-

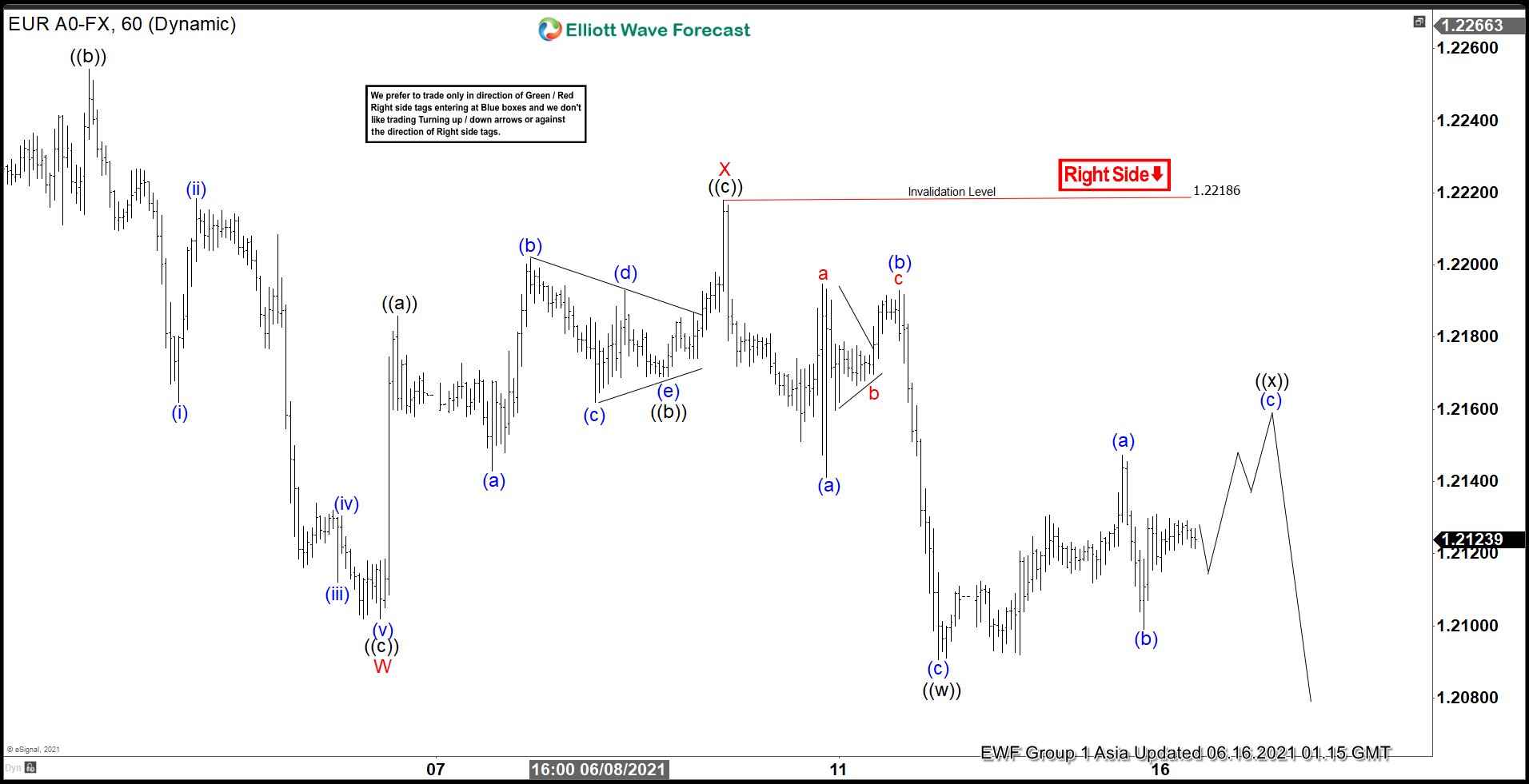

Elliott Wave View: EURUSD Looking for Support

Read MoreEURUSD shows 5 swing sequence from May 25 peak and can see more downside to end 7 swing. This article and video look at the Elliott Wave path.

-

Elliott Wave View: CADJPY Further Correction Lower Likely

Read MoreCADJPY shows 5 waves lower from June 1 peak suggesting further downside likely. This article and video look at the Elliott Wave path.

-

Silver Miners ETF (SIL) Looking for A Breakout

Read MoreSilver Miner ETF (SIL) has been consolidating for 10 months. In the next few months, the ETF may start the next major breakout to the upside The key areas remain to be around $52. A break and close above this level could start the next major bullish rally. The ETF still remains to be one […]

-

Elliott Wave View: Gold (XAUUSD) Preparing for Next Bullish Leg

Read MoreGold (XAUUSD) is getting ready for the next bullish leg. This article and video look at the short term Elliott Wave path for the metal.

-

Elliott Wave View: USDJPY Rally Expected to Fail

Read MoreUSDJPY short term rally is expected to fail below June 4 peak for more downside. This article and video look at the Elliott Wave path.

-

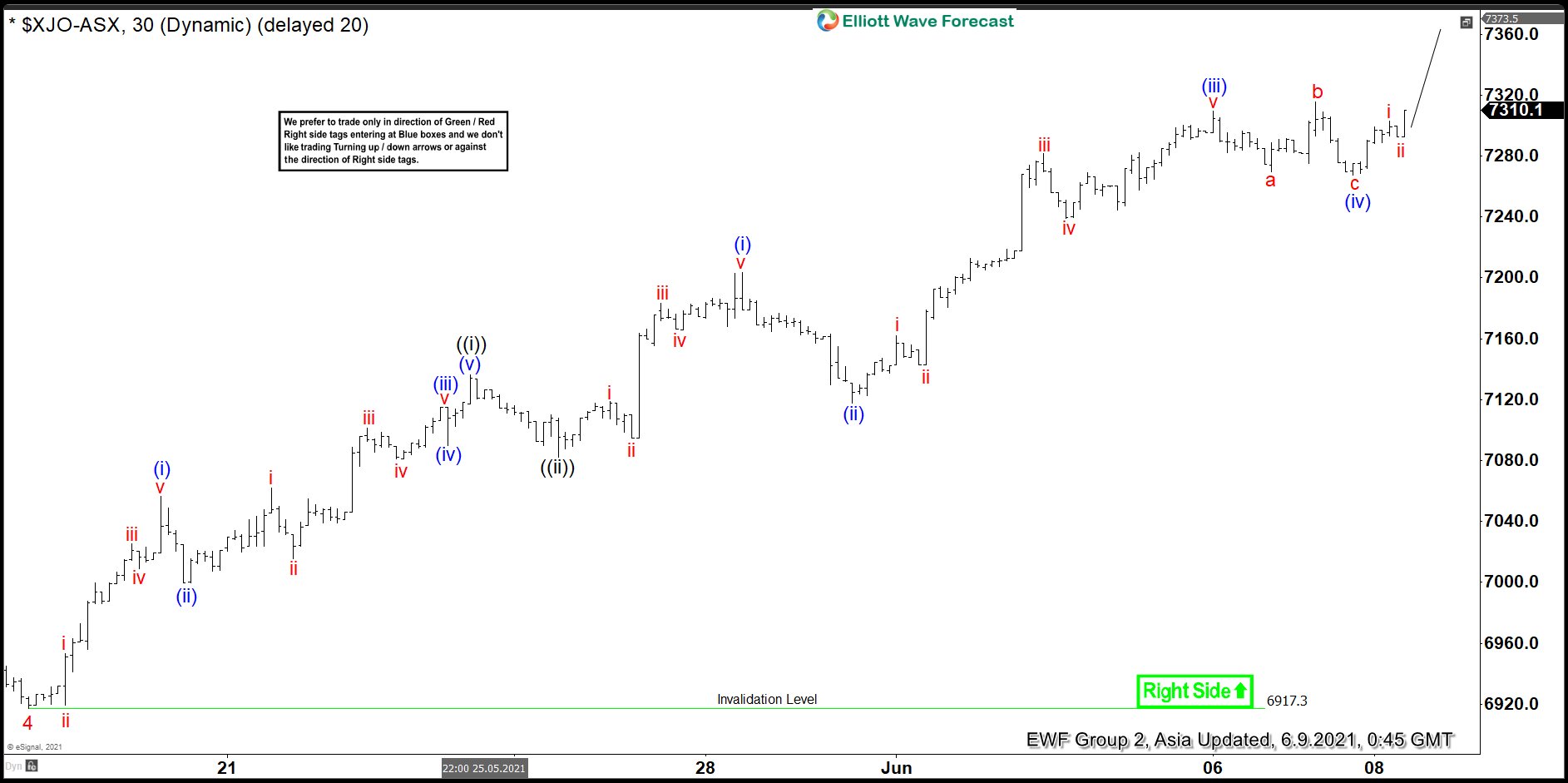

Elliott Wave View: ASX 200 (XJO) Looking to Complete Wave 5

Read MoreASX 200 (XJO) is looking to complete a 5 waves impulse move from February 1, 2021 low. This article and video look at the Elliott Wave path.