-

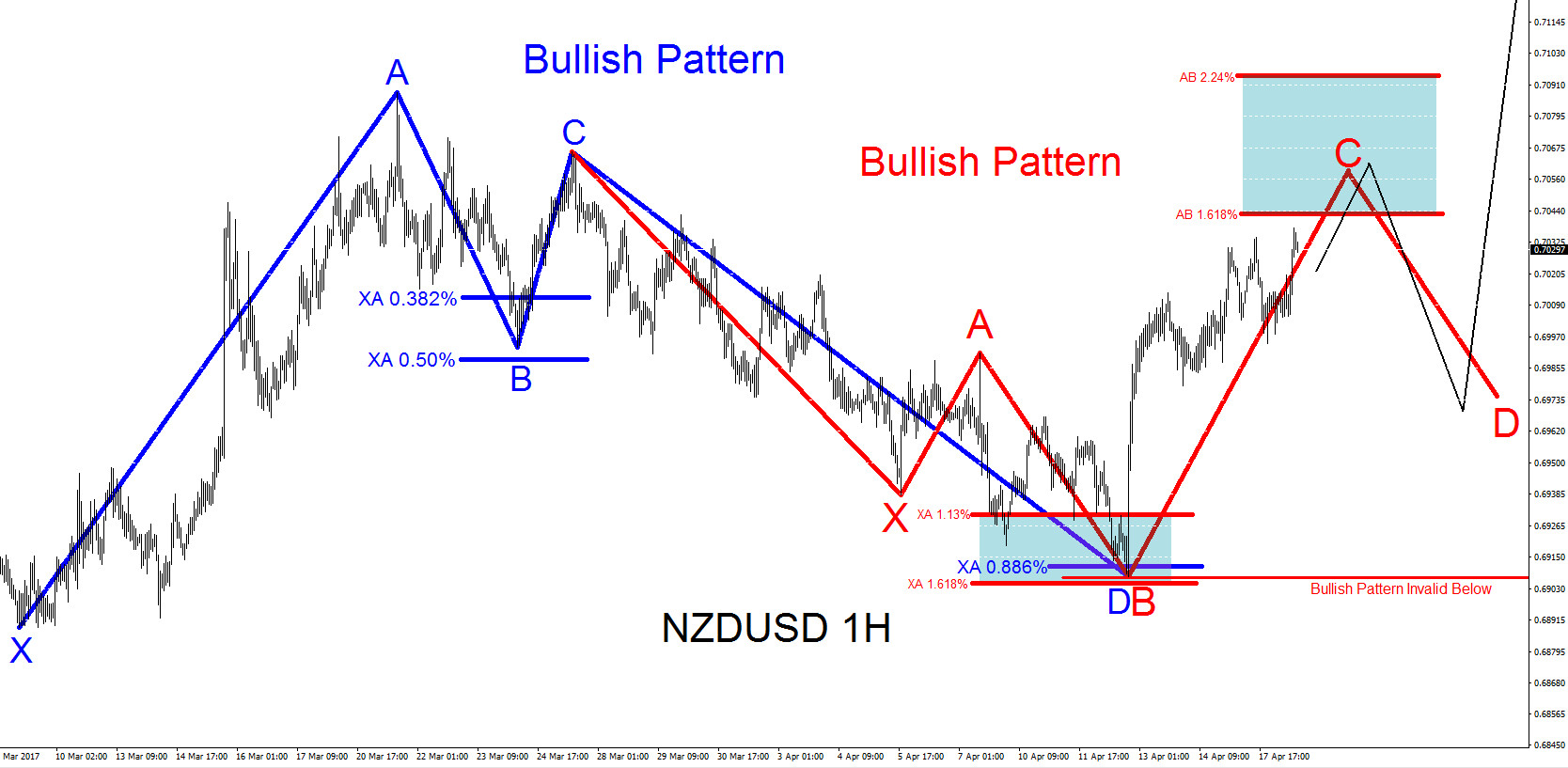

NZDUSD Technical Analysis April 18/2017

Read MoreNZDUSD found temporary support and has bounced higher on April 12/2017. At this moment, bias remains bullish and we expect the pair to continue higher in the coming trading sessions. Bulls will be waiting on any pullbacks to push the pair higher. NZDUSD 1 Hour Chart Bullish Patterns: The blue bullish pattern has already triggered a […]

-

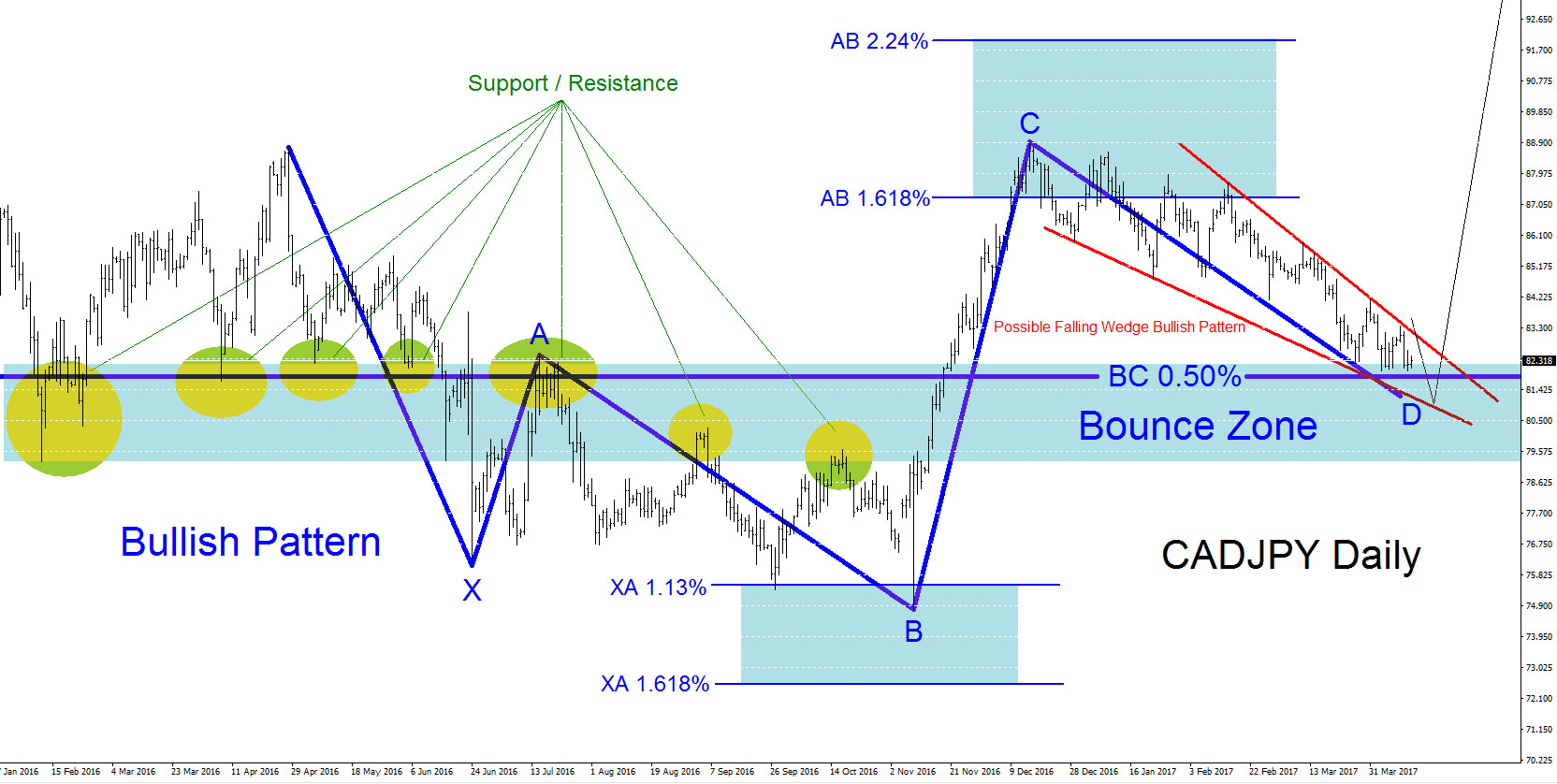

CADJPY Technical Analysis April 13/2017

Read MoreCADJPY Technical Analysis April 13/2017 CADJPY has been moving lower since December 2016. Price is entering an area where the pair can possibly bounce and reverse higher. There are a couple bullish patterns that seem to be forming and traders need to wait and see if CADJPY will find a bottom and terminate the bearish […]

-

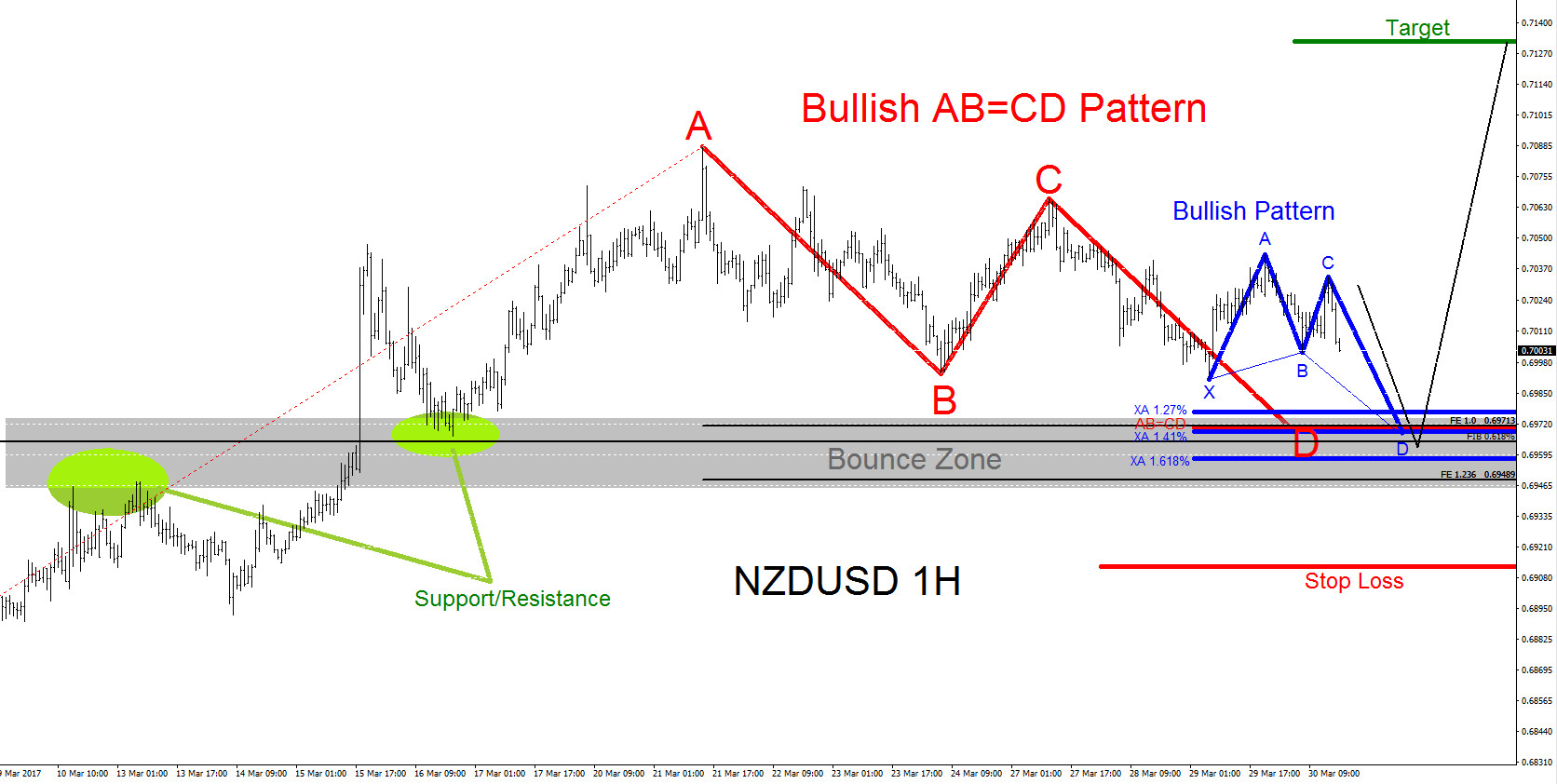

NZDUSD Technical Analysis 29 March 2017

Read MoreNZDUSD Technical Analysis March 29/2017 1 Hour Elliott Wave Analysis: NZDUSD is currently in a Elliott Wave double ((w))-((x))-((y)) correction lower on the 1 hour timeframe and we expect red wave X to terminate in the 0.6967 – 0.6943 area where the pair should bounce higher. We do not recommend selling the pair to the […]

-

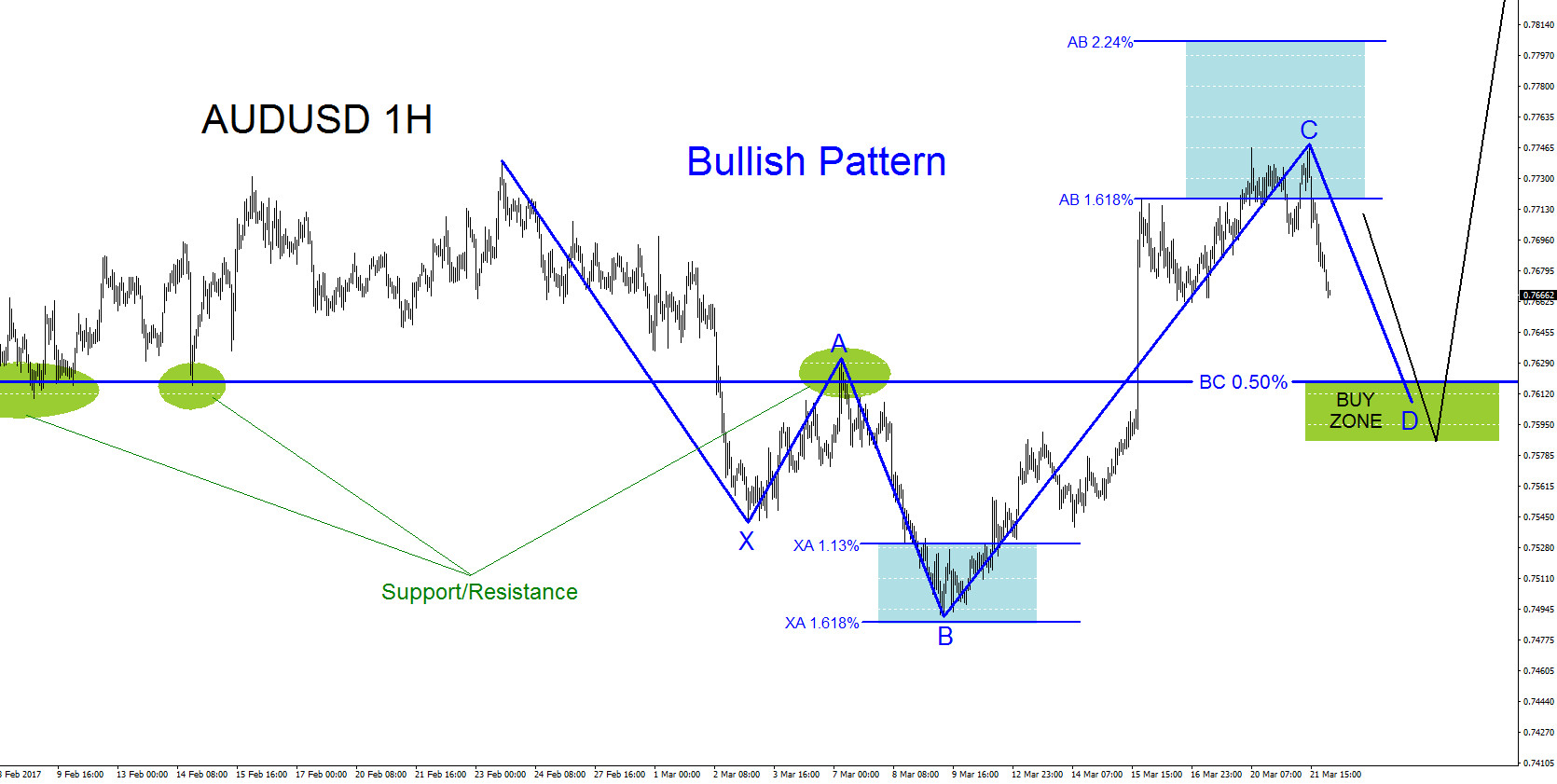

AUDUSD Technical Analysis March 21/2017

Read MoreAUDUSD found a possible bottom in December 2015 and has bounced higher. The pair has tried to test the December 2015 low but has been rejected twice, once in May 2016 and the second time in December 2016, both at the point D (Blue pattern) BC 0.50%-0.618% Fib. retracement levels. We at Elliottwave-Forecast still feel […]

-

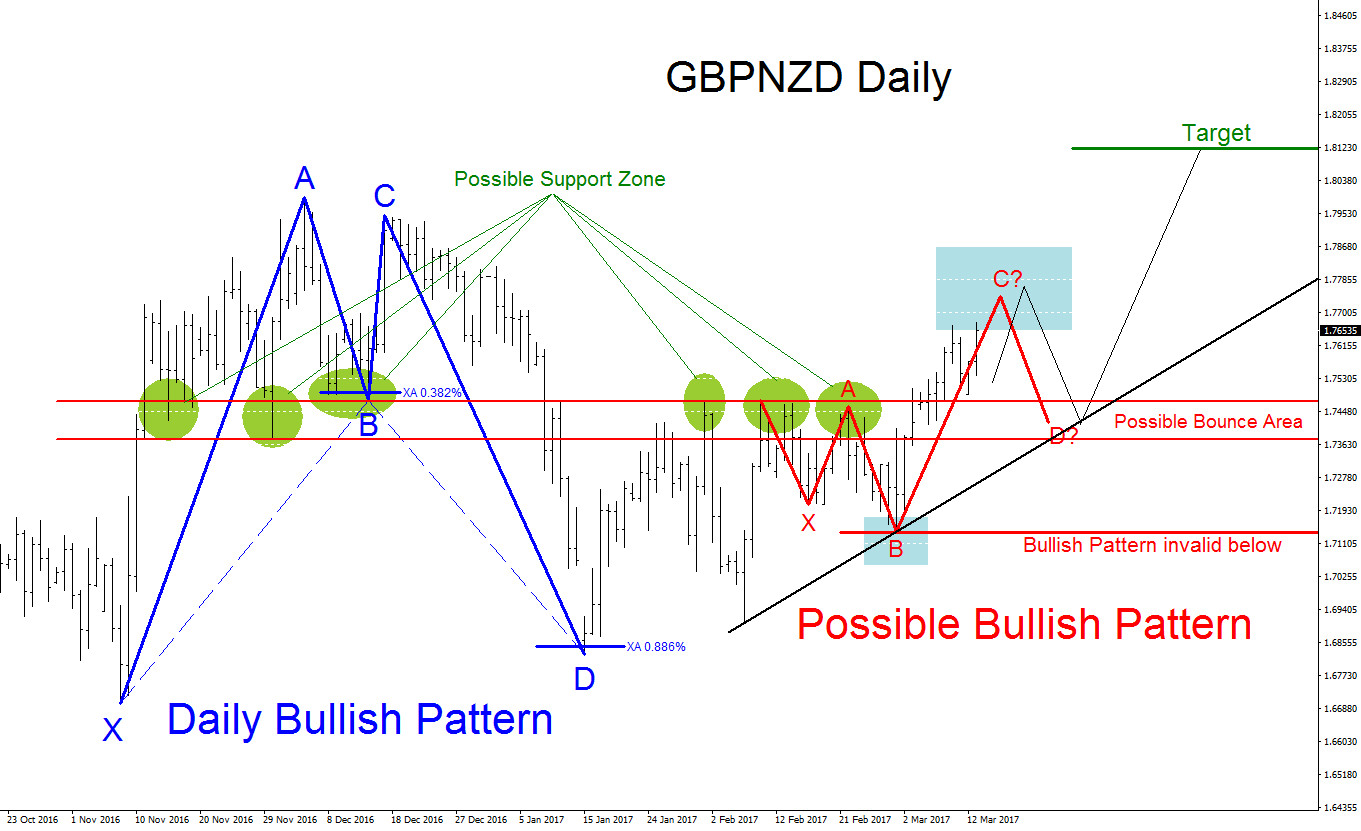

GBPNZD Technical Analysis 13 March 2017

Read MoreGBPNZD found buyers January 15/2017 and has bounced higher. A bullish pattern (Blue) triggered a buy January 15/2017 and bulls have been pushing the pair higher since. At this moment we can now see another possible bullish pattern (Red) emerging possibly in the coming days or weeks. Traders need to wait for the red bullish […]

-

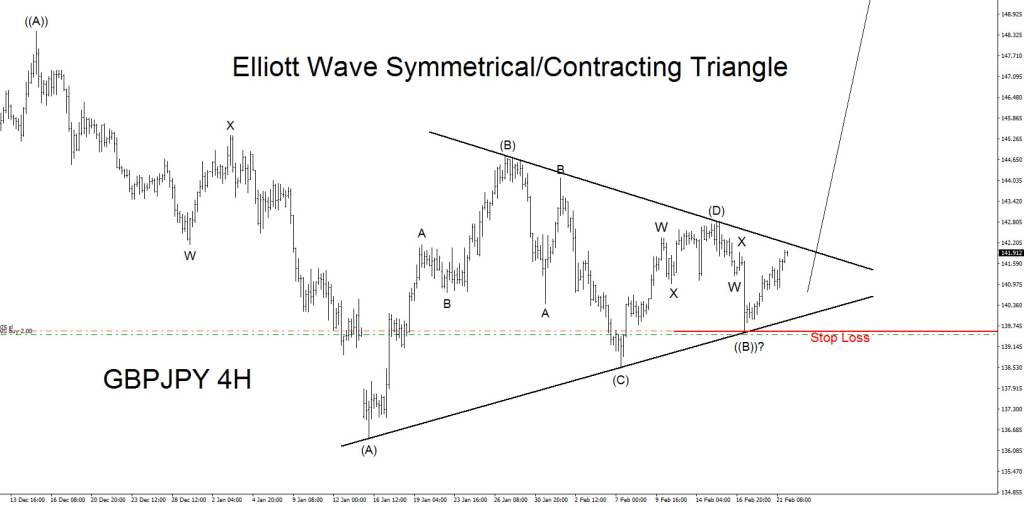

GBPJPY Elliott Wave Bullish Triangle Scenarios

Read More*** Triangle scenarios have been invalidated *** GBPJPY Technical Analysis February 21/2017 – Triangle Idea Traders should remain bullish as long as GBPJPY stays above the 138.51 level. Below we will show three possible Elliott Wave triangle bullish patterns. GBPJPY has bounced higher since October 2016 and the possibility of the pair continuing higher will […]