-

$DBK: Major Financial Services Provider Deutsche Bank Turns Higher

Read MoreDeutsche Bank is a German multinational investment bank and financial services provider. It is one of the nine bulge bracket banks. Deutsche Bank is the largest German banking institution and is a part of the DAX index. Founded 1869 and headquartered in Frankfurt, Germany, it can be traded under tickers $DBK at Frankfurt and $DB […]

-

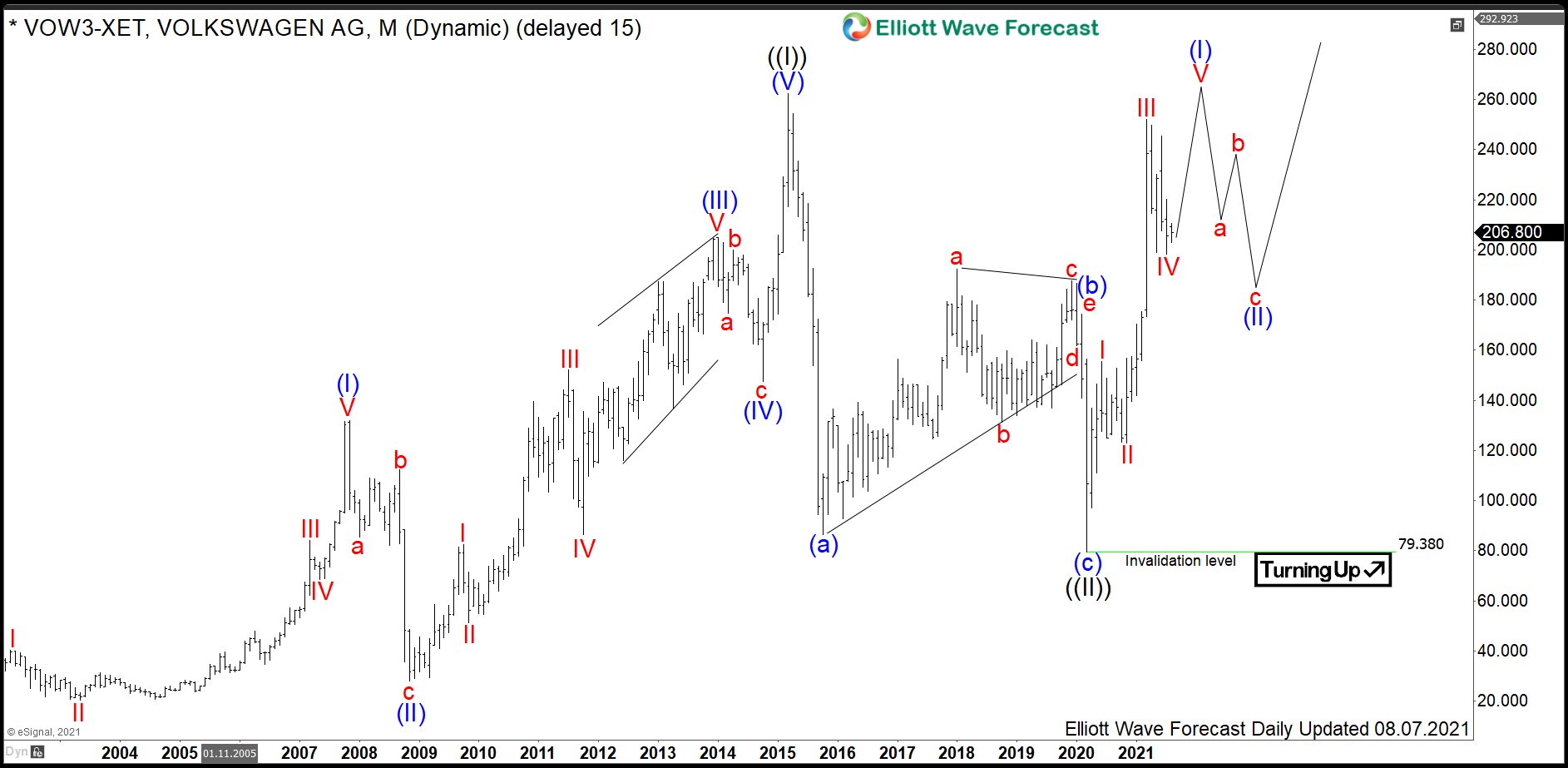

$VOW: Is it Already Too Late to Buy Volkswagen?

Read MoreVolkswagen AG is a German multinational automotive manufacturing corporation. It designs, manufactures, and distributes passenger and commercial vehicles, motorcycles, engines, and turbomachinery. Today, it is the largest automaker in the world in terms of sales. Founded in 1937 and headquartered in Wolfsburg, Germany, the company is largely owned by Porsche and Piëch family. Volkswagen is a […]

-

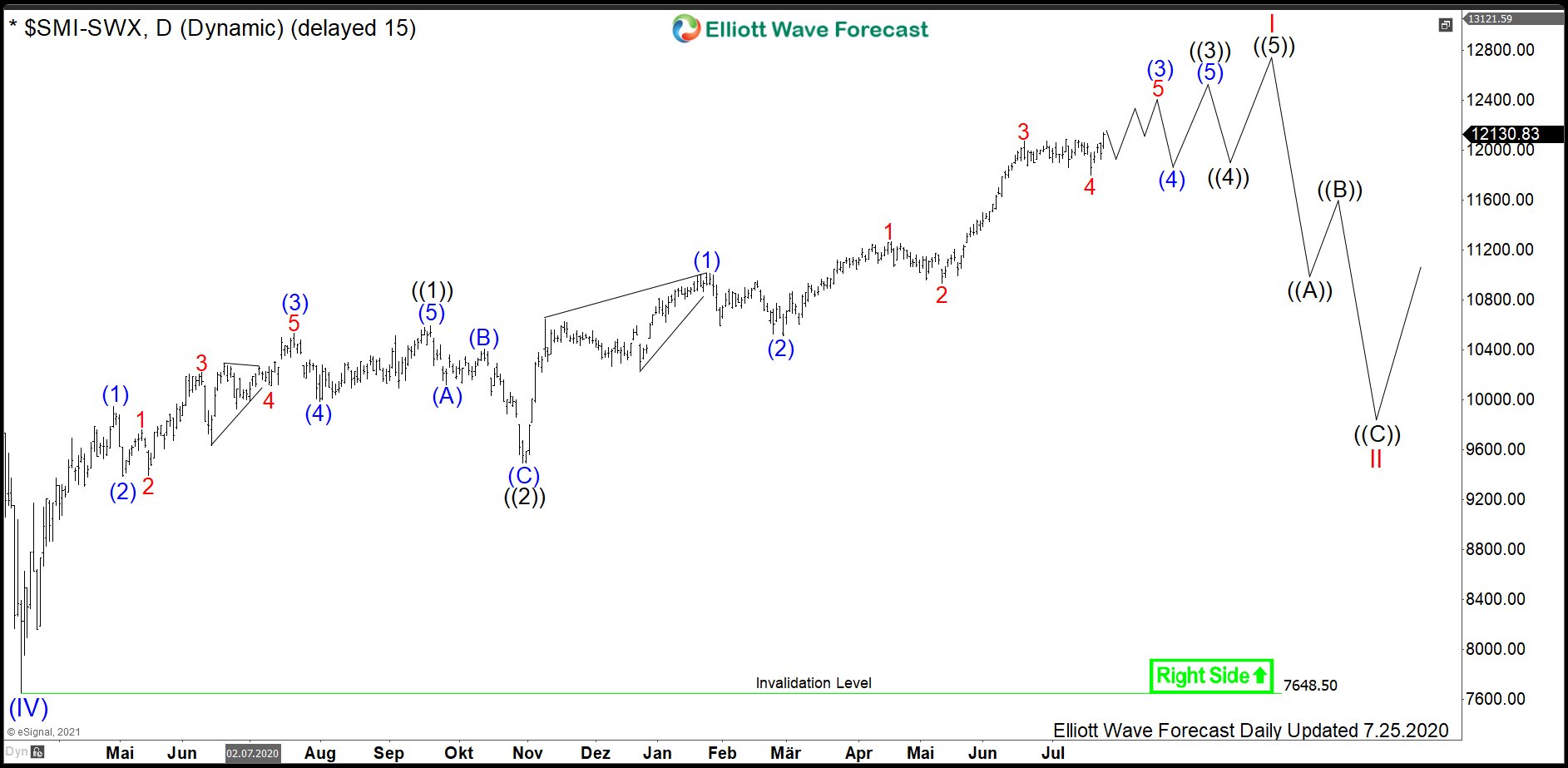

$ SMI : Daily Cycle of Swiss Market Index to Extend Higher

Read MoreAfter 9 months, we present here an updated view on the Swiss Market Index (SMI). SMI represents a capitalization-weighted measure of the 20 most significant stocks on the SIX Swiss Exchange in Zurich; the ticker is $SMI. In the initial blog article from November 2020, we were calling the “COVID-19” drop in February-March 2020 to become a […]

-

$EDF : Electric Utility Giant EDF to Catch Up the Energy Sector

Read MoreÉlectricité de France S.A. (literally, Electricity of France), commonly known as EDF, is a French multinational electric utility company. The operations include electricity generation and distribution, power plant design, construction and dismantling, energy trading and transport. Founded in 1946 and headquartered in Paris, France, the company is largely owned by the French state. EDF is a part […]

-

Elliott Wave View: Nasdaq Futures (NQ) Short Term Support Area

Read MoreShort Term Elliott Wave in Nasdaq Futures (NQ) suggests the rally from March 5, 2021 low remains ongoing as a 5 waves impulse Elliott Wave structure. In the 45 minutes chart below, we can see wave 4 of this impulsive rally ended at 14445. The Index has resumed higher within wave 5 with internal subdivision […]

-

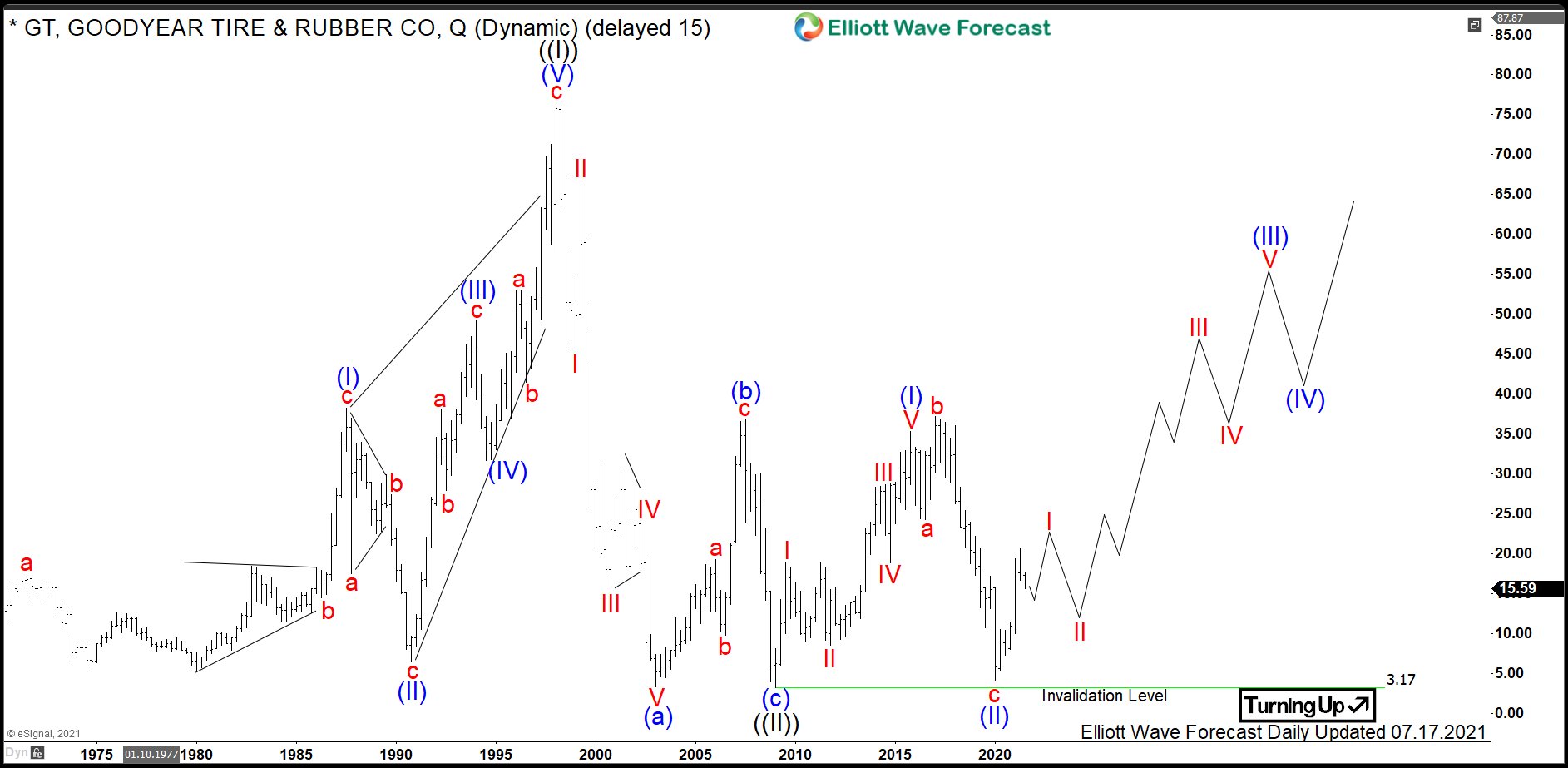

$GT : Goodyear Tire and Rubber Company Ramping Up

Read MoreGoodyear Tire and Rubber Company is a multinational tire manufacturing company based in Akron, Ohio, USA. The stock being a component of the S&P MidCap 400 index can be traded under ticker $GT at NASDAQ. As a matter of fact, Goodyear manufactures tires for automobiles, commercial trucks, light trucks, motorcycles, SUVs, race cars, airplanes, farm […]