-

JNJ Bullish Sequence Calling for New All Time Highs

Read MoreJohnson & Johnson (NYSE: JNJ) is one of the oldest companies around the market as it was founded in 1886. It manufactures medical devices, pharmaceutical and consumer packaged goods and its stock JNJ represent 10.8% of the Health Care ETF “XLV” weight. J&J beats Earnings & Sales Estimates in Q3 and since the release in mid […]

-

Google (NASDAQ: GOOGL) Elliott Wave View: Further Upside Expected

Read MoreGoogle (NASDAQ: GOOGL) super bullish cycle since 2009 low is still in progress and in this article we’ll be taking a look at the daily chart using the Elliott Wave Theory. Google rallied in an impulsive 5 waves structure since March 2018 low $983 and managed to make new all time highs which technically can be […]

-

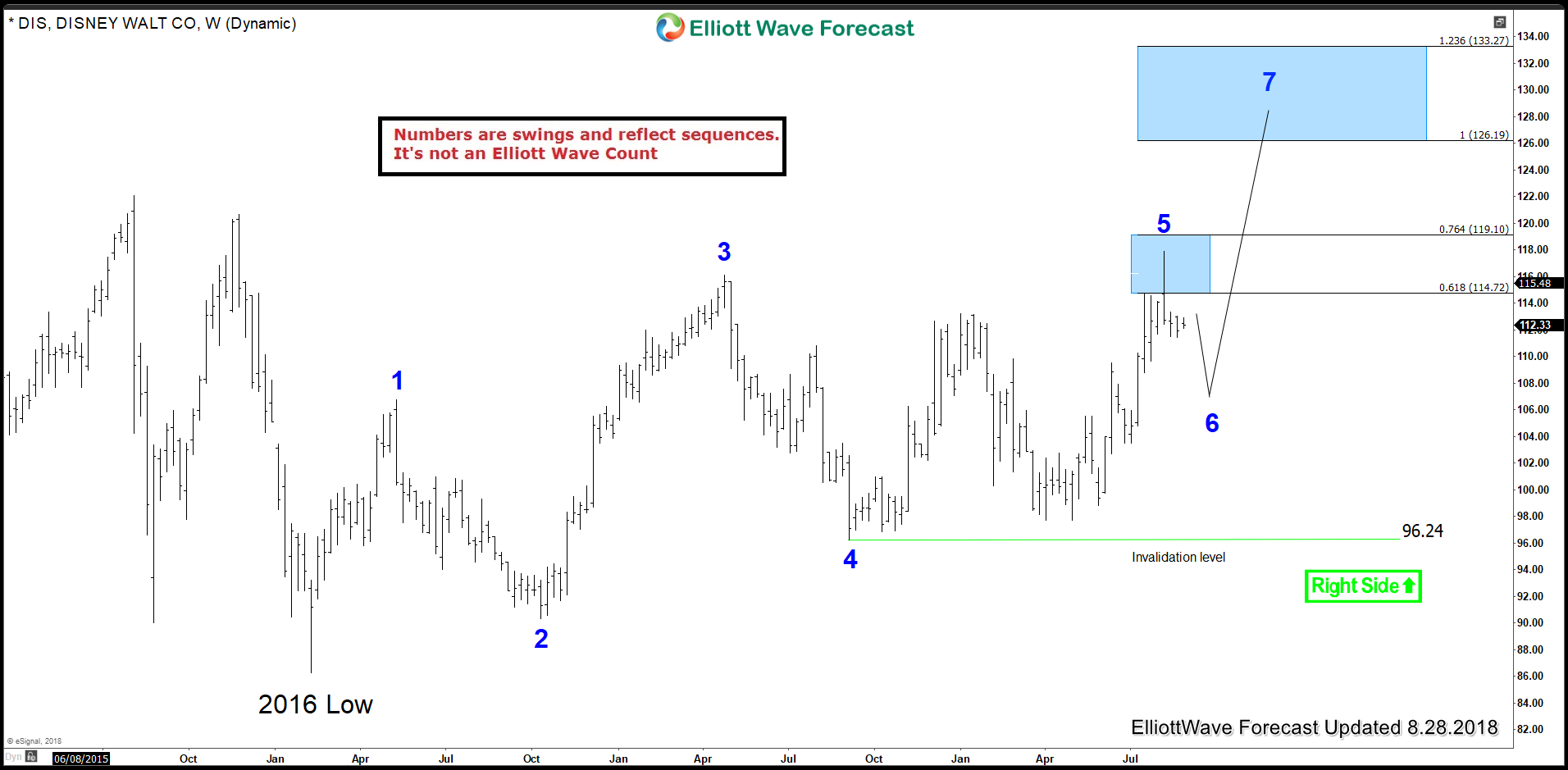

Disney DIS Bullish Sequence Looking For New All Time Highs

Read MoreIn the recent 3 years, Walt Disney stock price (NYSE: DIS) hovered between $120 and $90 without any real trending momentum. Last year, we looked for a potential break to new all time highs in Disney based on few scenarios which seems to be still playing out. Taking a look at the weekly chart, we […]

-

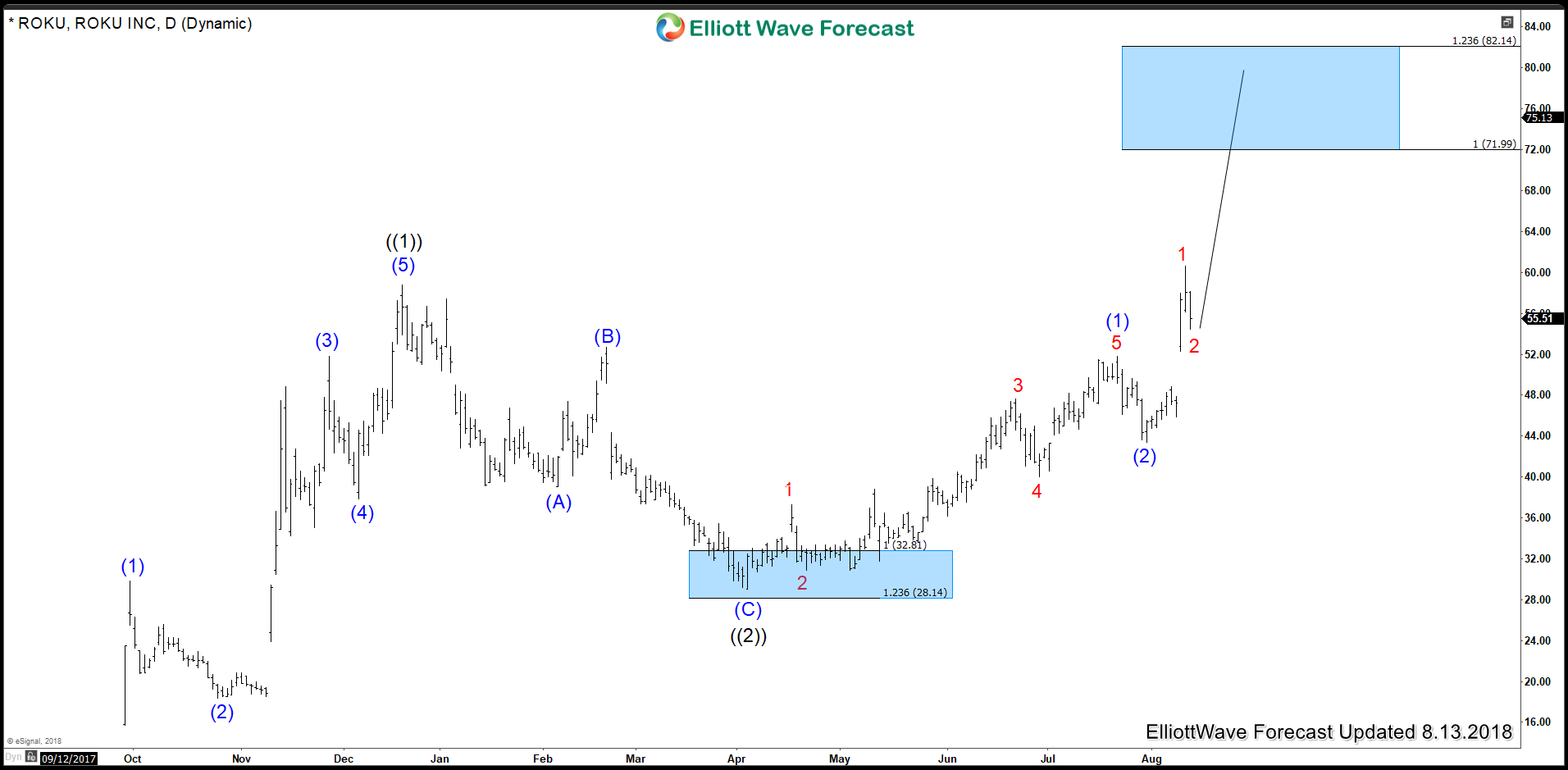

Can ROKU Stock price surpass $100? ElliottWave Forecast Analysis

Read MoreROKU (NASDAQ:ROKU) a streaming TV platform surged last Thursday more than 20% after the company reported better-than-expected second-quarter results. The company currently has 22 million active users but still can’t compete with the giant Netflix (NASDAQ:NFLX) having 130 million subscriber. However, ROKU is taking serious steps to expand and not limit the product to Roku devices. It already […]

-

Berkshire Hathaway Stock Aiming for Recovery

Read MoreBerkshire Hathaway (Class A NYSE: BRK.A – Class B NYSE: BRK.B) is currently the seventh largest company in the S&P 500 Index by market capitalization. The company ,lead by Warren Buffett, has averaged an annual growth in book value of 19.0% to its shareholders since 1965. Berkshire Hathaway Class B NYSE: BRK.B is one of the […]

-

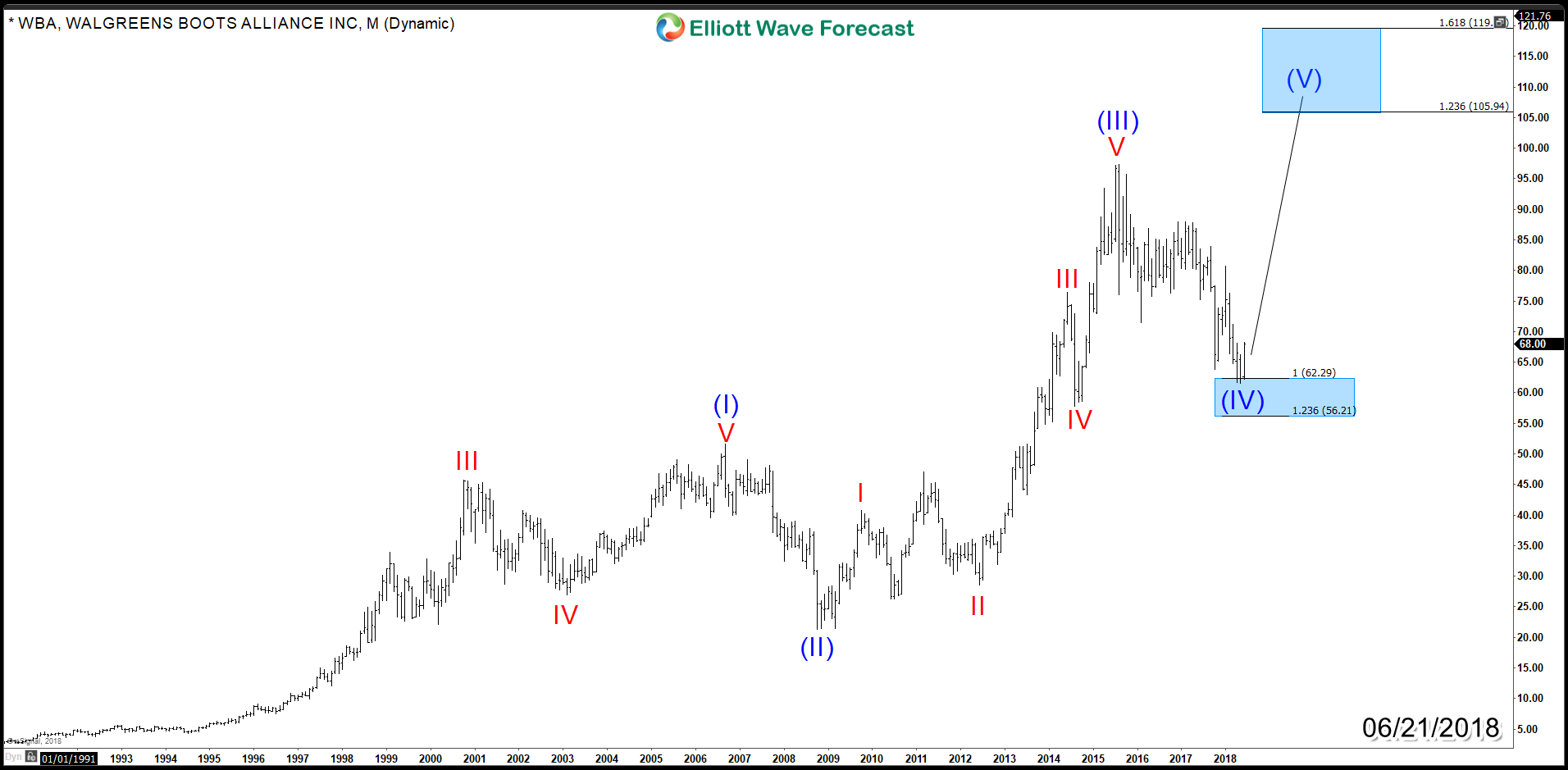

Walgreens WBA Ready to Rally to New All Time Highs

Read MoreWalgreens Boots Alliance (NASDAQ: WBA) is the second-largest pharmacy store chain in the United States. The drugstore chain will be listed in the Dow Jones Index replacing General Electric and a lot of expectation for the stock price to rise in future has come up recently following that news. We believe the market is ruled by […]