-

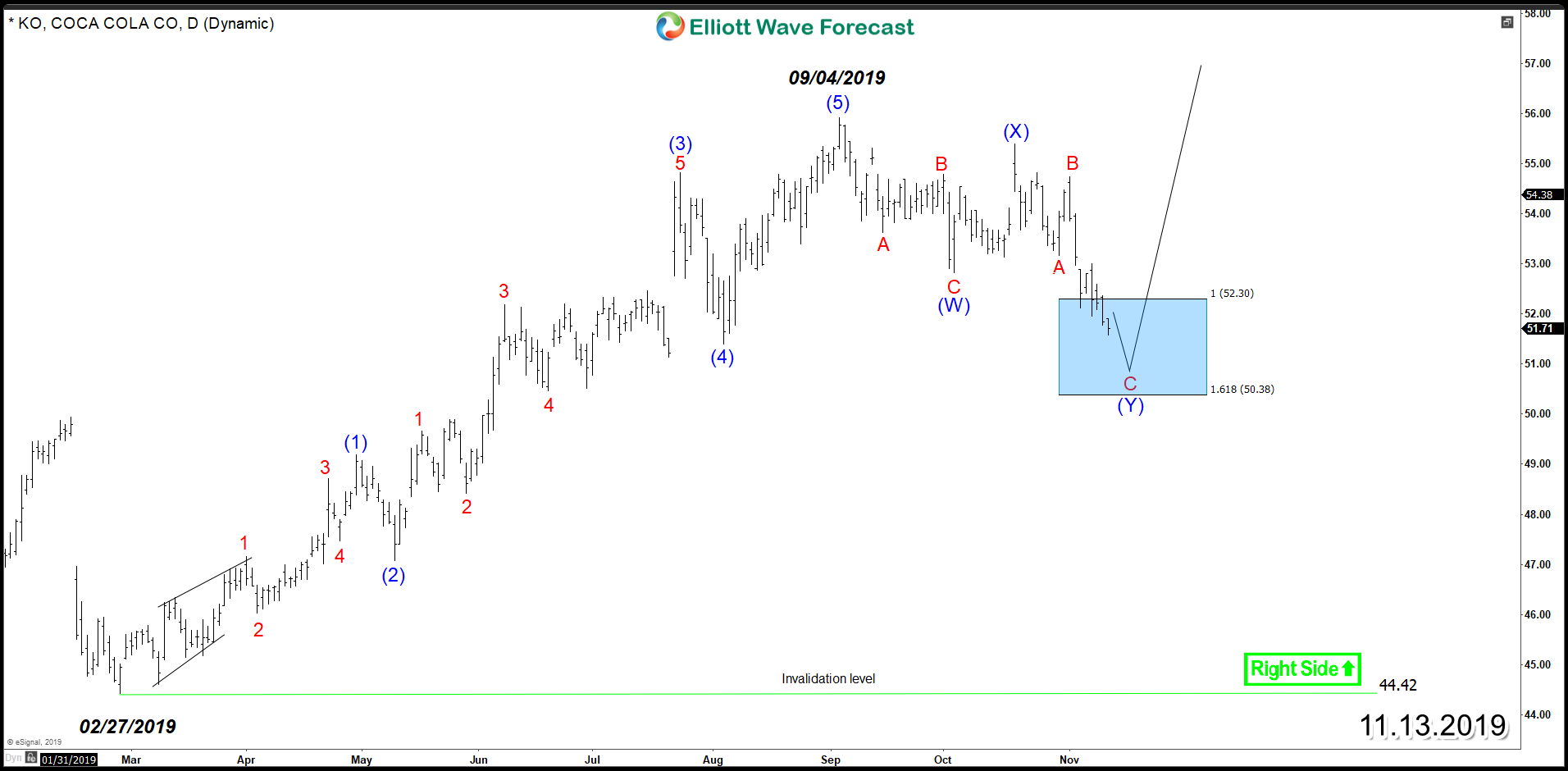

The Coca-Cola Company (NYSE: KO) Looking to Remain Supported

Read MoreThe Coca-Cola Company (NYSE: KO) is an American multinational corporation and it’s the world’s leading soft-drink company. Since February 2019, KO rallied higher within an impulsive 5 waves advance breaking to new all time highs and opening further extension. Down from $56 peak, the stock started a correction lower which is currently unfolding as Double Three Structure which reached the equal […]

-

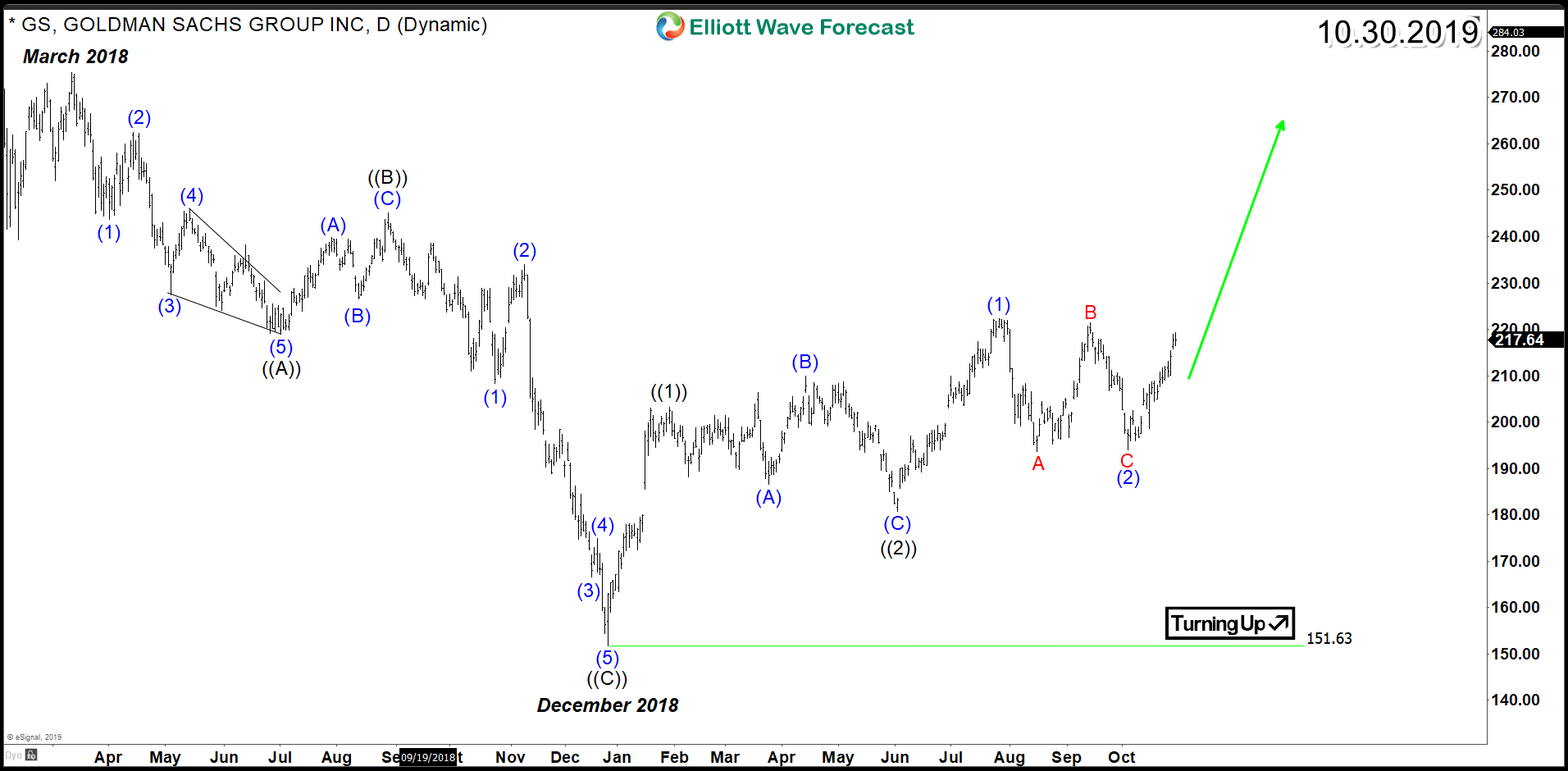

Goldman Sachs (NYSE : GS) Bulls Aiming for Strong Rally

Read MoreGoldman Sachs (NYSE : GS) is one of the top 5 banks in USA and it’s stock is currently up $25% year-to-date. Last year, GS was on the edge of breaking its bullish trend which was established since 2009 but the bulls took over on the right time to re-establish the main path. The stock created a bullish […]

-

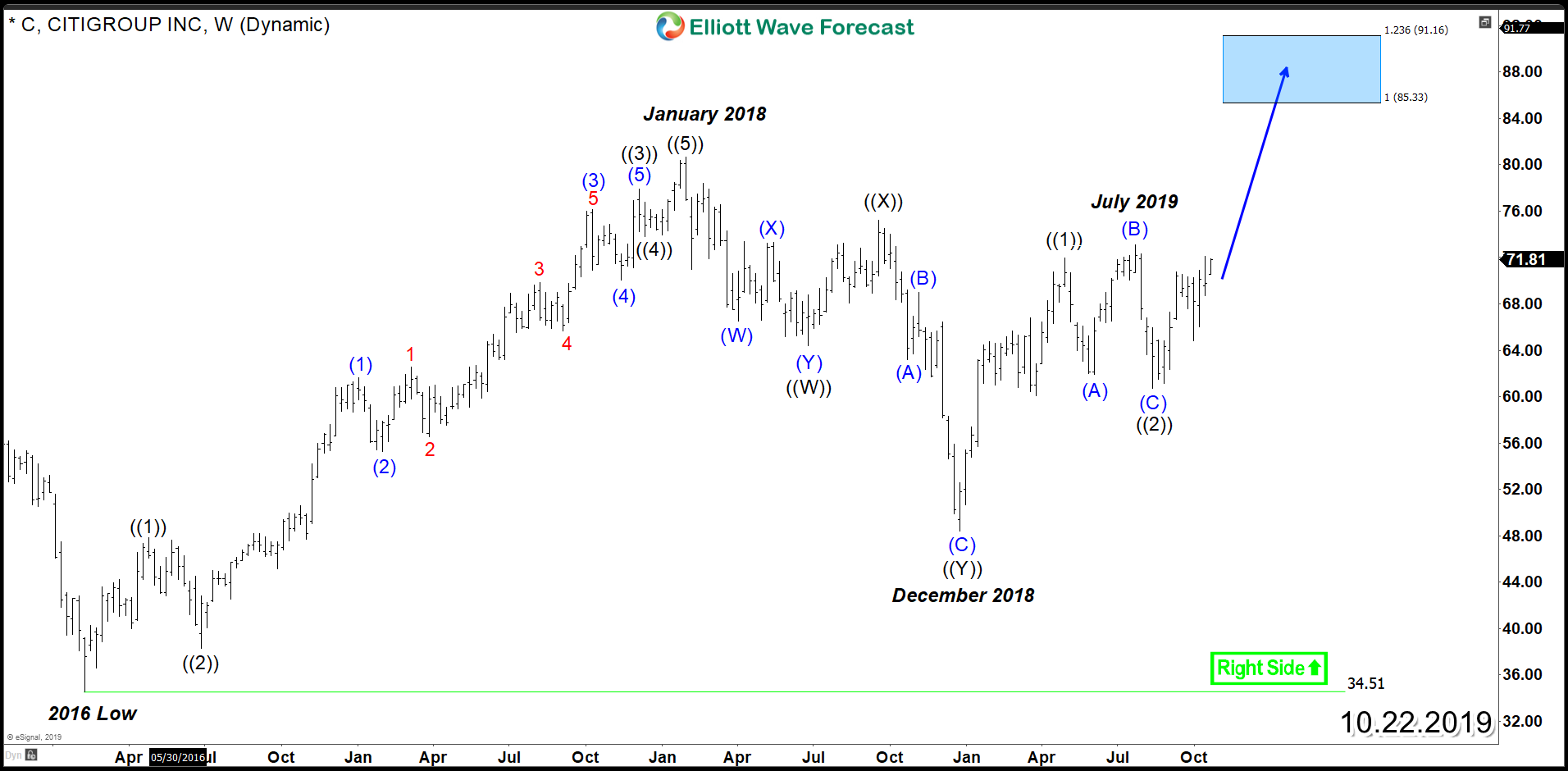

Citigroup (NYSE: C) Impulsive Rally Extending for Year-End

Read MoreCitigroup (NYSE: C) is currently up $34 year-to-date and the stock is still aiming for further gains before year-end as the financial sector continues the recovery from last year correction. The recent impulsive rally from 10.03.2019 low allowed the stock to break above September 2019 peak which opened a bullish sequence from August low and […]

-

Walmart (NYSE: WMT) Bull Run Leads the Market

Read MoreWalmart (NYSE: WMT) is the world’s largest retailer, operating discount stores, supercenters, and grocery stores around the world. In today’s article, we’ll take a look at the short term cycle of the stock based on Elliott Wave Theory : Back in July 2019, WMT made new all time highs by breaking above January 2018 peak and […]

-

Xilinx (NASDAQ: XLNX) Another Buying Opportunity

Read MoreXilinx (NASDAQ: XLNX) is an American technology company that is primarily a supplier of programmable logic devices. It designs, develops and markets complete programmable logic solutions, including advanced integrated circuits, software design tools, predefined system functions, customer training, field engineering and technical support. Since the dot com crash, XLNX struggled to recover and it only managed to make […]

-

FactSet Research Systems (NYSE: FDS) Technical correction

Read MoreFactSet Research Systems (NYSE: FDS) is a financial data and software company providing financial information and analytic software for investment professionals in the United States, Europe, and the Asia Pacific. Shares of FactSet dropped 11% following the release of fiscal its fourth-quarter financial results despite beating analysts’ forecast. Revenue climbed 5%, lifting adjusted net income by 19% […]