-

$CGC: Canopy Growth Corporation Starting Bull Run

Read MoreCanopy Growth Corporation is a Canadian cannabis company producing medical and recreational marijuana. The company owns brands like Tweed, Deep Space, Wana, Vert, Spectrum Therapeutics and others. Founded 2013 and headquartered in Smiths Falls, Ontario, Canada, one can trade Canopy Growth Corporation under the tickers $WEED at Toronto Stock Exchange and $CGC at NASDAQ. Canopy Growth Corporation Weekly […]

-

$ABNB: Airbnb Stock Nesting before Acceleration Higher

Read MoreAirbnb is an U.S. American corporation operating an online marketplace for short- and long-term homestays and experiences. Hereby, the company acts as a broker and charges a commission from each booking. Founded in 2008 and headquartered in San Francisco, California, USA, Airbnb can be traded under ticker $ABNB at NASDAQ. There, it is a component of the Nasdaq-100 index. Airbnb Weekly Elliott Wave Analysis 09.05.2023 […]

-

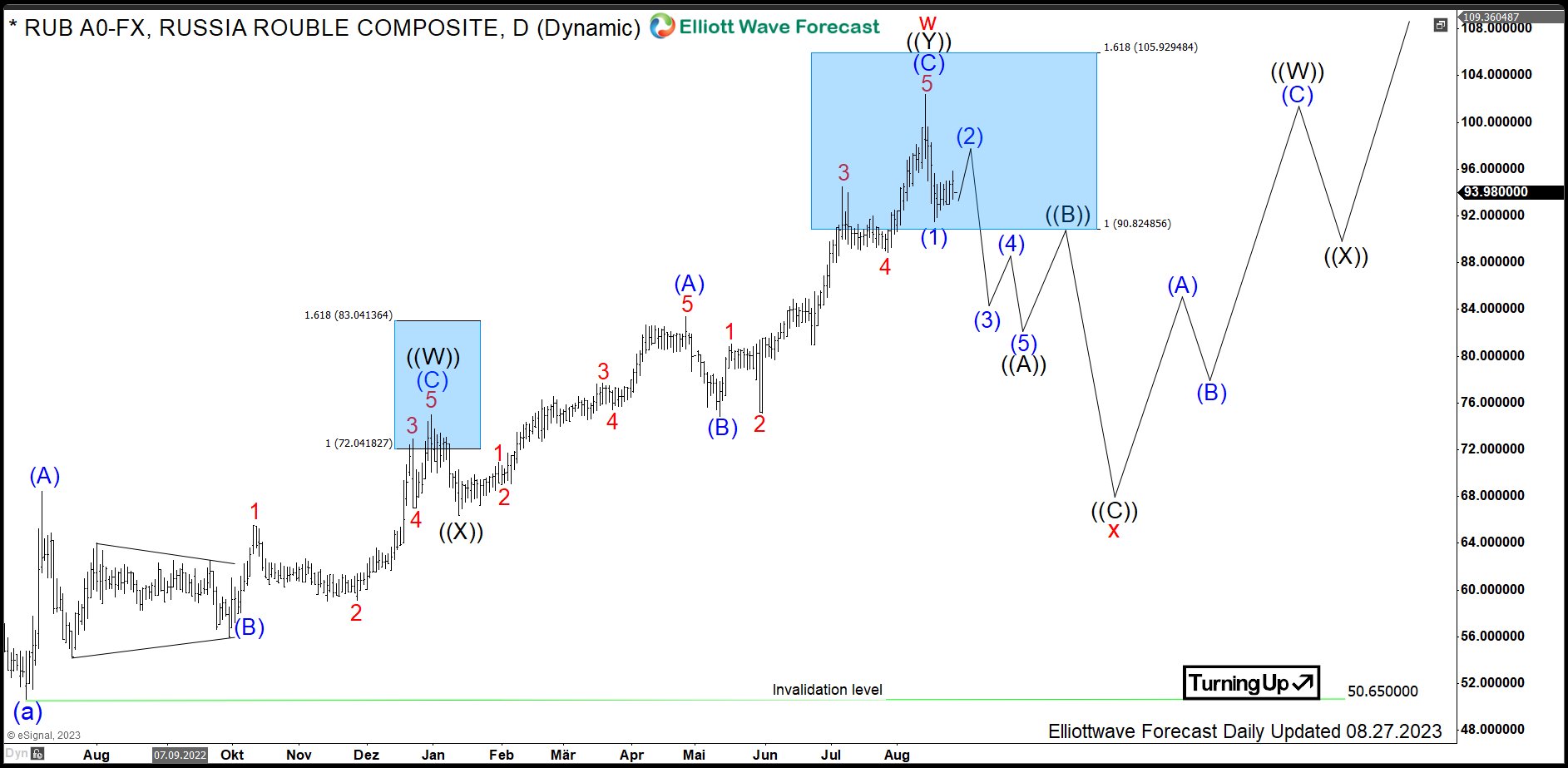

USDRUB : What to Expect from Rouble Reaching Daily Bluebox?

Read MoreRussian Rouble (or Ruble) is the currency of the Russian Federation and the 17th most traded currency in the world. Within current environment of rising commodity prices, the world market impact of Russia, which is a major commodities producer, should strengthen. Without any doubt, this fact will increase the trading volumes of the Russian national […]

-

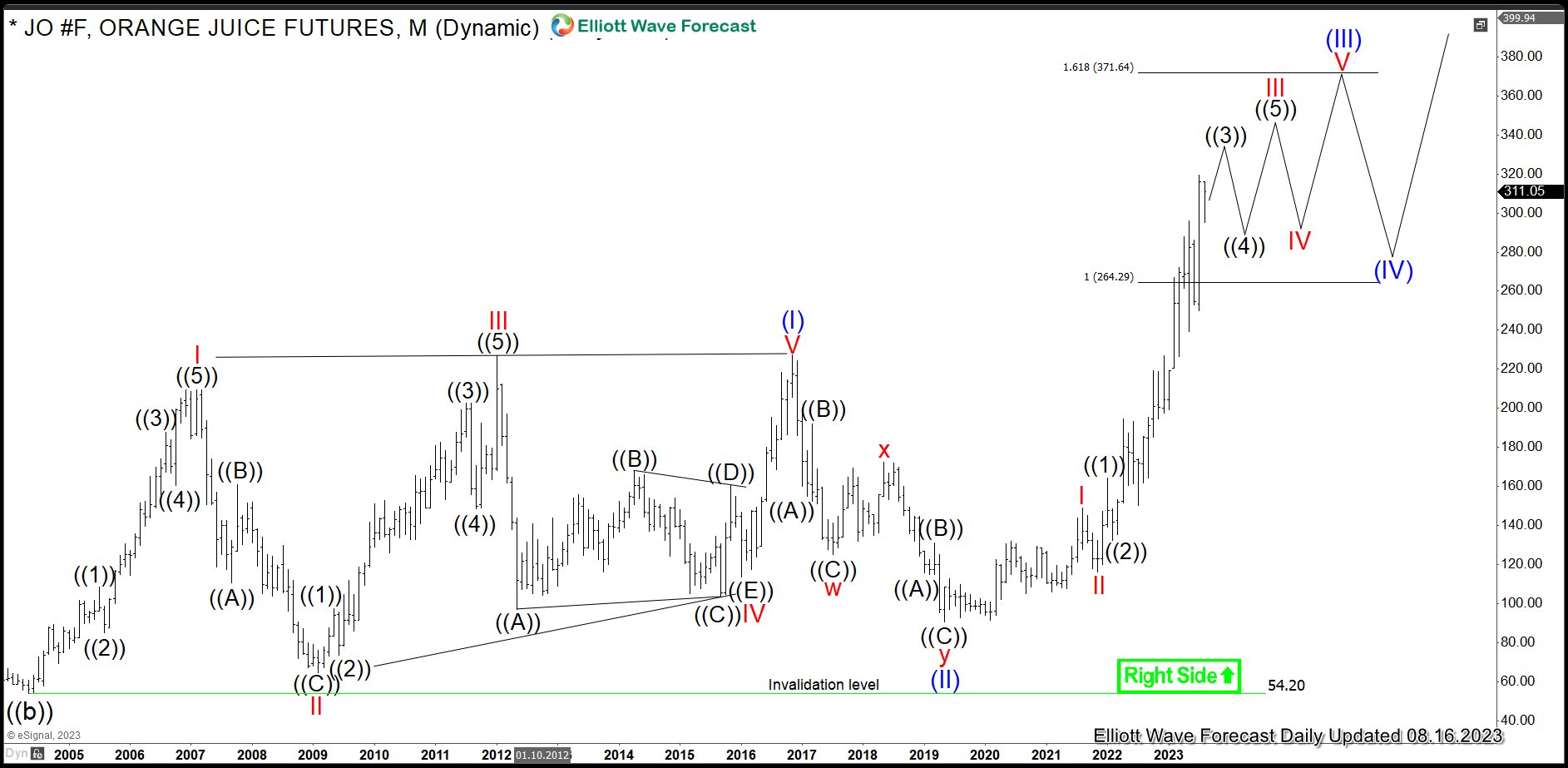

FCOJ: Buying Pullbacks in Frozen Concentrated Orange Juice

Read MoreIn the previous articles from March, November 2021 and October 2022, we have discussed the price action and the outlook for the Frozen Concentrated Orange Juice. As it has been expected, the soft commodities have advanced or they are nesting higher. In particular, we saw cocoa rallying. Others, like sugar, coffee and cotton are nesting before acceleration higher should take place. Hereby, […]

-

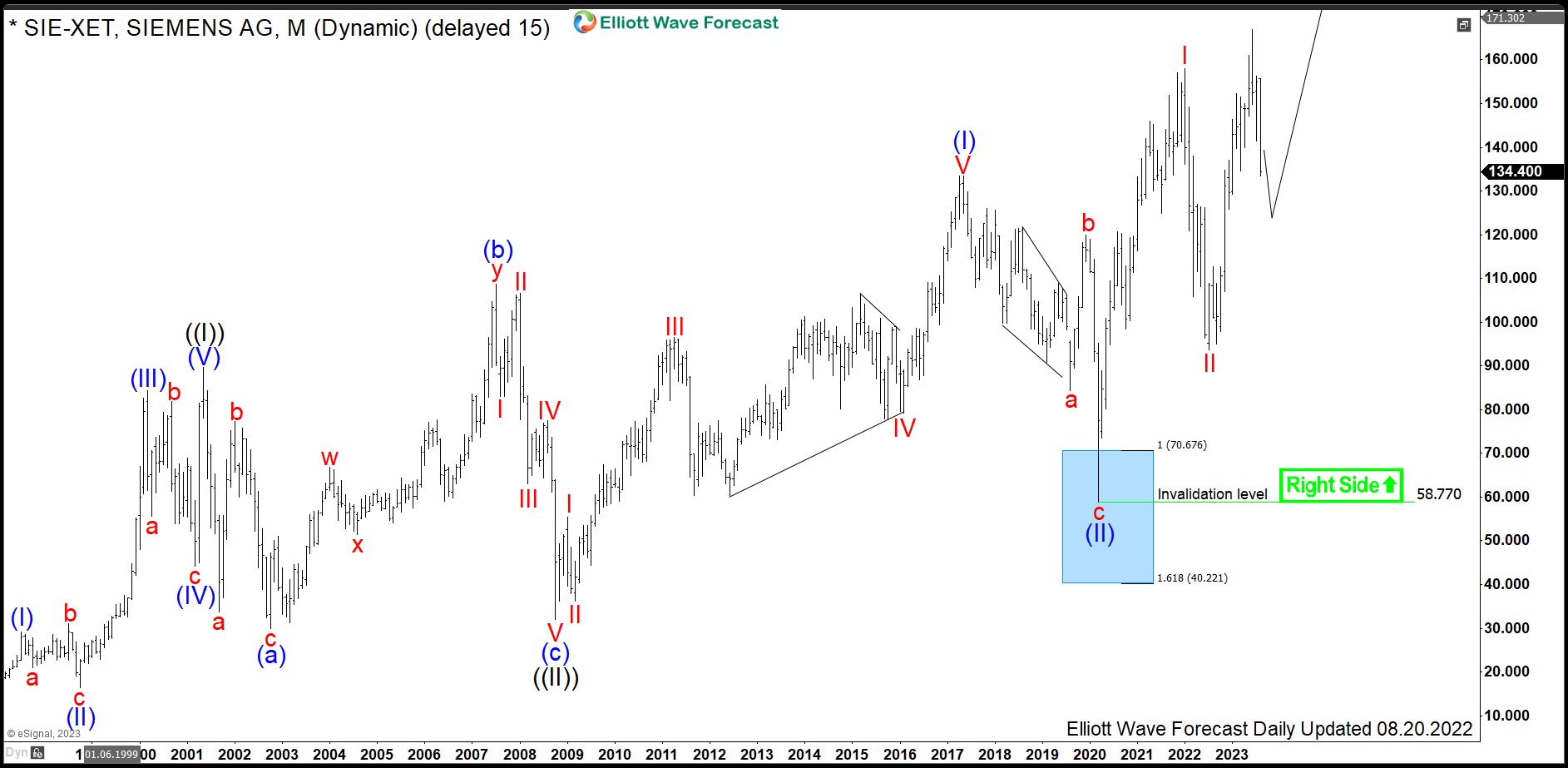

$SIE: Join the Siemens Rally in a Pullback from All-Time Highs

Read MoreSiemens SE is a German multinational conglomerate company and by revenue the largest industrial manufacturing enterprise in Europe. Company’s principal business divisions are Industry, Energy, Healthcare, Infrastructure & Cities. Founded in 1847 and headquartered in Munich, Germany, the company employs approx. 385’ooo people worldwide. Siemens is a part of both DAX40 and of SX5E indices. […]

-

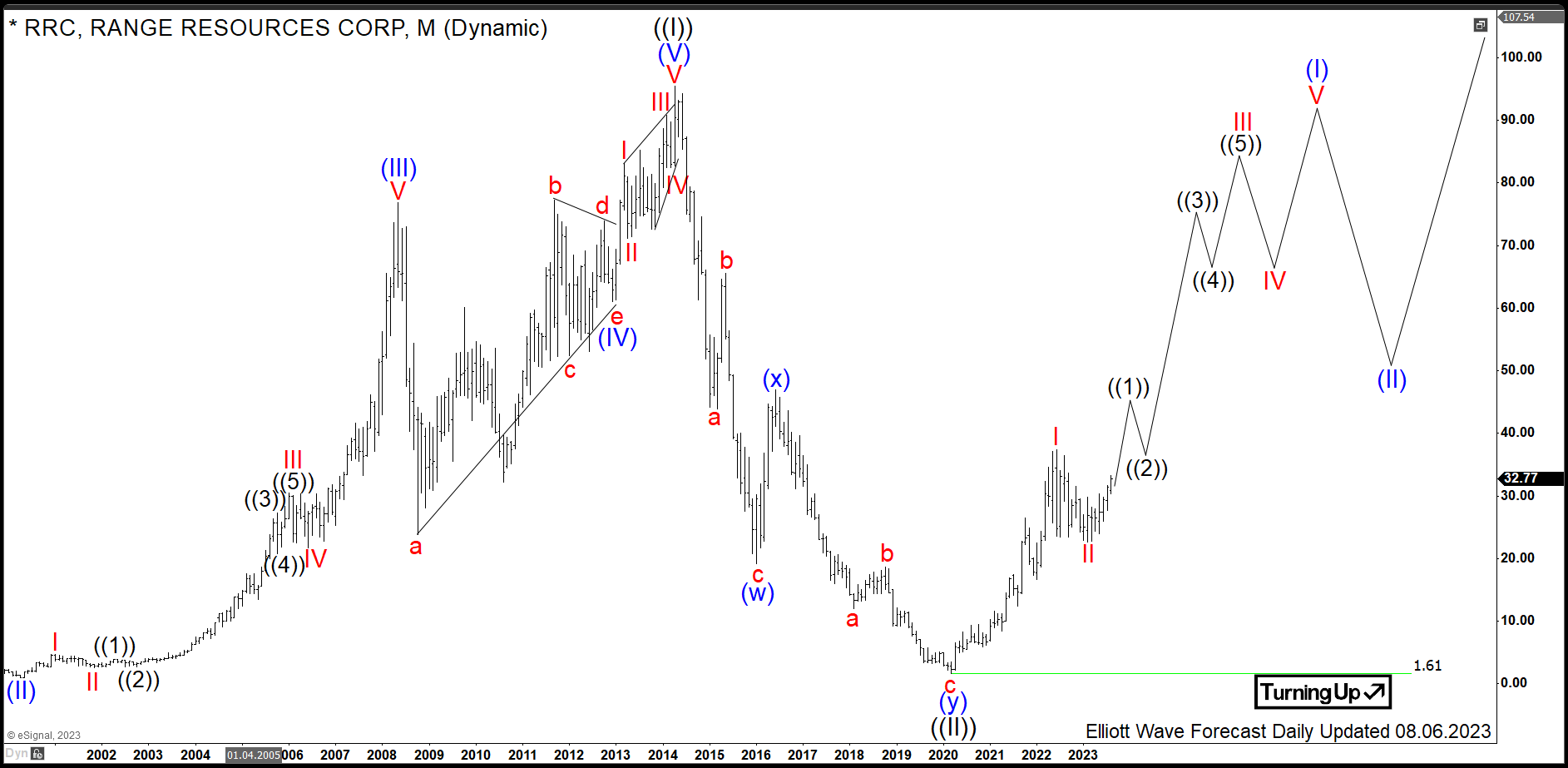

$RRC: Gas Producer Range Resources Starting Next Bullish Cycle

Read MoreRange Resources is an U.S. american corporation which has its headquarters in Fort Worth, Texas, USA. Founded in 1976 and traded under tickers $RRC at NYSE, it is a component of the S&P400 index. Range Resources is the 7th largest U.S. producer of natural gas and possesses the reserves in the Appalachian Basin, the Barnett Shale […]