-

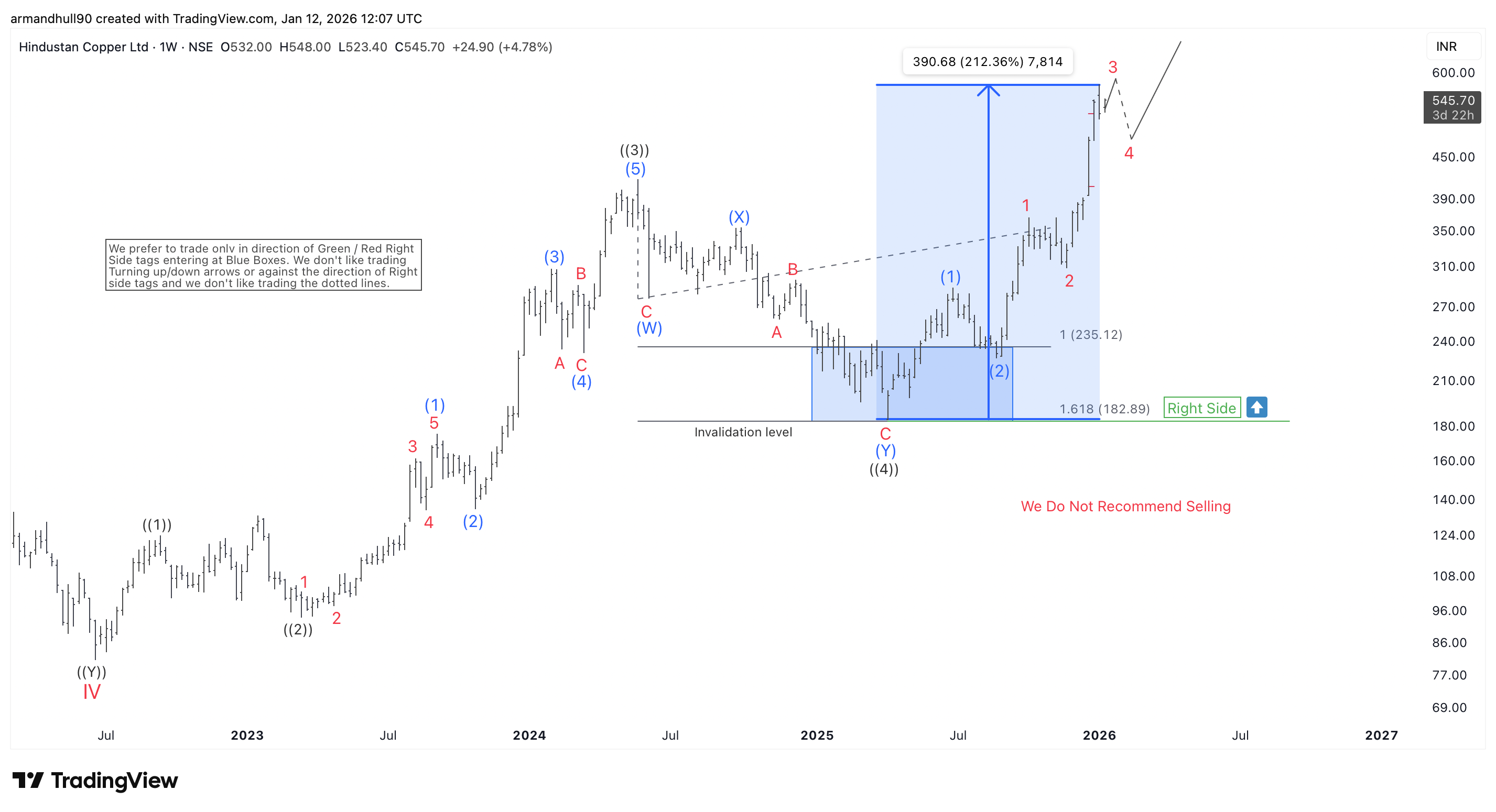

HINDCOPPER: Elliott Wave Bullish Cycle Continues After 200% Rally From Blue Box

Read MoreHINDCOPPER Elliott Wave Update – Blue Box Reaction Delivers Strong Rally and Keeps Bullish Outlook Intact Hindustan Copper (NSE: HINDCOPPER) has shown an impressive Elliott Wave performance. It respected the bullish structure shared earlier. In our previous update, we highlighted a high-probability blue box area. This was where buyers were expected to step in again. The […]

-

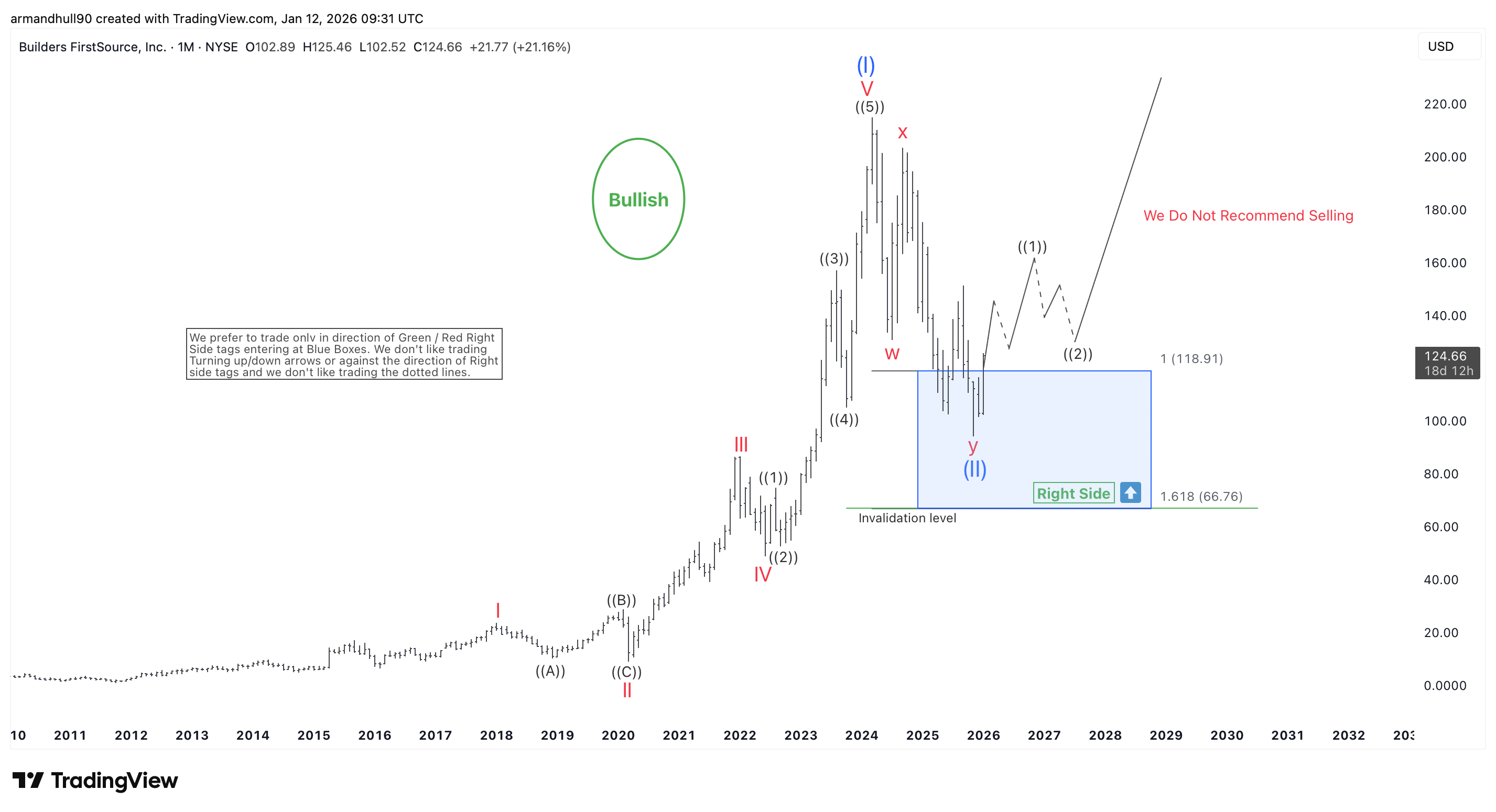

BLDR Elliott Wave Bullish Structure Points Toward New All-Time Highs

Read MoreWave (II) Looks Complete, Right-Side Remains Bullish, and Wave (III) Targets Higher Prices Ahead Builders FirstSource (NYSE: BLDR) continues to show a strong bullish outlook based on Elliott Wave Theory. The monthly chart highlights an impressive impulsive advance into the peak of wave (I). After that strong rally, the stock entered a larger corrective phase. […]

-

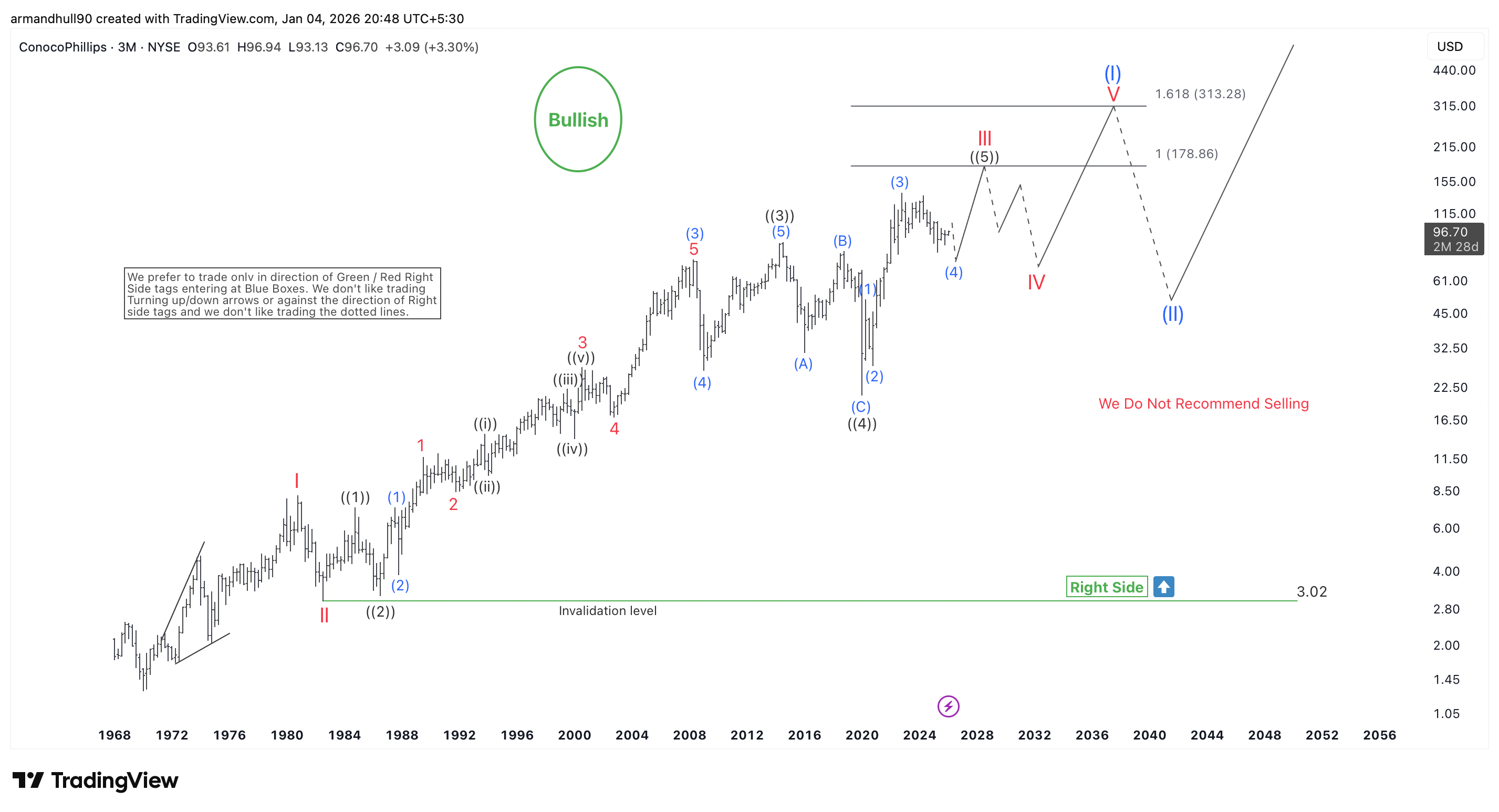

ConocoPhillips (COP) Elliott Wave Forecast: Bullish Trend Eyes $178–$313 Targets

Read MoreCOP Keeps Its Long-Term Bullish Elliott Wave Structure Intact, with Strong Upside Potential Toward Key Fibonacci Targets. ConocoPhillips continues to show a strong long-term bullish trend using Elliott Wave analysis. The quarterly chart shows a clear impulsive rally from historic lows. The Right Side tag stays bullish as long as price remains above the invalidation […]

-

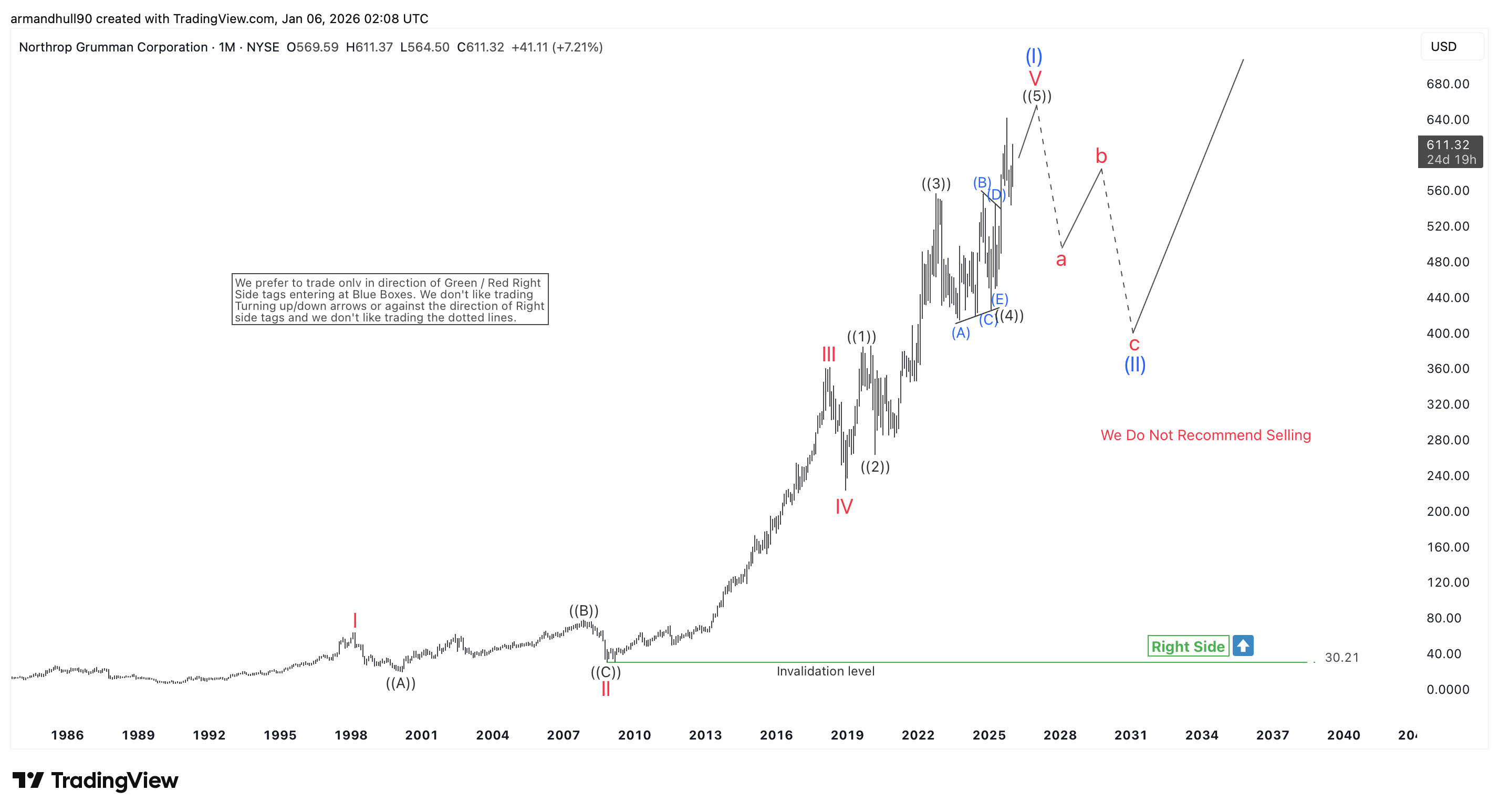

NOC Bullish Cycle Nearing Completion with Possible Retest of Highs

Read MoreNOC remains in a strong long-term bullish structure, but the Elliott Wave cycle looks mature and may retest recent highs before a deeper corrective phase begins. Northrop Grumman Corporation (NYSE: NOC) remains in a strong long-term bullish trend on the monthly chart. The stock has shown years of steady growth supported by a clear Elliott […]

-

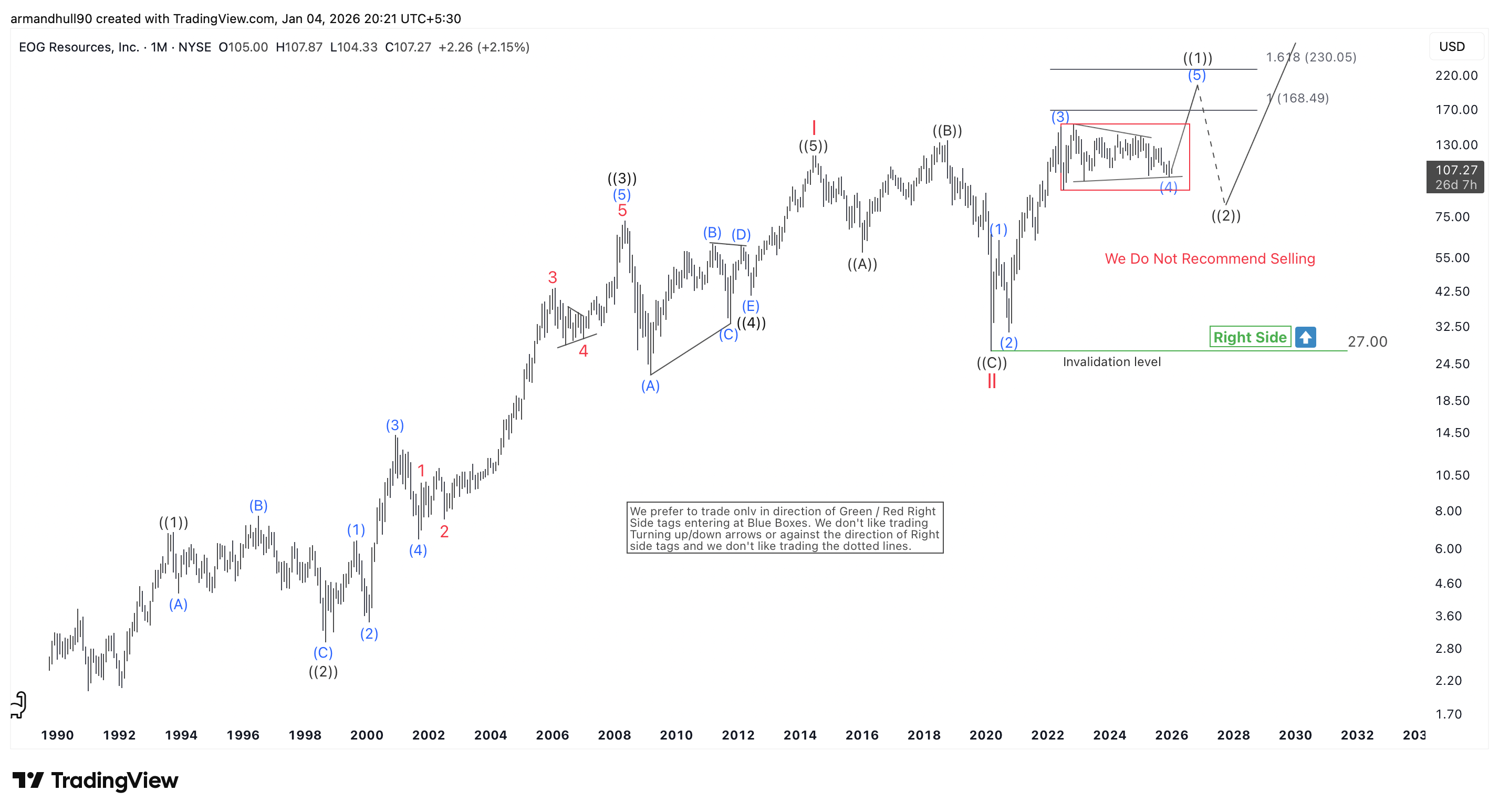

EOG Resources Elliott Wave Outlook: Range Breakout Could Target 168.49 and 230.05

Read MoreEOG consolidates inside a Wave (4) range in the very start of a powerful Wave III advance, with a bullish breakout pointing to higher Fibonacci targets. EOG Resources, Inc. (NYSE: EOG) continues to trade within a strong long-term bullish Elliott Wave structure on the monthly chart. The broader trend remains firmly positive. Price action from […]

-

Silver Extends Higher as Wave ((iii)) Remains in Progress

Read MoreSilver (XAGUSD) maintains a bullish Elliott Wave structure with pullbacks offering buying opportunities It continues to trade firmly higher and maintains a bullish structure. Price action respects the broader Elliott Wave sequence and keeps favoring the upside while key support levels hold. The rally from the prior swing low remains impulsive and shows no signs […]