-

Bank Of America (NYSE: BAC) Inverted Head & Shoulder

Read MoreBank Of America (NYSE: BAC) recovered 50% of the 2008 financial crisis crash while majority of banks already rallied back to new all time highs. The stock is still showing positive signs as the rallies taking place since 2009 low are unfolding as an Elliott Wave impulsive structure. BAC recent daily rally from 2016 low […]

-

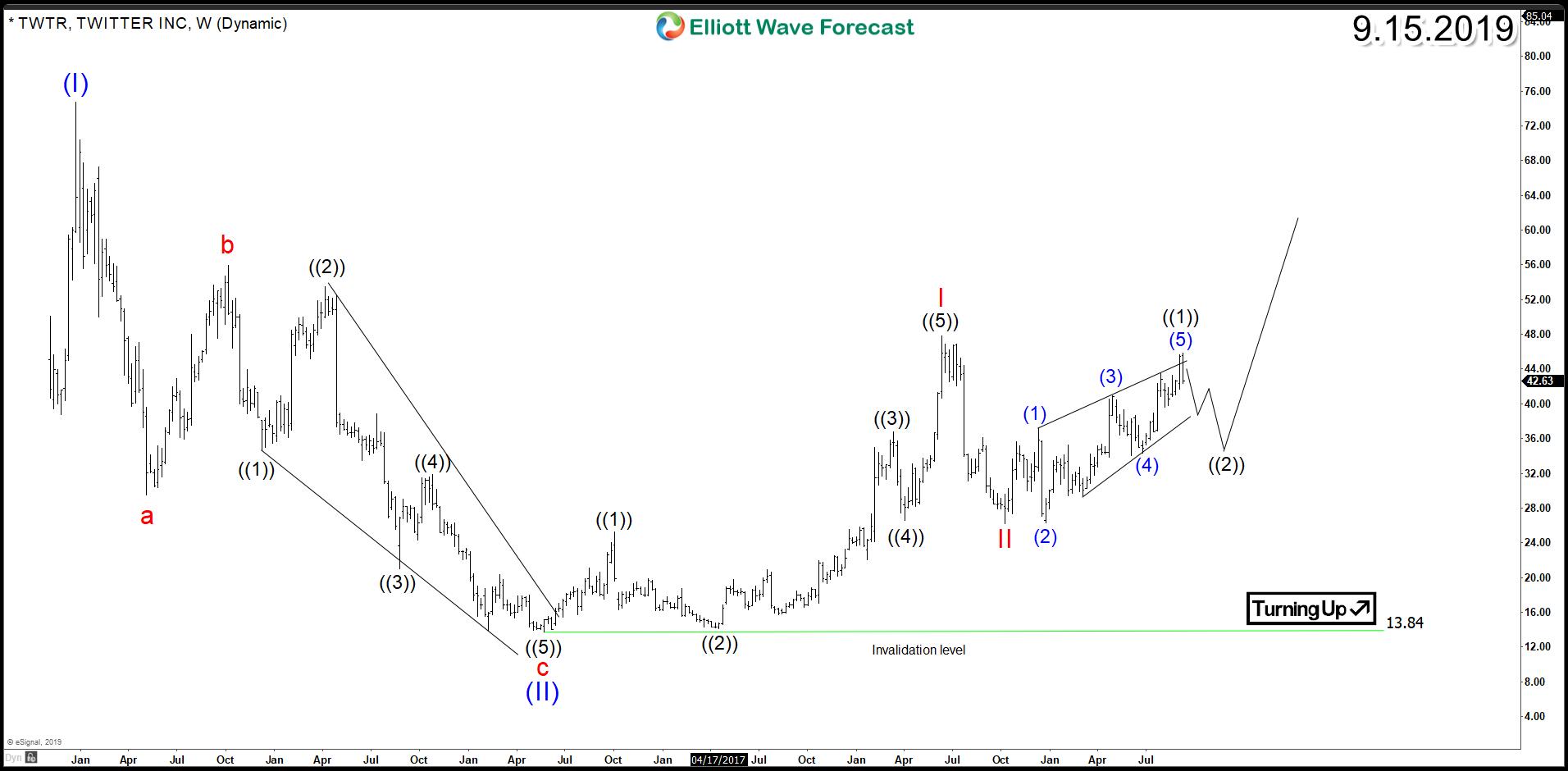

Twitter (NYSE: TWTR) Impulsive Elliott Wave Structure

Read MoreThe social networking giant Twitter (NYSE:TWTR) has become the number one platform for government leaders and it’s still considered one of the best places for breaking news. For the first time in the company’s history, Twitter made a profit in the fourth quarter of the 2017 just one year after its stock established a major bottom. […]

-

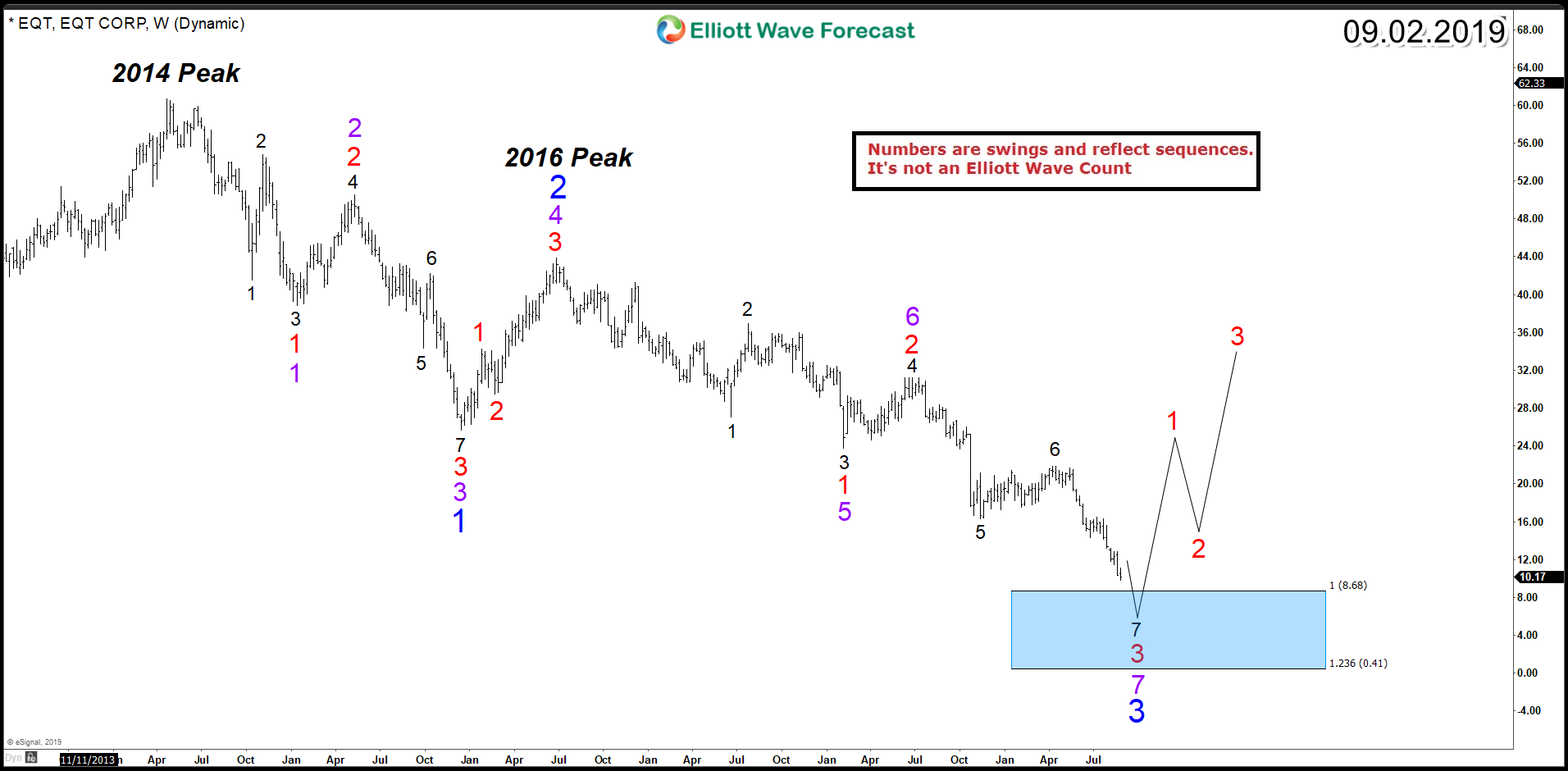

EQT Corporation (NYSE: EQT) – Ending a Corrective Decline

Read MoreEQT Corporation is one of the largest natural gas exploration and pipeline companies in United State. The Energy giant has more than 130 years of experience and it continues to be a leader in the use of advanced horizontal drilling technology . It’s also an integrated energy company with emphasis on natural gas exploration, production, gathering, […]

-

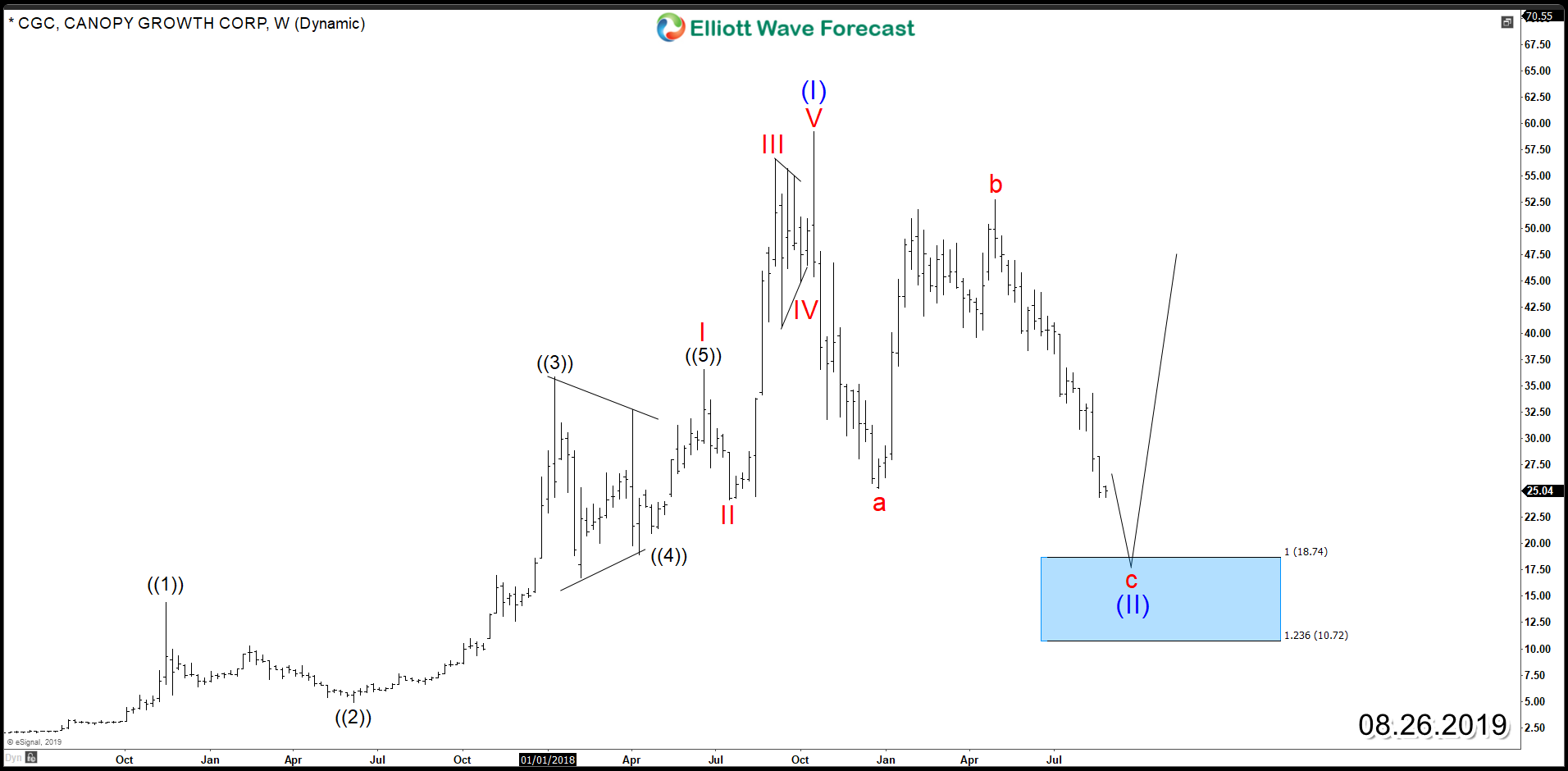

Canopy Growth Corporation – Investment Opportunity Around the Corner

Read MoreThe world’s largest medical cannabis producer by market cap, Canopy Growth (NYSE : CGC) reported earning two weeks ago. While revenue surged by nearly 250% year over year to 90.5 million Canadian dollars, it was down 59% from the previous quarter and more than 20 million Canadian dollars below the average analyst estimate which raised some concerns. The company managed […]

-

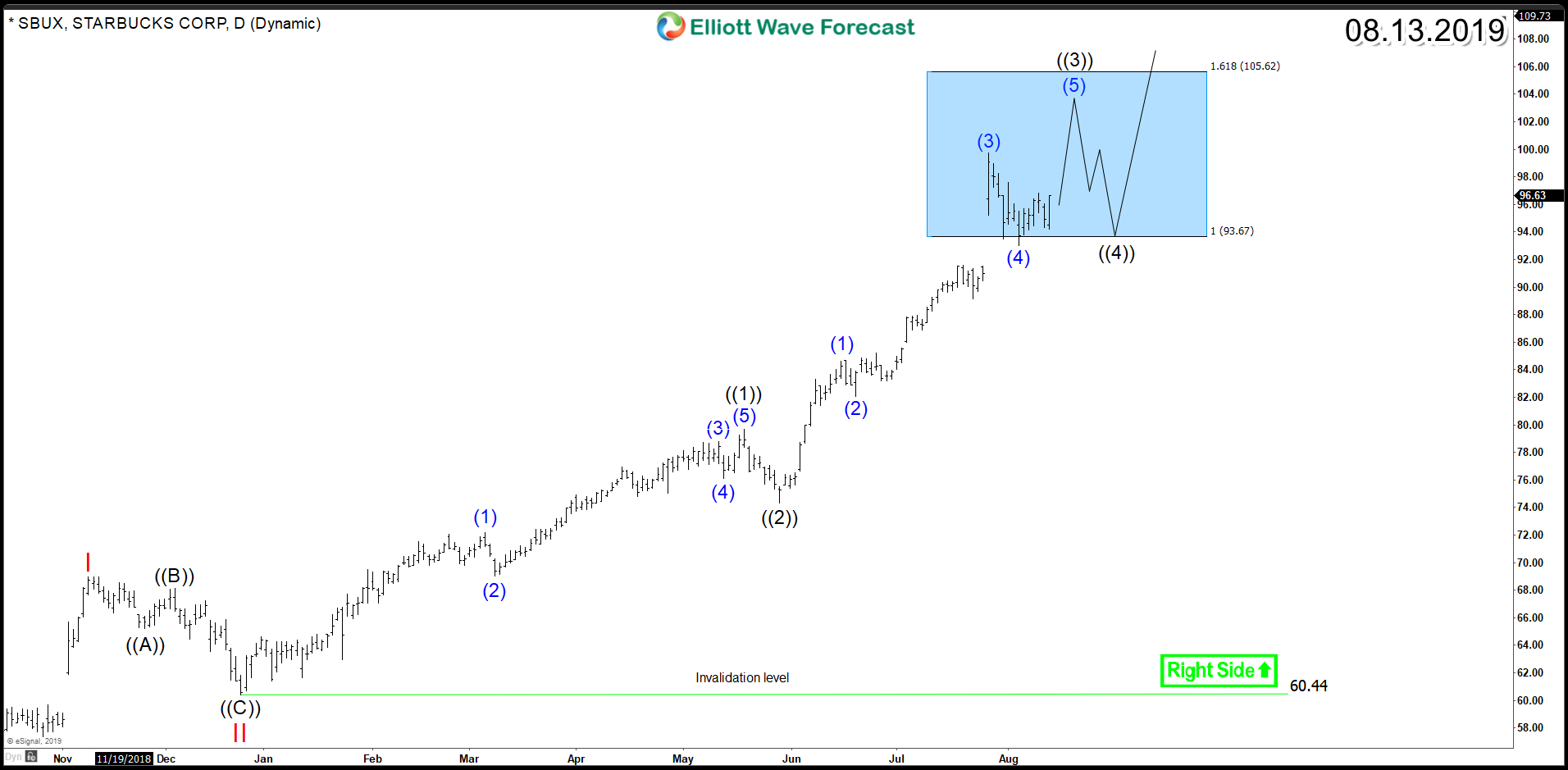

Starbucks (NASDAQ: SBUX) – Bull Market Looking to Extend

Read MoreStarbucks (NASDAQ: SBUX) is currently up 50% year-to-date and remains as one of the strongest stocks leading the bull market higher and making new all time highs. the stock is currently trading within an impulsive 5 waves advance which started since December 2018 and it reached the minimum target area at equal legs $93.6 – […]

-

Disney (NYSE: DIS) Impulsive Structure is Supporting Further Rally

Read MoreDisney (NYSE: DIS) surged to new all time highs in April 2019 confirming the breakout of the consolidation range that lasted for 3 years. The rally from December 2018 low unfolded as an impulsive 5 waves structure which is part of the weekly cycle from 2016 low. The cycle ended on July peak from where […]