-

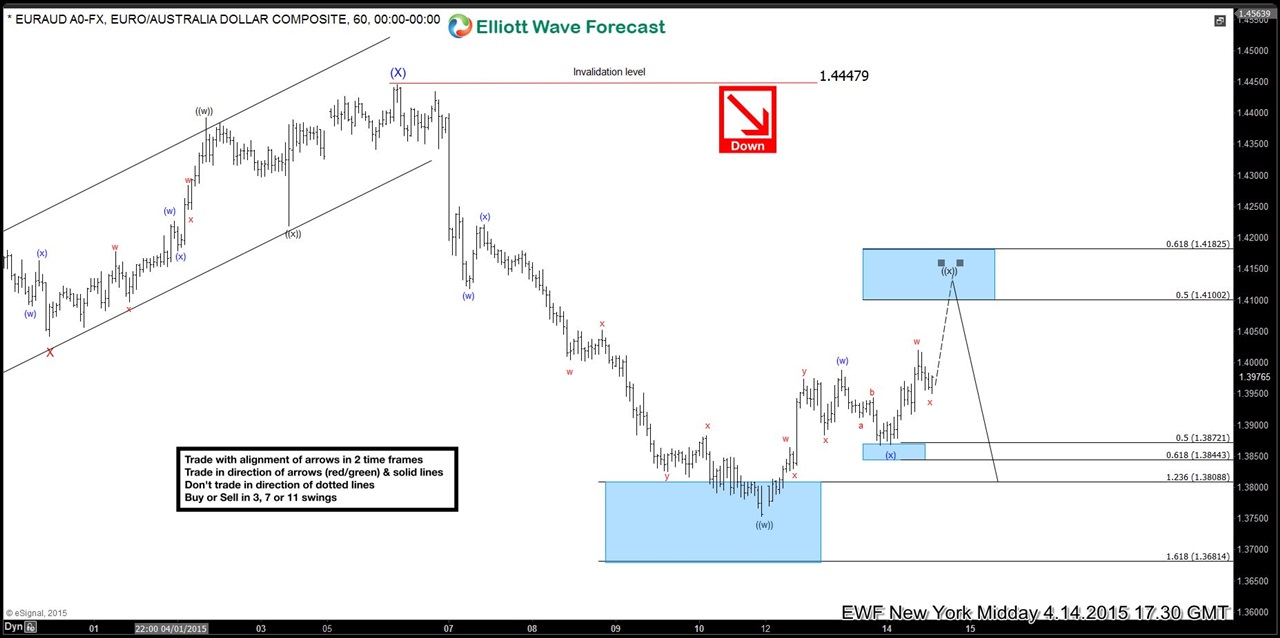

EURAUD Short-term Elliott Wave Analysis 4.14.2015

Read MorePreferred Elliott wave view suggests EURAUD cycles remain bearish against 6th April high (1.4447). Decline from 1.4447 – 1.3753 was a double three Elliott wave structure i.e. (w)-(x)-(y) when wave (w) completed at 1.4118, wave (x) completed at 1.4221 and wave (y) completed at 1.3753 making a higher degree wave ((w)). Pair is currently in […]

-

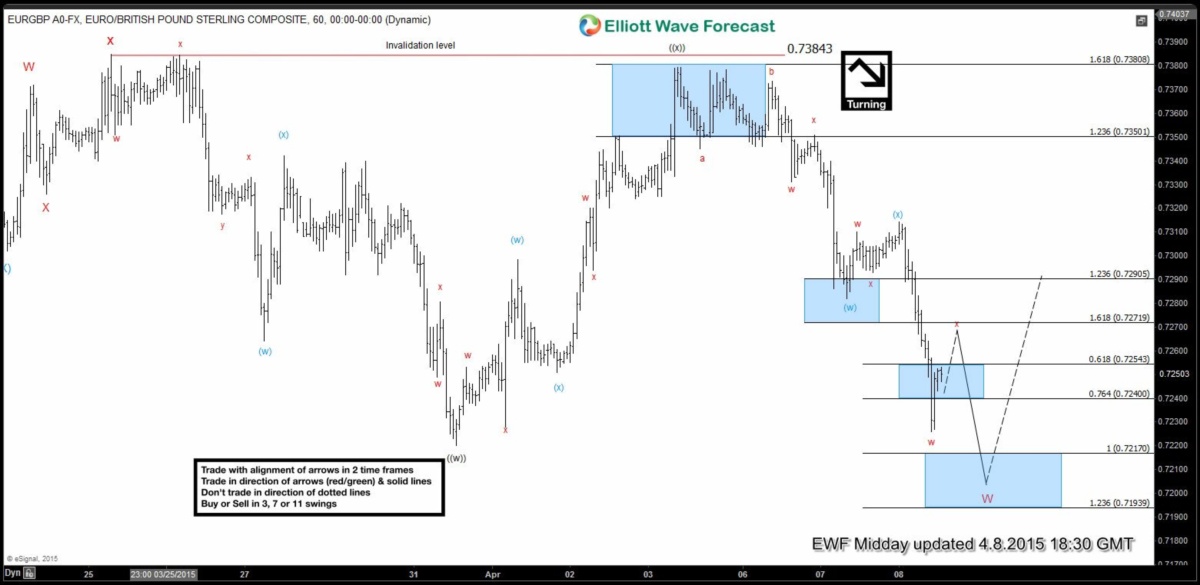

EURGBP Short-term Elliott Wave Analysis 4.8.2015

Read MorePreferred view suggests pair is in a double three or ((w))-((x))-((y)) Elliott wave structure down from 0.7384 peak when dip to 0.7223 completed wave ((w)) and wave ((x)) ended at 0.7380 with a full test of 0.7384 peak. Wave (w) of ((y)) ended at 0.7285 and recovery to 0.7315 was wave (x). Pair is now […]

-

$NI225 (Nikkei) Short-term Elliott Wave Analysis 4.7.2015

Read MorePreferred Elliott Wave view suggests rally to 19770 completed wave (W) and wave (X) pull back is also proposed to be over at 18973 with a test of equal legs (100% Fibonacci extension). As per Chart of the day presented yesterday (4.6.2015), we were looking for higher prices toward 19888 – 20032 area to complete a (w)-(x)-(y) […]

-

$NI225 (Nikkei) Short-term Elliott Wave Analysis 4.6.2015

Read MorePreferred Elliott Wave view suggests rally to 19770 completed wave (W) and wave (X) pull back is also proposed to be over at 18980 with a test of equal legs (100% Fibonacci extension). Move up from here is taking the form of a double three or (w)-(x)-(y) structure when wave (w) ended at 19590, wave (x) ended […]

-

Impulse wave vs WXYZ

Read MoreIn this video we take a look at FTSE decline from the recent peak which visually looks to be a 5 wave move. We dissect the price action and show the viewers why we don’t see the decline as a 5 wave move and rather as a triple three (w)-(x)-(y)-(z) structure. Learn more how to […]

-

IBEX (IBC-MAC) Short-term Elliott Wave Analysis 3.25.2015

Read MorePreferred Elliott wave view suggests wave “X” connector ended at 10864. Wave ((w)) took the form of a triple three structure & is proposed to be over at 11618. Pull back in wave ((x)) is now expected before rally resumes. Of interest, 50 – 61.8 fib area of ((w)) lies between 11244 – 11157. We don’t […]