-

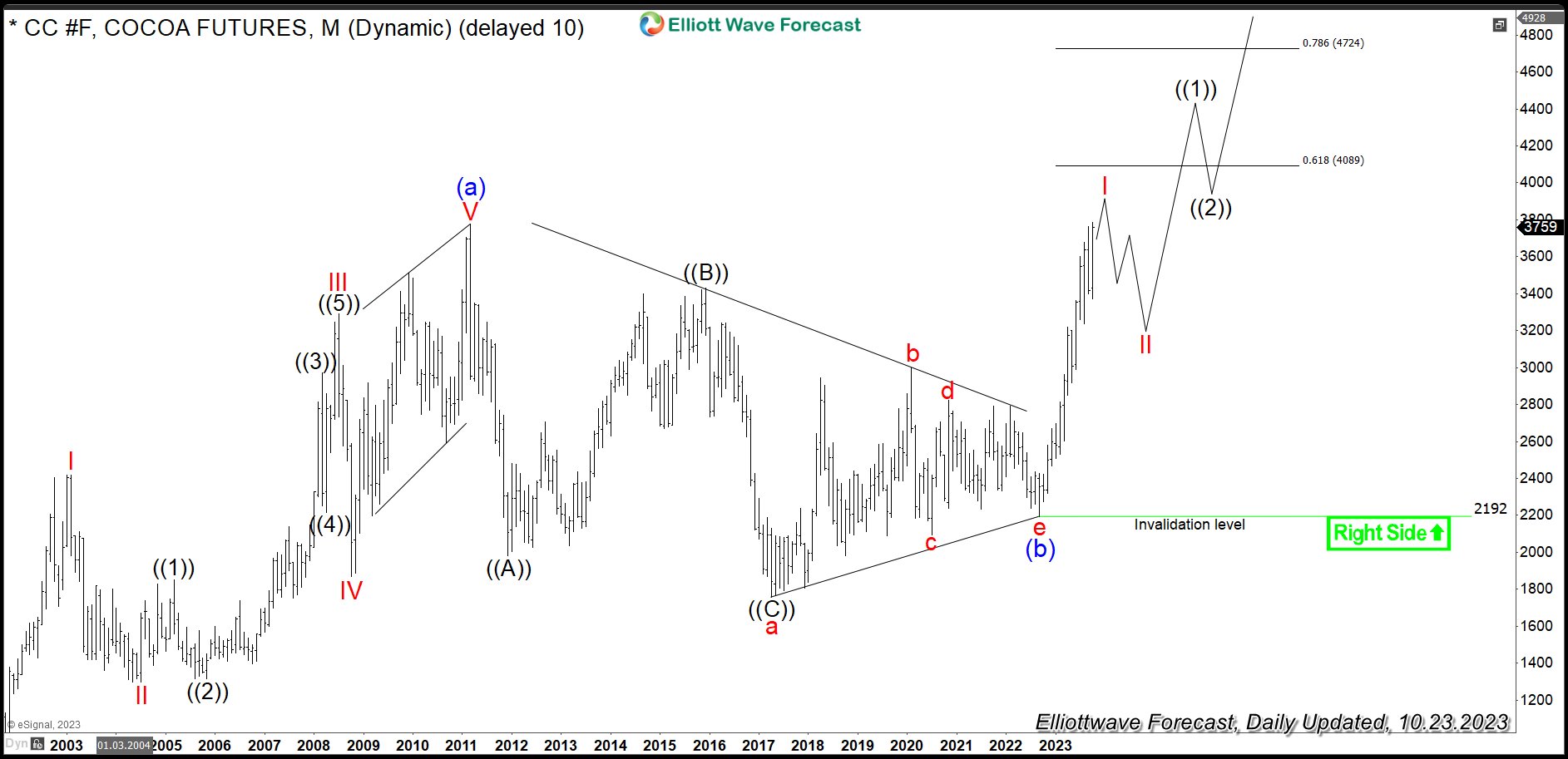

$CC #F: Cocoa Prices Trade in a Bullish Sequence

Read MoreCocoa (or cocoa bean) is one of soft commodities, along with sugar, coffee, orange juice and cotton. The bean is the fully dried and fermented seed, wherefrom cocoa solids and cocoa butter can be extracted. Cocoa beans are the basis of the chocolate. One can trade Cocoa futures at ICE owned New York Board of […]

-

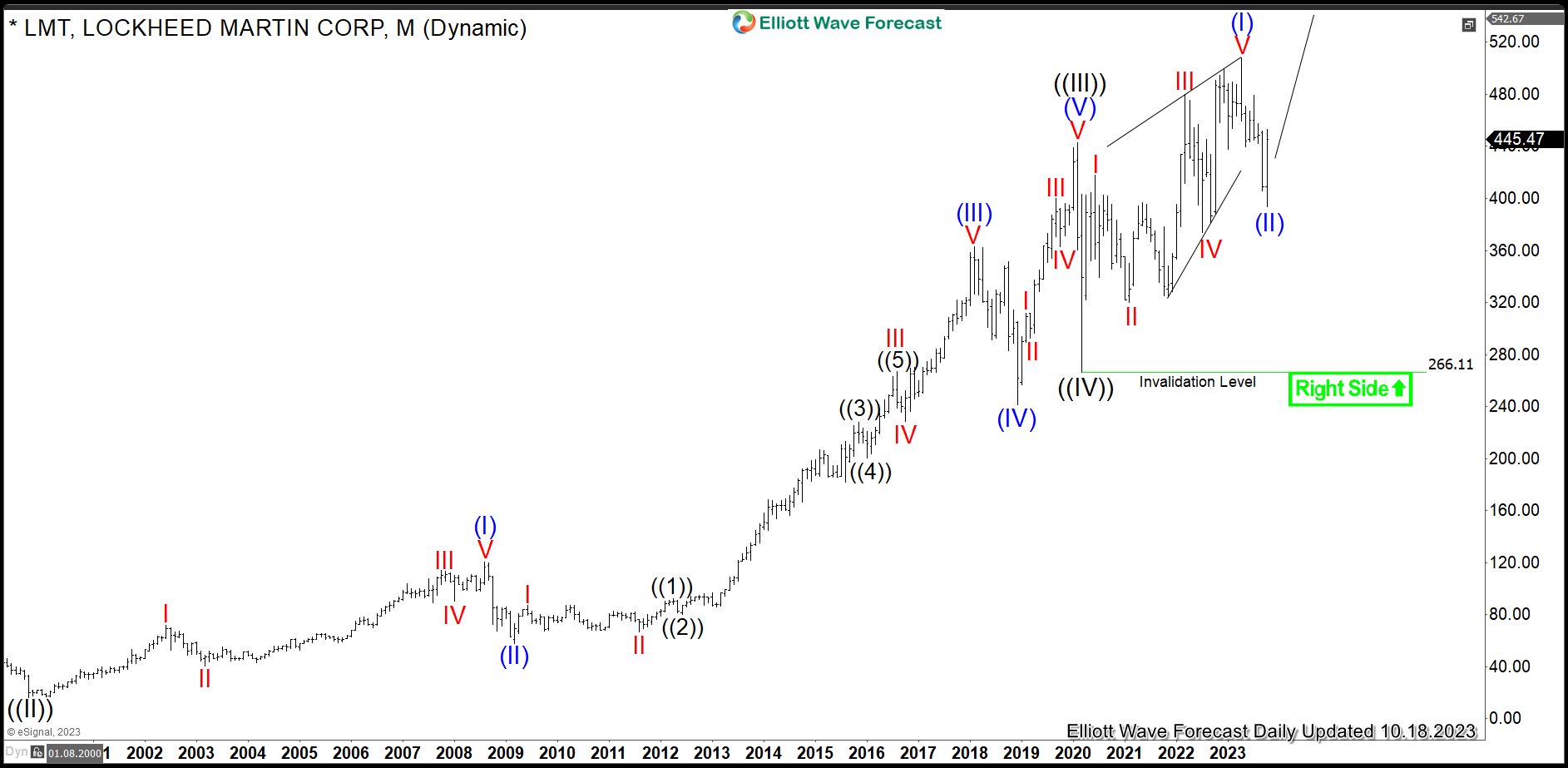

$LMT : Pullbacks in Lockheed Martin Remain Supported

Read MoreLockheed Martin is one of the the largest defense, arms and aerospace companies based in the United States and the world. It employs approximately 110’000 people worldwide. The company operates mainly on four business segments, i.e., Aeronautics, Missiles & Fire control, Rotary & Mission system and Space systems. It’s the world’s largest defense contractor based […]

-

$NKLA: Nikola Corporation Preparing Acceleration

Read MoreNikola corporation is an US American manufacturer of heavy-duty commercial battery-electric vehicles, fuel-cell electric vehicles, and energy solutions. The company delivered first two battery-electric trucks in December 2021. In 2022, Nikola has projected deliveries of between 300 and 500 of its battery-electric semitrucks — known as the Nikola Tre — to customers. Like Tesla, Inc., the company […]

-

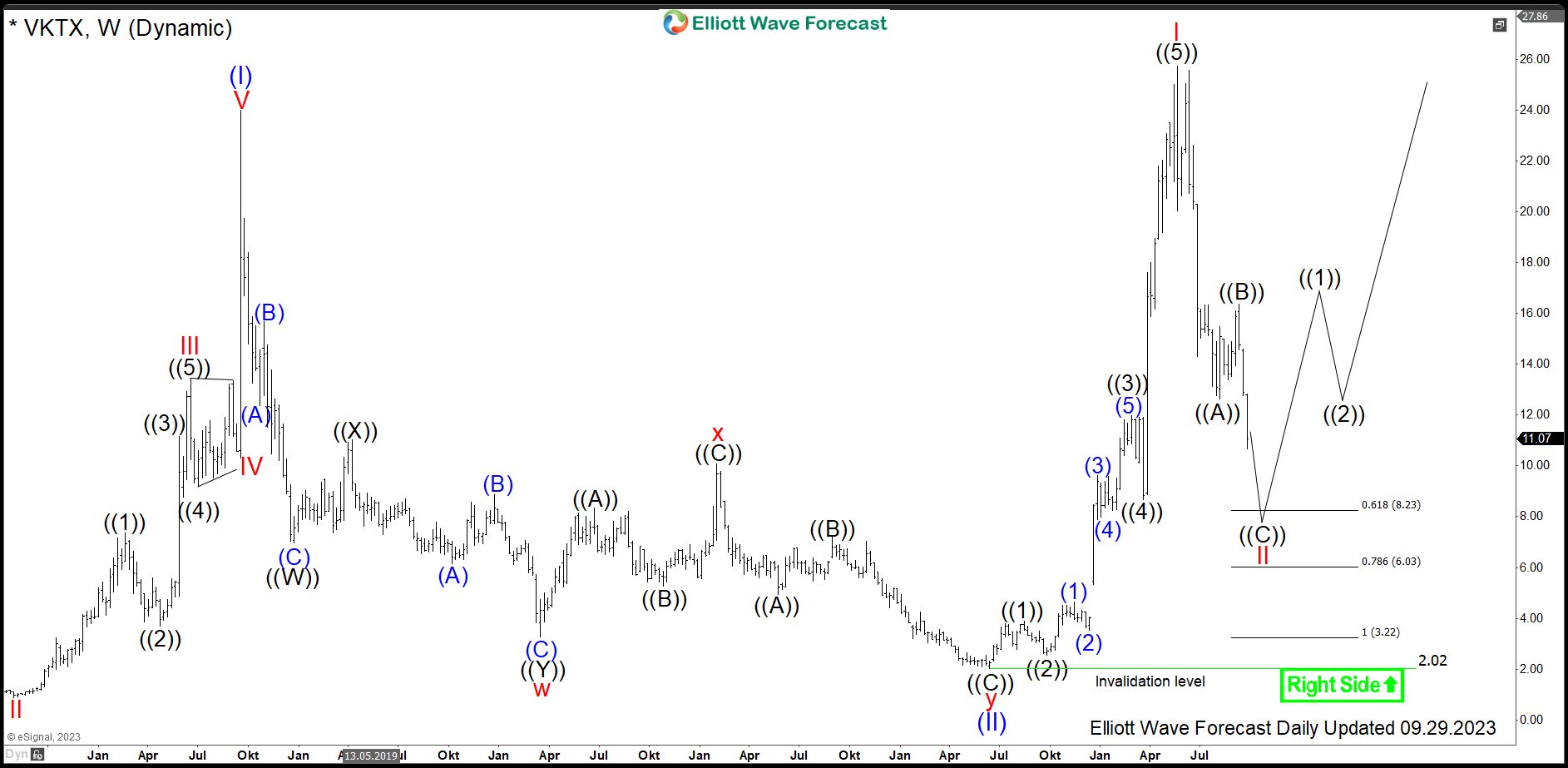

$VKTX: Consolidation in Viking Therapeutics Provides an Opportunity

Read MoreViking Therapeutics Inc. is an innovative biotechnology company developing novel therapeutics for metabolic and endocrine diseases. Metabolic and rare disease programs include novel selective thyroid receptor-β agonist approach. These and other programs are currently within phases 1, 2 and preclinical. Viking Therapeutics saw IPO back in 2015. Since then, investors can trade it under the […]

-

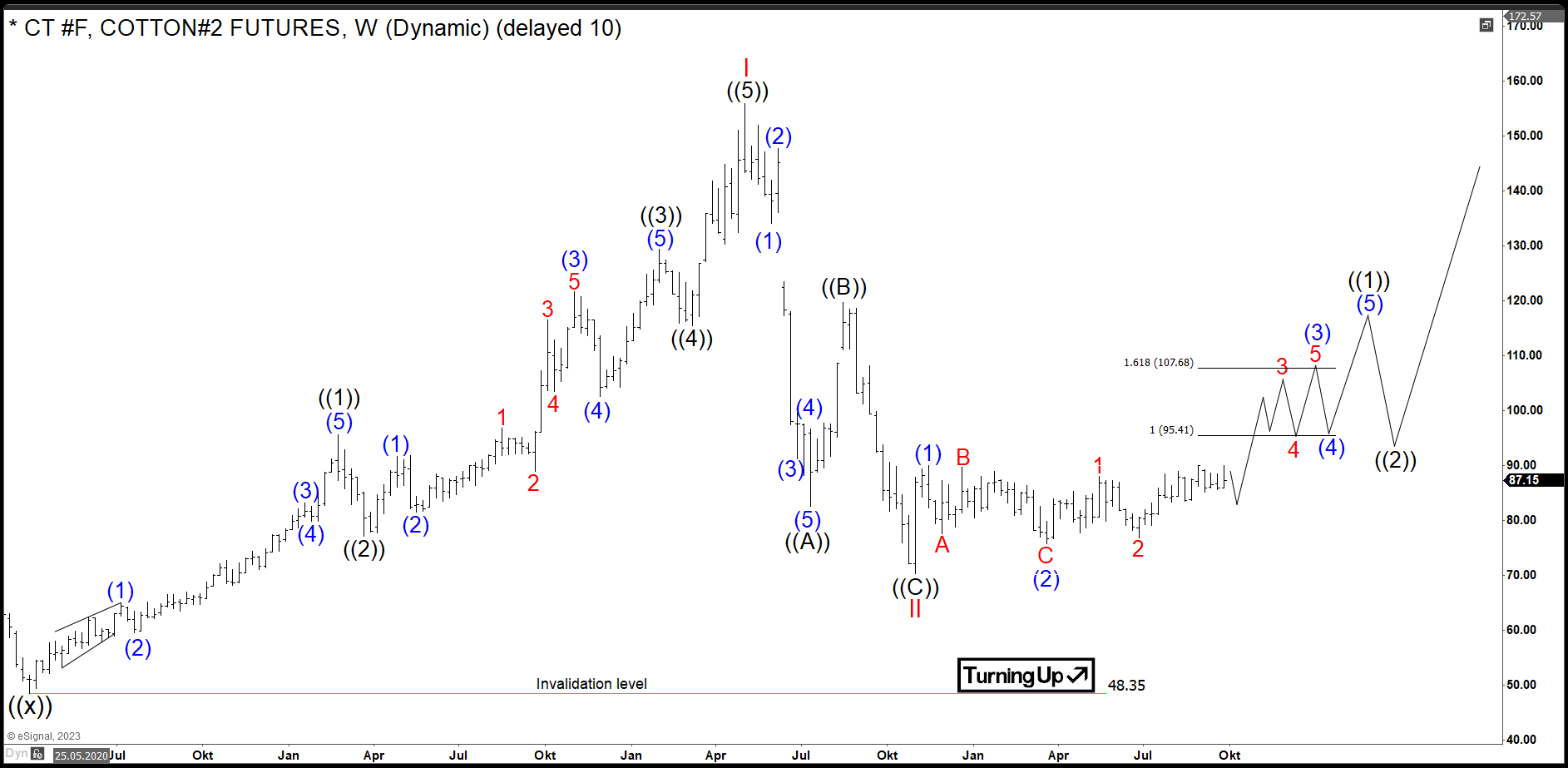

$CT #F: Nesting Price Action in Cotton Provides an Opportunity

Read MoreCotton is one of soft commodities, along with sugar, coffee, orange juice and cocoa. In early centuries, Alexander the Great has brought cotton from Pakistan to Europe. Much later and finally, it has obtained the dominance in textile manufacturing during the British industrial revolution in the 18th century. It was so critical that at times of Civil War […]

-

$CLF: Cleveland Cliffs Heading for a Next Big Rally

Read MoreCleveland Cliffs, Inc. (formerly Cliffs Natural Resources) is an US American company that specializes in the mining, beneficiation, and pelletizing of iron ore, as well as steelmaking, including stamping and tooling. It is the largest flat-rolled steel producer in North America. Founded in 1847, it is headquartered in Cleveland, Ohio, USA. The stock being a component of the S&P MidCap 400 index […]