-

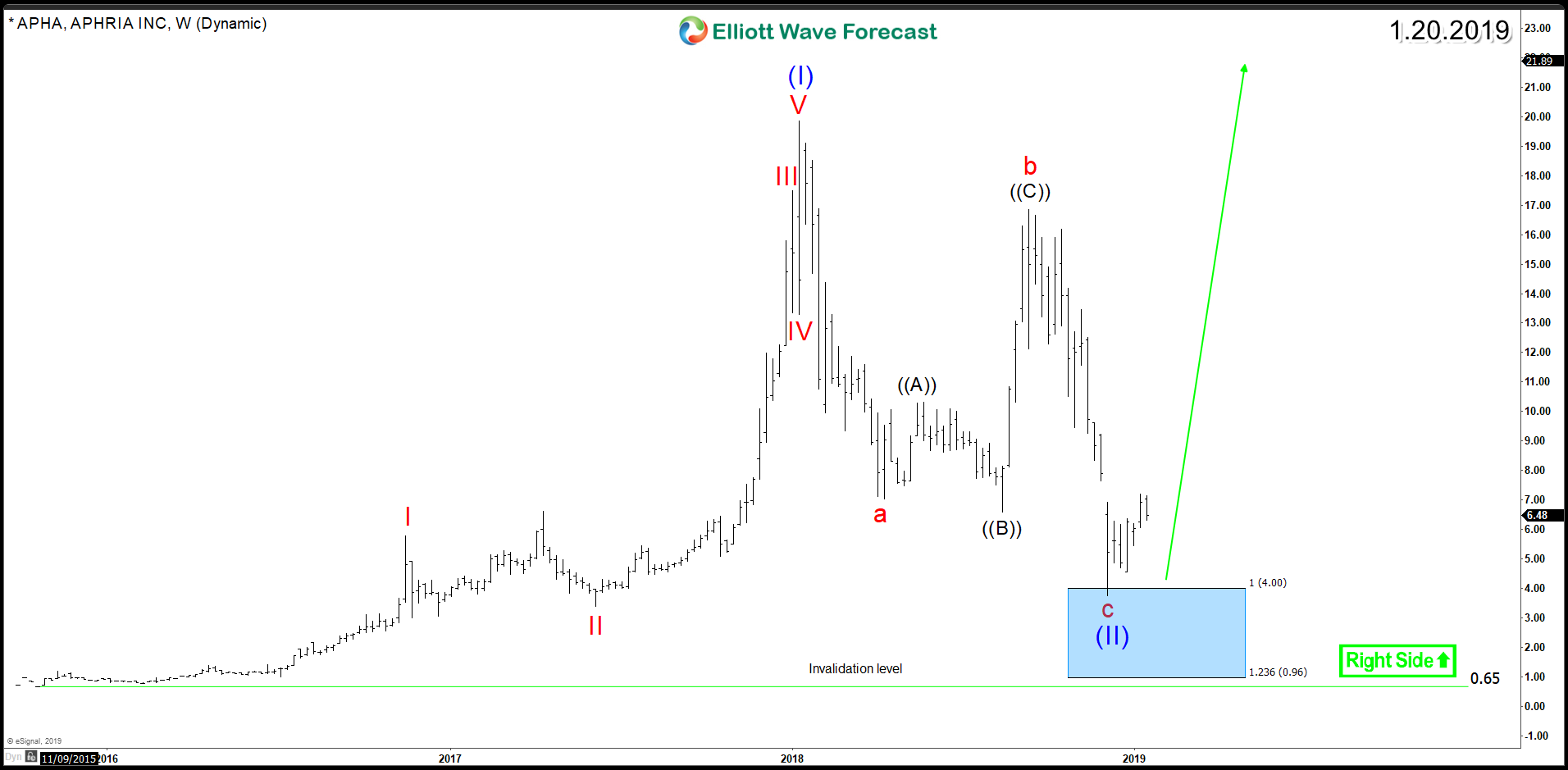

Marijuana Stock APHRIA (NYSE:APHA) Ending Correction

Read MoreAPHRIA is a Canadian cannabis company (TSX:APHA) and in November 2018 it was listed in New York Stock Exchange. The company is as a leader in the production of pharmaceutical-grade cannabis and also produces a range of marijuana and cannabis oil products. In 2018, Aphria stock took a big hit with a 75% decline as world stock […]

-

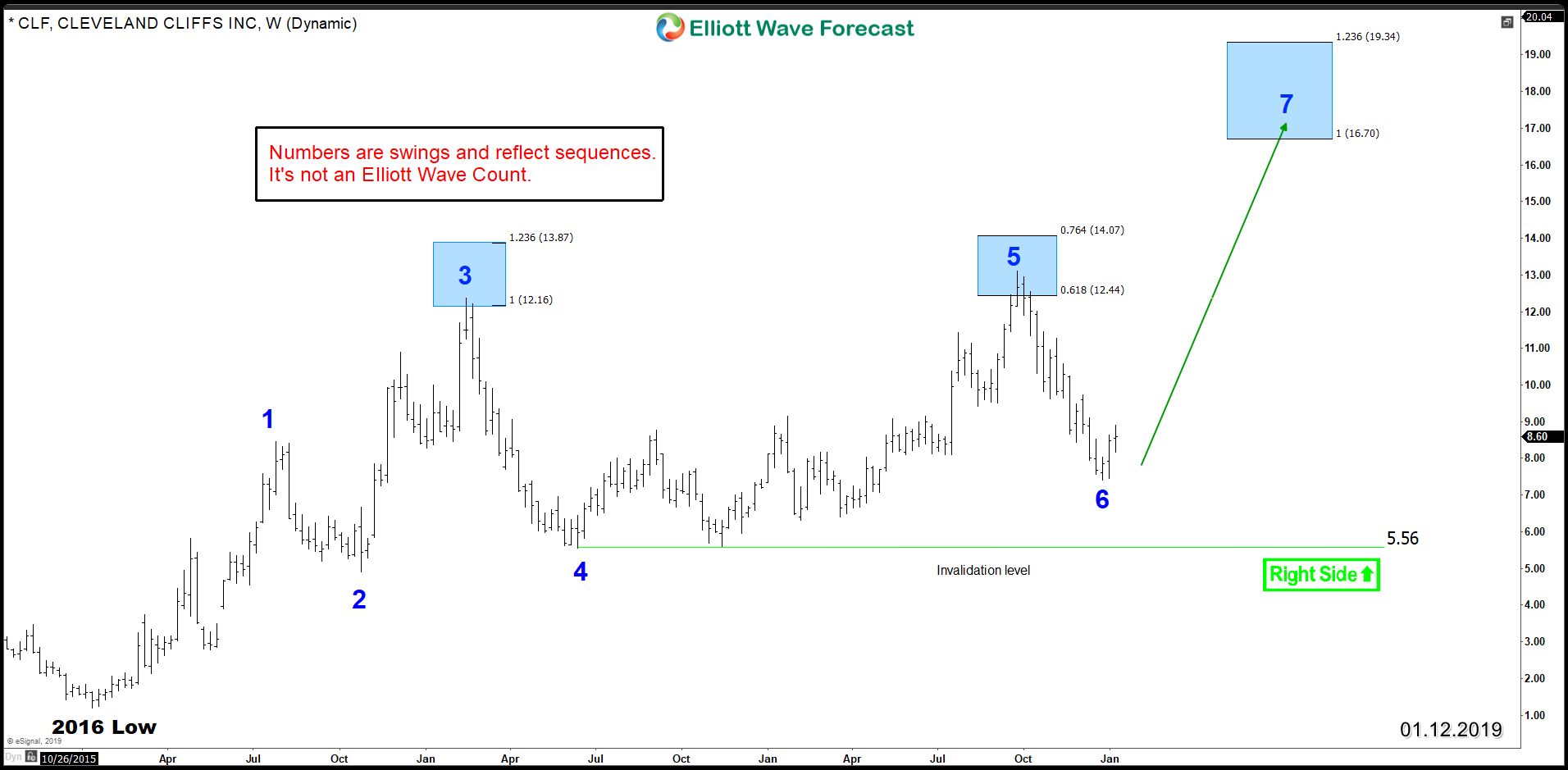

Cleveland Cliffs (NYSE:CLF) Aiming for Double Digits

Read MoreCleveland Cliffs (NYSE:CLF) is an American mining company that specializes in Iron Ore. With the demand for construction steel soaring around the world and specially in China, the price of Iron Ore continues to rise which makes big miners such as CLF, BHP, Rio Tinto and Vale a major beneficiaries thanks to the high-grades of […]

-

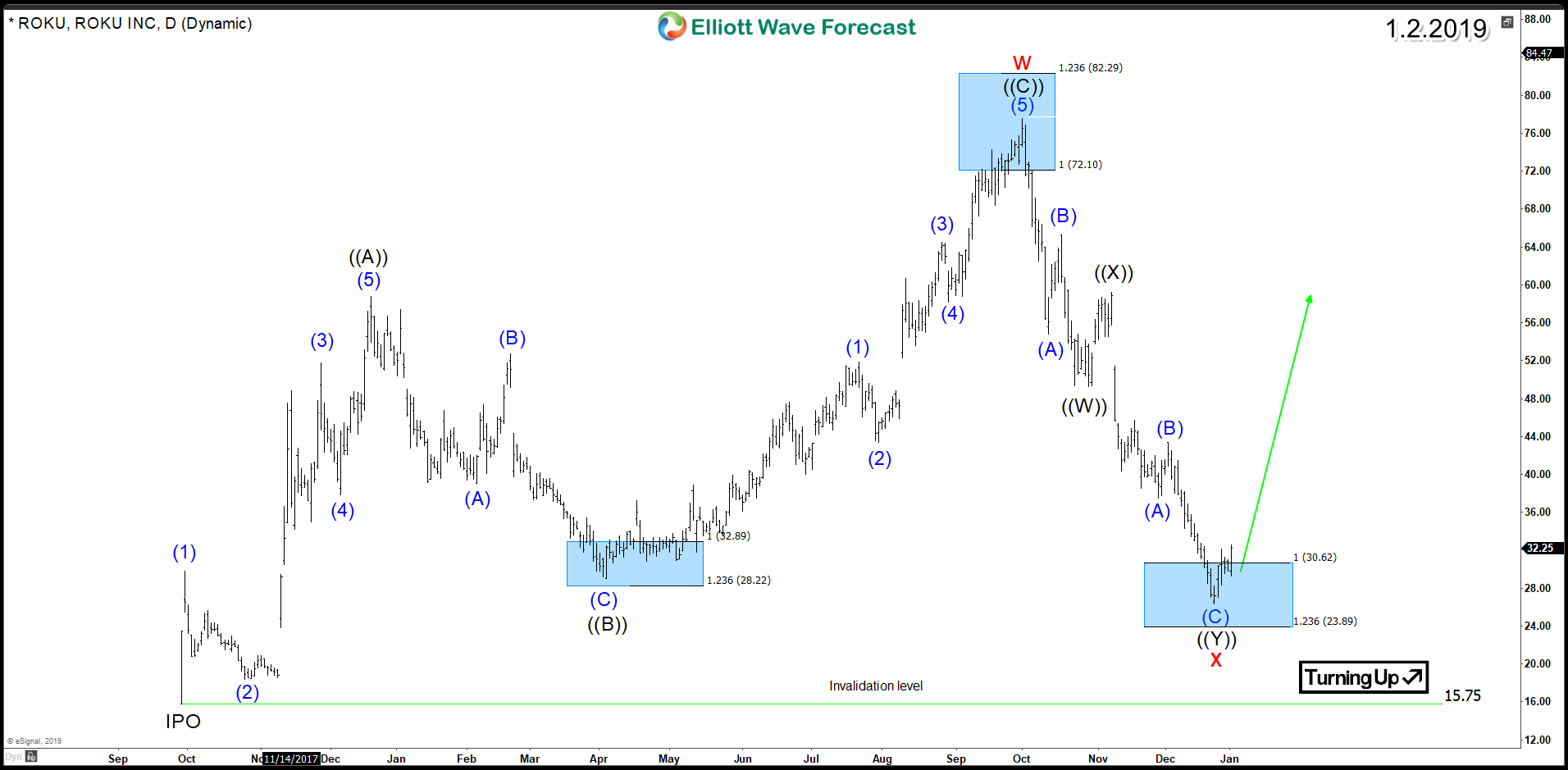

ROKU ElliottWave Corrective Structure Suggesting a Recovery

Read MoreROKU investors had great hopes for 2018 as the streaming TV platform continued it outstanding growth in addition to its stock price surging to new all time highs. However in just 3 months, the stock erased all gains to end up with -40% similar to the rest of stock market in 2018. The company earning report […]

-

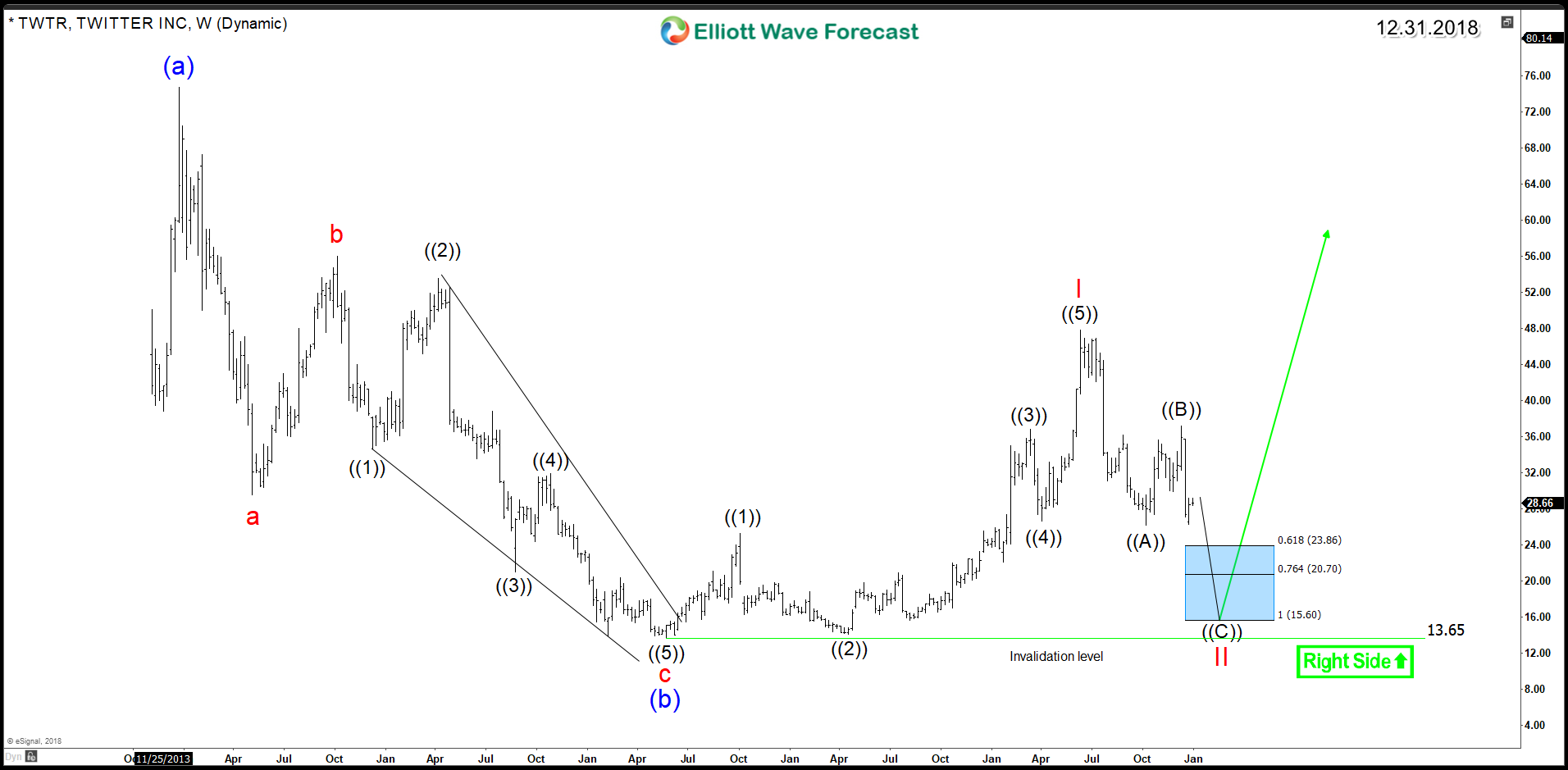

Can Twitter (NYSE:TWTR) Aim for New All Time Highs ?

Read MoreThe social networking service Twitter (NYSE:TWTR), is one of the fewest technology companies that went public and its stock under-performed among the sector against the giants of the game. After its IPO in 2013, TWTR rallied to $74 and since then it started a correction lower with a 3 waves decline as a zigzag structure that […]

-

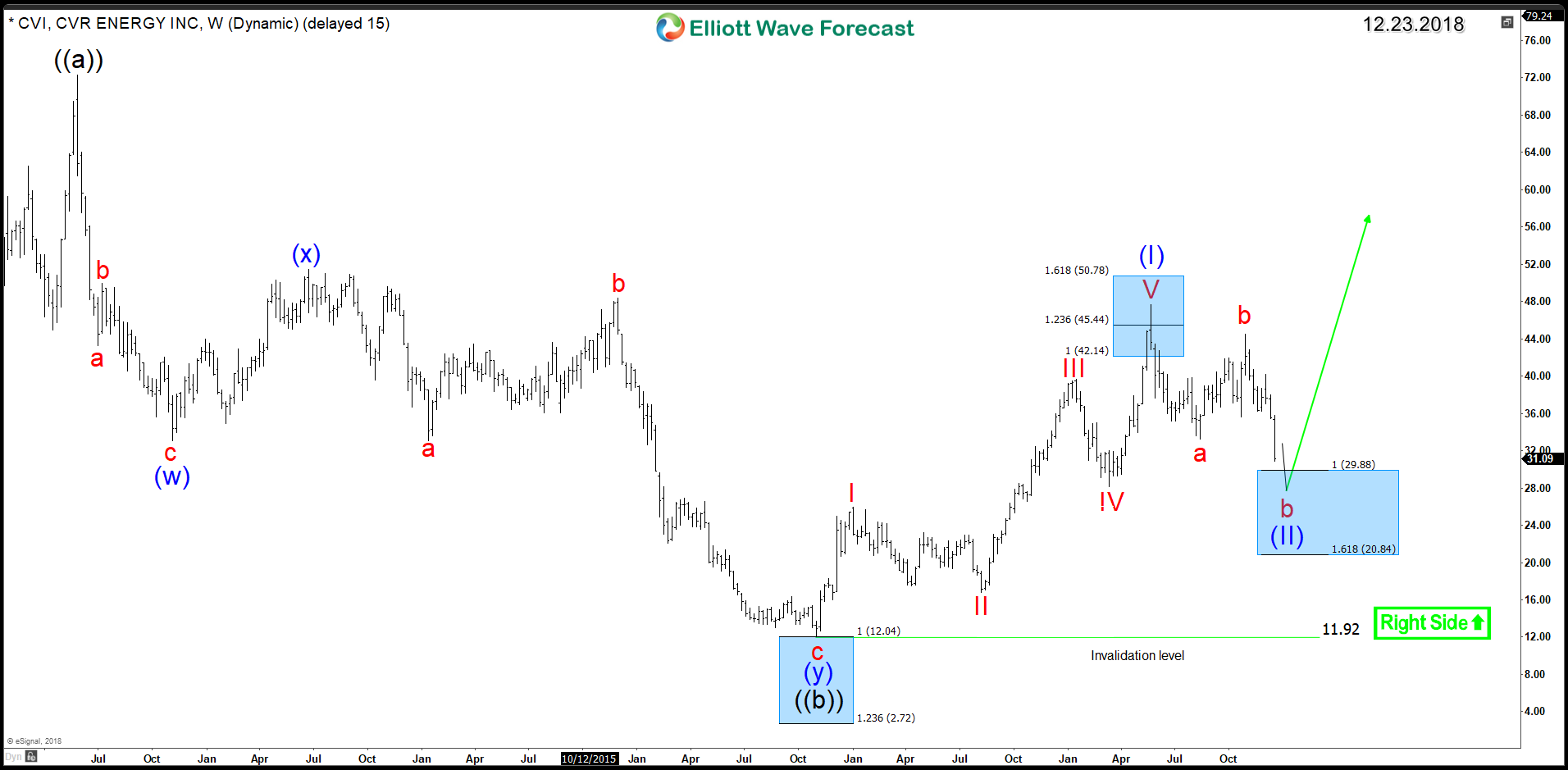

CVR Energy (NYSE:CVI) – Another 5 Waves Rally To Follow

Read MoreCVR Energy (NYSE:CVI) is presenting one of the best technical structure in Energy market despite the recent scary 40% drop in Oil prices. At Elliottwave Forecast, we believe in the One Market Concept therefore we always look for answers around other instruments within the market. Since 2016 low, CVI did advance in a bullish 5 waves impulsive […]

-

Citigroup (NYSE:C) – Time to Wake Up Bulls

Read MoreCitigroup (NYSE:C) is the 3rd largest bank in the United States. Since the crash of 2008, its stock wasn’t able to recover 15% of that decline compared to other Banks like JP Morgan or Goldman Sachs. 2018 wasn’t a good year for the entire market and Citigroup wasn’t any different as its stock price is currently […]