-

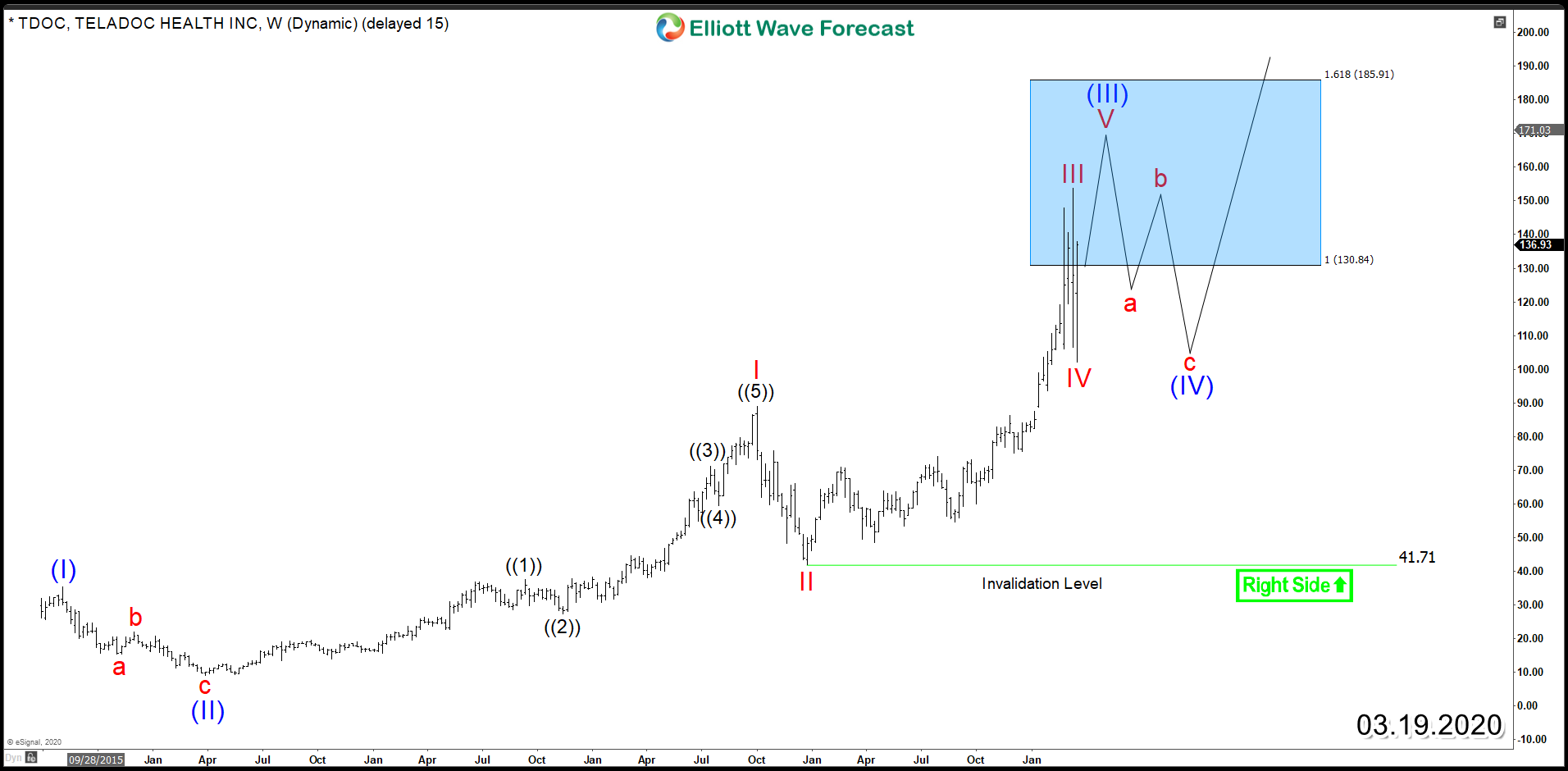

Teladoc Health (NYSE: TDOC) Bullish Cycle Can Extend

Read MoreTeladoc Health (NYSE: TDOC) is a multinational telemedicine and virtual healthcare company based in the United States. It offers an app-based medical consultations which present a safer solution for patient during the current pandemic conditions. The stock is obviously offering better options for investors compared to regular times as online services are getting a higher demand […]

-

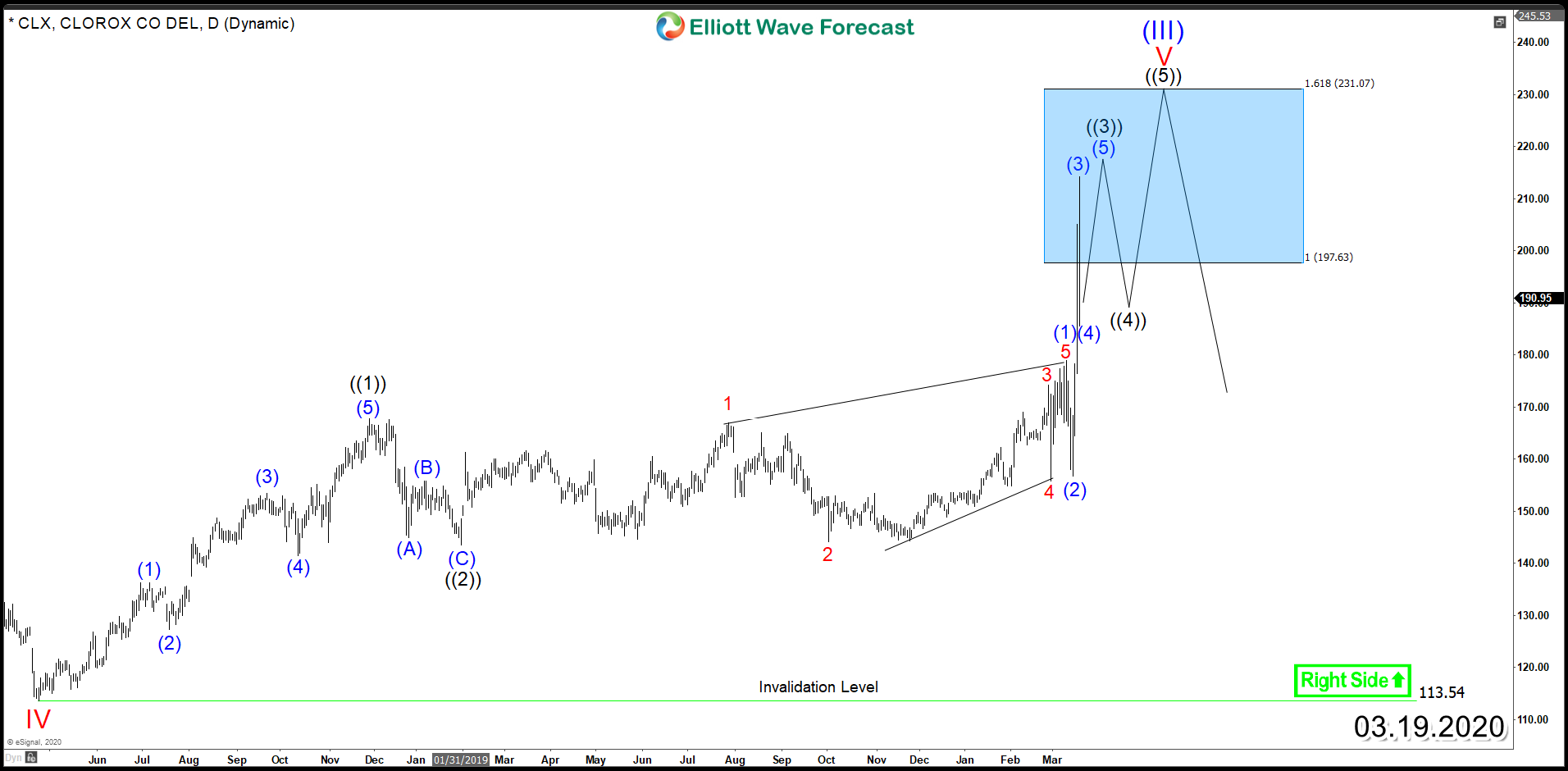

The Clorox Company (NYSE: CLX) Ending an Impulsive Cycle

Read MoreThe Clorox Company (NYSE: CLX) is an American global manufacturer and marketer of consumer and professional products. Its’s brands include its namesake bleach and cleaning products. During a pandemic, the demand for sanitizing products rises significantly which helped Clorox to avoid steep declines in the recent weeks as rest of the stock market was plunging down. The […]

-

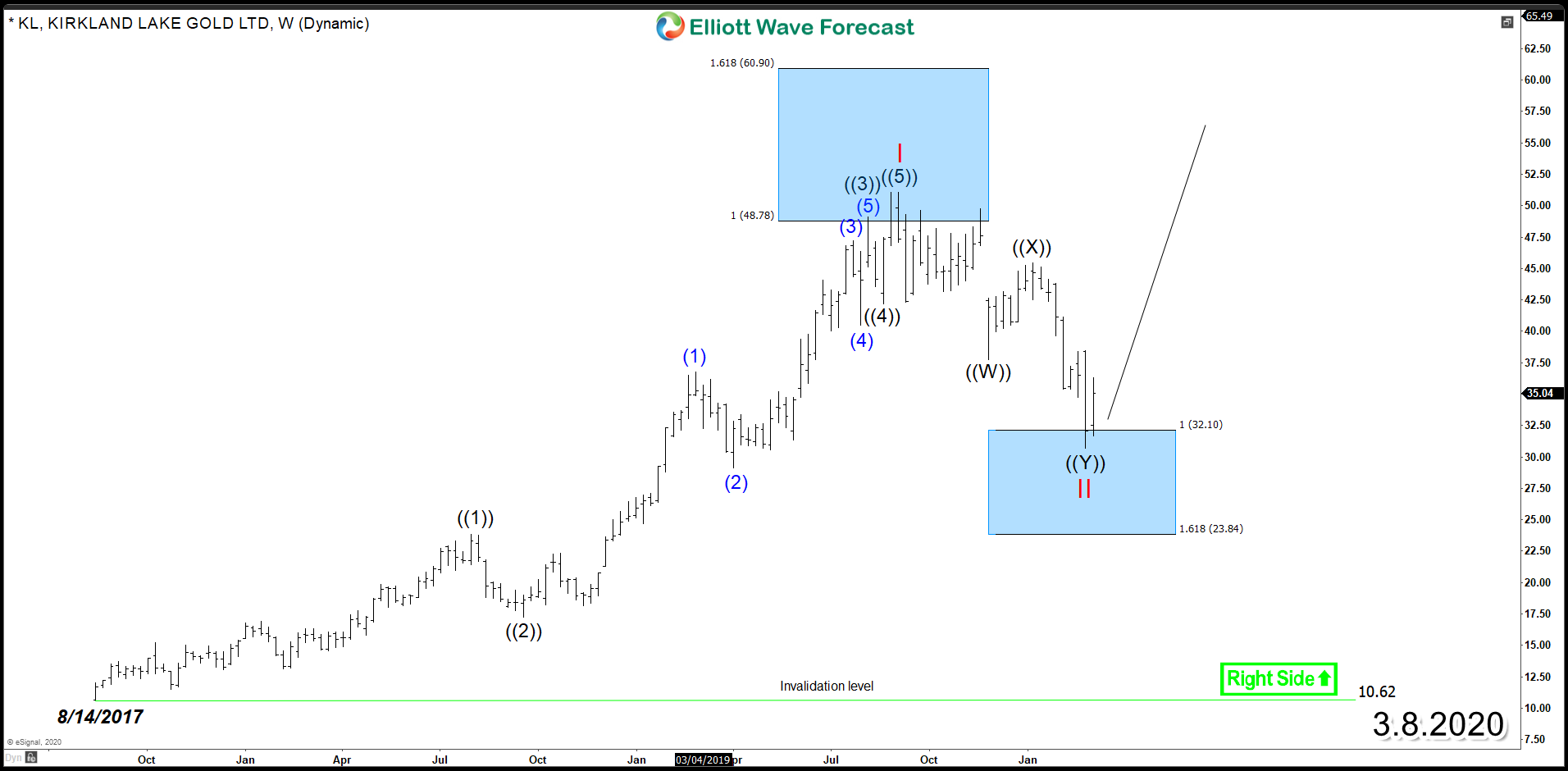

Kirkland Lake Gold Ltd. (NYSE: KL) New All-Time-High in Sight

Read MoreKirkland Lake Gold Ltd. (NYSE: KL) is gold mining growing company with highly productive yet low-cost mining operations in Canada and Australia. Last month, the company reported its revenue in Q4 2019 totaled $412 million, 47% higher than Q4 2018 and an 8% increase from the previous quarter. On a year-over-year basis, both higher gold sales and an increase in gold price contributed to about […]

-

Domino’s Pizza (NYSE: DPZ) Started a New Bullish Cycle

Read MoreDomino’s Pizza (NYSE: DPZ) is an American multinational pizza restaurant chain. Last month, it reported a strong fourth-quarter revenue and earnings per share and also it surprised investors by posting accelerating sales growth at the close of fiscal 2019. Domino’s also said it’s increasing its quarterly dividend by 20%, to $0.78 per share. If we take […]

-

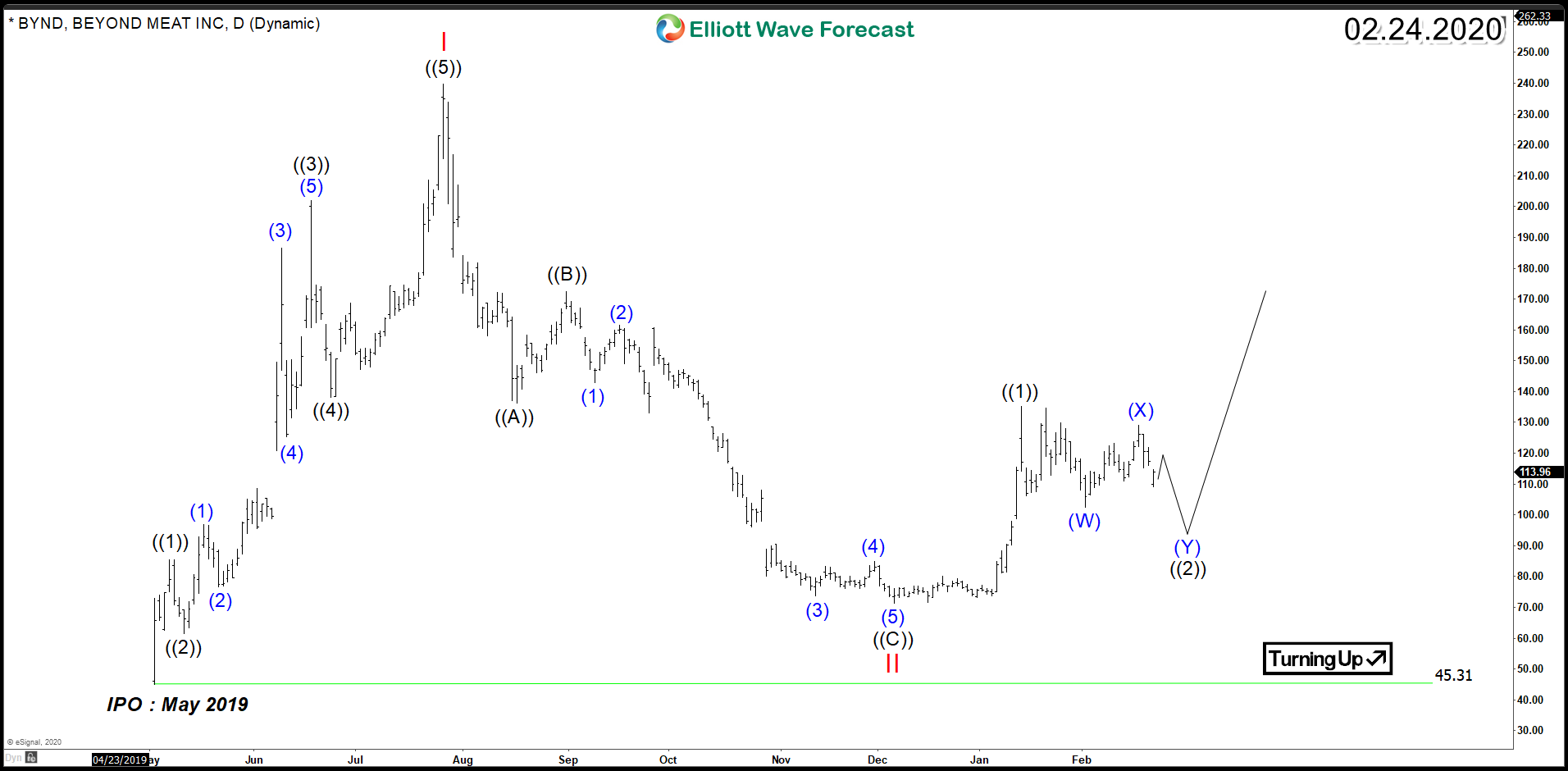

Beyond Meat Inc (NASDAQ: BYND) – Starting an Impulsive Cycle

Read MoreBeyond Meat Inc (NASDAQ: BYND) is a producer of plant-based meat substitutes including products designed to simulate chicken, beef, and pork sausage. After IPO, BYND surged 250% for 3 months then it came down erasing all gains and settling around 15% on December 2019. Last month, the stock soared 46% looking to start a new cycle similar to last year. So let’s […]

-

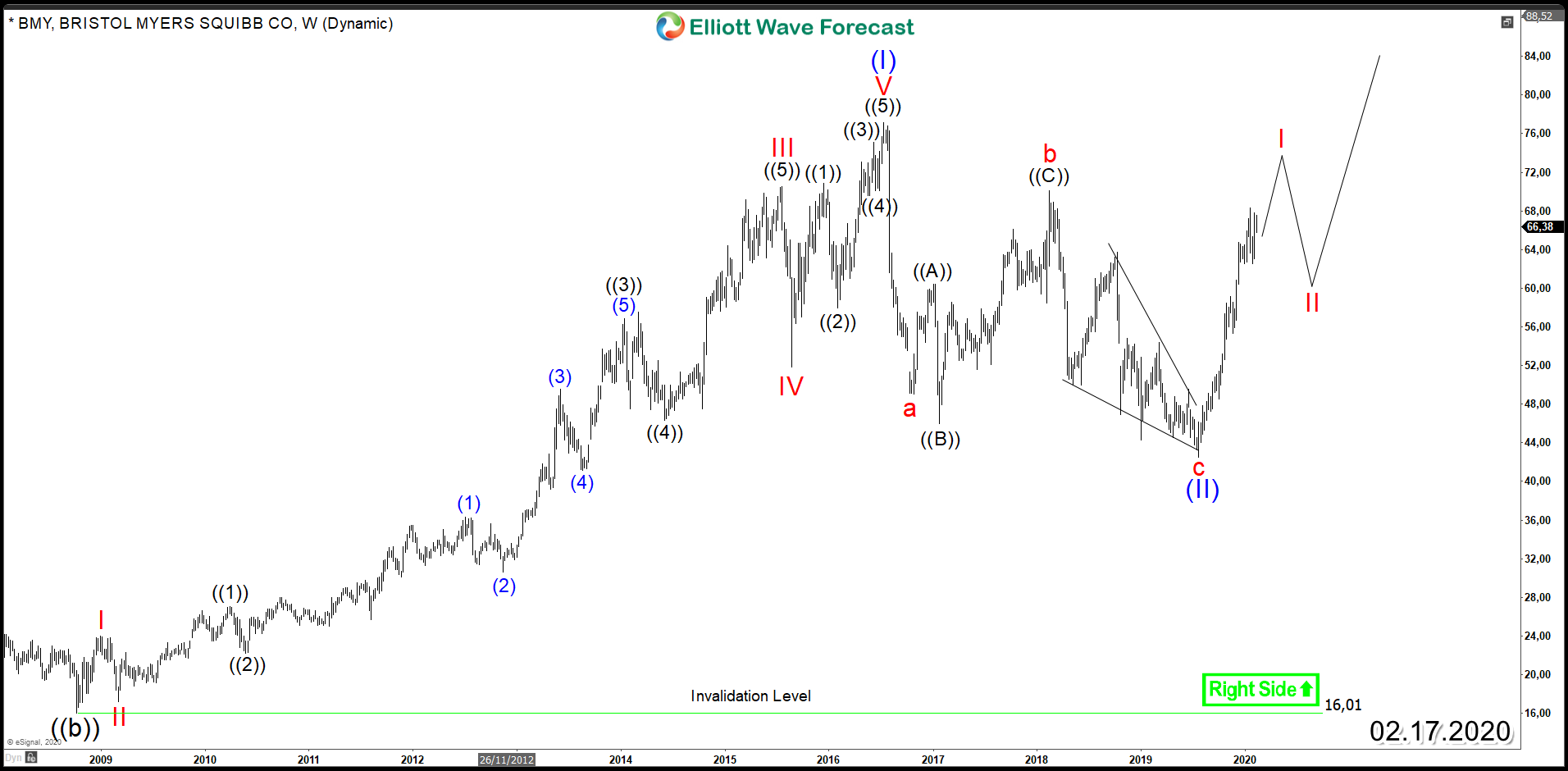

Bristol-Myers Squibb ( NYSE: BMY ) Aiming for New All Time Highs

Read MoreBristol-Myers Squibb (NYSE: BMY) is an American pharmaceutical company which manufactures prescription pharmaceuticals and biologics in several therapeutic areas with particular success in cardiovascular treatments. Since 2008, BMY established an impulsive rally taking the stock to new all time highs after it managed to break above 1999 peak which opened a multi-year bullish sequence. The cycle lasted for […]