-

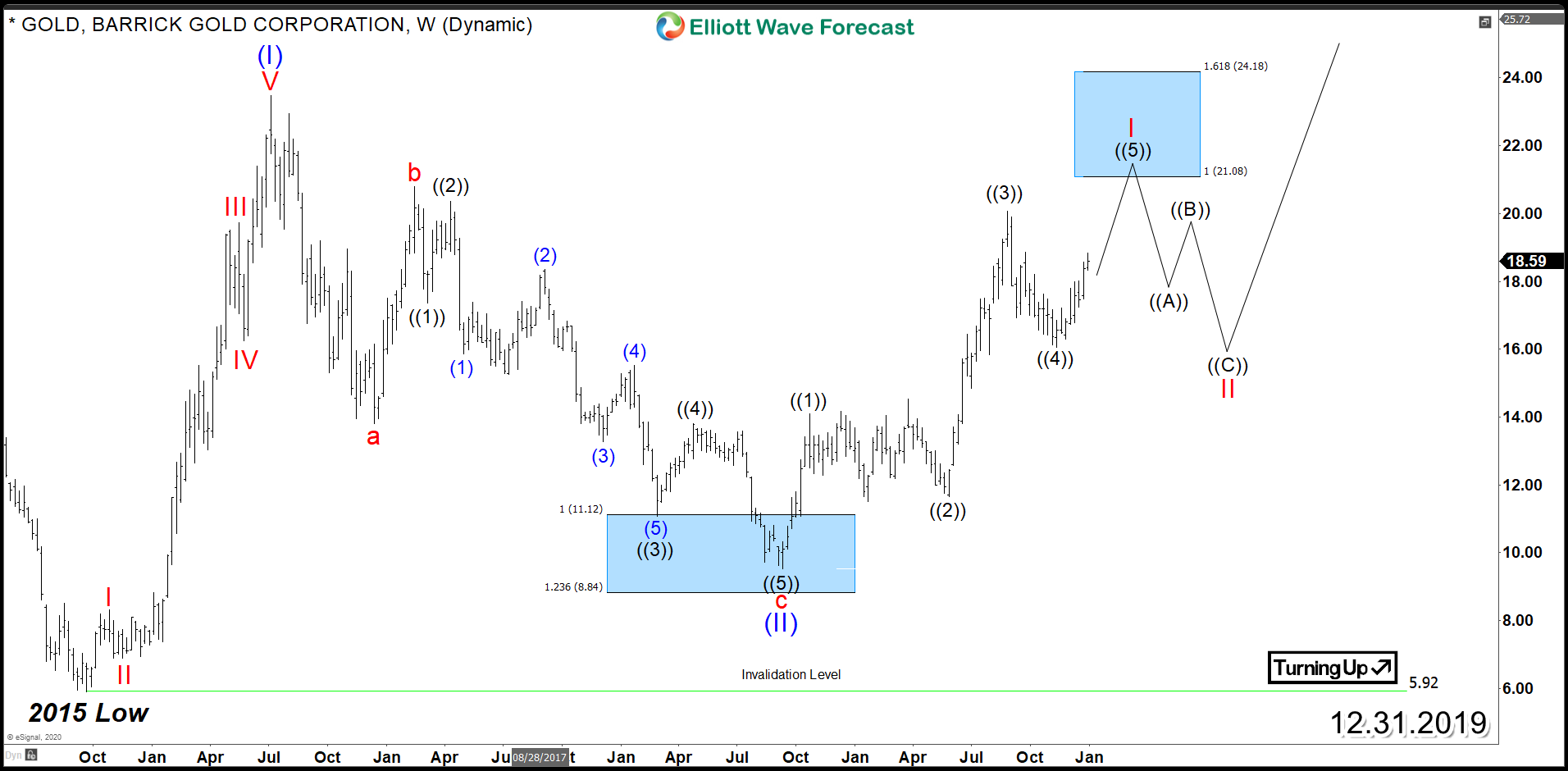

Barrick Gold Corporation (NYSE: GOLD) Looking for Further Upside

Read MoreBarrick Gold Corporation (NYSE: GOLD) is the second-largest gold mining company in the world. As the precious metal price has been soaring recently, let’s take a look at the technical structure of the stock. GOLD established a major low back in September 2015 from where the stock rallied strongly within an impulsive 5 waves advance which was […]

-

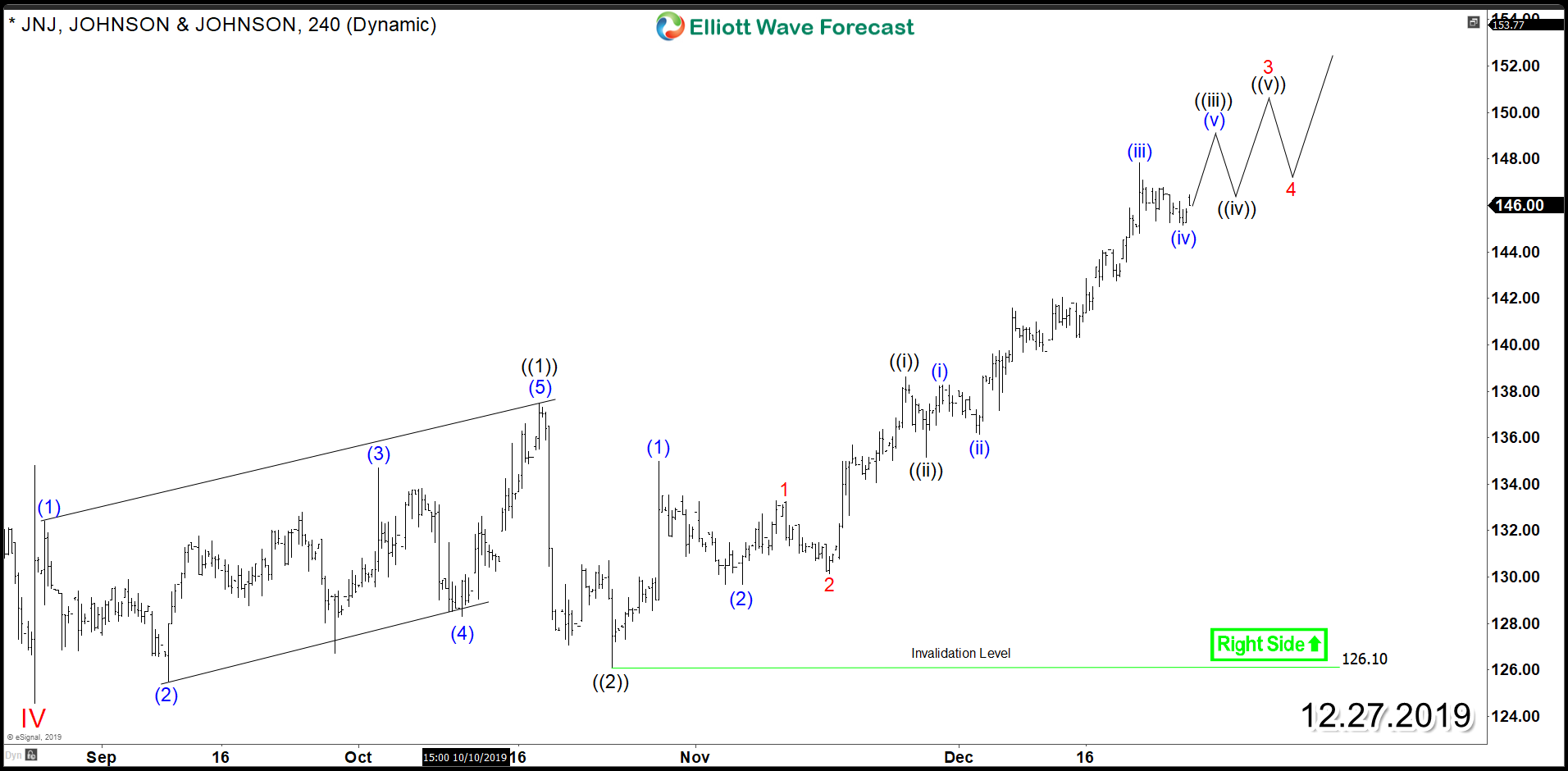

JNJ Bullish Outlook Suggests Further Upside for Next Year

Read MoreJohnson & Johnson (NYSE: JNJ) released its third-quarter earnings and revenue in mid October 2019 which beat Wall Street’s expectations. Despite facing a sell-off during that week, the stock managed to establish a major low in October and it has been rallying higher since then looking to challenge 2018 peak. Let’s take a look at the […]

-

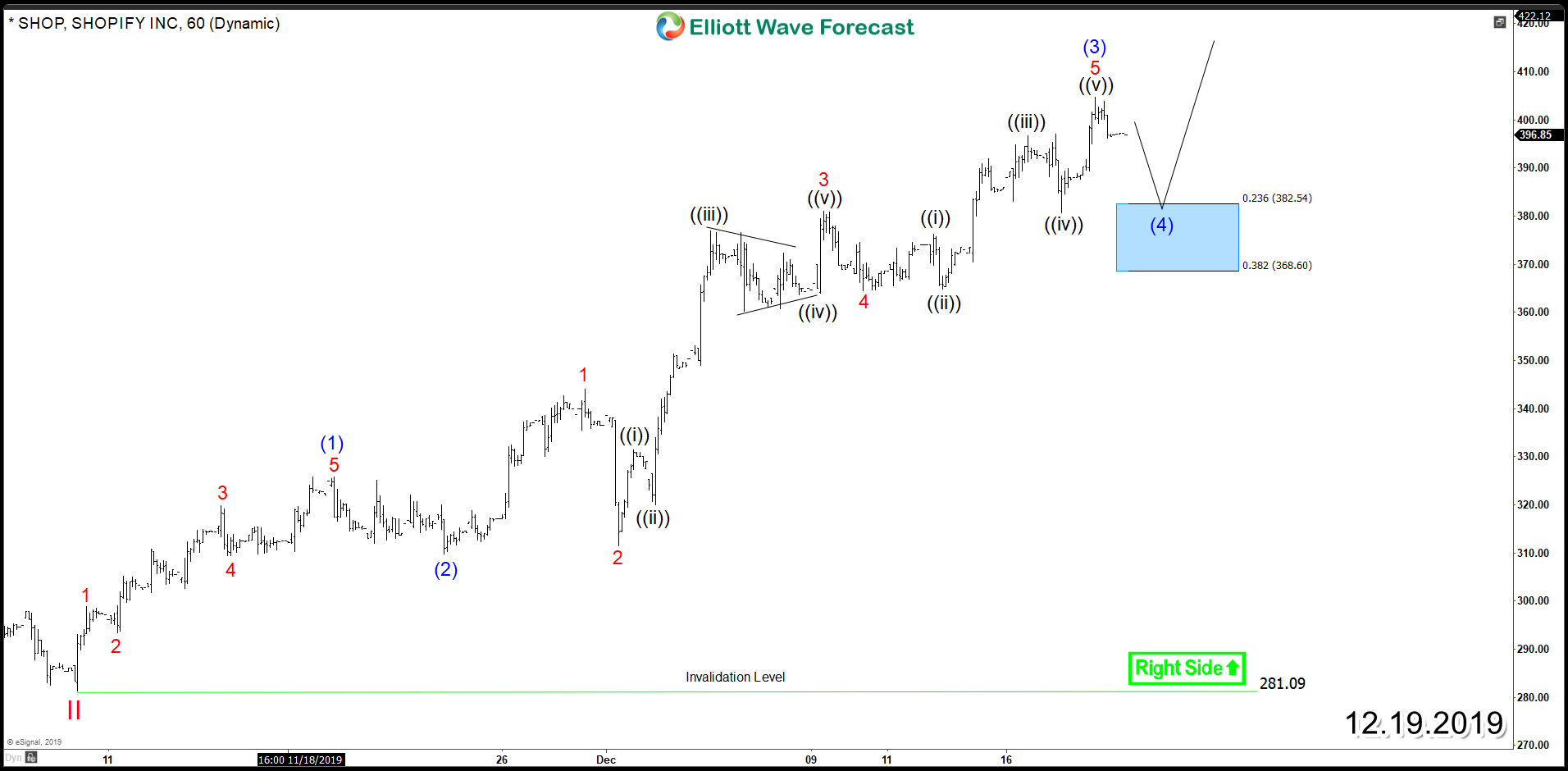

Shopify (NYSE: SHOP) New All time Highs on the Horizon

Read MoreShopify (NYSE: SHOP) surged higher this year after a strong Breakout of a Bullish Flag which allowed the stock to rally almost 200%. Despite the 40% correction that took place since August, SHOP managed to recover and it’s currently retesting the previous peak aiming for a break to new all time-highs. The short term cycle taking […]

-

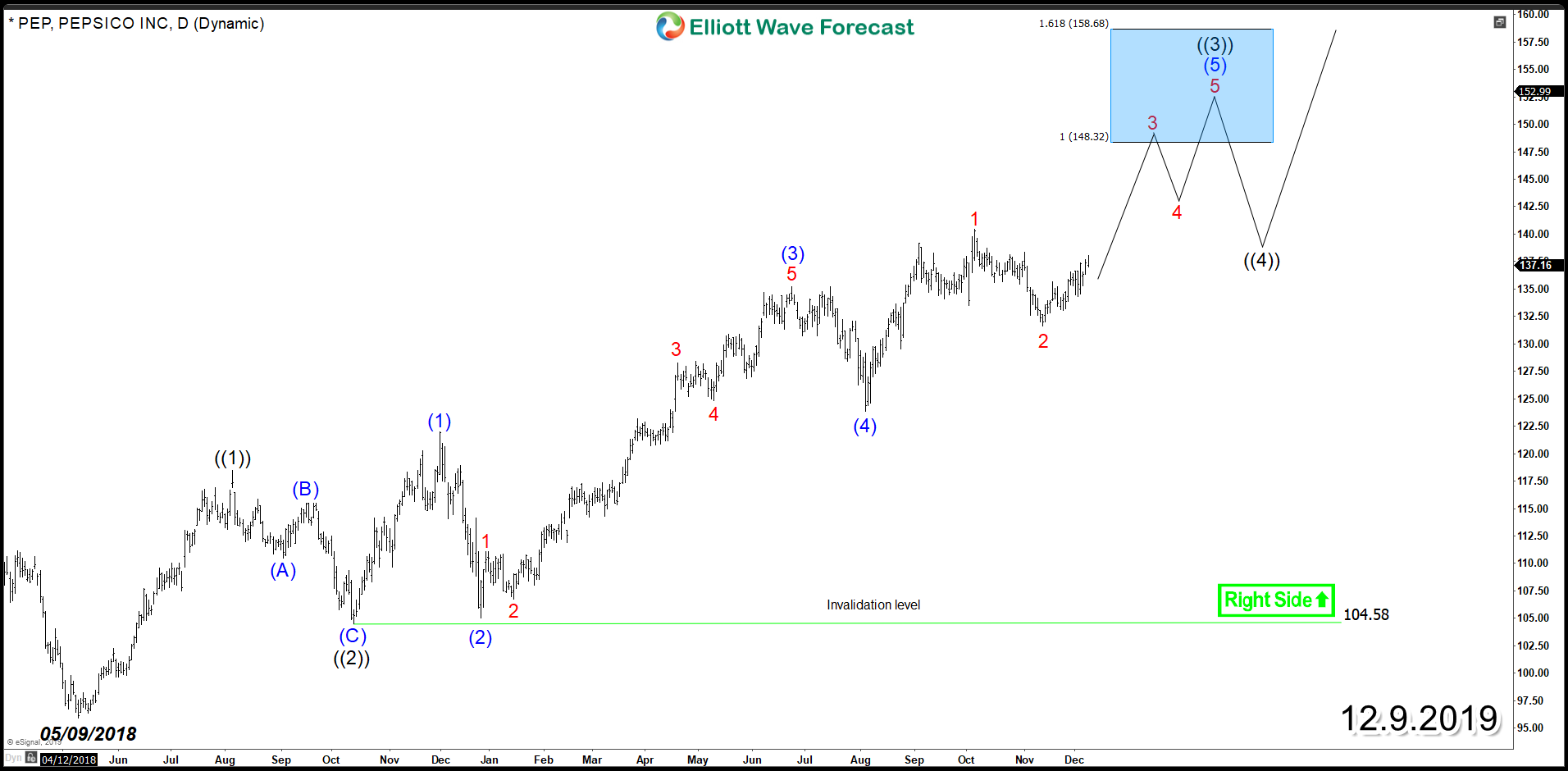

PepsiCo (NASDAQ: PEP) Impulsive Rally Still in Progress

Read MorePepsiCo (NASDAQ: PEP) is an American multinational food, snack, and beverage corporation offering food (brands include Frito-Lay and Quaker) and drinks, including Pepsi, Tropicana, and Gatorade. PEP rally since May 2018 is unfolding as an impulsive Elliott Wave structure which currently can still see further upside within an extended wave (5) of of wave ((3)) and reach equal legs area […]

-

Fortinet Inc (NASDAQ: FTNT) Making Record Highs

Read MoreFortinet Inc (NASDAQ: FTNT) is an American multinational corporation providing network security solutions such as firewalls, anti-virus, intrusion prevention and endpoint security. Since IPO, the stock started a bullish cycle within an impulsive Elliott Wave structure which is currently still in progress. It’s expected to continue making new all time highs as the more aggressive view is suggestion further extension […]

-

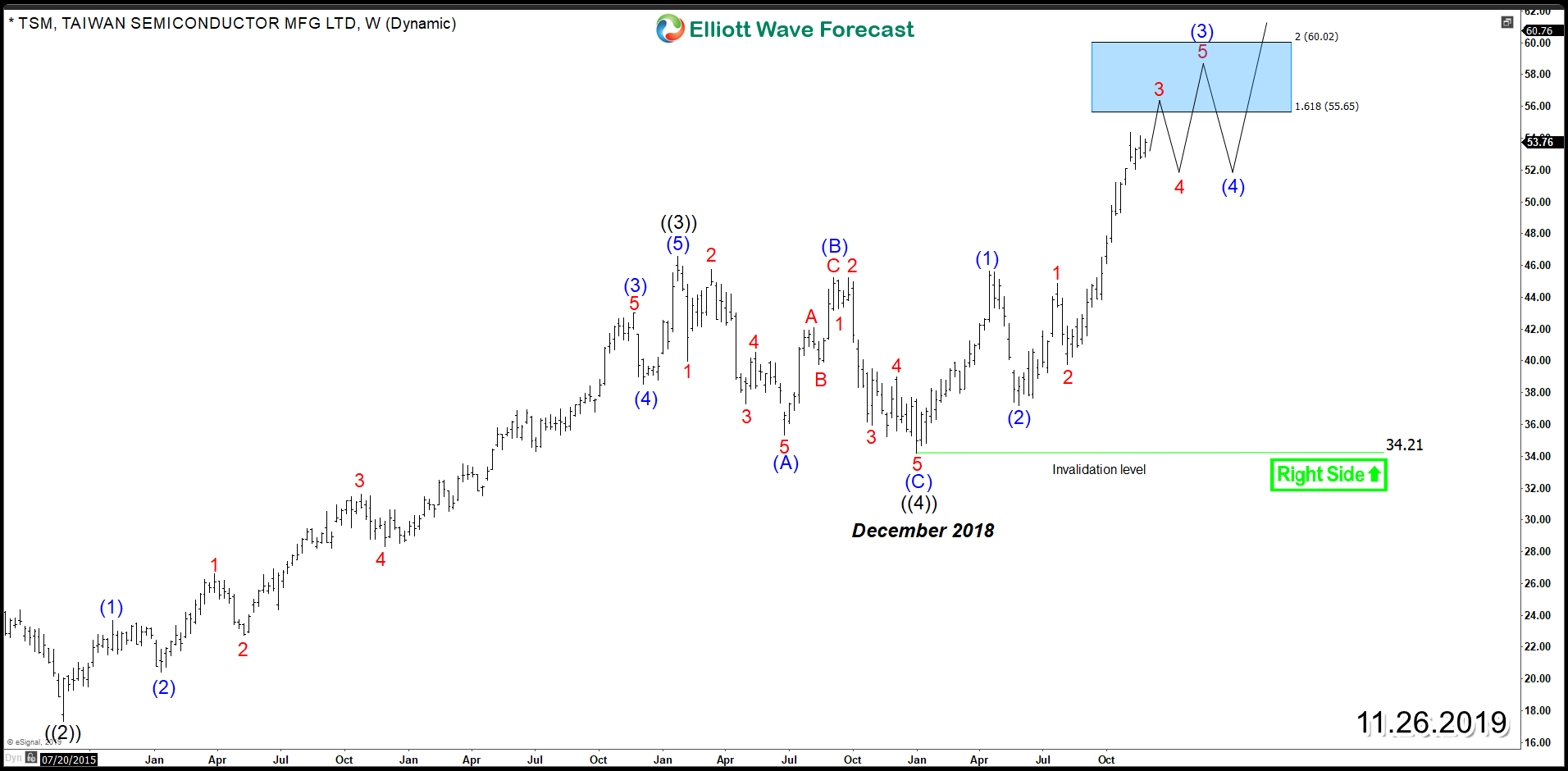

Taiwan Semiconductor (NYSE: TSM) Impulse Rally Calling More Upside

Read MoreTaiwan Semiconductor Manufacturing Company (NYSE: TSM) is the world’s largest dedicated independent (pure-play) semiconductor foundry and it’s located in the Hsinchu Science and Industrial Park in Hsinchu, Taiwan. In 2018, TSM spent the year in a corrective structure after it ended the 5 waves advance from 2015 low. The stock did correction unfolded as 3 waves Zigzag […]