-

Tesla TSLA Providing the Floor in Stock market

Read MoreTESLA (NASDAQ:TSLA) shares spiked 7% higher today before closing the day at $268 same level as late March of last year. What’s hiding behind the move and can investors be relieved ? Shares of the electric-car maker are still down 16.5 percent since the beginning of the year, alongside other automakers like General Motors (NYSE:GM) Down […]

-

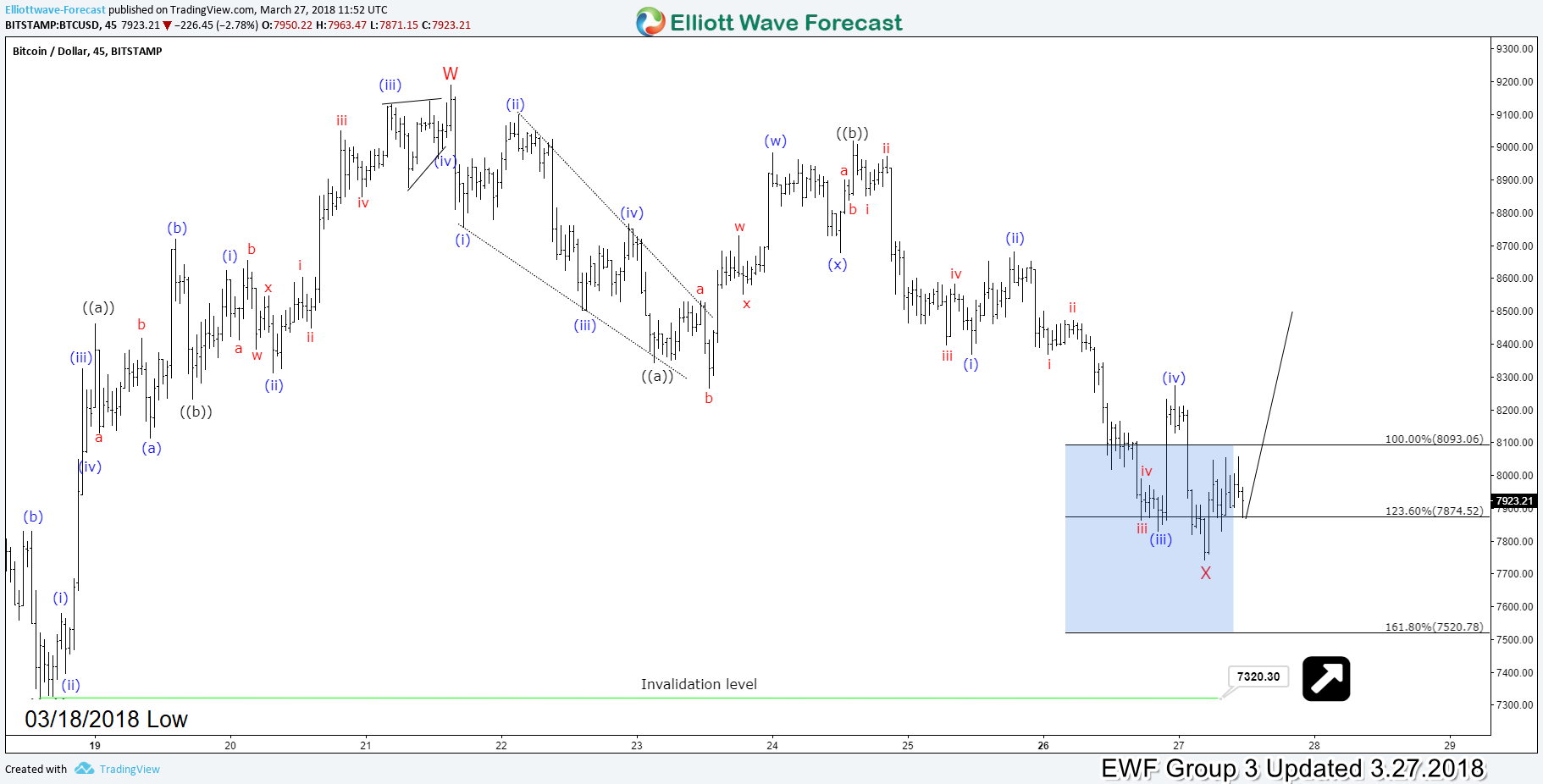

Bitcoin Elliott Wave Analysis Looking for Short Term Recovery

Read MoreBitcoin Elliott Wave Analysis in the short term is showing an interesting corrective structure suggesting a recover to take place after it finishes the current move. The digital instrument is correcting the cycle from 03/18 low in 3 waves as a Zigzag structure which reached the 100% – 161.8% Fibonacci extension area $8093 – $7520 from […]

-

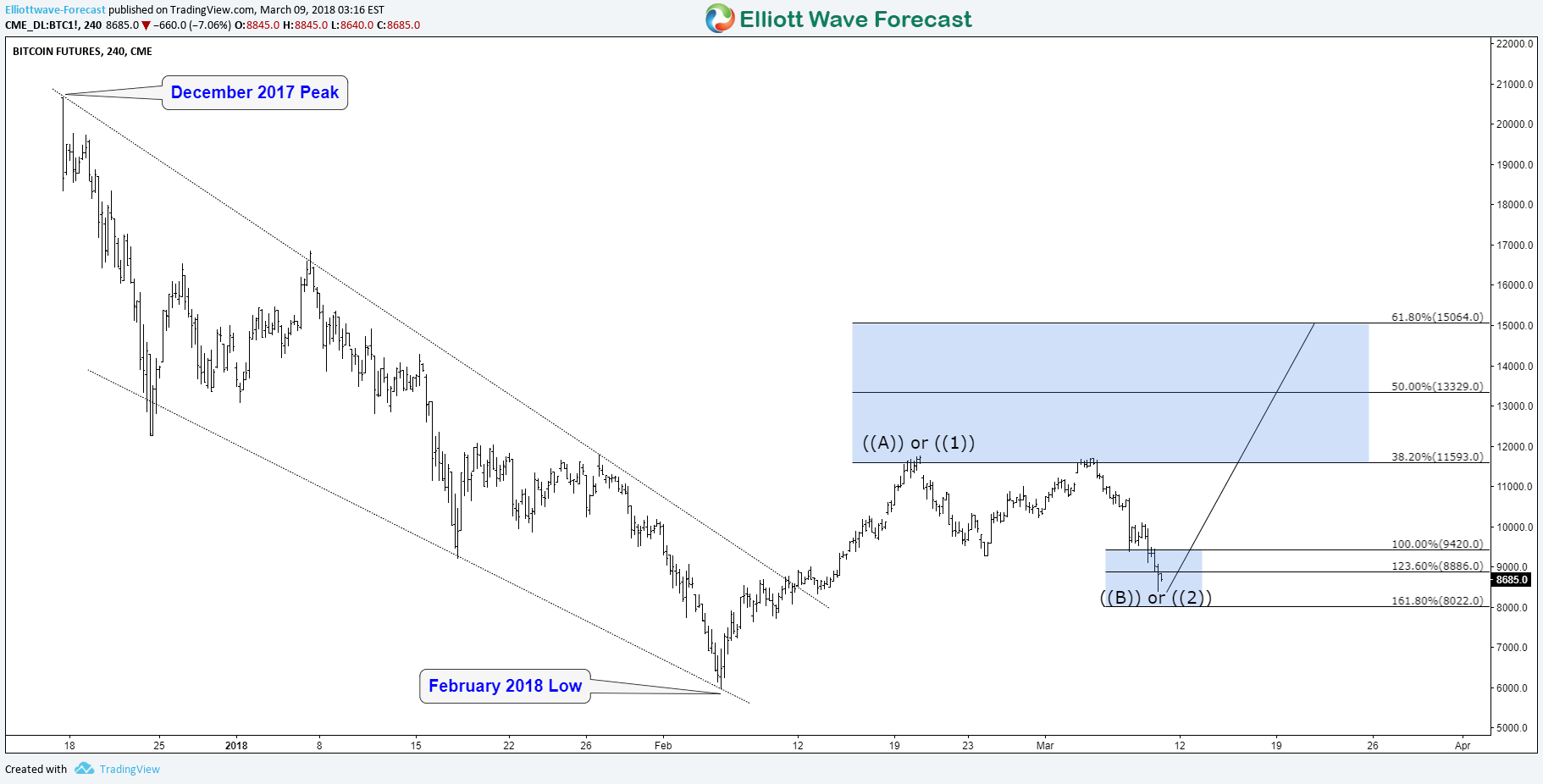

Bitcoin BTCUSD Elliott Wave View Calling for Rally toward $15,000

Read MoreSince all time high in December 2017, Bitcoin BTCUSD ( Value in US Dollar ) dropped 70% before finally bottoming around $6590 on the 6th of February 2018. The big decline drove fear into the digital market as many new investors / traders lost their money during that period so they decided to stay away […]

-

United States Steel Corporation $X Daily Elliott Wave View

Read MoreUnited States Steel Corporation (NYSE: X) is the second largest steel domestic producer behind Nucor Corporation (NYSE: NUE) and also the world’s 24th largest steel producer. Last year, Steel price surged higher reaching new all time high of 4772 in December gaining +60% before a correction took place. The price is expected keep rising in the coming years […]

-

Baidu (BIDU) Resuming the Bullish Cycle

Read MoreBaidu, Inc. (NASDAQ: BIDU) is one of the largest Chinese multinational technology companies specializing in Internet-related services & products and one of the premier AI leaders in the world. Last week, Baidu has reported excellent results in Q4 which helped its stock to bounce +15%. Solid margin expansion and good developments on several fronts were on the headlines behind the recent […]

-

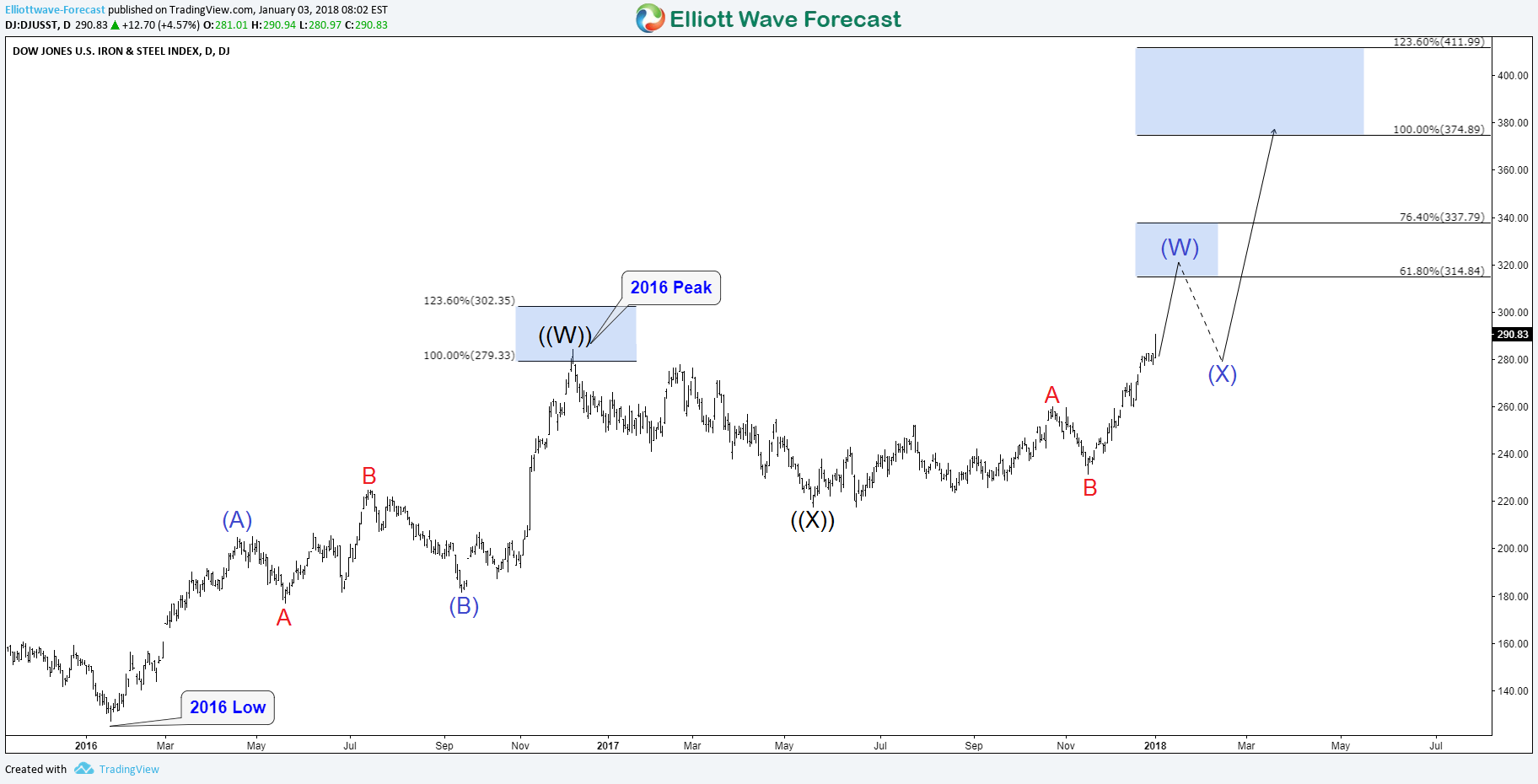

Dow Jones Iron & Steel Index DJUSST Bullish Sequence

Read MoreLast month, Dow Jones Iron & Steel Index DJUSST managed to break above December 2016 peak and created an incomplete bullish sequence from 2016 low calling for a move higher toward equal legs area $374 -$411. In the daily chart, we can see that the move higher was expected to pullback from the 61.8% – […]