-

GBPNZD Short-term Elliott Wave Analysis 2.9.2015

Read MorePreferred Elliott Wave view suggests pair has ended a cycle from 1.9237 low as a triple three structure at 2.0935. We have labelled this wave “W” and a pull back in wave “X” is now in progress as a double three Elliott wave structure or a (( w )) – (( x)) – (( y […]

-

$INDU (Dow) and Elliott Wave Hedge

Read MoreIn this video we take a look at running FLAT Elliott Wave structure (3-3-5). In a running FLAT structure, wave C would fail to break the ending point of wave A. Dow (INDU) is showing an impulsive Elliott wave structure (5 wave move) up from 17037 (2/2) low and as far as RSI divergence remains […]

-

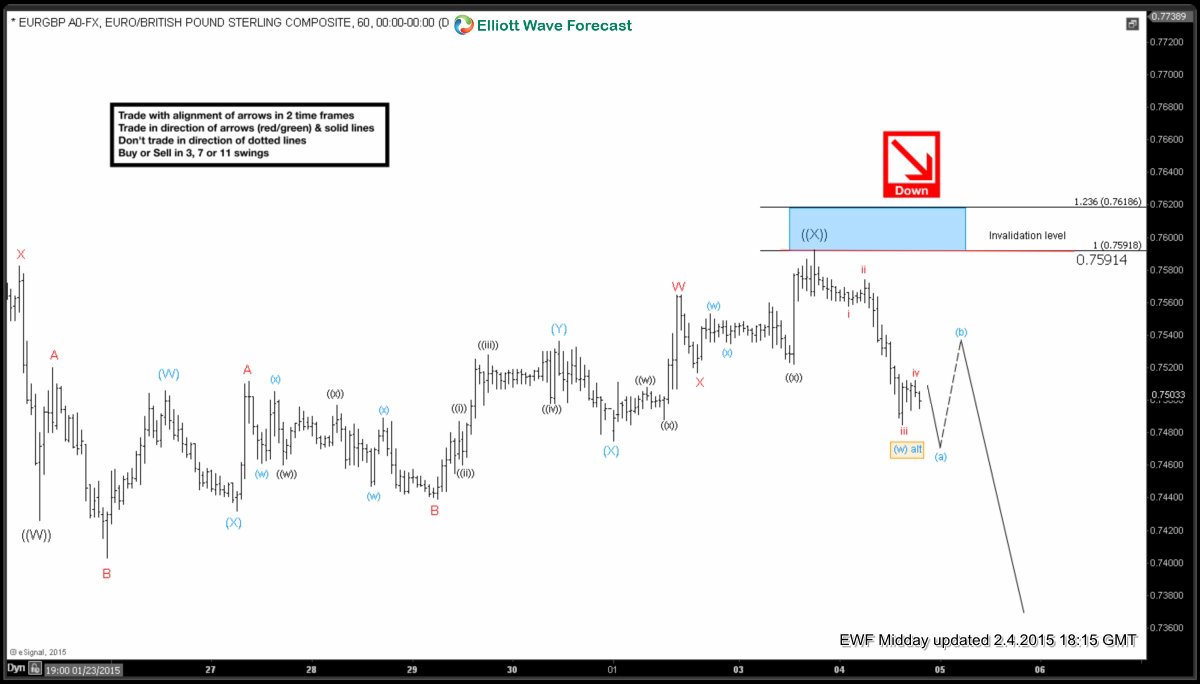

EURGBP Elliott Wave Setup Video

Read MoreOur mid-term Elliott Wave cycles remain firmly bearish in EURGBP. Pair tested the inflection area between 0.7591 – 0.7618, got rejected and turned lower as expected. Cycle from the lows is over so connector wave (( X )) is thought to be in place at 0.7591. Pair could test 0.7465 – 0.7449 area to finish […]

-

EURGBP Short-term Elliott Wave Analysis 2.4.2015

Read MoreOur mid-term Elliott Wave cycles remain firmly bearish in EURGBP. Pair tested the inflection area between 0.7591 – 0.7618, got rejected and turned lower as expected. Cycle from the lows is over so connector wave (( X )) is thought to be in place at 0.7591. Decline from this high is so far in 3 […]

-

$HG_F (Copper) Short-term Elliott Wave Analysis 2.4.2015

Read MoreMetal made a marginal new low below 2.423 and started recovering we are going with the idea of a double correction in wave (( X )) as per preferred Elliott Wave view and expected to test 2.633 – 2.684 region before decline resumes. Ideally expected price to stay below 1.618 ext at 2.766 for a turn lower. […]

-

EURGBP Short-term Elliott Wave Analysis 1.26.2015

Read MorePreferred Elliott wave view suggests wave (W) ended at 0.7593 and wave (X) ended @ 0.7714. Wave “W” is proposed to be over at 0.7403. Wave “X” bounce is in progress & could reach as high as 0.7558 – 0.7597 (50 – 61.8 fib) area before decline resumes. We don’t like buying the pair & expect sellers to keep […]