-

Risk Management Technique Seminar

Read MoreIn the video seminar below, we talk about what trading really is and how to do a proper risk management. Below is an excerpt of the video from the opening. You can skip to the video directly if you want to watch the seminar. Excerpt of the Seminar Trading is not about being right or […]

-

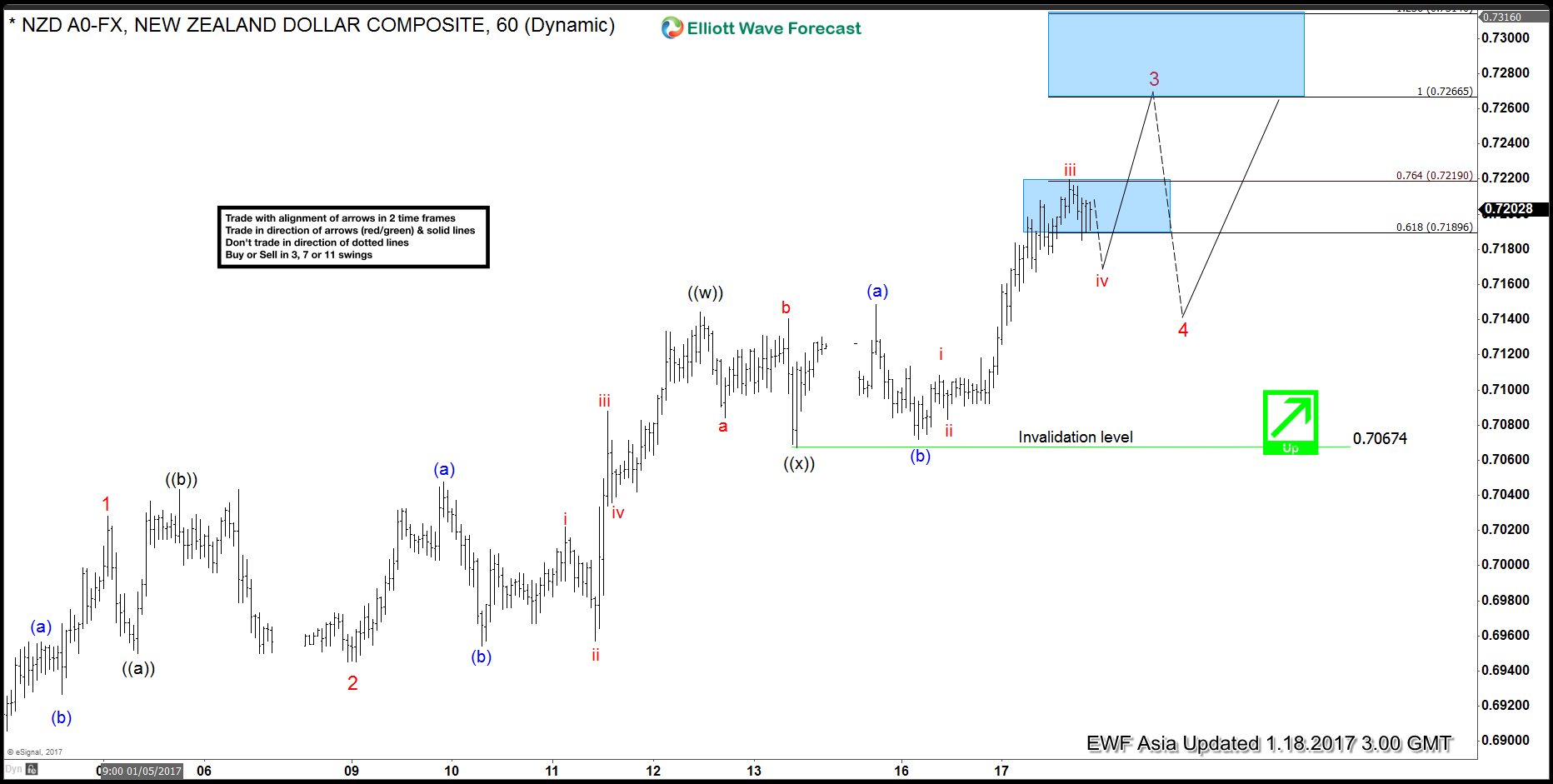

NZDUSD – Possible diagonal move in making

Read MoreNZDUSD move up from 12/23 low is extending and it looks like the move up from 12/23 low is unfolding as an Elliott wave diagonal when pair is still in wave 3. Rally to 0.7028 is labelled as wave 1 and dip to 0.6945 is labelled as a FLAT wave 2. Up from there wave 3 […]

-

GBPUSD: Elliott Wave Analysis calling for new lows

Read MoreGBPUSD preferred Elliott wave structure suggests pair is in an Ending Diagonal structure where wave ((4)) completed on 12/6 at 1.2775. Each sub-wave of a diagonal pattern sub-divides in 3, 7 or 11 swings. As the chart below shows, wave (W) of ((5)) completed at 1.2198 followed by a 3 wave bounce to 1.2432 which […]

-

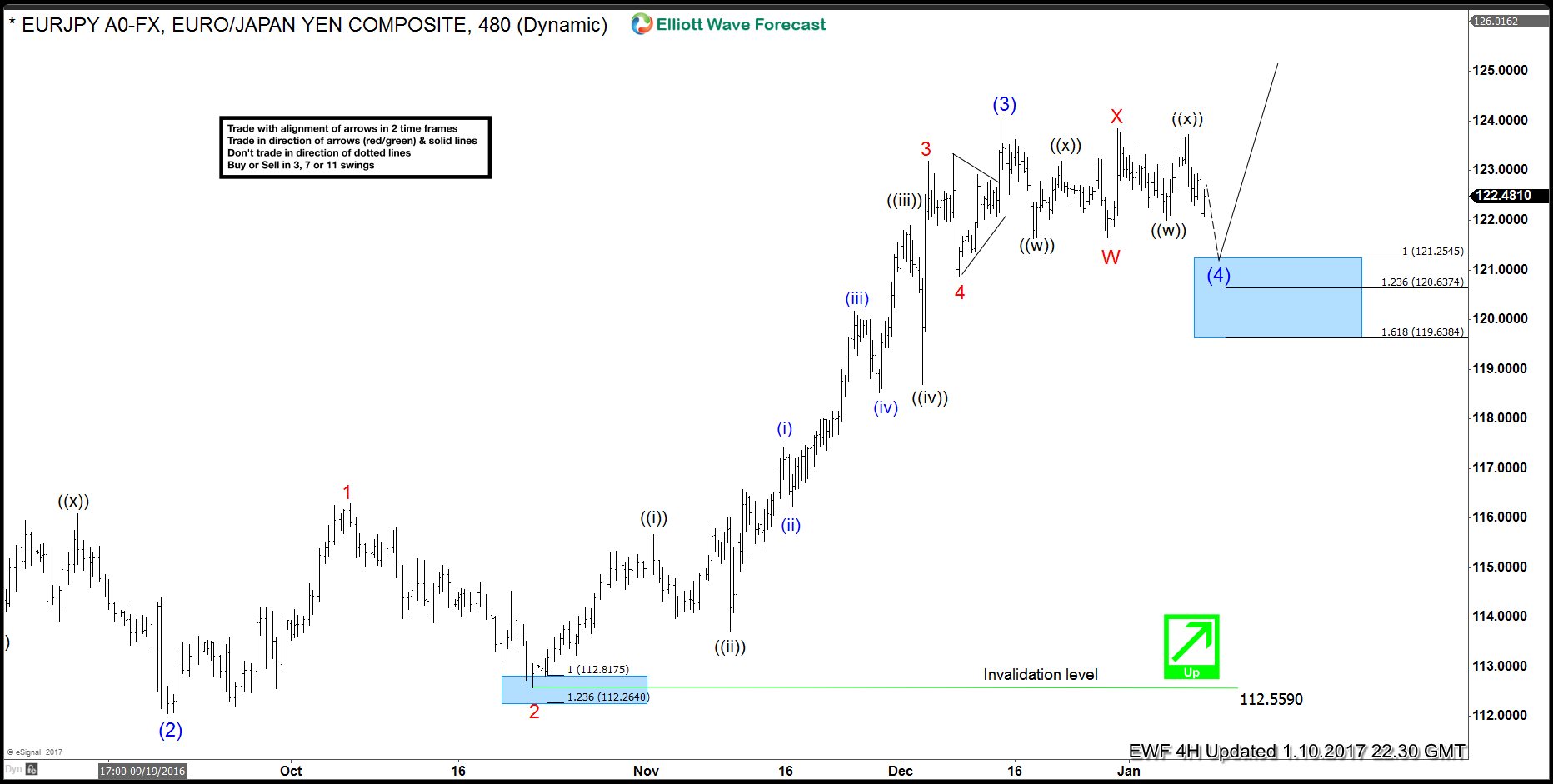

EURJPY Elliott Wave (4) nearing completion

Read MoreEURJPY has been in a sideways consolidation for the last few weeks and today it broke lower from the consolidation. Many might view it as start of a sustained decline but looking at the choppy nature of the decline from blue (3) peak, we are viewing it as a wave (4) blue pull back of an […]

-

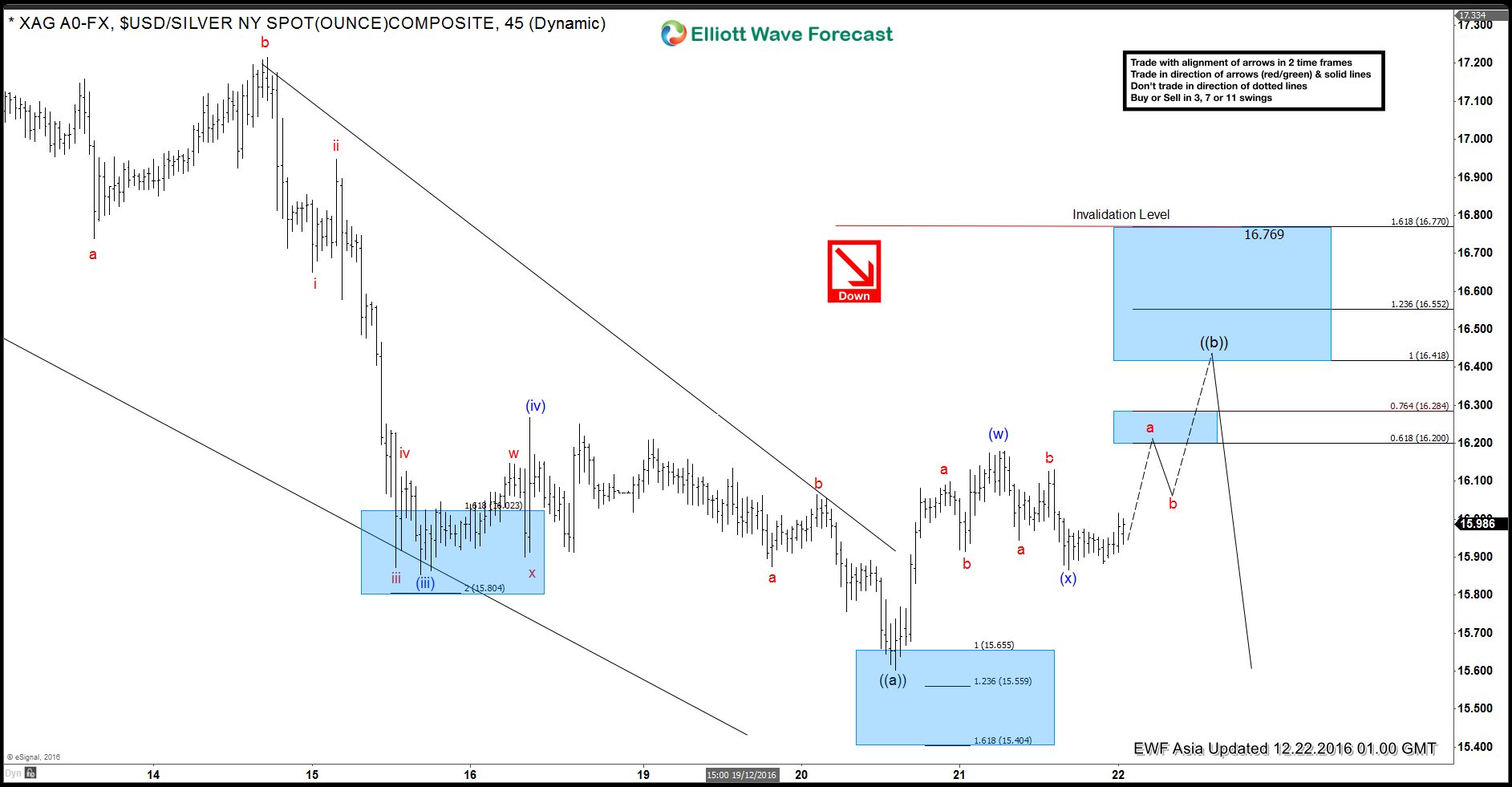

XAG Elliott Wave Forecast 12.23.2016

Read MoreXAG (Silver) is showing an incomplete Elliott Wave sequence from 11.9.2016 peak. There are 5 swings down from 11.9.2016 peak which makes short-term sequence bearish against 12.7.2016 (17.25) peak. Decline from 18.99 – 16.14 was a 3 wave move labelled wave W followed by a 3 wave bounce to 17.25 that completed wave X. Cycle […]

-

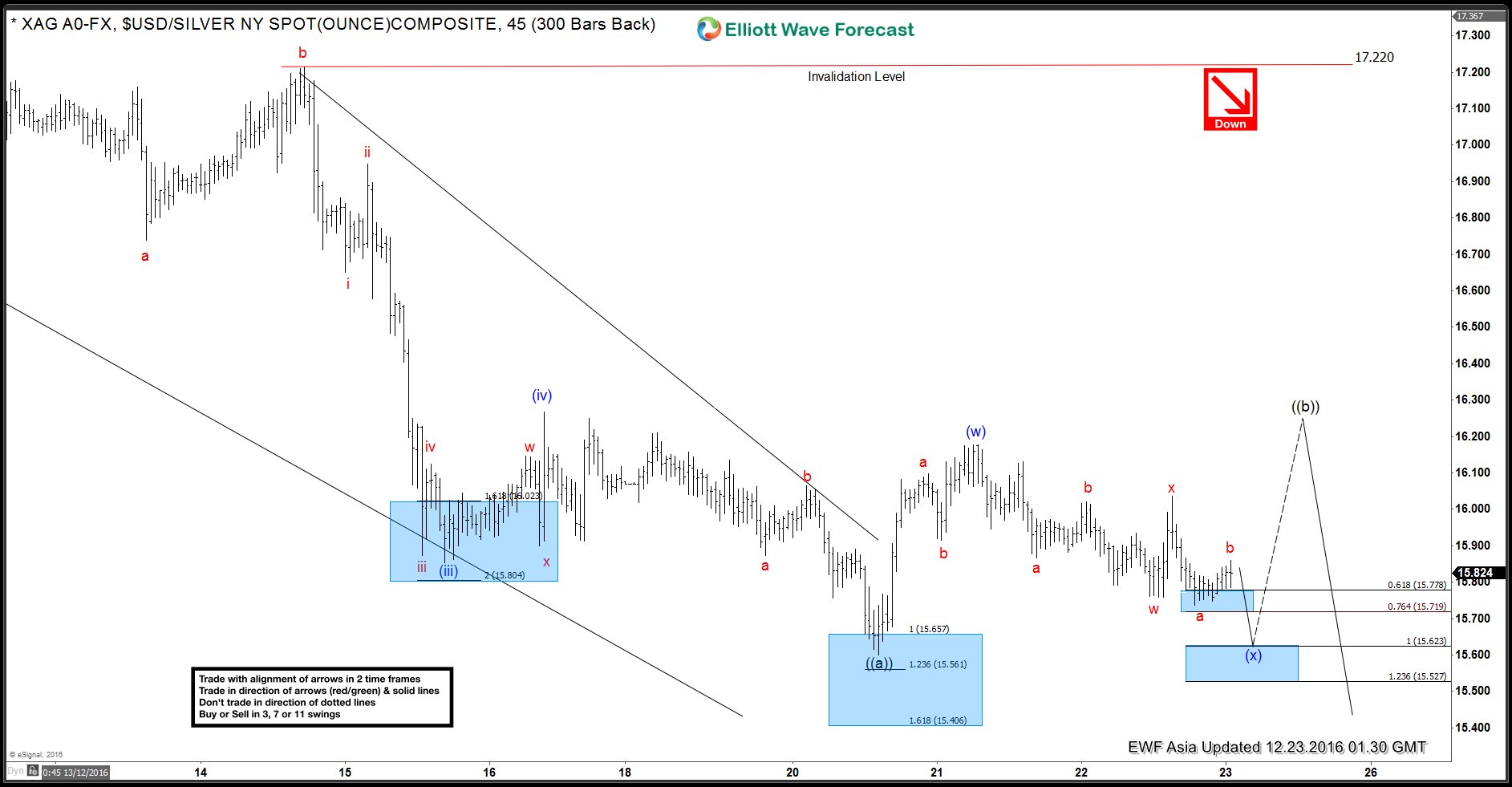

Silver 1H Elliott Wave Analysis 12.21.2016 – Elliott Wave Forecast

Read MoreSilver metal is showing an incomplete Elliott Wave sequence from 11.9.2016 peak. There are 5 swings down from 11.9.2016 peak which makes short-term sequence bearish against 12.7.2016 (17.25) peak. Decline from 18.99 – 16.14 was a 3 wave move labelled wave W followed by a 3 wave bounce to 17.25 that completed wave X. Cycle […]