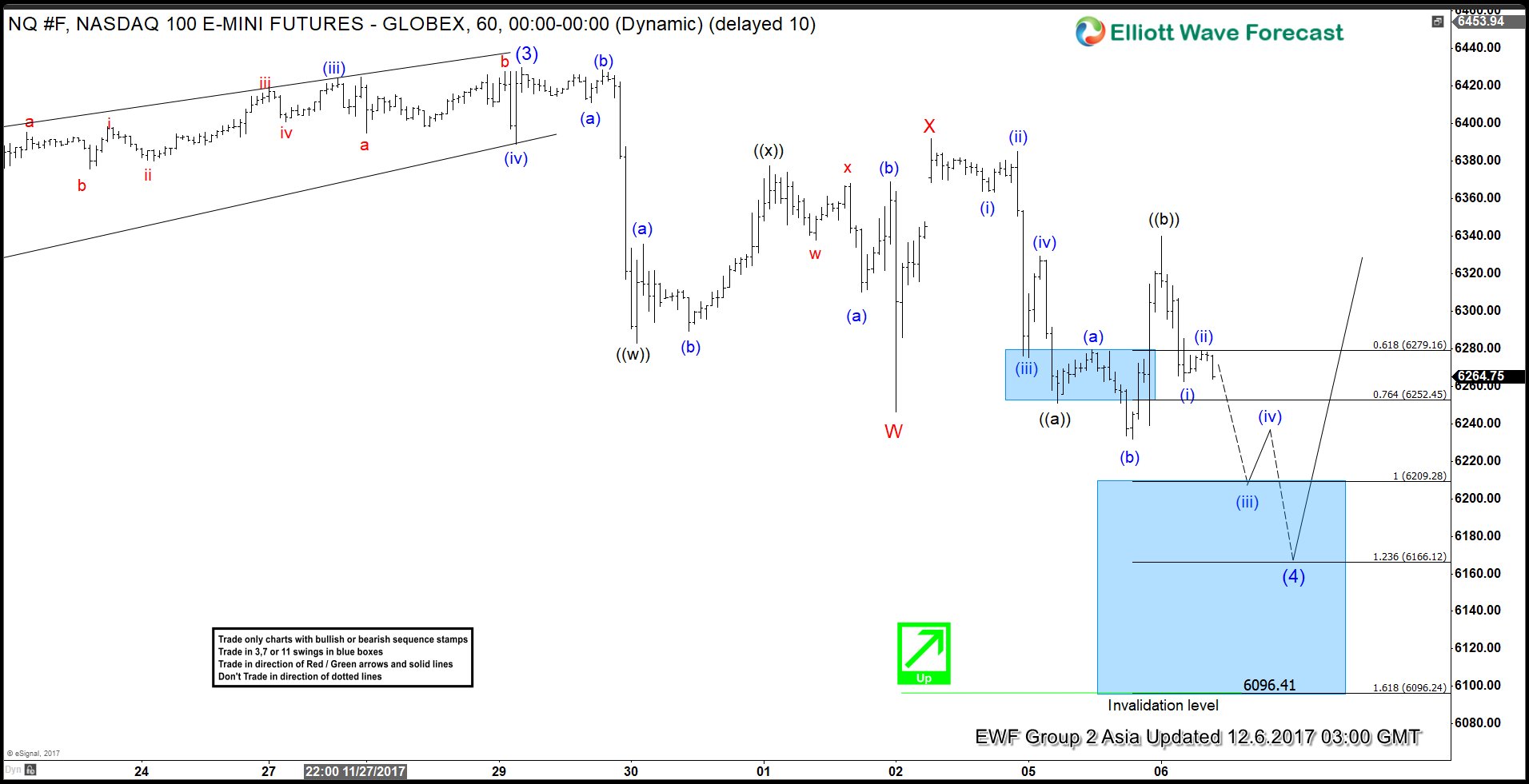

Nasdaq Intra-Day Elliott Wave Analysis

Read MoreNasdaq Intraday Elliott Wave view suggests that rally to 6429.5 ended Intermediate wave (3). Intermediate wave (4) pullback is currently in progress to correct cycle from 8/21 low (5753.6) in 3, 7, or 11 swing before the rally resumes. Subdivision of Intermediate wave (4) is unfolding as a double three Elliott wave structure where Minor wave W ended at 6246 and […]

-

Nasdaq Elliott Wave Analysis 12.6.2017

Read MoreNasdaq Intraday Elliott Wave view suggests that Intermediate wave (3) ended with the rally to 6429.5. Intermediate wave (4) pullback remains in progress to correct cycle from 8/21 low (5753.6) in 3, 7, or 11 swing before the rally resumes. Intermediate wave (4) is unfolding as a double three Elliott wave structure where Minor wave W ended at 6246 and Minor […]

-

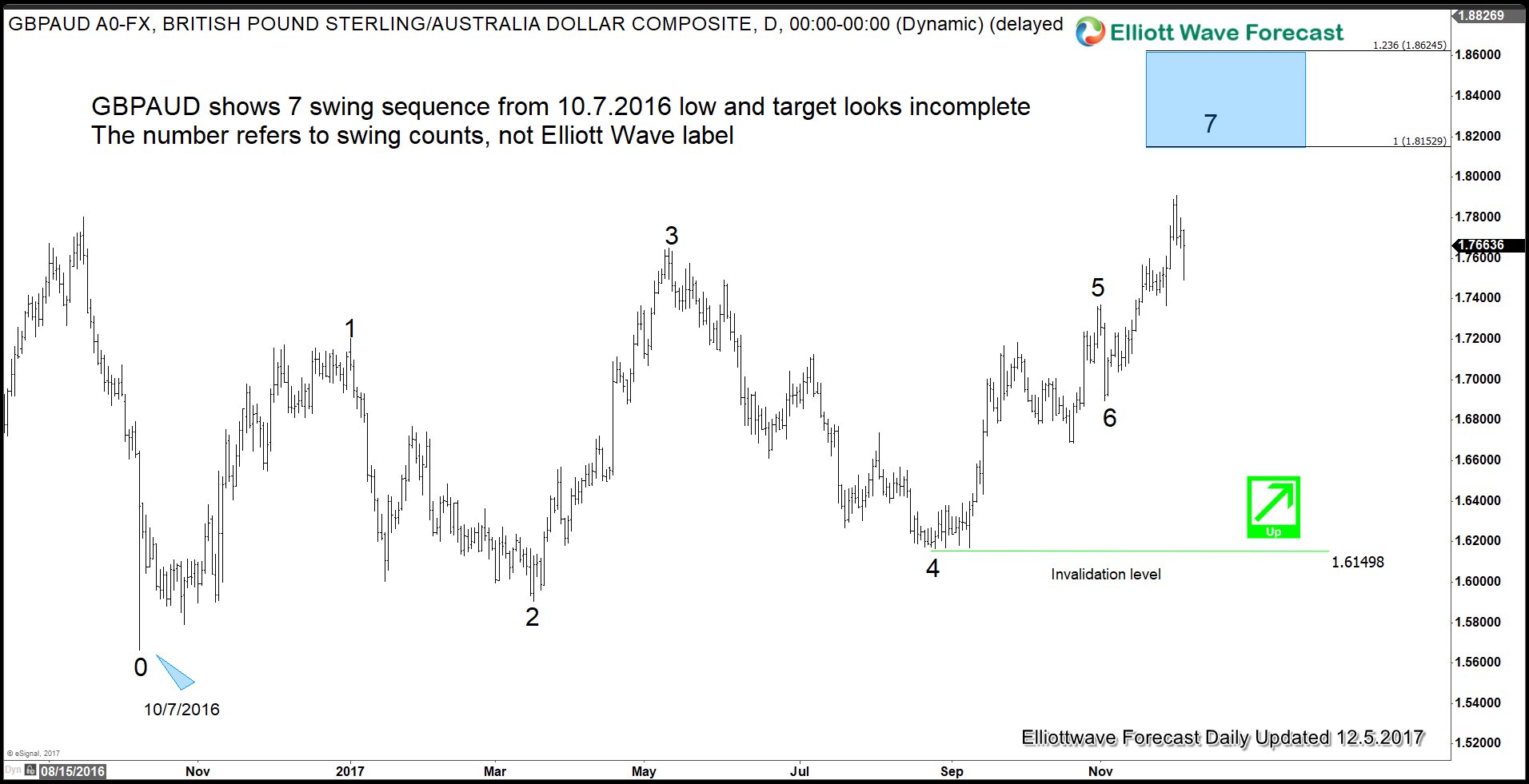

Sterling Volatility In Crucial Week of Brexit Talk

Read MoreSterling fell versus the dollar earlier this week as Brexit talk between the UK and EU falter at the last minute. British Prime Minister Theresa May is on the race to break the deadlock on the issue of Irish border. Irish border is one of the three key issues required to be settled before the U.K can […]

-

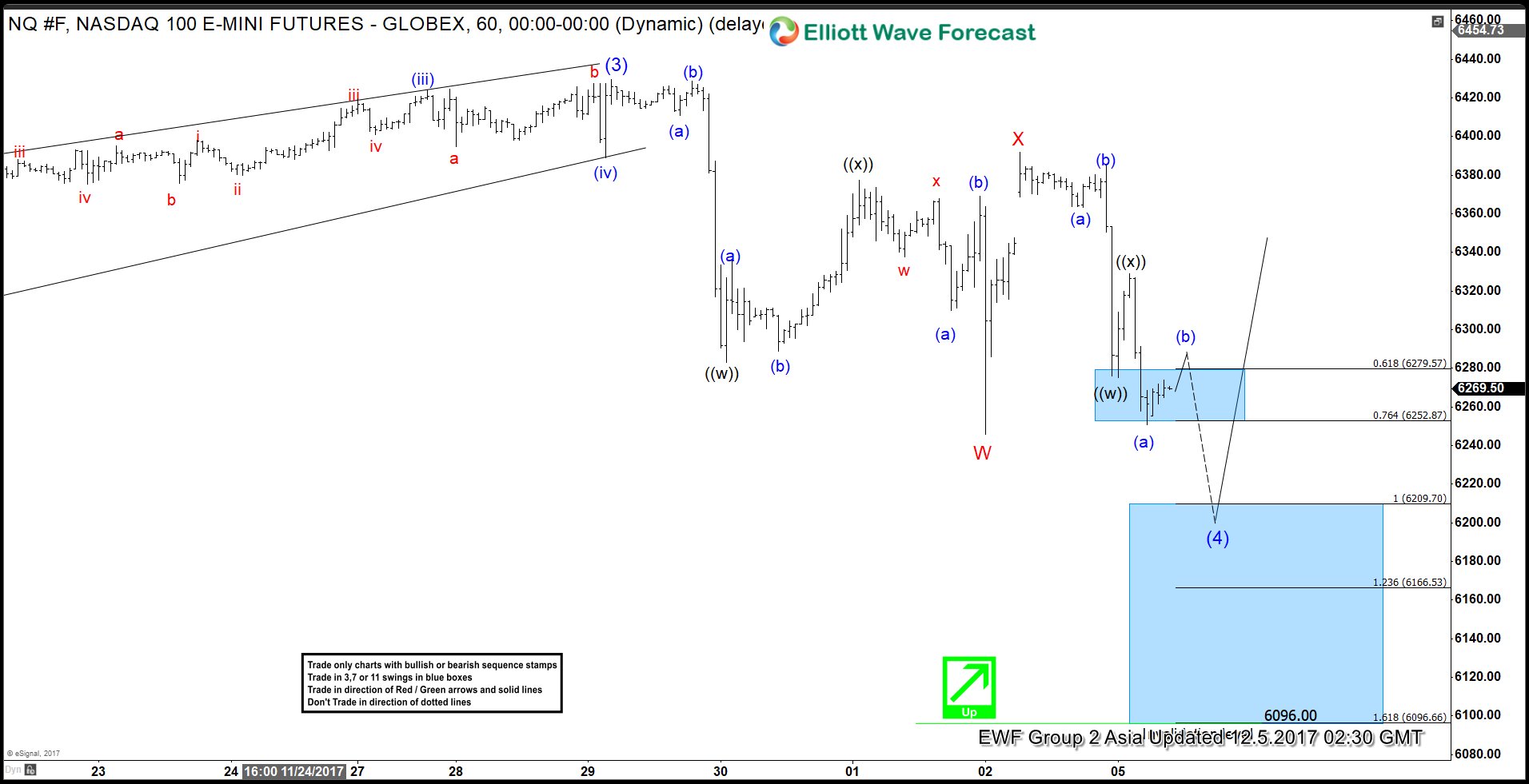

Nasdaq Short Term Elliott Wave Analysis

Read MoreNasdaq Short term Elliott Wave view suggests that the rally to 6429.5 ended Intermediate wave (3). Intermediate wave (4) pullback is currently in progress to correct cycle from 8/21 low (5753.6) in 3, 7, or 11 swing before Index resumes the rally. Subdivision of Intermediate wave (4) is unfolding as a double three Elliott wave structure where Minor wave W ended […]

-

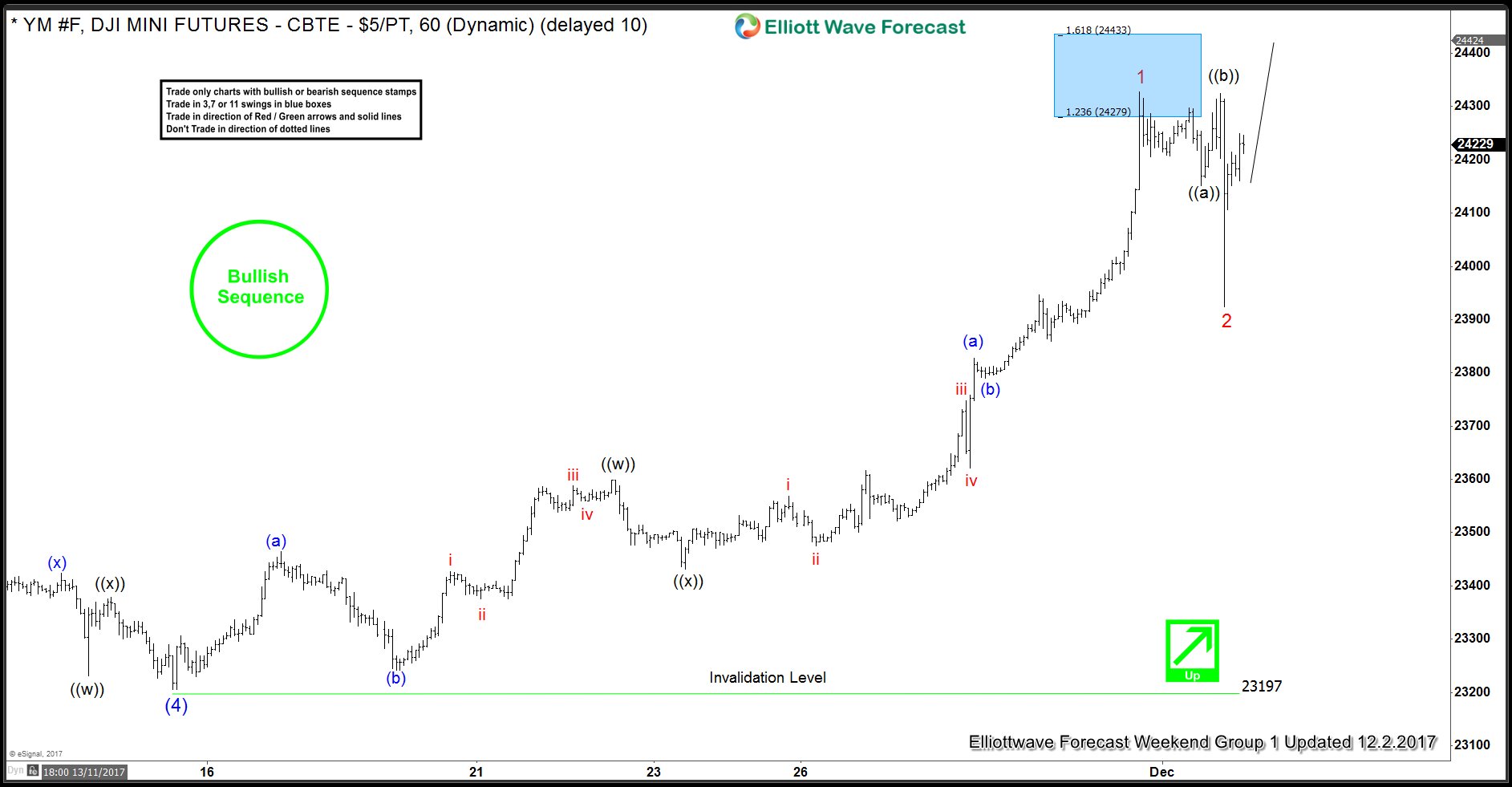

Dow Future Elliott Wave Analysis 12-3-2017

Read MoreDow Future Short term Elliott Wave view suggests that Intermediate wave (4) ended at 23205. Intermediate wave (5) rally is unfolding as a 5 waves diagonal Elliott wave structure. Minor wave 1 ended at 24328 and subdivided as a double three where Minute wave ((w)) ended at 23599, Minute wave ((x) ended at 23432, and Minute wave […]