-

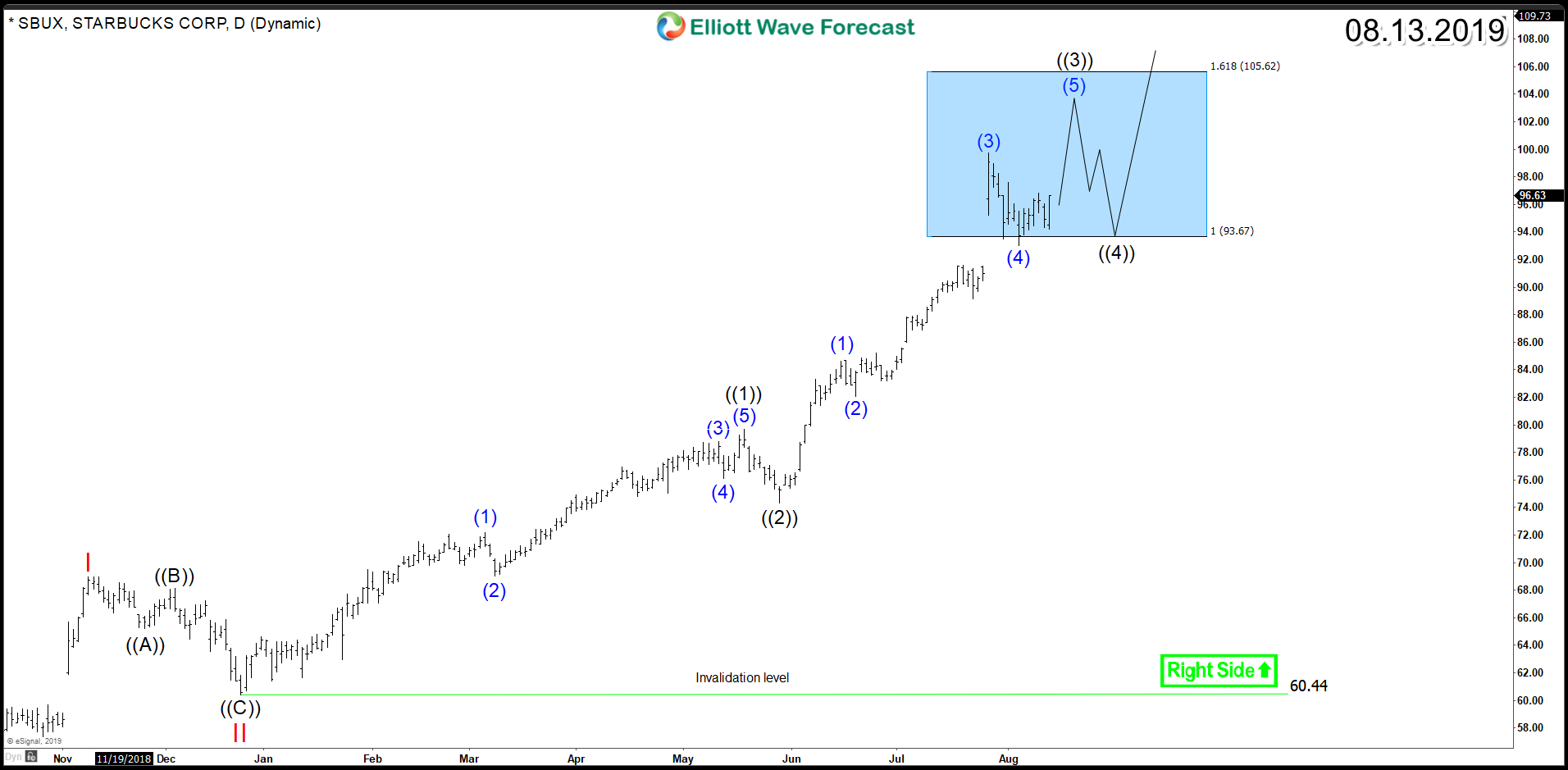

Starbucks (NASDAQ: SBUX) – Bull Market Looking to Extend

Read MoreStarbucks (NASDAQ: SBUX) is currently up 50% year-to-date and remains as one of the strongest stocks leading the bull market higher and making new all time highs. the stock is currently trading within an impulsive 5 waves advance which started since December 2018 and it reached the minimum target area at equal legs $93.6 – […]

-

Disney (NYSE: DIS) Impulsive Structure is Supporting Further Rally

Read MoreDisney (NYSE: DIS) surged to new all time highs in April 2019 confirming the breakout of the consolidation range that lasted for 3 years. The rally from December 2018 low unfolded as an impulsive 5 waves structure which is part of the weekly cycle from 2016 low. The cycle ended on July peak from where […]

-

Lockheed Martin (NYSE: LMT) Bulls Facing CrossRoad

Read MoreLockheed Martin (NYSE: LMT) has a current market cap of $104.3B and $56.46B in revenue, outperforming the defense sector companies in the recent years. The second quarter earnings report provided a clear indication that the bull case for the stock is intact with revenue up across the board. The technical picture for the stock is showing […]

-

Can Binance Coin (BNB) Price Reach 100$ in 2020 ?

Read MoreBinance Coin (BNB) is cryptocurrency that was issued in July 2017 with Binance ICO and it’s used to pay fees on the Binance cryptocurrency exchange. In 2018, the cryptocurrency market saw a significant correction causing the majority of coins to drop more than 70% and BNB wasn’t any difference with an 80% decline. However, since December 2018, the […]

-

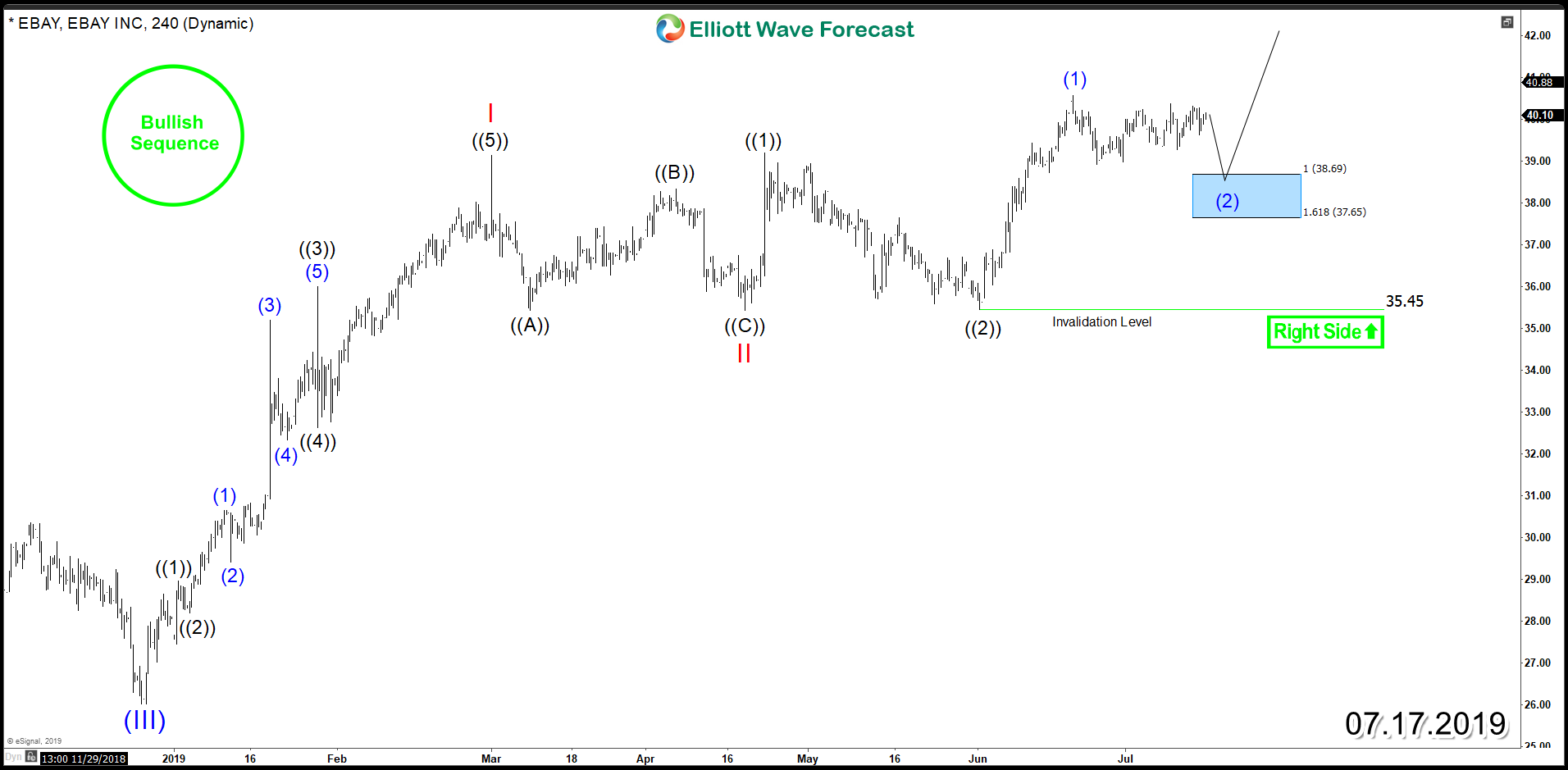

eBay Rally Aiming For Break To New All Time Highs

Read MoreeBay (NASDAQ: EBAY) is the world’s largest online marketplace that facilitates consumer-to-consumer and business-to-consumer. The company was founded in 1995 and currently operating in about 30 countries. The stock is up nearly 40% so far this year and the move higher was supported by a better-than-expected first-quarter results which saw improvement across several key operating metrics. The company is […]

-

Cisco Systems (CSCO) Elliott Wave Impulsive Structure Calling Higher

Read MoreCisco Systems, Inc. (NASDAQ: CSCO) is an American multinational technology conglomerate that develops, manufactures and sells networking hardware, telecommunications equipment and other high-technology services and products. In the age of cloud-based services, Cisco has built its business by providing top-shelf internet connectivity hardware and services for years. providing Internet Protocol-based routers and switches that move data, voice, […]