-

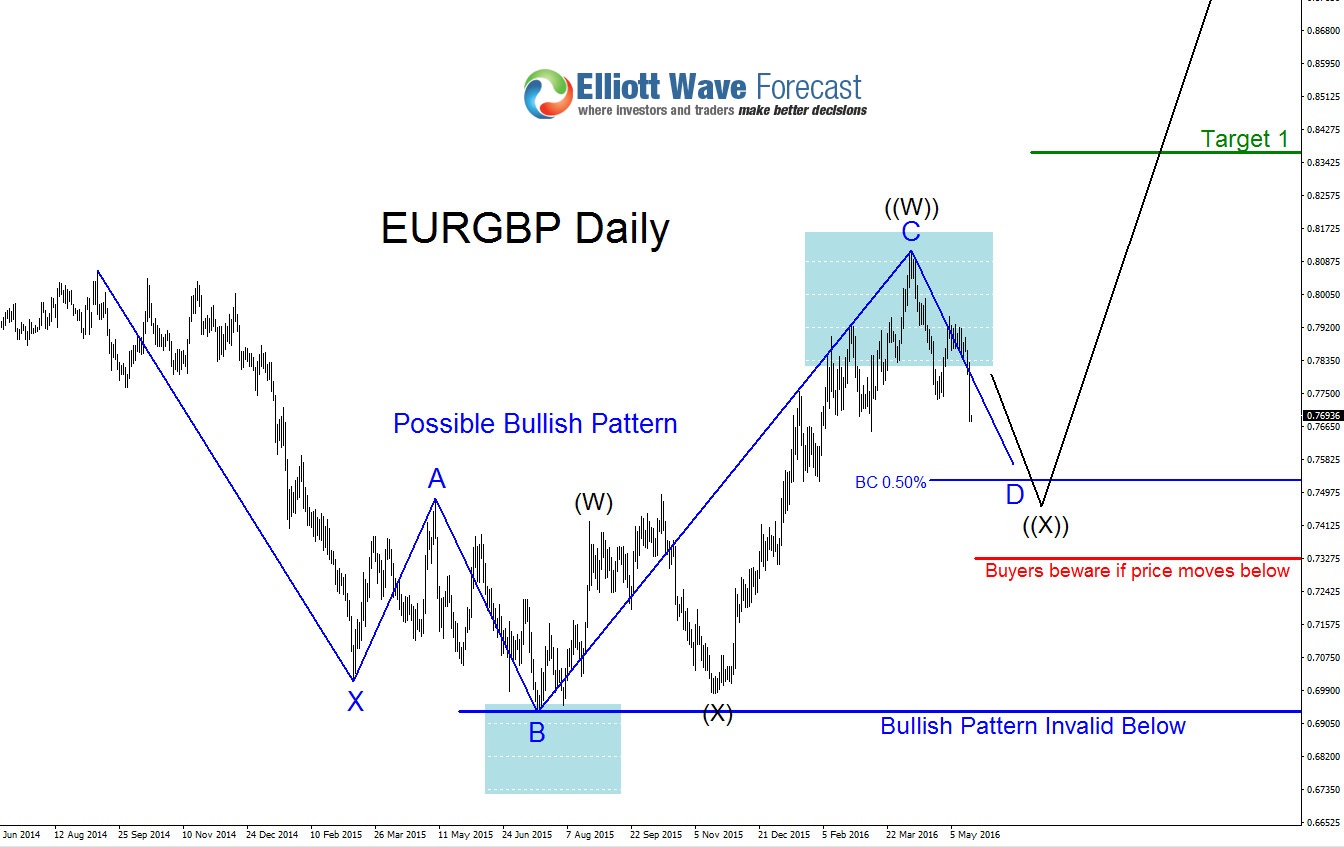

EURGBP: Bullish Possibilities

Read MoreSince November 2015 EURGBP has been moving higher and on April 7 it has formed a top and reversed lower. The cycle from November 2015 low to April 2016 high has ended and is now at the moment correcting lower. We still expect another move higher but need to wait for signs that this current correction/cycle […]

-

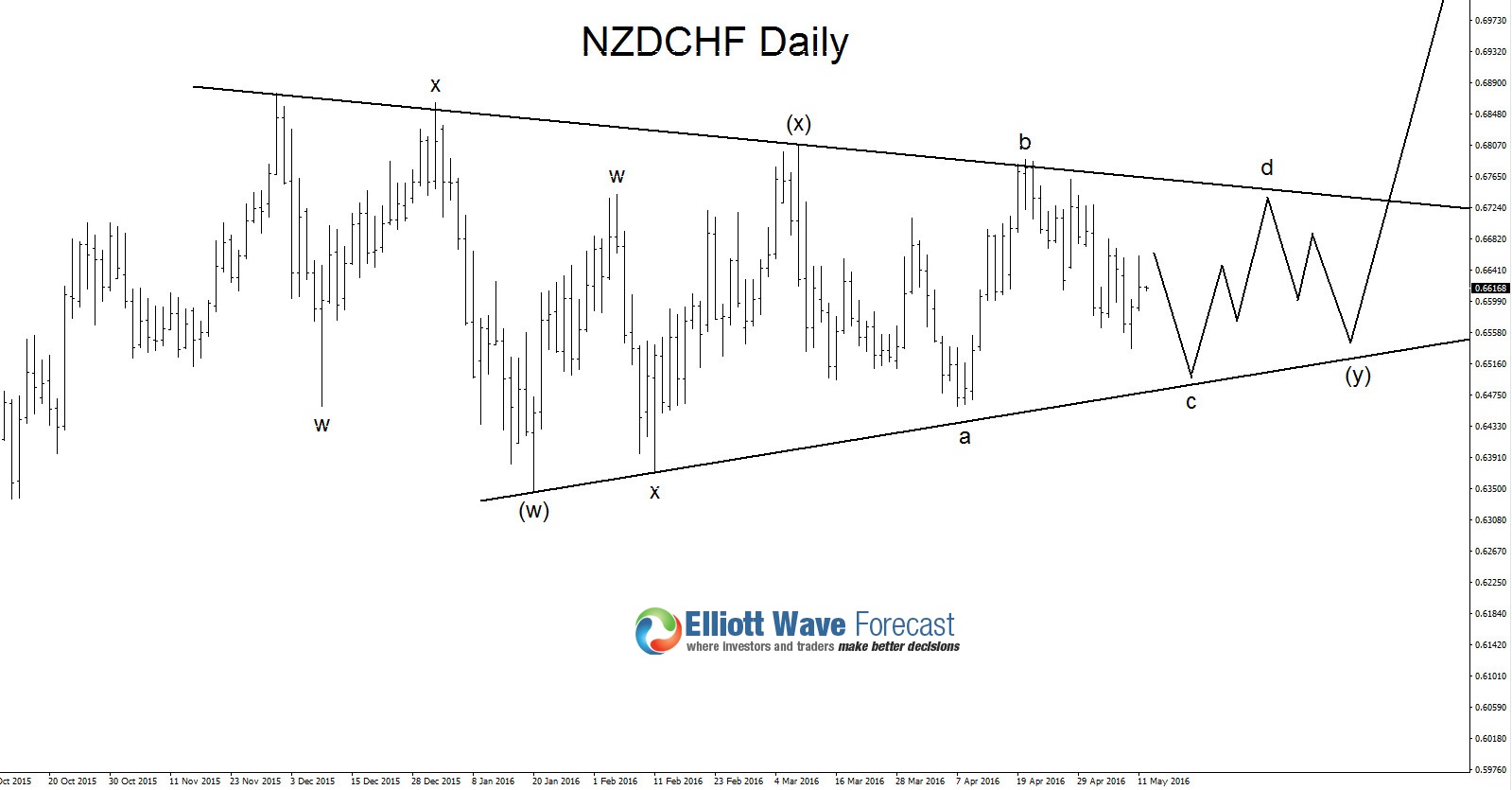

Will NZDCHF break higher?

Read MoreOn August 24 2015 NZDCHF has bounced higher and since December 2015 it has been trading sideways stuck in a triangle structure. It now looks to be forming an Elliott Wave WXY Double Three correction pattern where we still need Wave e/(y) to terminate. Below we will show this Elliott Wave WXY Double Three correction pattern and […]

-

CADCHF: Another Swing Higher is Highly Probable

Read More*Bullish patterns have been invalidated* CADCHF has been moving higher since January 20/2016. It has been making higher highs and higher lows showing that it is trending to the upside. It is also showing an Elliott Wave WXY (Double correction) where we still need to see the 7th swing higher to complete Wave Y. In the […]

-

Daniel Hussey @danielhusseyjr of Elliottwave-Forecast.com

Read MoreClick here to watch video > Play Video

-

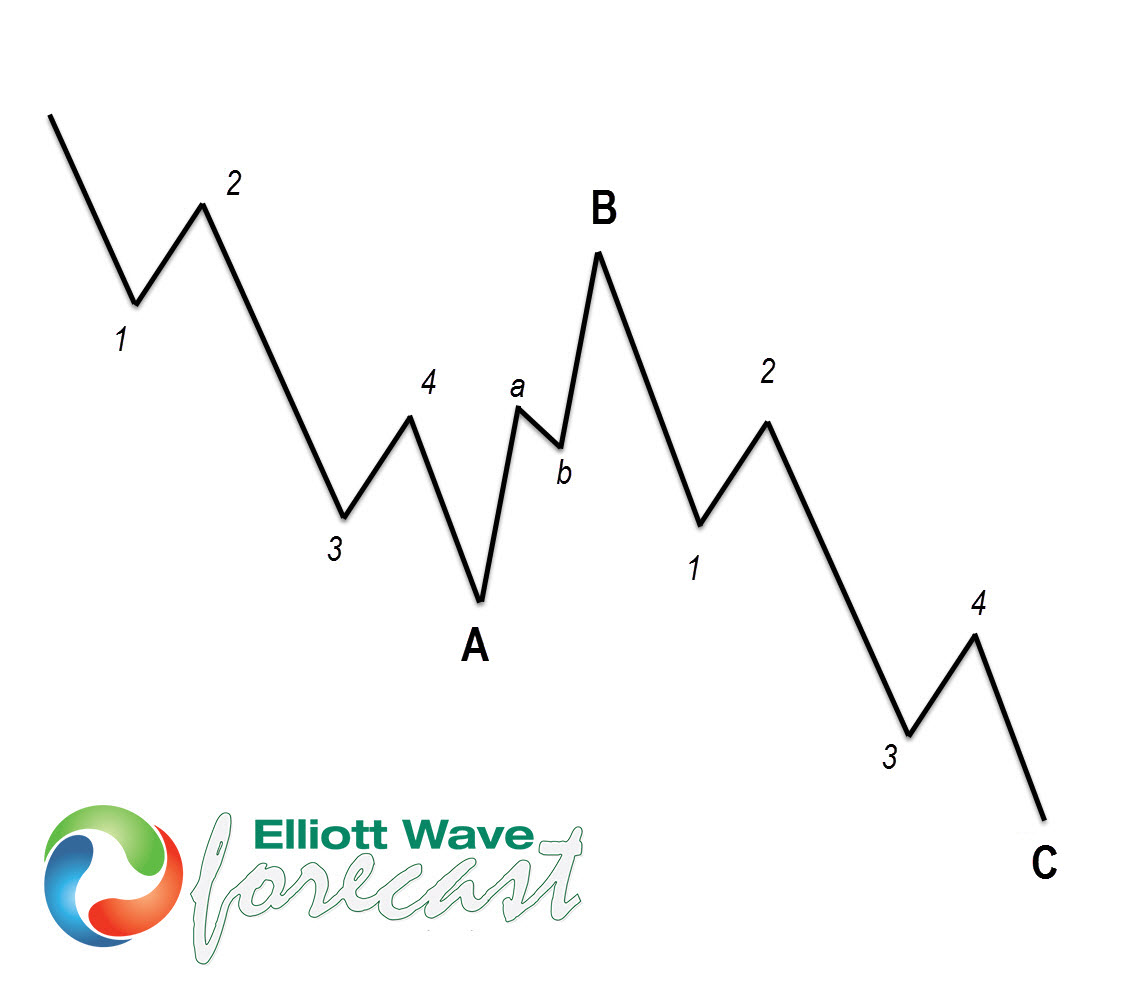

ABC (Zig-Zag) Elliott Wave Structure

Read MoreSee Eric Morera explain an ABC (Zig-Zag) Elliott Wave Structure in an interview with Dale Pinkert (@ForexStopHunter). He goes over the 5 key rules that we use at Elliottwave-Forecast.Com to define an ABC structure. Learn to spot what is and what is not an ABC structure with the help of this video.

-

Interview with Eric Morera: ABC (Zig-Zag) Elliott Wave Structure

Read MoreSee Eric Morera explain an ABC (Zig-Zag) Elliott Wave Structure in an interview with Dale Pinkert (@ForexStopHunter). He goes over the 5 key rules that we use at Elliottwave-Forecast.Com to define an ABC structure. Learn to spot what is and what is not an ABC structure with the help of this video.