-

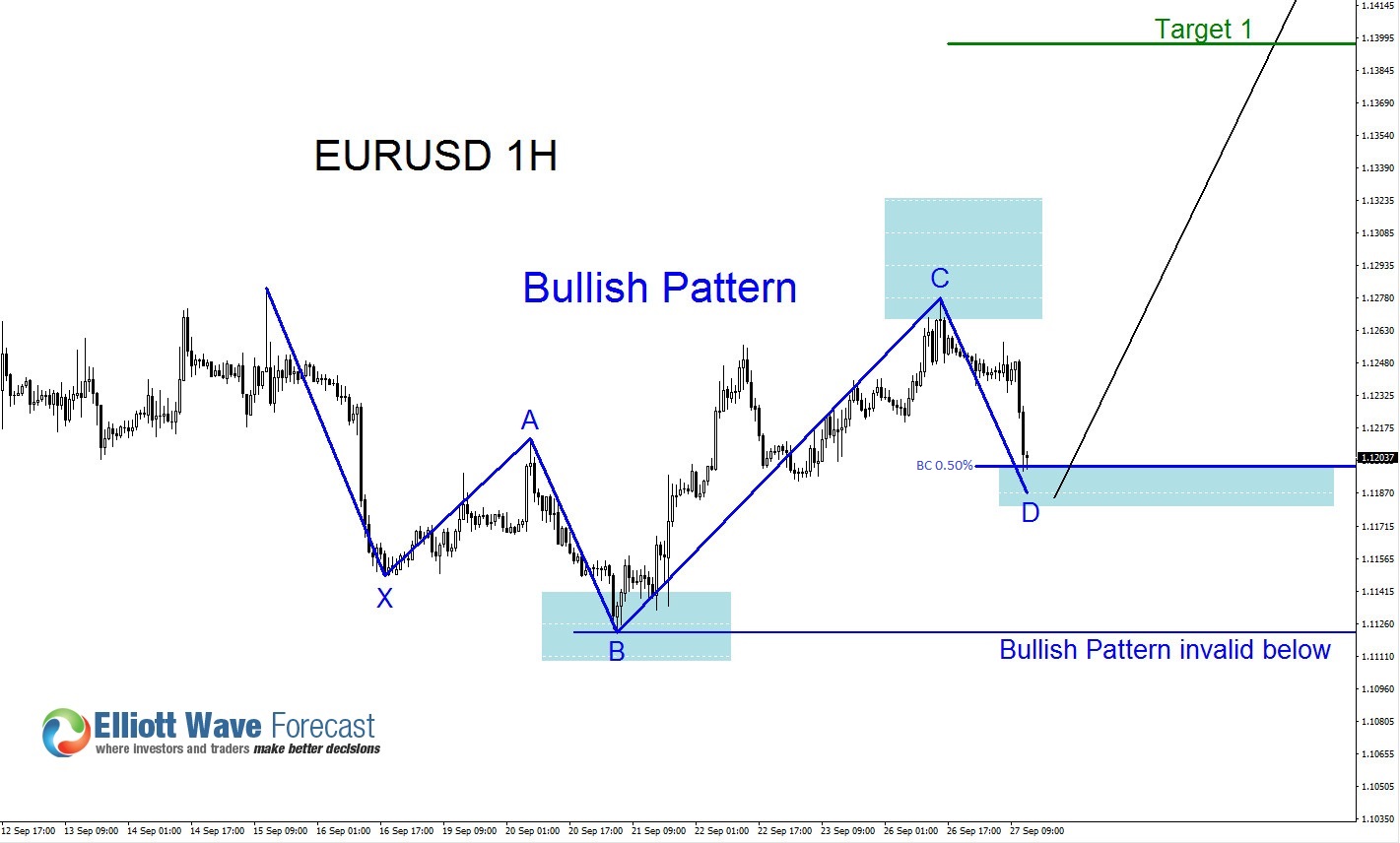

EURUSD Possible Bounce?

Read More*Forecast has been invalidated / Bullish view has been invalidated* It is possible that EURUSD can produce a bounce from the 1.1200 – 1.1180 area and target the 1.1400 level. EURUSD needs to stay above the 1.1122 September 21/2016 low for this blue bullish pattern to stay valid. Any buying stops should be placed at […]

-

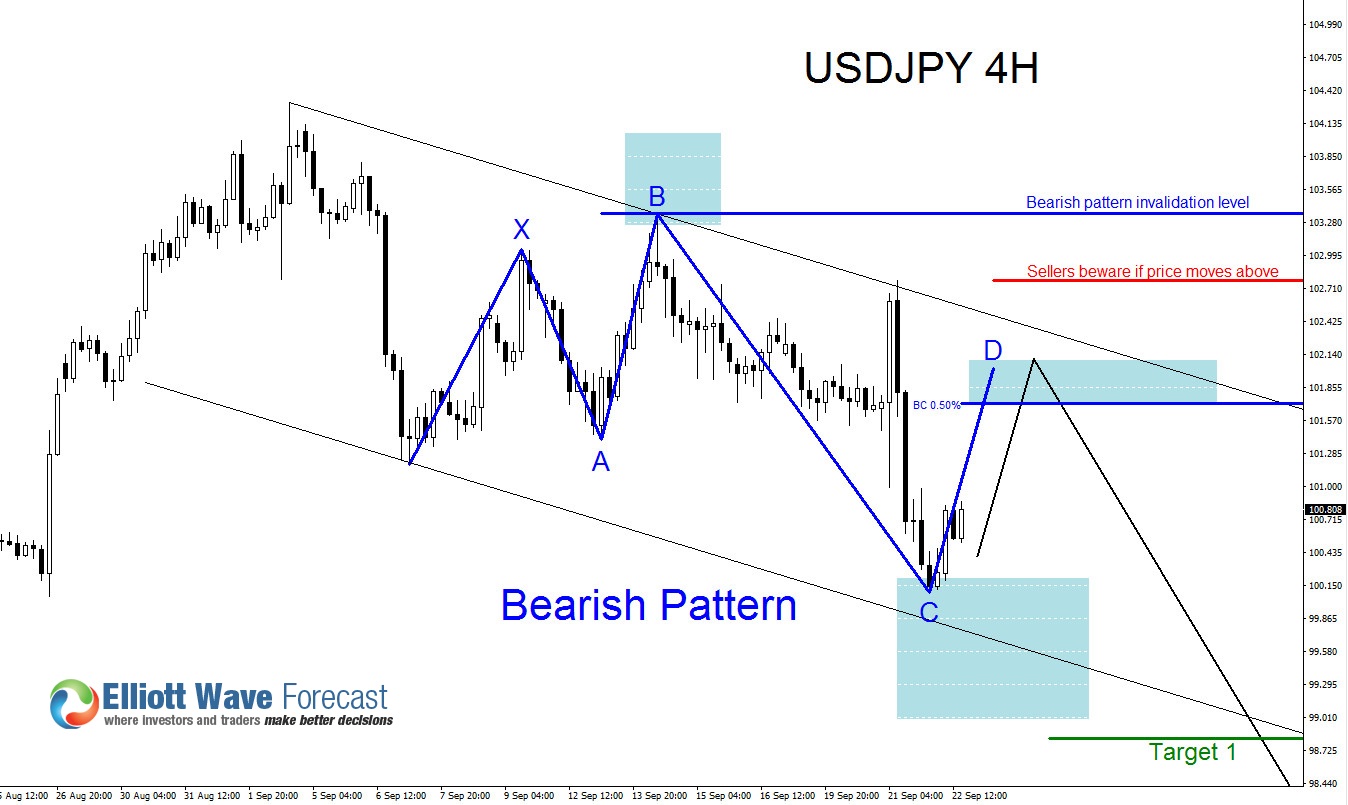

After the BOJ smoke clears a USDJPY trade setup emerges

Read More*Forecast has been invalidated / Bearish pattern has been invalidated* Traders need to have patience and wait for USDJPY to make a pullback towards the BC 0.50% Fib. level to start looking for selling opportunities. Should expect sellers waiting at the 101.70 – 102.10 area to push USDJPY lower. Blue bearish pattern invalidates if price […]

-

Will Bulls Push EURCAD Higher?

Read MorePossibly bulls will be waiting to push EURCAD higher if we see a dip lower towards the 1.4625 – 1.4525 area. Two possible bullish patterns trigger in this area. If EURCAD moves lower look for a possible bounce at the Blue BC 0.50% level or at the Red AB=CD 1.0%-1.236% zone. Buyers need to beware if […]

-

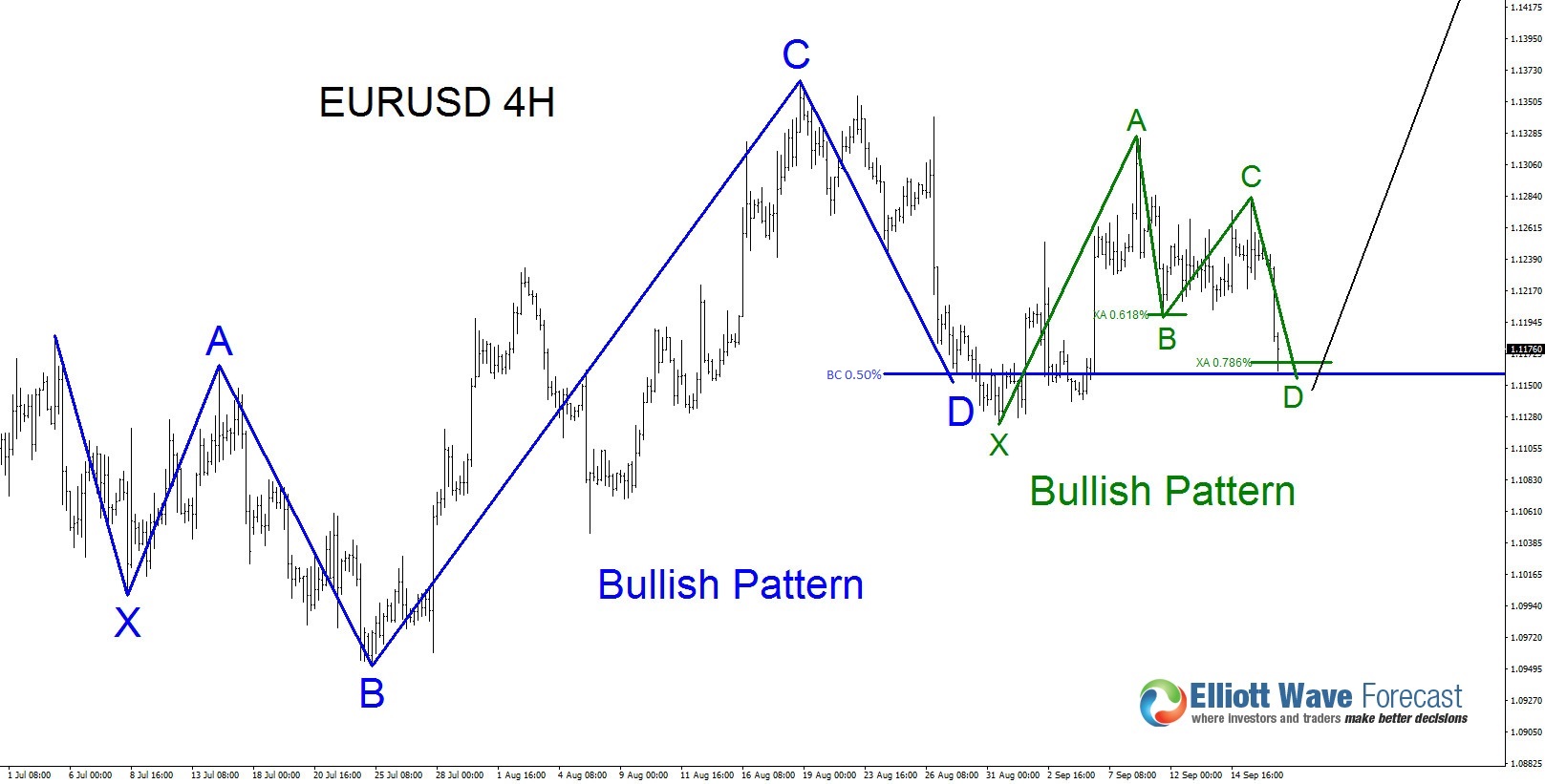

EURUSD Bullish Patterns?

Read More*Forecast has been invalidated / Bullish pattern has been invalidated* Below you will see some possible bullish scenarios that could push EURUSD higher. Green bullish pattern invalidates if price moves below 1.1122 and the blue bullish pattern invalidates if price moves below 1.0951. *** Always use proper risk/money management according to your account size *** […]

-

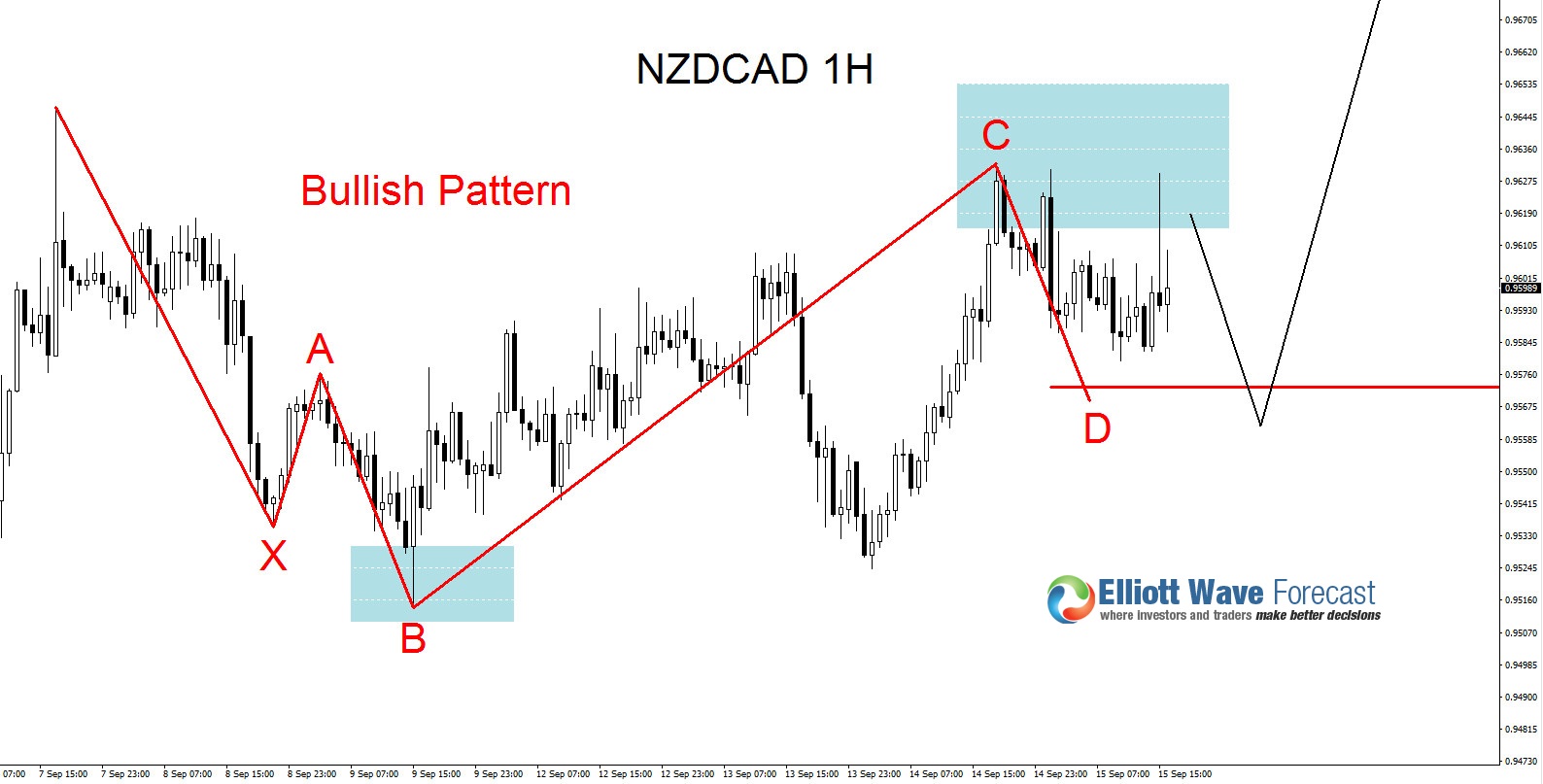

NZDCAD Possible 1H Bullish Scenario

Read MoreWatch for a possible bullish scenario to take place in NZDCAD on the 1 hour chart. It’s possible NZDCAD can bounce if it makes a minor push lower towards the 0.9570 area. Bulls should watch this area for any possible buying signals/opportunities. Bulls should also be aware if NZDCAD breaks below September 14/2016 0.9524 low […]

-

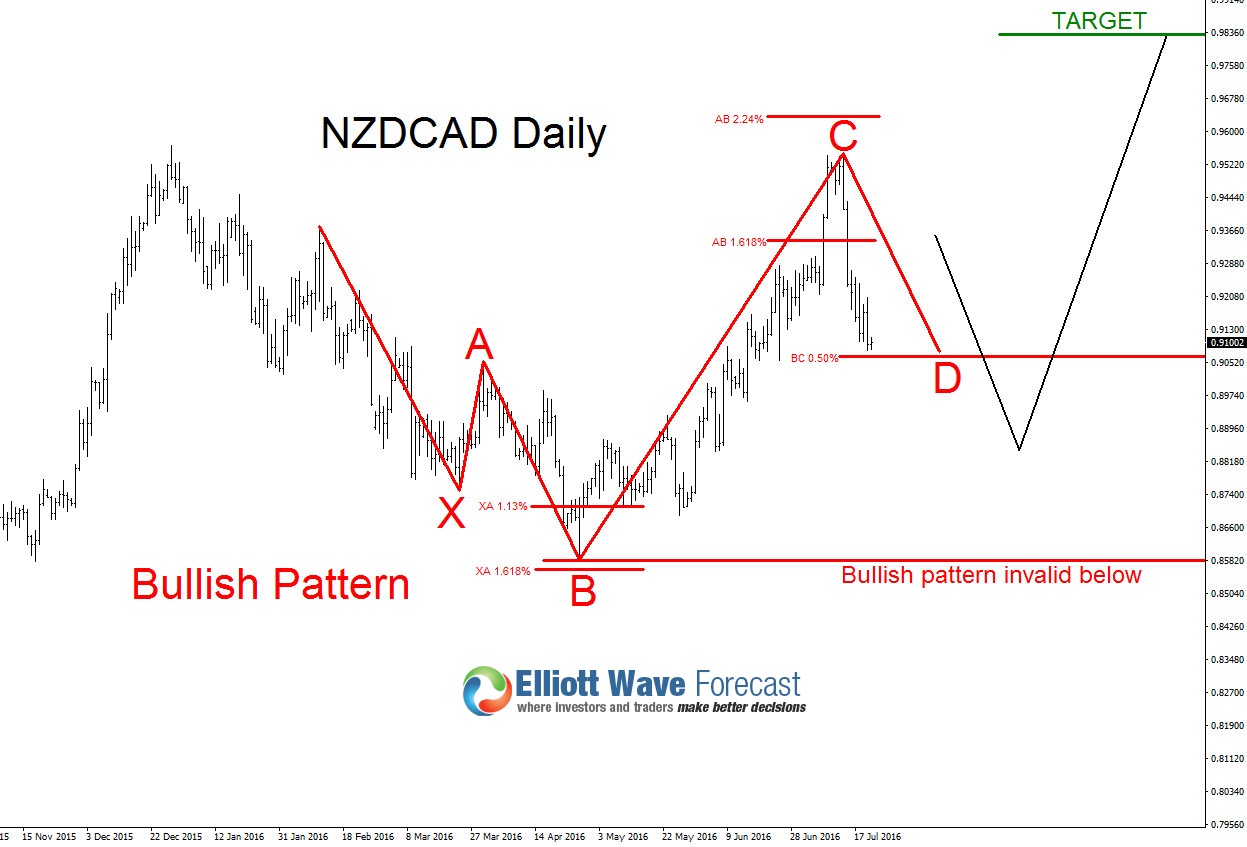

New Zealand Dollar Possible Buying Opportunities

Read MoreNZDUSD, NZDCHF and NZDCAD has been pushing higher since August of 2015 and it’s possible that another move higher can happen in the near future. All three pairs still needs to find a bottom to possibly reverse higher and traders need to wait and watch for this in order to catch the next move higher. Below […]