-

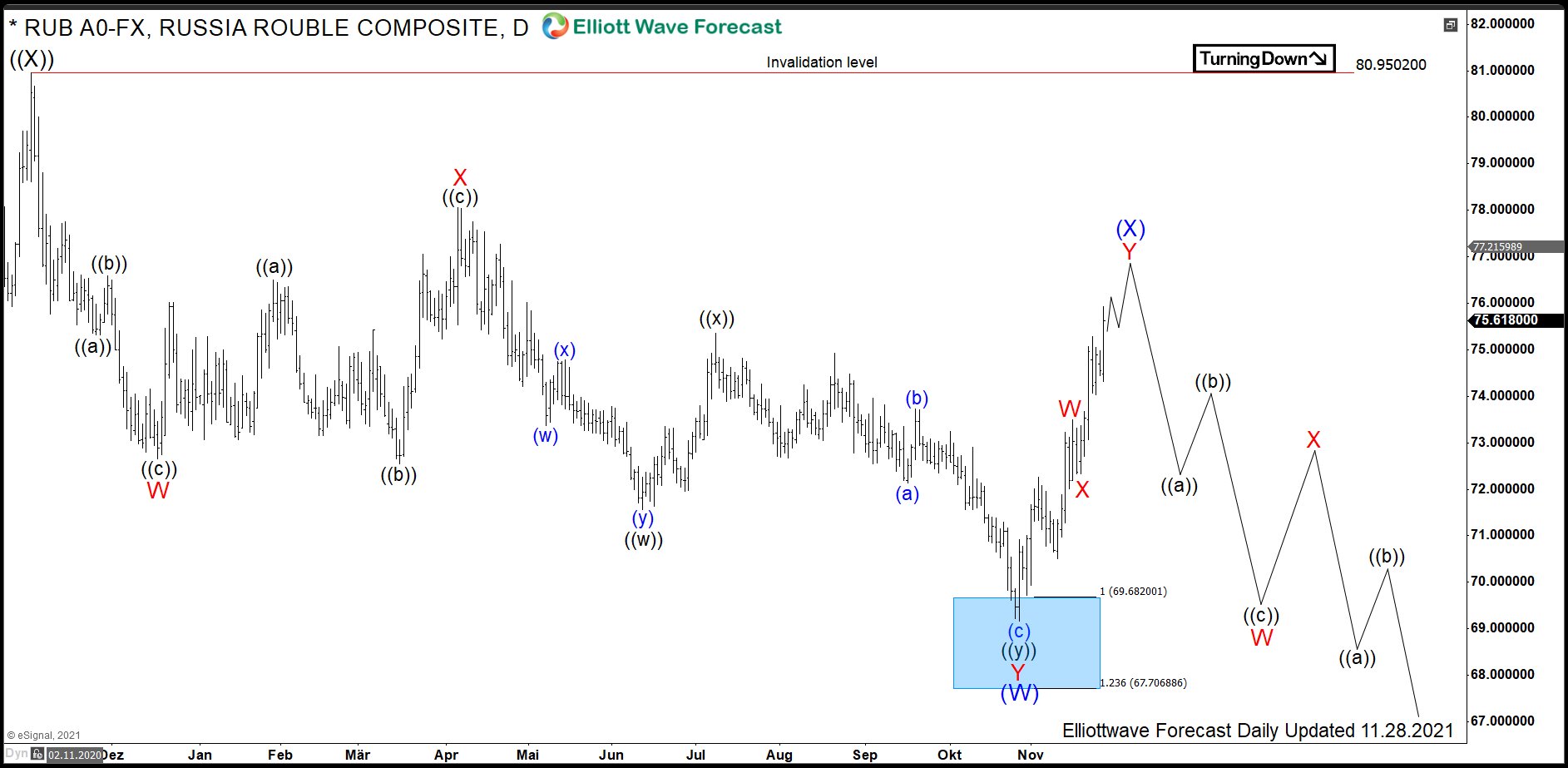

$RUB: Rouble Should See Strength within a Triangle

Read MoreBack in December 2020, we presented within the main article both the monthly and the daily view in the USDRUB. Long-term, the pair should provide a resolution thrust higher out of a multi-year triangle pattern. This means a weakness of Russian currency. Medium-term, however, we saw Russian Rouble gaining strength as related to the US Dollar. Short-term, Rouble […]

-

$LBS: Lumber Prices Start a New Large Cycle Higher

Read MoreLumber, also known as timber, is a type of wood that has been processed into beams and planks. One can trade it in form of Random Length Lumber futures and options at Chicago Mercantile Exchange within the agriculture asset class under the ticker $LBS. In 2020, we saw commodities turning higher. Then, a medium term […]

-

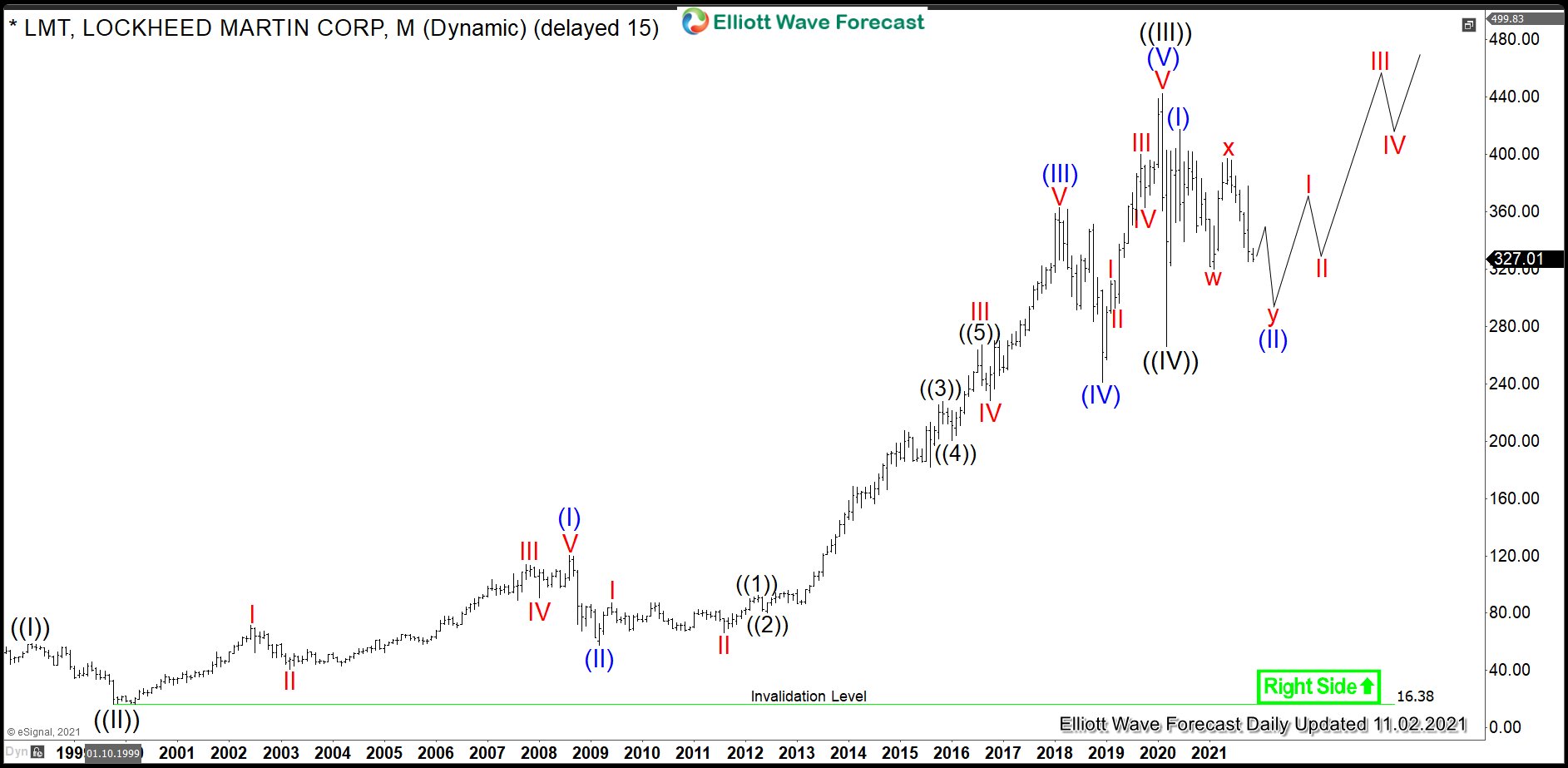

$LMT : Lockheed Martin Provides Opportunity in Pullback

Read MoreLockheed Martin is one of the the largest defense, arms and aerospace companies based in the United States and the world. It employs approximately 110’000 people worldwide. The company operates mainly on four business segments, i.e., Aeronautics, Missiles & Fire control, Rotary & Mission system and Space systems. It’s the world’s largest defense contractor based […]

-

FCOJ: Frozen Concentrated Orange Juice Provides Opportunity

Read MoreIn the original article from March 2021, we have discussed the price action and the outlook for the Frozen Concentrated Orange Juice. Today, we present un updated view. As it has been expected, the soft commodities have advanced. In particular, we saw commodities like coffee, cocoa, cotton and sugar extending higher. Hereby, orange juice futures OJ #F […]

-

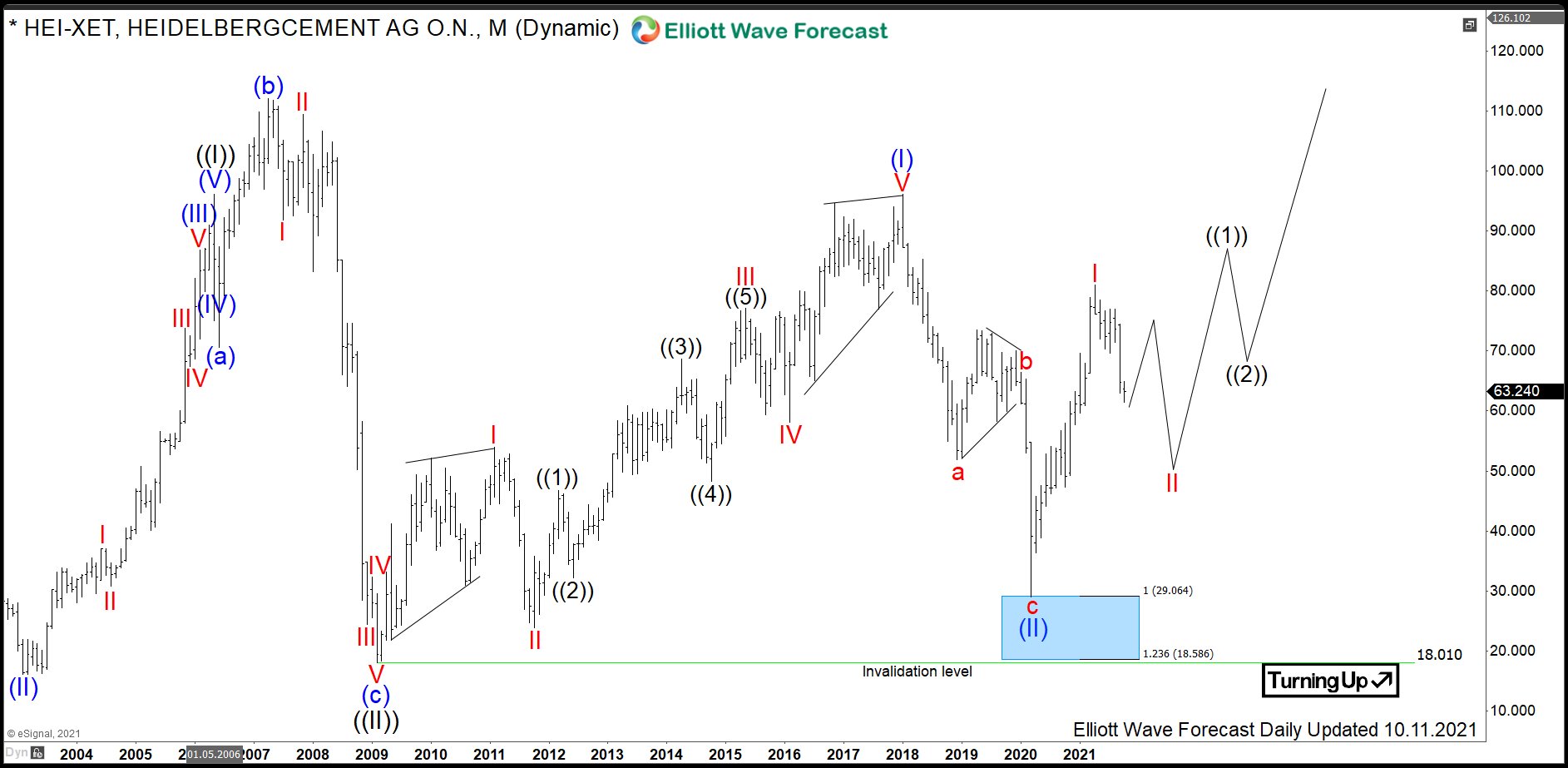

$HEI : HeidelbergCement Provides a High Upside Potential

Read MoreHeidelbergCement is a German multinational building materials company. Today, it is the largest producer of construction aggregates in the world. It is number 2 in production of cement and number 3 worldwide in ready mixed concrete. Founded in 1874 and headquartered in Heidelberg, Germany, HeidelbergCement is a part of DAX40 index. One can trade it […]

-

$FME : Fresenius Medical Care Provides a Long-Term Opportunity

Read MoreFresenius Medical Care is a German healthcare company. It is one of the four devisions of Fresenius SE & Co. KGaA. The company provides kidney dialysis services and treats end-stage renal disease. Today, it has 38% share of the dialysis market in the US. Fresenius Medical Care operates 45 production sites, mainly in the US, […]