-

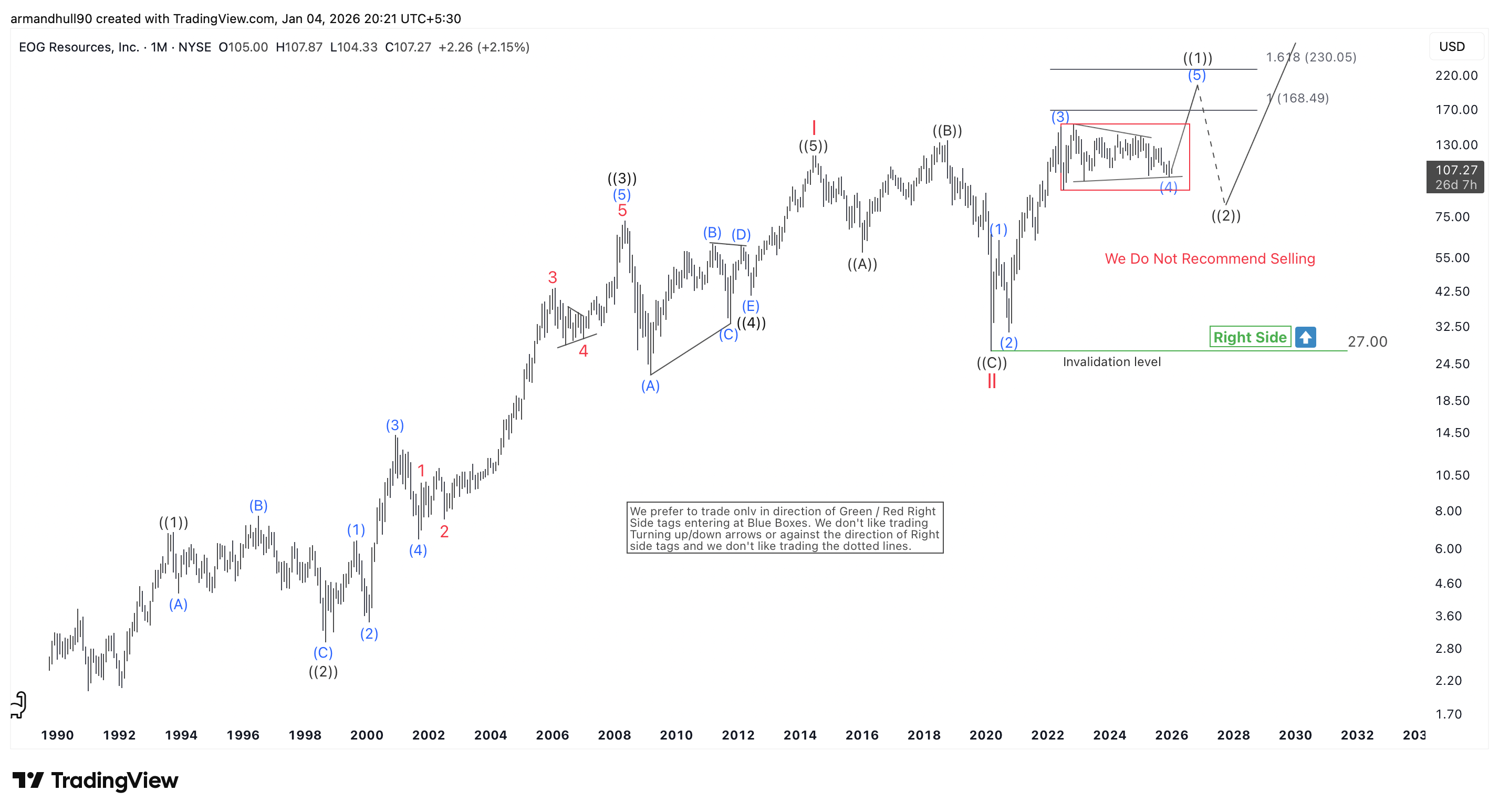

EOG Resources Elliott Wave Outlook: Range Breakout Could Target 168.49 and 230.05

Read MoreEOG consolidates inside a Wave (4) range in the very start of a powerful Wave III advance, with a bullish breakout pointing to higher Fibonacci targets. EOG Resources, Inc. (NYSE: EOG) continues to trade within a strong long-term bullish Elliott Wave structure on the monthly chart. The broader trend remains firmly positive. Price action from […]

-

Silver Extends Higher as Wave ((iii)) Remains in Progress

Read MoreSilver (XAGUSD) maintains a bullish Elliott Wave structure with pullbacks offering buying opportunities It continues to trade firmly higher and maintains a bullish structure. Price action respects the broader Elliott Wave sequence and keeps favoring the upside while key support levels hold. The rally from the prior swing low remains impulsive and shows no signs […]

-

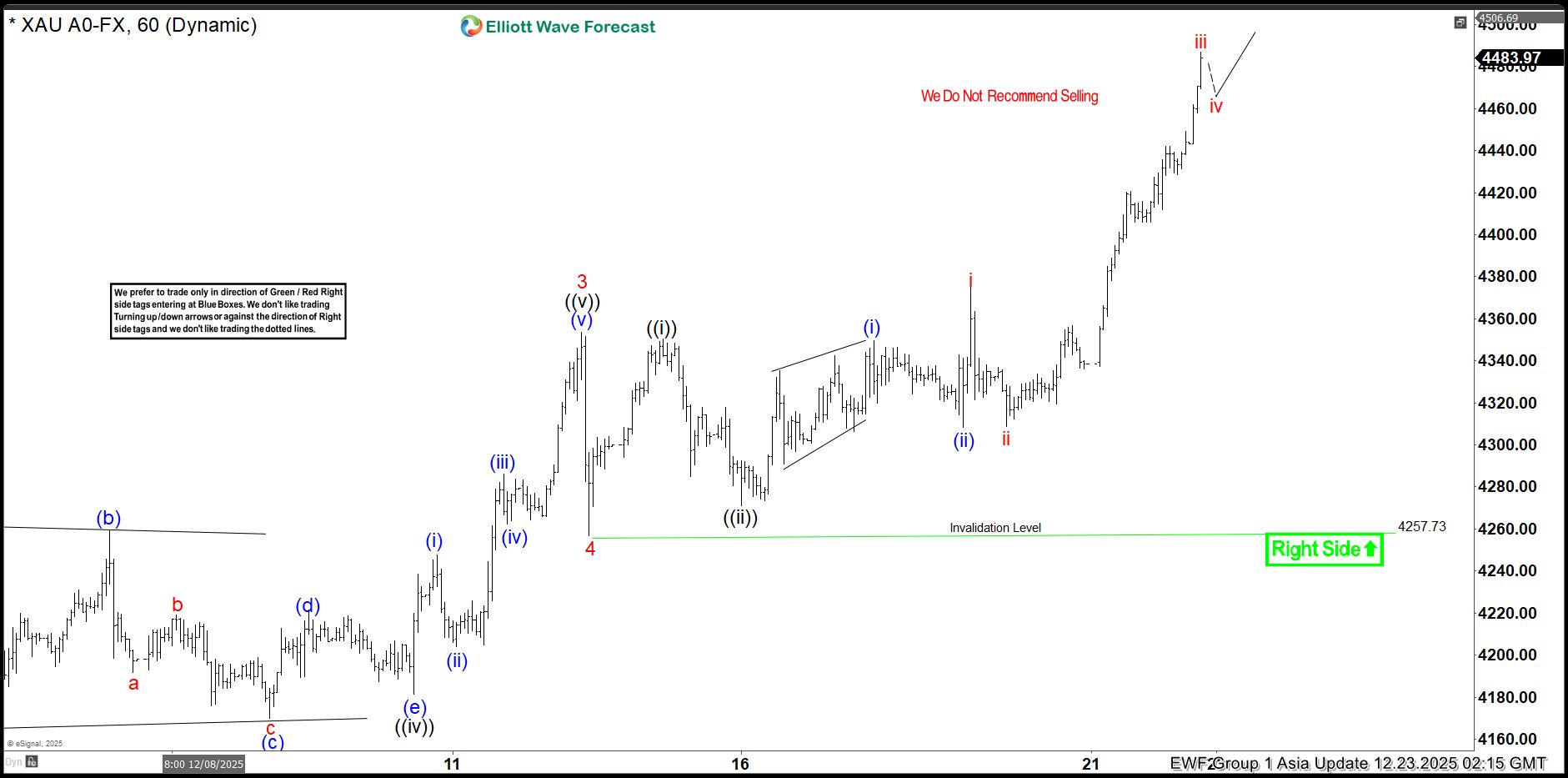

Gold Wave 5 Extends Higher After Wave 4 Pullback

Read MoreGold resumes its bullish trend from the 4258 low as wave ((iii)) unfolds within wave 5. XAUUSD has turned higher after completing the pullback in wave 4 at 4258. This move confirms that the broader bullish trend remains intact. Price is now advancing within wave 5, and the structure continues to favor higher levels. From […]

-

SPX Pullback Completed, Ready for the Next Leg Higher?

Read MoreS&P 500 has completed its wave ((ii)) pullback at Fibonacci support and is turning higher. Elliott Wave structure favors further upside in SPX.

-

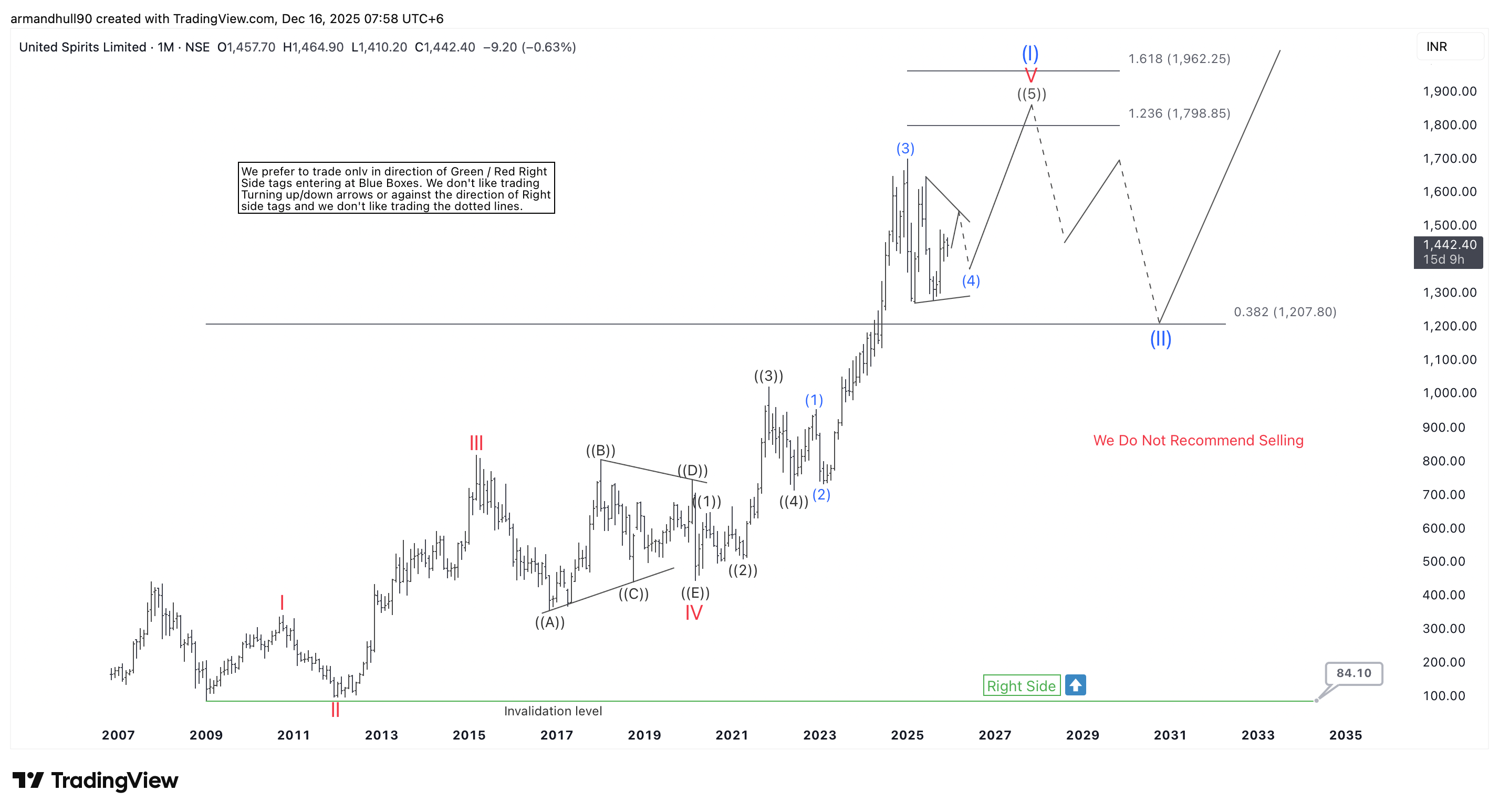

UNITDSPR Elliott Wave Outlook: Bullish Structure Points to ₹1,798–₹1,962 Targets

Read MoreMonthly Elliott Wave analysis shows Wave I nearing completion, key Fibonacci targets ahead, and a corrective pullback before the next major rally. United Spirits Limited (NSE: UNITDSPR) continues to trade in a strong long-term bullish Elliott Wave structure on the monthly chart. The broader trend remains positive despite short-term price swings. Since the 2020–2021 period, […]

-

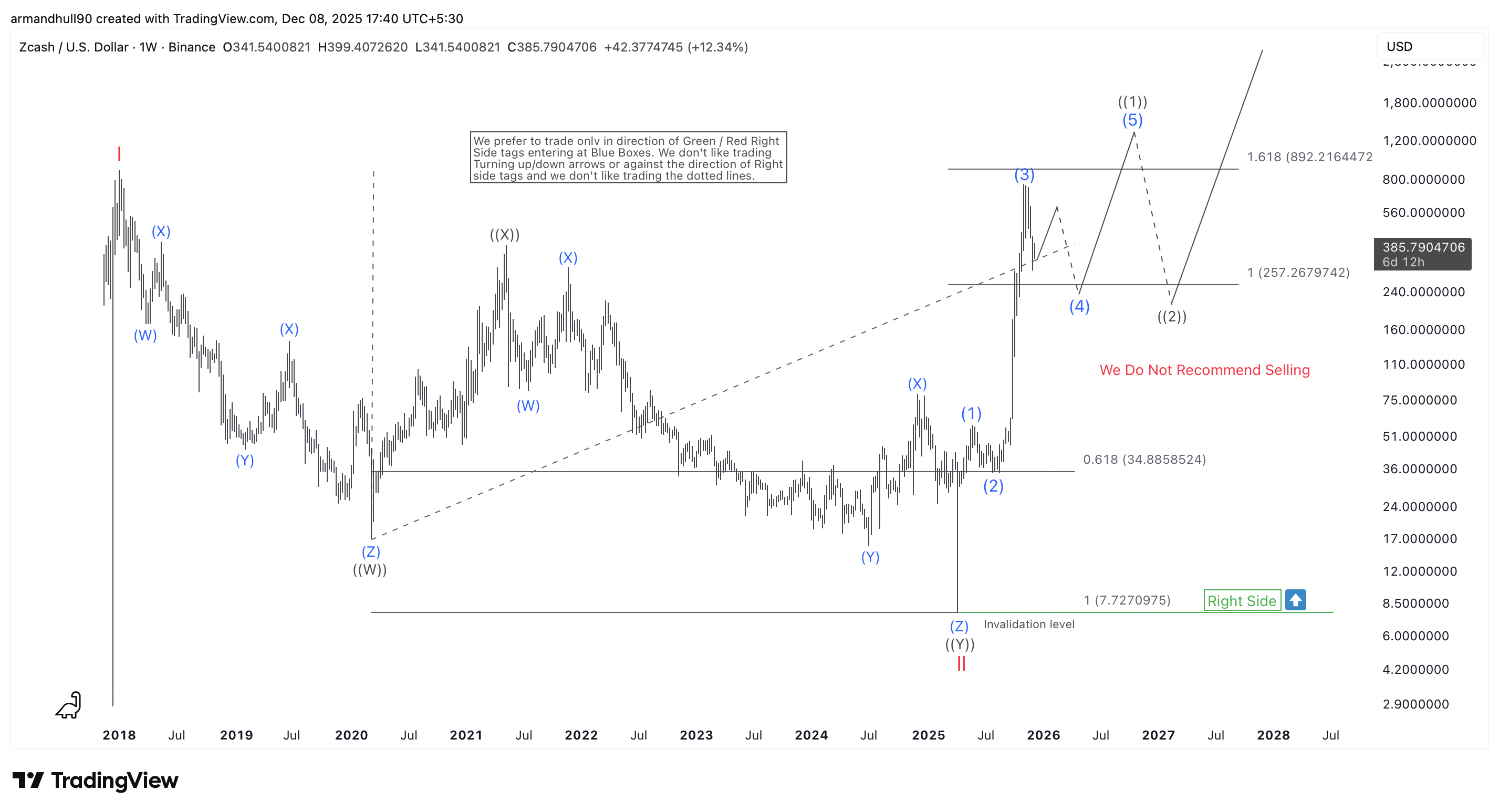

Zcash Elliott Wave Analysis: Equal Legs Perfection and the Start of a Massive Bull Cycle

Read MoreA perfect equal-legs reaction at Wave ((Y)) sparked a 9000% surge in Zcash. This powerful move confirmed the end of Wave II and the start of a new bullish cycle. Now ZEC prepares for its next impulsive advance as the structure continues to unfold. Zcash (ZECUSD) has recently shown one of the cleanest Elliott Wave […]