-

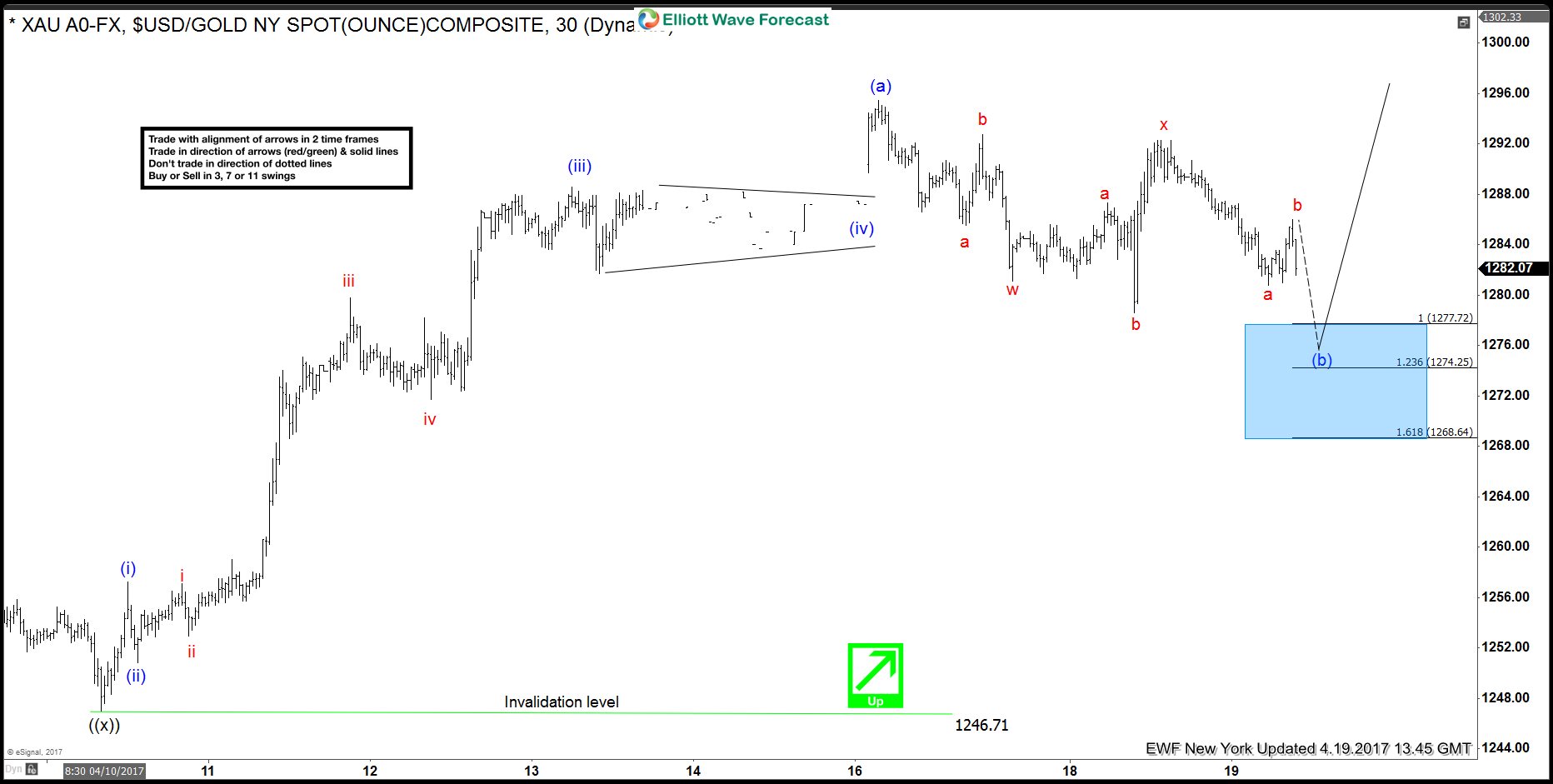

Gold Elliott Wave View: Pull back in progress

Read MoreShort term Elliott Wave view in Gold (XAUUSD) suggests that cycle from 4/10 low (1246.92) unfolded as an impulse Elliott wave structure where Minutte wave ((i)) ended at 1257.2, Minutte wave (ii) ended at 1250.8, Minutte wave (iii) ended at 1279.75, Minutte wave (iv) ended at 1271.69 and Minutte wave (v) of (a) ended at 1295.6 peak. […]

-

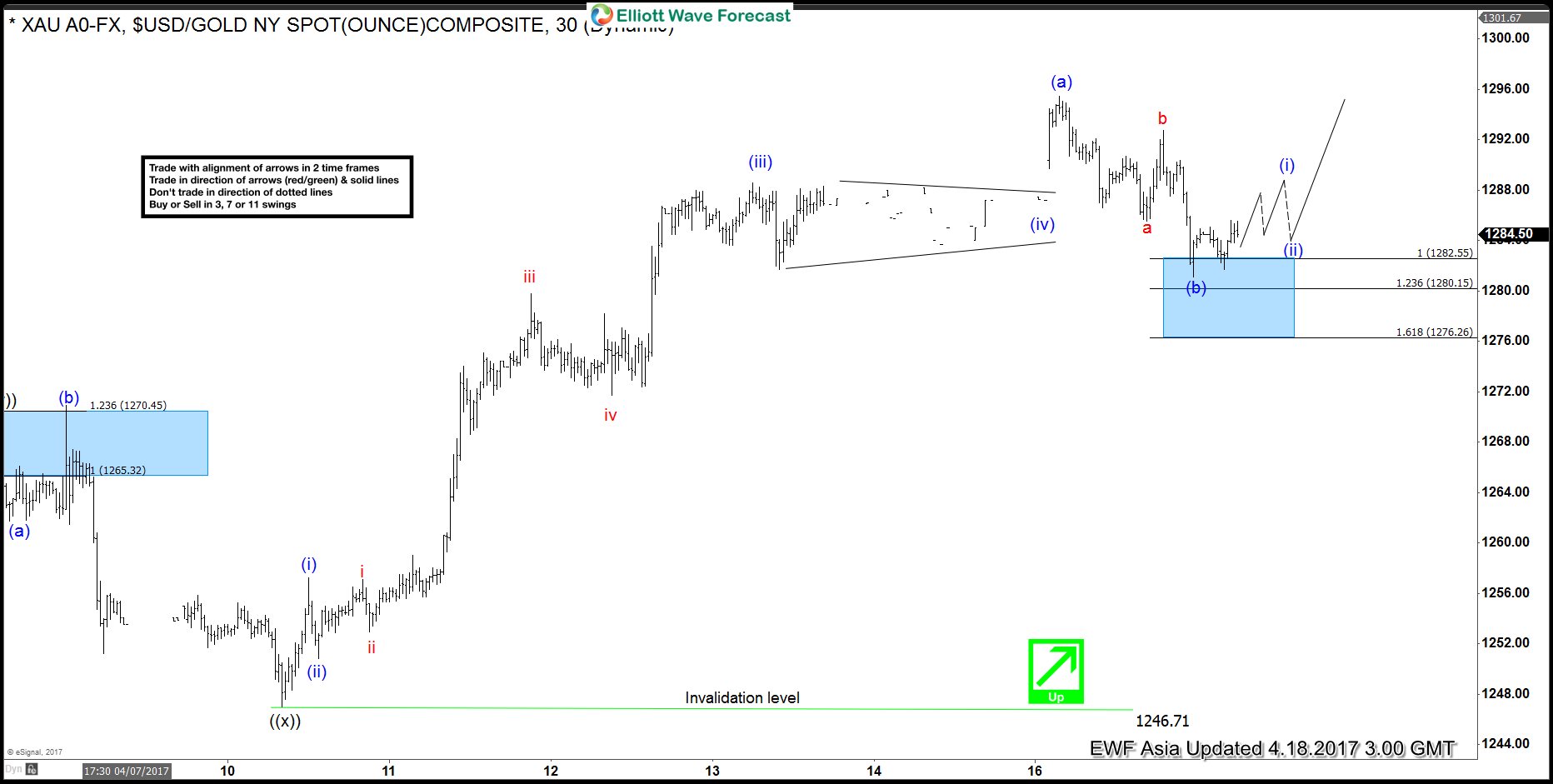

Gold Elliott Wave View: Pullback completed

Read MoreShort term Elliott Wave view in Gold (XAUUSD) suggests that cycle from 4/10 low (1246.92) is unfolded as an impulse Elliott wave structure where Minutte wave ((i)) ended at 1257.2, Minutte wave (ii) ended at 1250.8, Minutte wave (iii) ended at 1279.75, Minutte wave (iv) ended at 1271.69 and Minutte wave (v) of (a) ended at yesterday’s […]

-

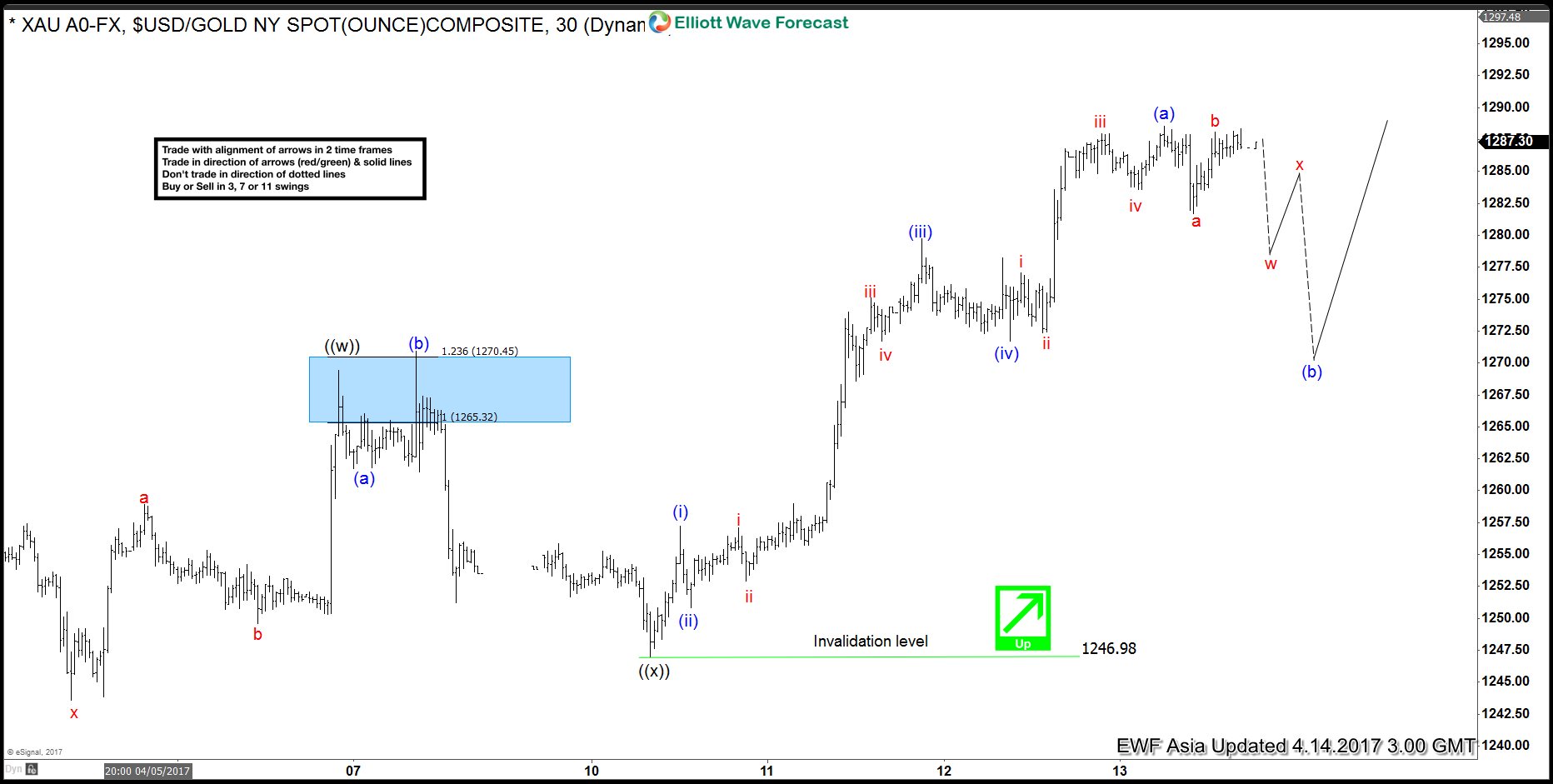

Gold Elliott Wave View: Pullback starting Elliott Wave Forecast

Read MoreShort term Elliott Wave view in Gold (XAUUSD) suggests that cycle from 4/10 low (1246.92) is unfolded as an impulse Elliott wave structure where Minutte wave ((i)) ended at 1257.2, Minutte wave (ii) ended at 1250.8, Minutte wave (iii) ended at 1279.75, Minutte wave (iv) ended at 1271.69 and Minutte wave (v) of (a) could be done […]

-

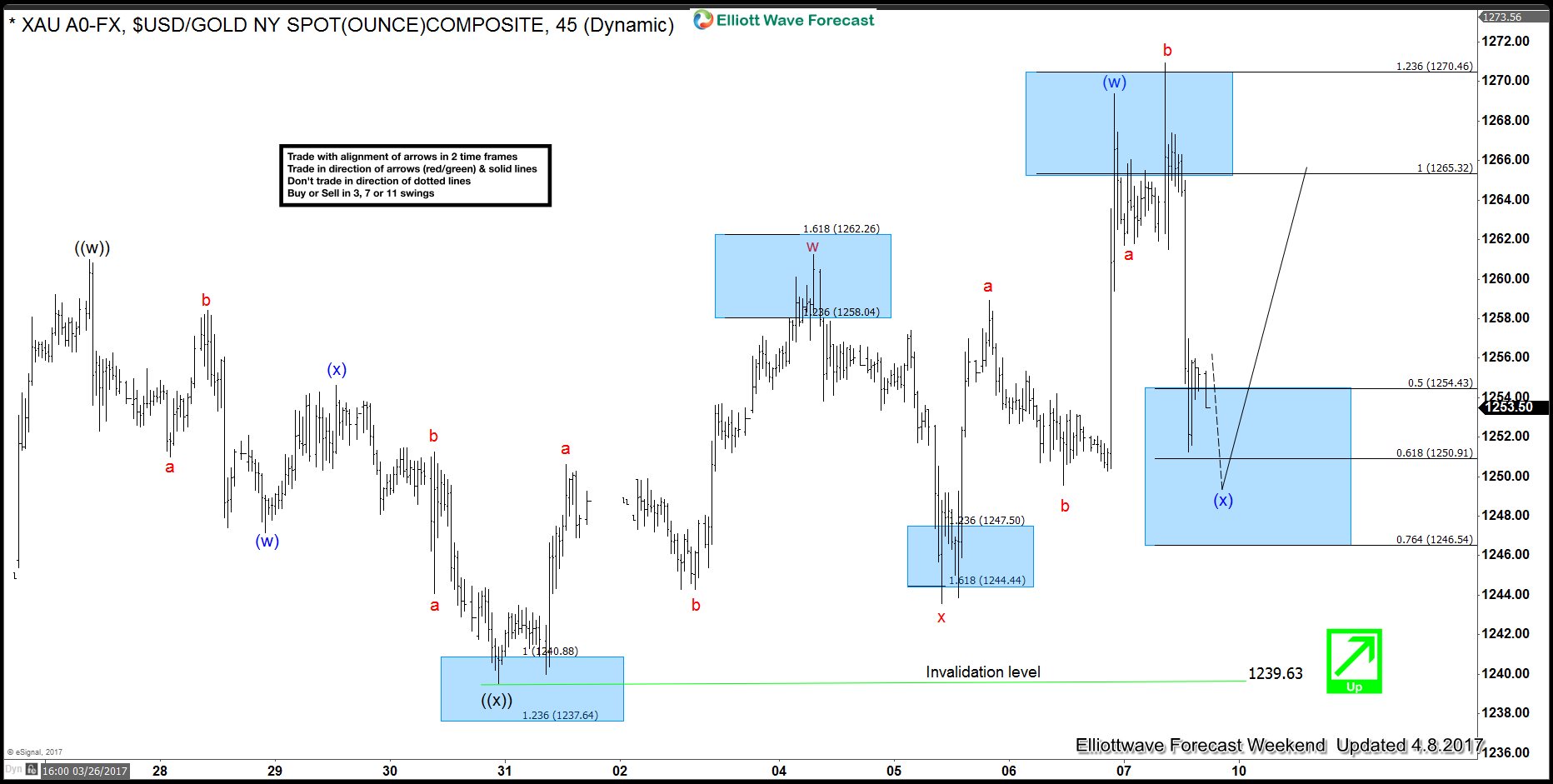

Gold rallied after Elliott Wave Flat Correction

Read MoreGold ( GC_F ) has been rallying since forming a low on 3/10 (1196). Rally from there is still incomplete and needs some more upside, so we were keep looking for buying any intraday dip in the yellow metal for continuation higher. Below is the Elliott wave 1 hour weekend updated chart from April 8, […]

-

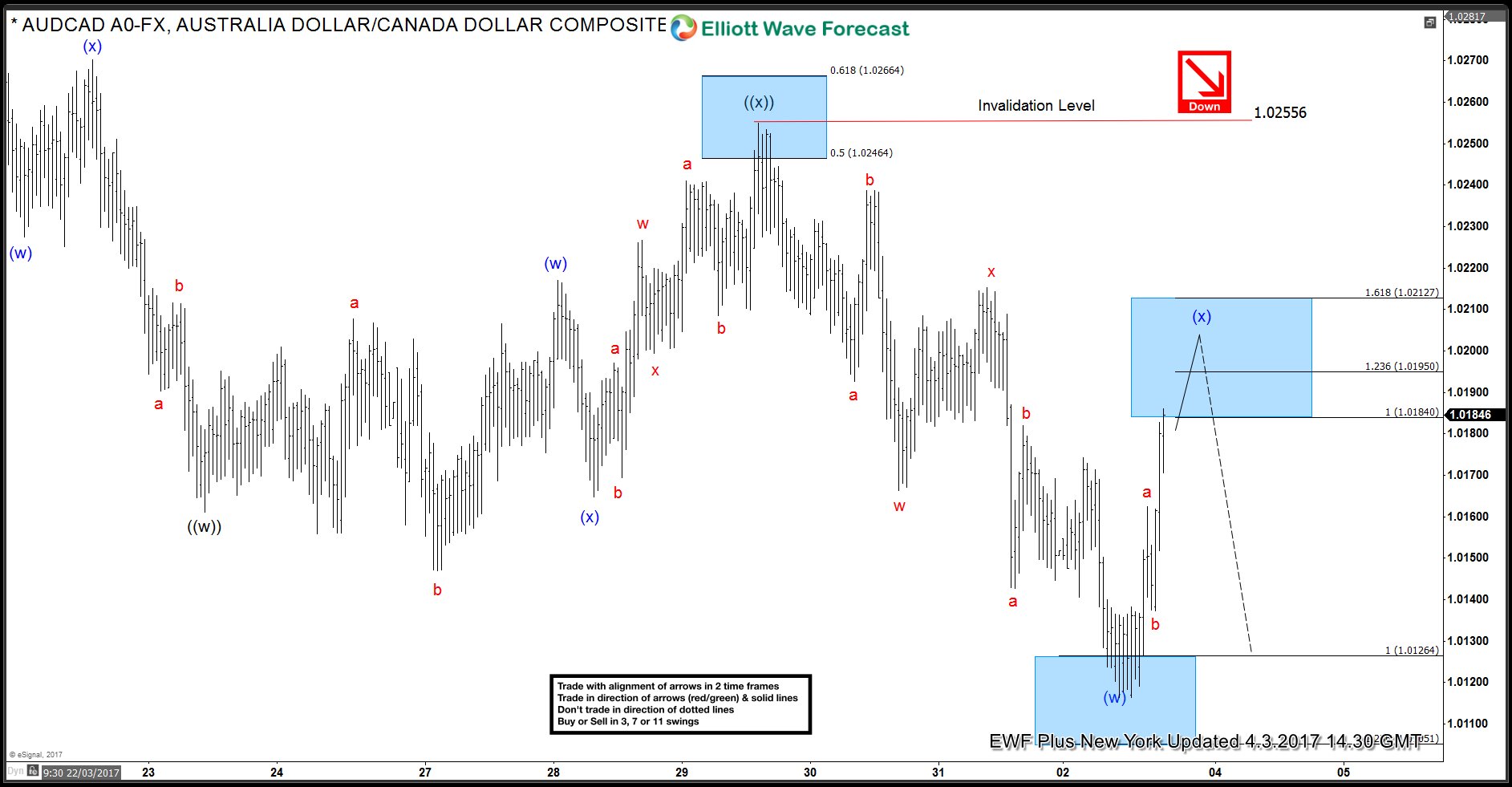

AUDCAD Elliott waves calling the decline

Read MoreIn this Technical blog we are going to take a quick look at the past 1 hour Elliott Wave performance of AUDCAD cycle from March 20 peak (1.0332), which we presented to our clients at elliottwave-forecast.com We are going to explain the structure from that peak below AUDCAD 3/29 1 Hour NY Updated Chart The cycle from […]

-

IBEX: Triple Three Elliott Wave Structure

Read MoreIn this Technical blog we’re going to take a quick look at the past Elliott Wave chart of IBEX chart from March 22,2017, which were presented to the clients at elliottwave-forecast.com. We are going to explain the structure & see how the index continued the rally afterwards. IBEX 1 Hour March 22 London Updated Chart Above […]