-

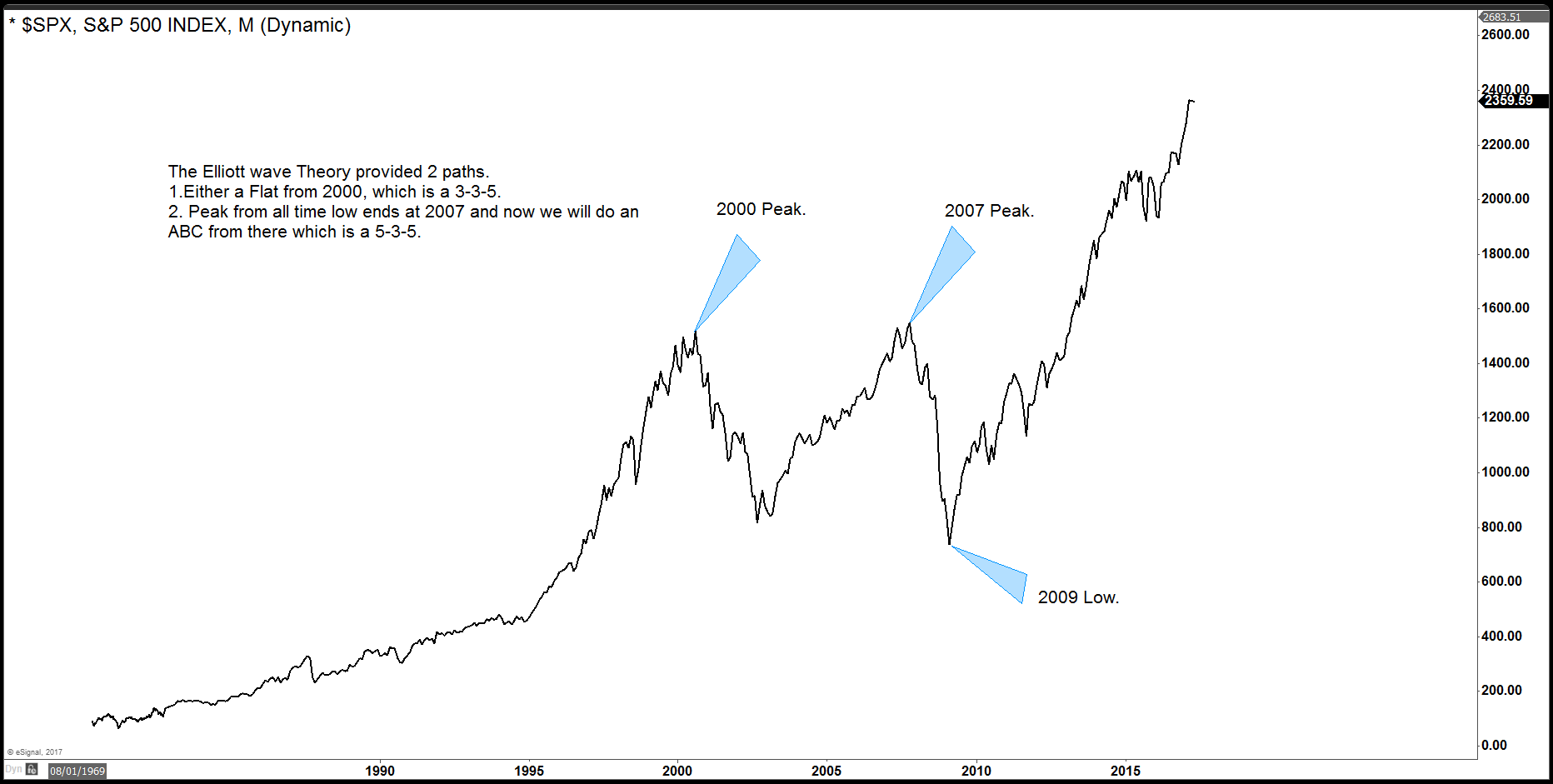

Elliott Wave Theory: Is Elliott’s Theory enough?

Read MoreUnderstanding Elliott Wave Theory As many traders know, The Elliott wave Theory is a form of technical analysis that finance traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology, highs and lows in prices, and other collective factors. Elliott’s Theory was developed by Ralph Nelson Elliott and […]

-

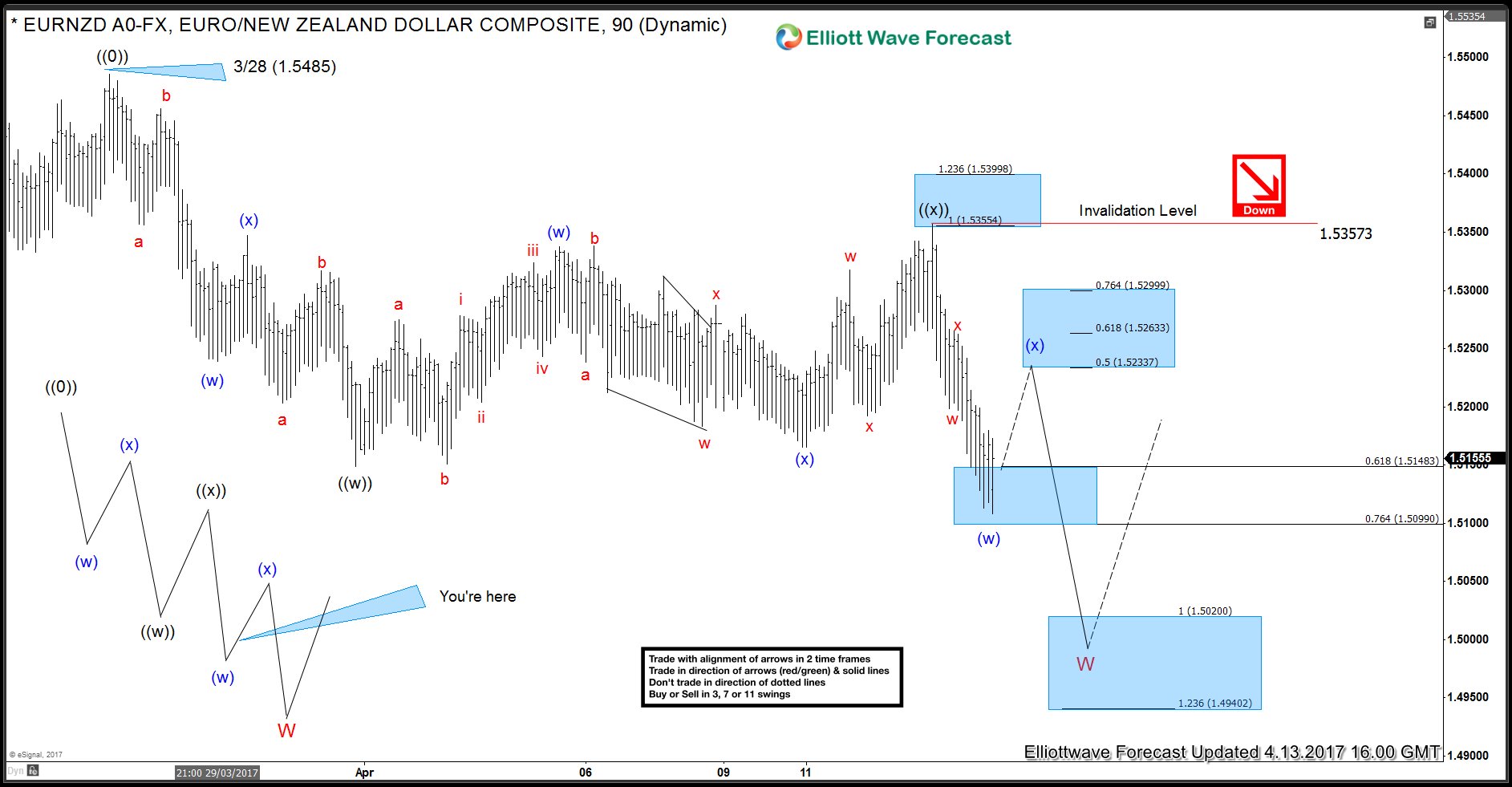

EURNZD Double Three Elliott Wave Structure

Read MoreEURNZD rally this week failed as pair found sellers in 1.5355 – 1.5399 area and made new lows below 1.5149 low. With the new low seen today, pair is now showing 5 swings sequence down from 3/24 (1.5485) peak. 5 swings means the sequence is incomplete and pair is in need of another swing lower to […]

-

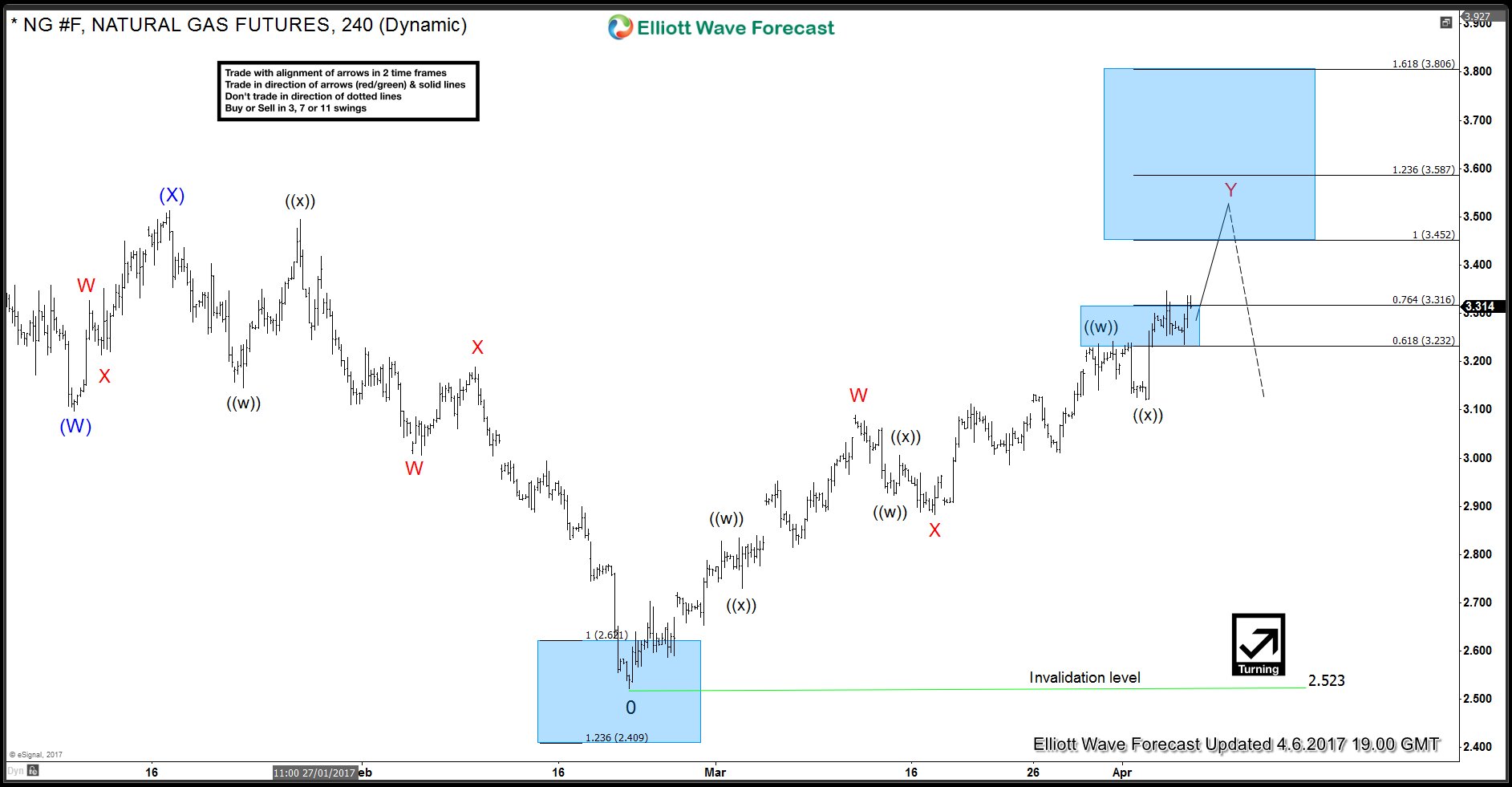

NG #F (Natural Gas) rally is not over yet

Read MoreNG #F (Natural Gas) has been rallying since forming a low on 2/22 (2.523). Rally is unfolding as a WXY or double three Elliott Wave Structure where wave W completed at 3.089 and wave X completed at 2.882. Up from red X low, Natural Gas is showing 5 swings up which means the sequence is incomplete […]

-

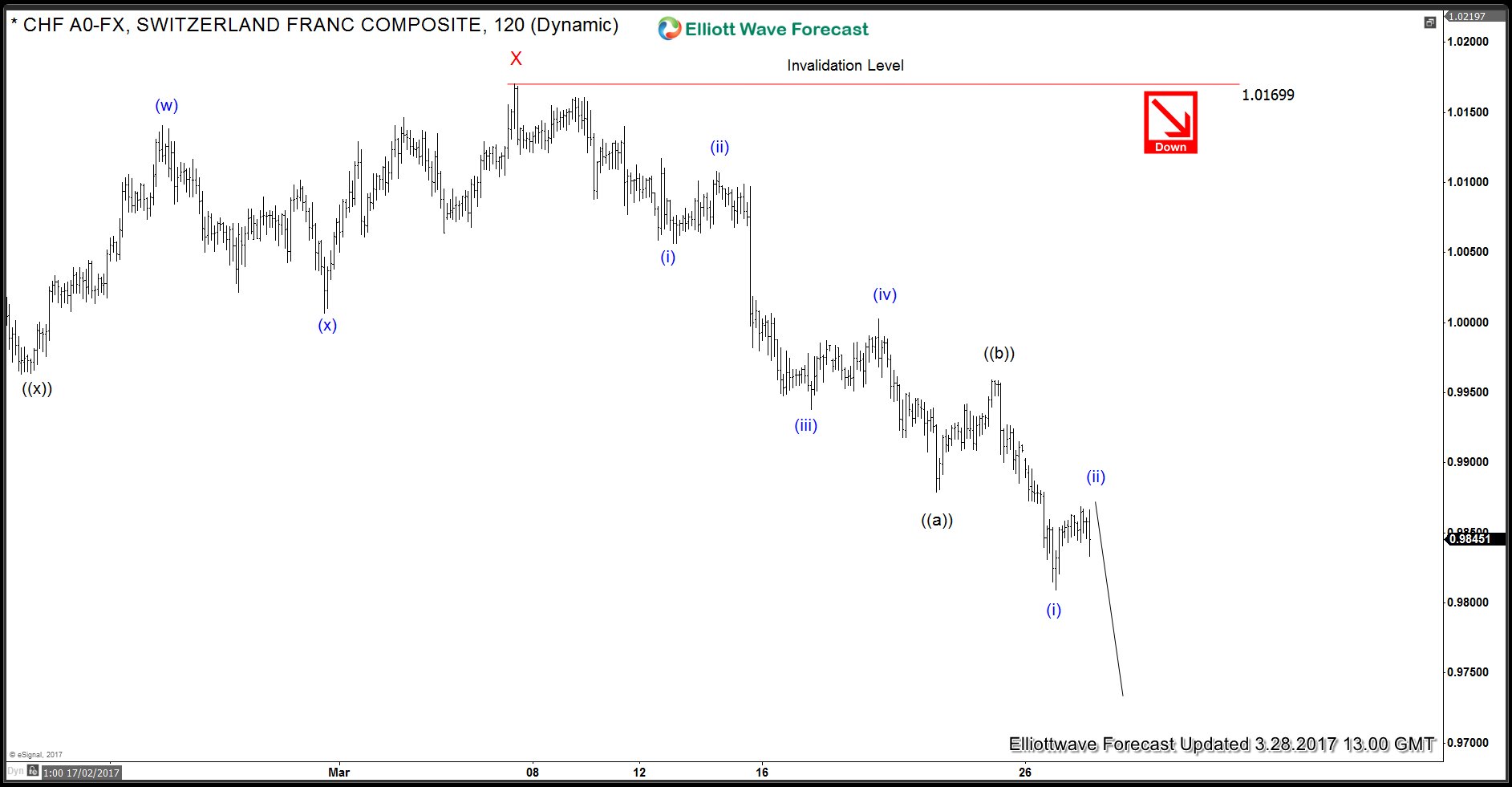

USDCHF Intraday Elliott Wave View

Read MoreUSDCHF decline from 3/7 (1.0170) high to 3/22 (0.9879) low could be viewed as a 5 swing move that we have labelled as Elliott wave ((a)). Bounce to 0.9960 was a three move and completed Elliott wave ((b)). Pair has since dropped to a new low below 0.9879 confirming the view that wave ((b)) ended at […]

-

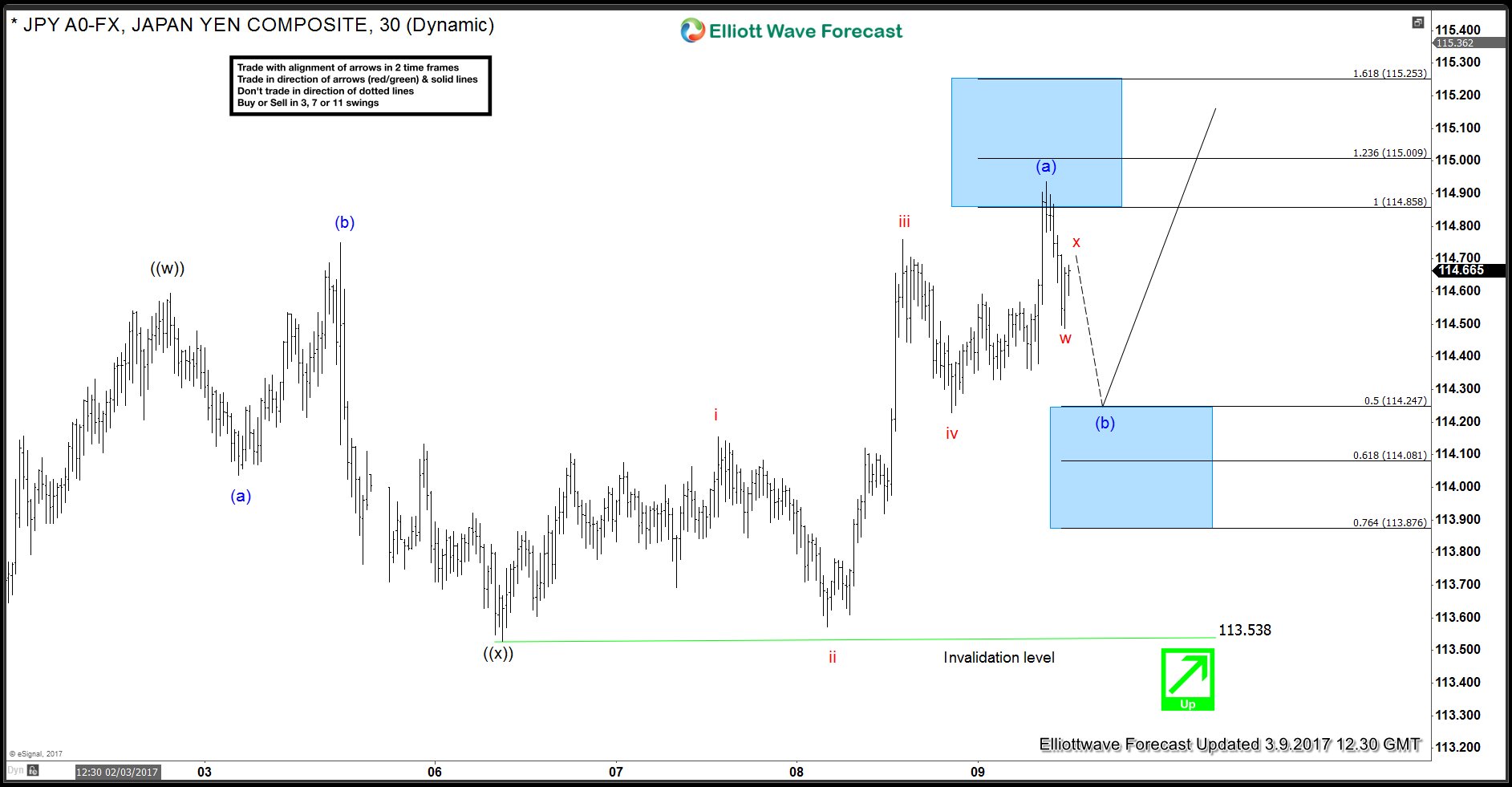

USDJPY Intra-day Elliott Wave view

Read MoreJPY (USDJPY) made a new high above last Friday’s peak and now seems to be pulling back. Move up from 113.53 ((x)) low could be viewed as a 5 swing Leading Diagonal Elliott Wave structure. There is RSI divergence (not showing) between red wave iii and blue (a) which further supports the idea of JPY […]

-

EURUSD: Elliott wave sequence from February peak

Read MoreEURUSD Elliott Wave Sequence from 2/2 peak doesn’t support the idea of 5 wave impulse or even a series of 1,2’s. Decline from 2/2/2017 high to 2/15/2017 low was a 7 swing sequence and the decline from 2/16/2017 to 2/22/2017 low was also a 7 swing decline. This means neither leg down from 2/2/2017 peak was […]