-

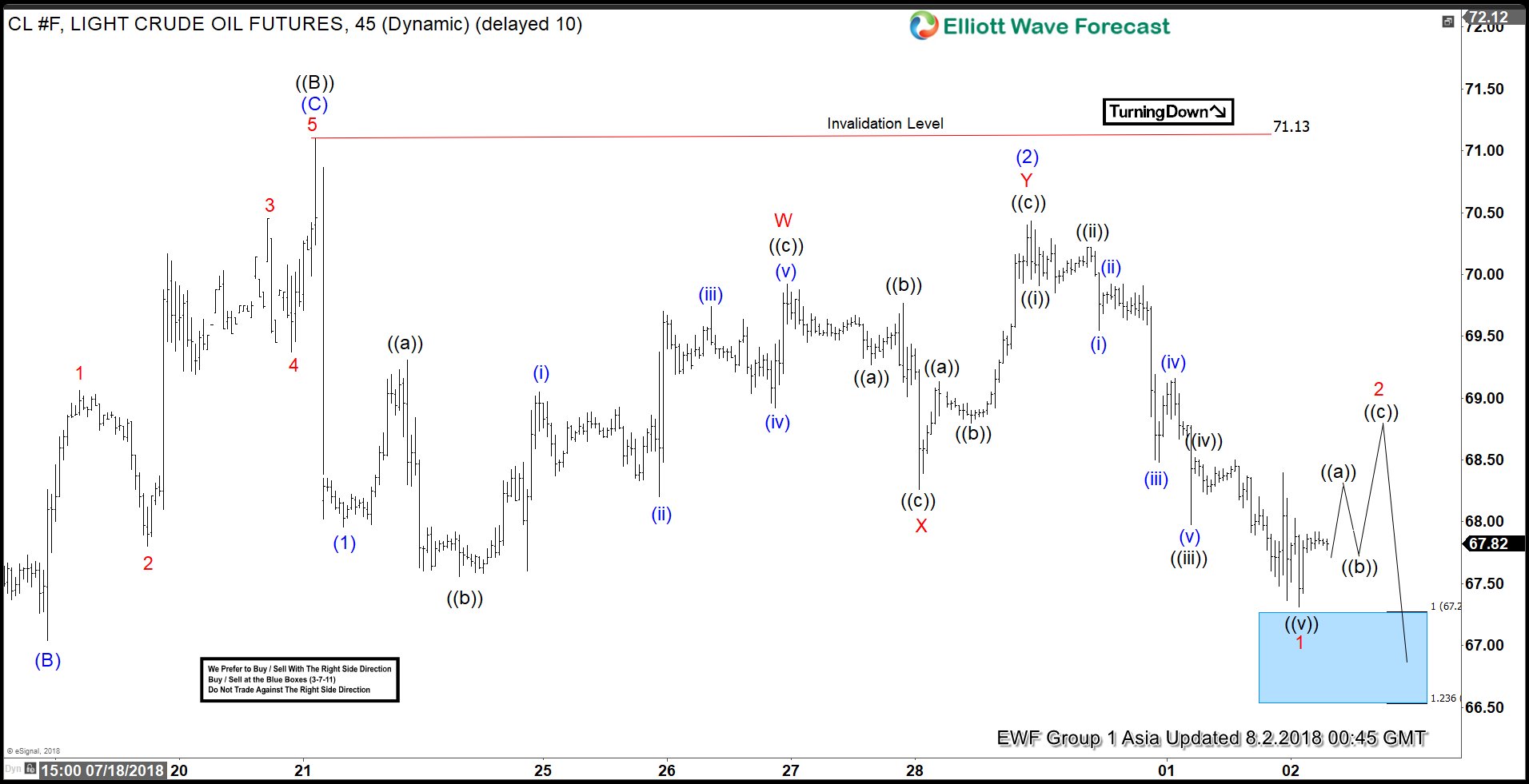

Elliott Wave Analysis: OIL Starting The Next Leg Lower

Read MoreOIL short-term Elliott wave analysis suggests that the bounce to $71.13 high ended primary wave ((B)) bounce against 7/03/2018 peak ($75.27). Primary wave ((C)) lower currently remains in progress as Elliott Wave impulse structure looking for more downside. Down from $71.13 high, the decline to $67.96 low ended intermediate wave (1) in 5 waves structure. […]

-

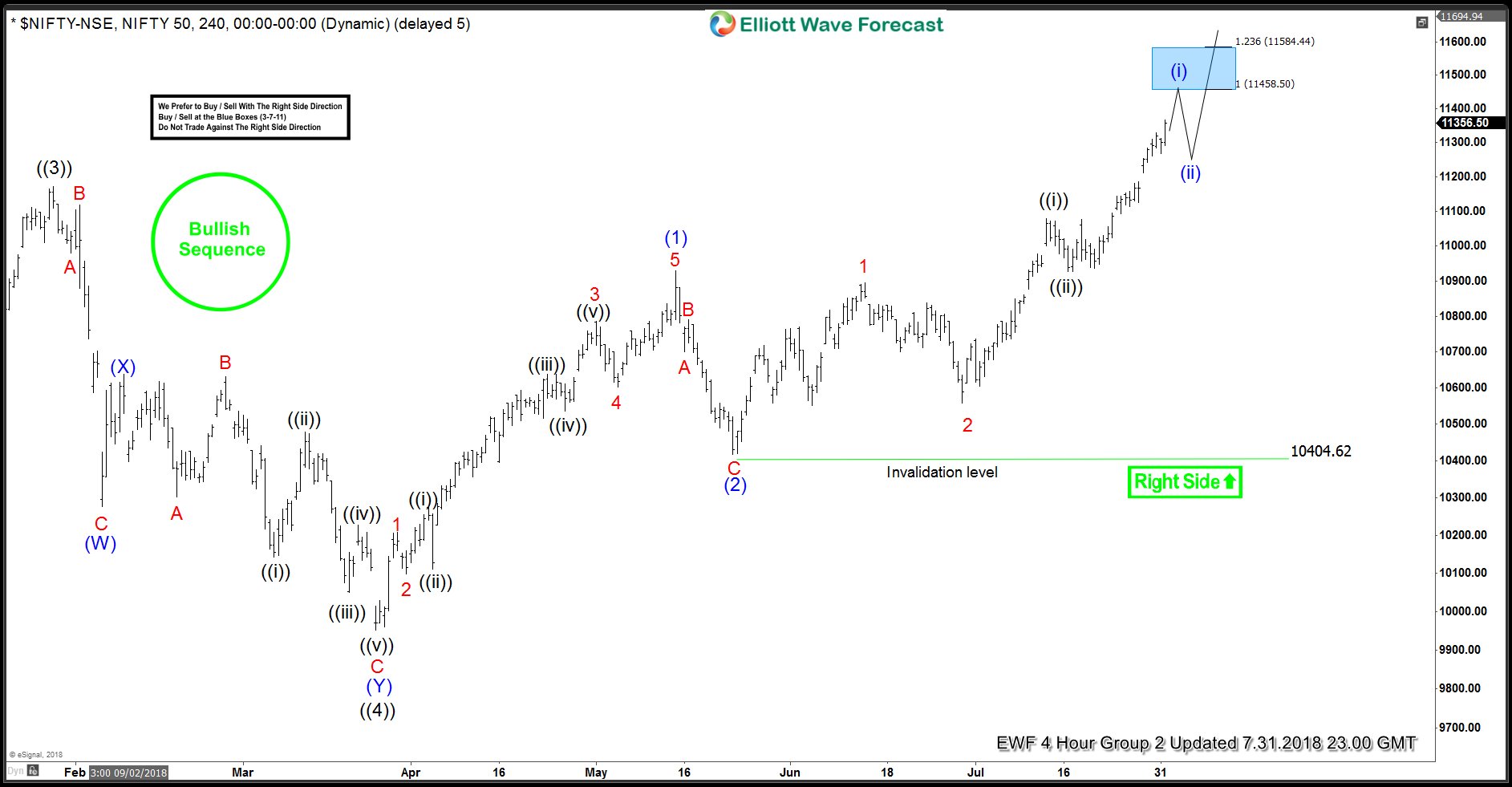

Nifty Elliott Wave Analysis: Rallying Higher as Impulse

Read MoreNifty Elliott wave analysis suggests that the rally to 11171.55 high ended primary wave ((3)). Down from there, the decline to 9951.9 low ended primary wave ((4)) pullback. The internals of that pullback unfolded as Elliott wave double three structure with sub-division of 3-3-3 corrective swings in each leg. Down from 11171.55 high, the initial decline […]

-

SPX Elliott Wave Analysis: Buying Opportunity Soon

Read MoreSPX Short-term Elliott Wave analysis suggests that the pullback to $2691.80 low on 6.28.2018 ended intermediate wave (2). Above from there, the rally higher to $2848.03 peak ended Minor wave 1. The internals of that rally higher took the form as impulse Elliott wave structure where Minute wave ((i)), ((ii)) & ((iii)) unfolded in 5 waves structure […]

-

SPX Elliott Wave Analysis: Next Leg Higher May Have Started

Read MoreSPX short-term Elliott Wave analysis suggests that the decline to $2691.99 low ended intermediate wave (2) pullback. Above from there, the rally is taking the form of an impulse Elliott wave structure. The internal subdivision of each leg higher unfolded in 5 waves (i.e Minor wave 1, 3 and 5). On the other hand, Minor wave […]

-

Elliott Wave Analysis: DAX Ready For Rally Higher?

Read MoreDAX short-term Elliott wave analysis suggests that the pullback to 6.28.2018 low ended intermediate wave (2) at 12088.56. Up from there, the rally higher to 12769.8 higher ended Minor wave 1. The internals of that rally higher took place as impulse structure with internal sub-division of 5 wave structure in Minute wave ((i)), ((iii)) & ((v)). […]

-

Bitcoin Elliott Wave Analysis: Close to Ending 5 Waves

Read MoreBitcoin Ticker symbol: $BTCUSD short-term Elliott wave analysis suggests that the decline to $6072 low ended Minor wave 2 pullback. The internals of that pullback unfolded as Elliott wave Flat correction where Minute wave ((a)) ended in 3 swing at $6445.31 low. Minute wave ((b)) bounce ended in 3 swing at $6820 high and Minute […]