-

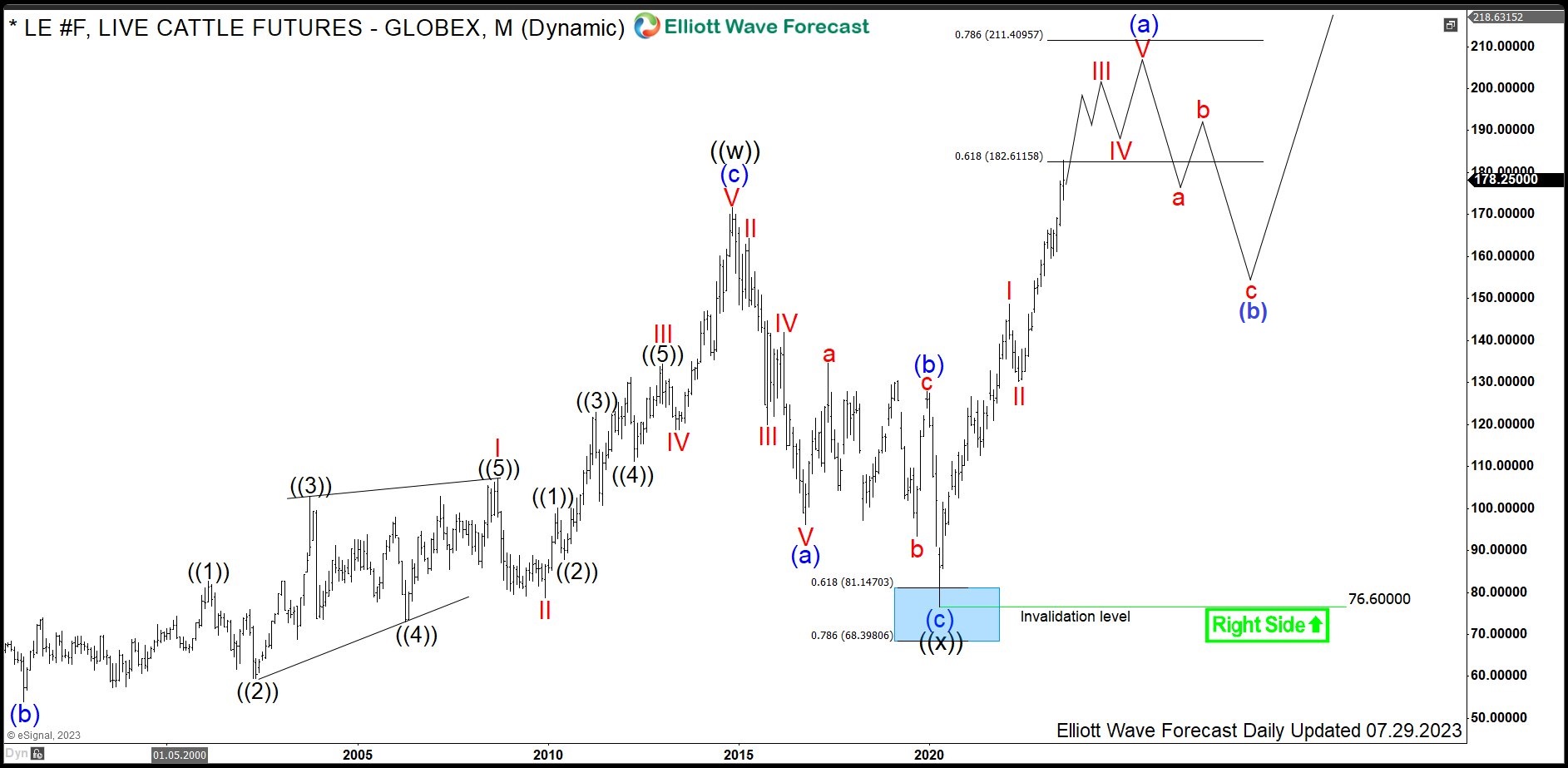

LE #F: Live Cattle Futures Trading within Monthly Bullish Sequence

Read MoreLive Cattle is a livestock commodity within the agriculture asset class, along with lean hogs, feeder cattle and porc cutouts. Once the feeder cattle have reached the target weigh of 1050-1500 pounds, they can be referred to as fed or live cattle. One can trade Live Cattle futures at Chicago Board of Trade in contracts […]

-

$CVS: CVS Health Corporation Trading within Bullish Triangle

Read MoreCVS Health Corporation is an US American healthcare company. Founded in 1963 and headquartered in Woonsocket, Rhode Island, USA, it is a part of S&P100 and S&P500 indices. Investors can trade it under the ticker $CVS at New York Stock Exchange. CVS Health owns CVS Pharmacy, a retail pharmacy chain; CVS Caremark, a pharmacy benefits manager; and Aetna, a health insurance […]

-

$PFE: Buying Weekly Dips in Pfizer before Next Big Move

Read MorePfizer, Inc. is an US American pharmaceutical and biotechnology company. Founded in 1849 and headquartered in New York, USA, it is a part of S&P100 and S&P500 indices. Investors can trade it under the ticker $PFE at New York Stock Exchange. Pfizer develops and produces medicines and vaccines for immunology, oncology, cardiology, endocrinology, and neurology. The company’s largest products by sales are the Pfizer–BioNTech COVID-19 […]

-

$NVAX: Novavax Starts New Bullish Cycle From Weekly Buying Area

Read MoreNovavax, Inc. is an US American biotechnology company. Founded in 1987 and headquartered in Gaithersburg, Maryland, USA, it is a part of Russel1000 index. Investors can trade it under the ticker $NVAX at NASDAQ as well as $NVV1 at XETRA. Before 2020, the company has developed vaccines to counter such diseases like Ebola, influenza, respiratory […]

-

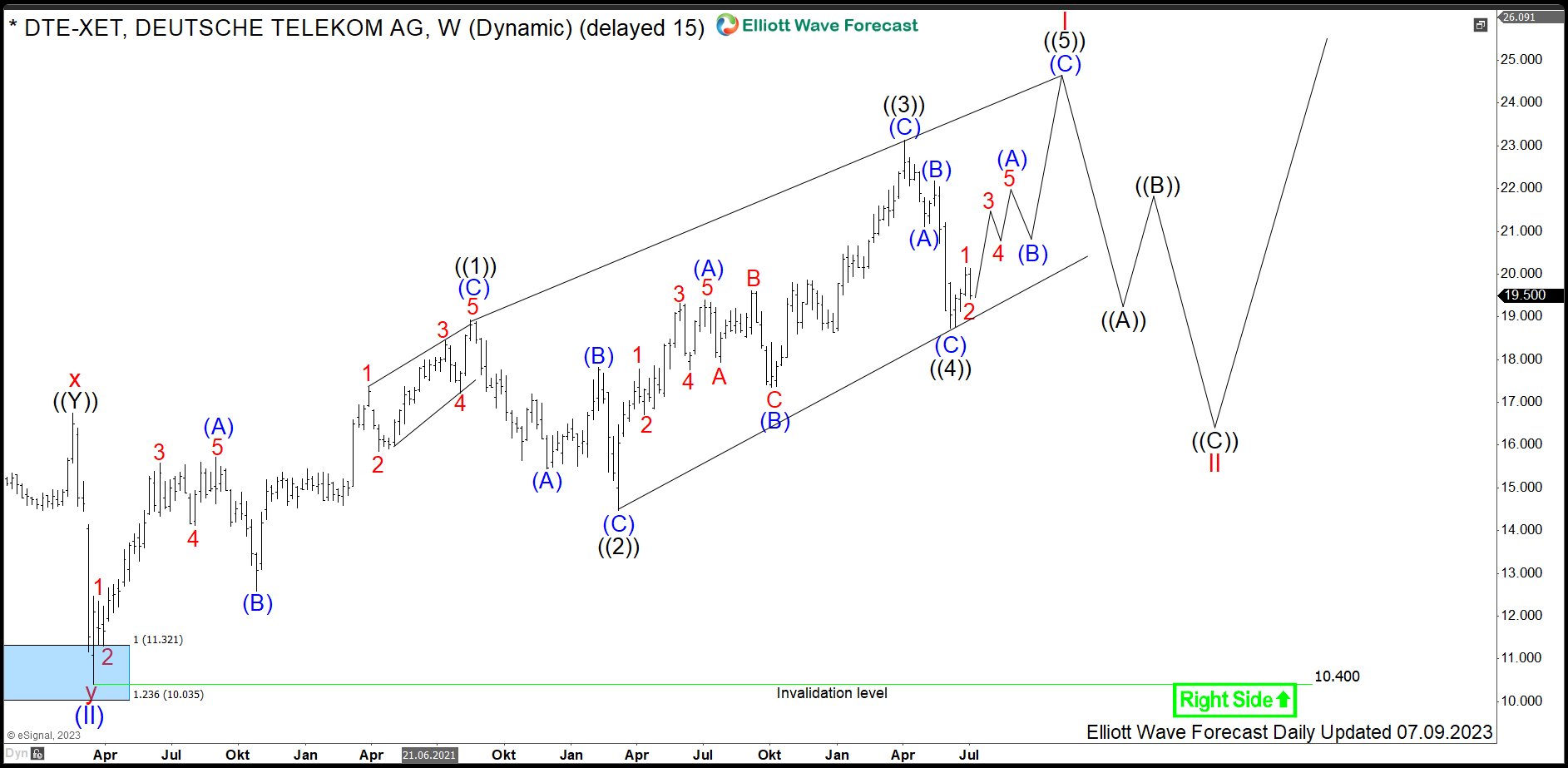

$DTE : Telecommunications Stock Deutsche Telekom Remains Supported

Read MoreDeutsche Telekom AG is a German telecommunications company and by revenue the largest telecommunications provider in Europe. Formed in 1995 and headquartered in Bonn, Germany, the company operates several subsidiaries worldwide. Deutsche Telekom is a part of both DAX40 and of SX5E indices. Even though the stock is highly appreciated by investors, the stock price […]

-

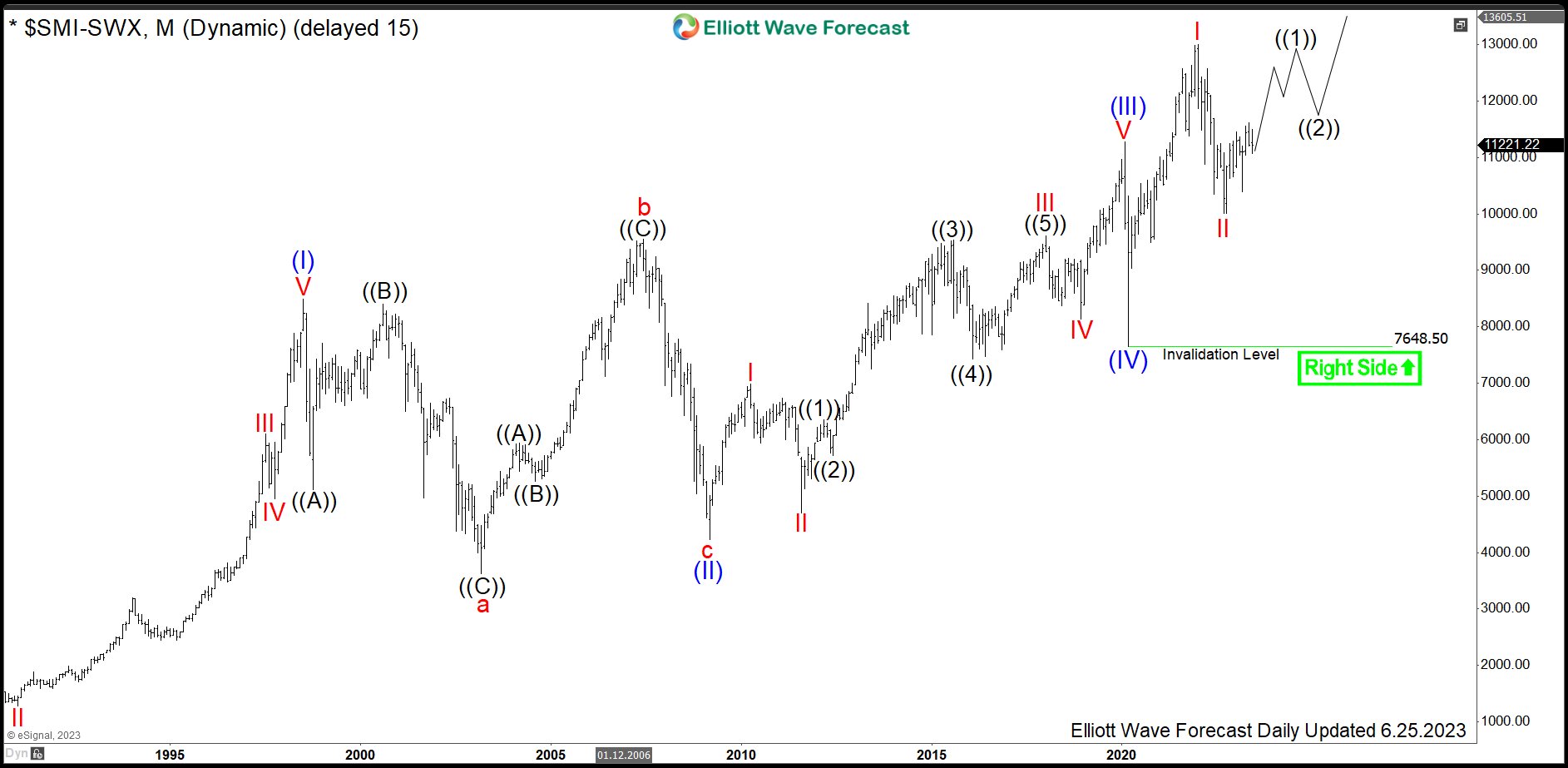

SMI: Swiss Market Index to Accelerate After Double Nest

Read MoreSMI is a Swiss Market Index representing a capitalization-weighted measure of the 20 most significant stocks on the SIX Swiss Exchange in Zurich; the ticker is $SMI. In the initial blog article from November 2020, we were calling the “COVID-19” drop in February-March 2020 to become a significant low in world indices. We were right. Then, in the […]