-

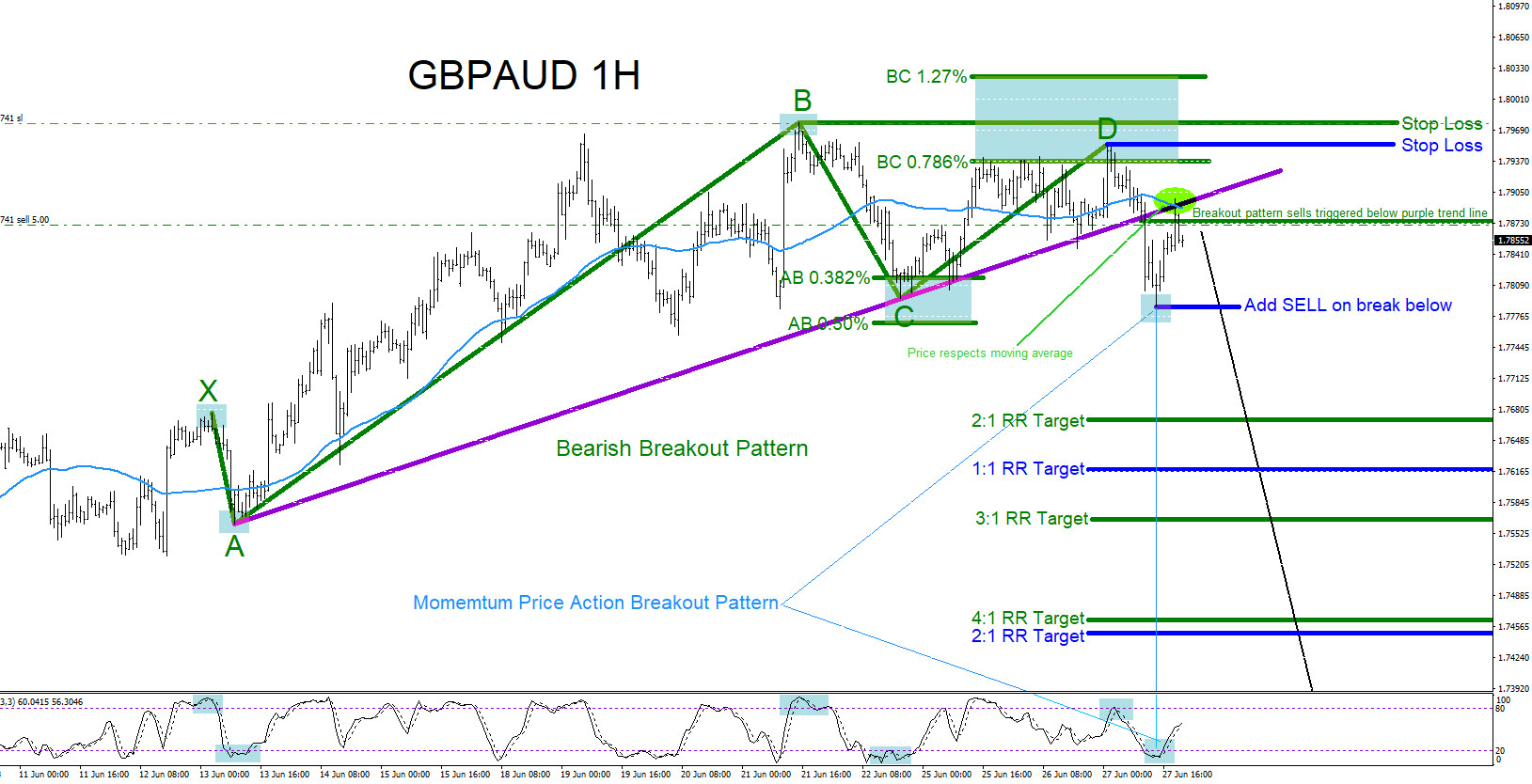

GBPAUD : Down Side Trade Set Up

Read MoreGBPAUD Technical Analysis 6.28.2018 GBPAUD Possible SELL/SHORT Trade Setup: GBPAUD on the 1 hour chart has broken out of a possible bearish pattern and a Momentum Price Action Breakout Pattern can be forming where bears can potentially push the pair lower. Traders should be watching to see if price respects the 50 Simple Moving Average […]

-

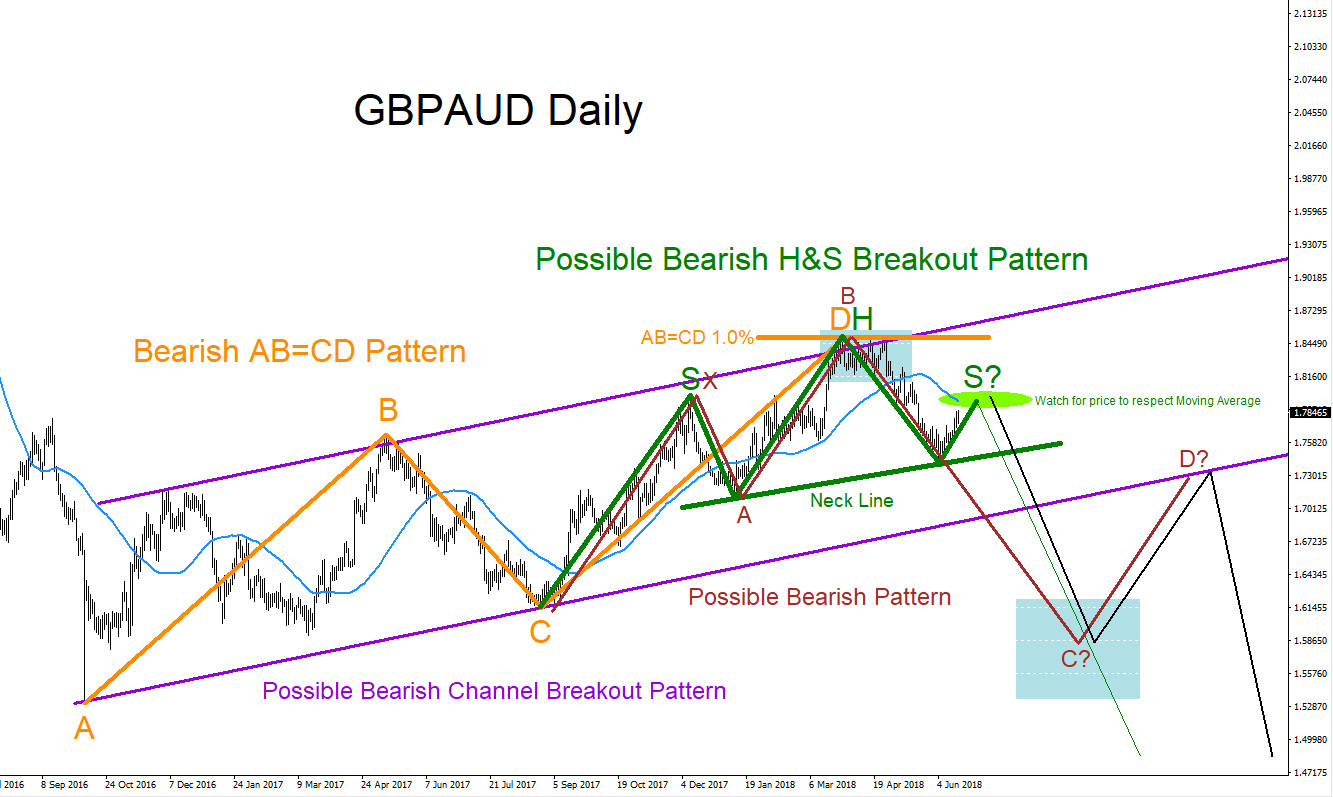

GBPAUD : Possible Bearish Scenario

Read MoreGBPAUD Technical Analysis June 18/2018 GBPAUD Possible SELL/SHORT Trade Setup: GBPAUD on the Daily chart has clear possible bearish patterns which can be signalling for a move lower in the coming days and weeks. Traders should be watching to see if price will respect the 50 Simple Moving Average (Turquoise) and reverse off lower in […]

-

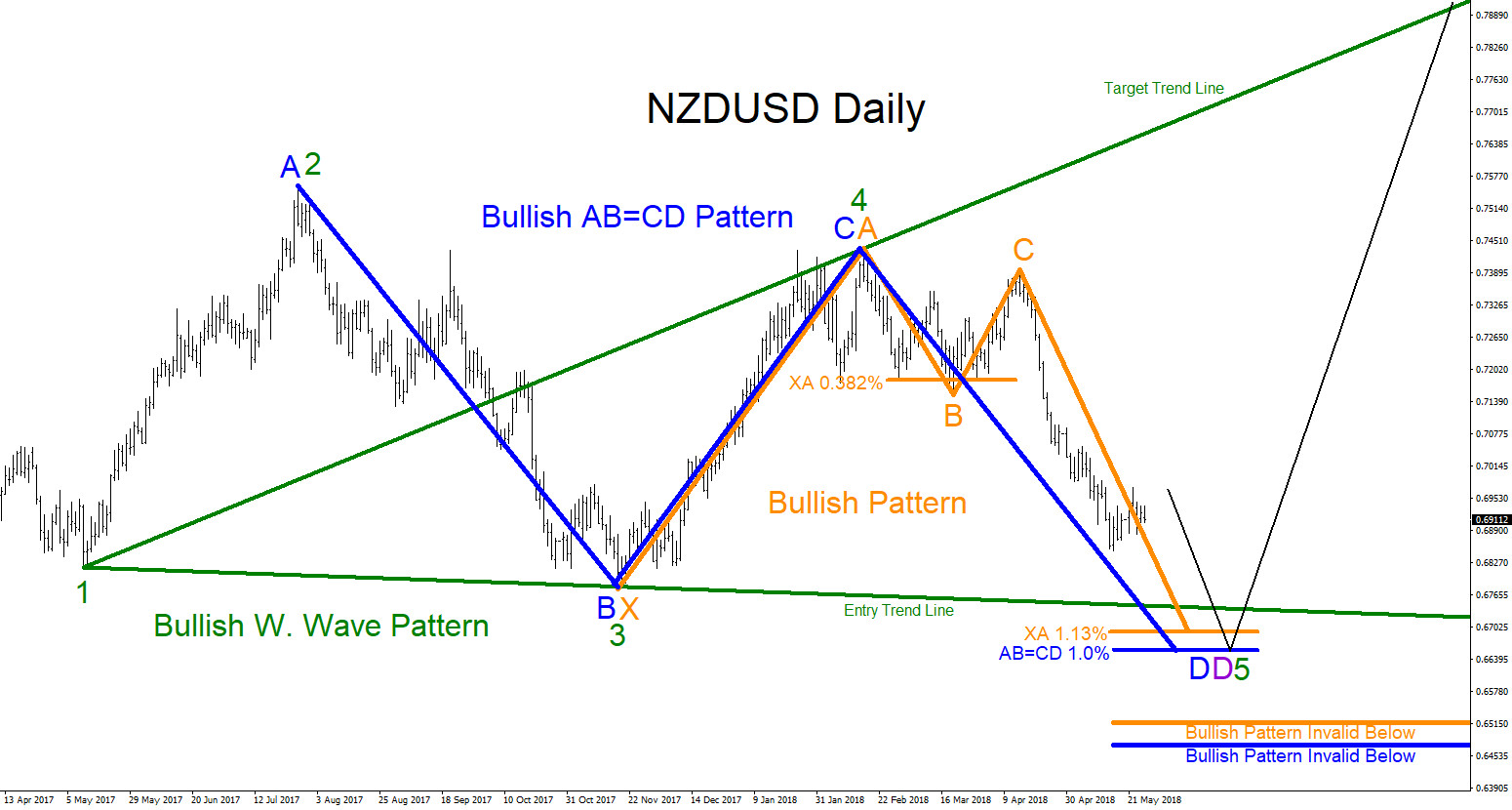

NZDUSD : Possible Reversal Higher?

Read MoreNZDUSD Technical Analysis 5.25.2018 NZDUSD at the current moment looks to be in a 3 swing move lower (Daily chart) starting from the July 27/2017 highs. Expect price to continue lower and break below the November 17/2017 lows. If breaks lower, the next level of interest where NZDUSD can find support and possibly reverse and […]

-

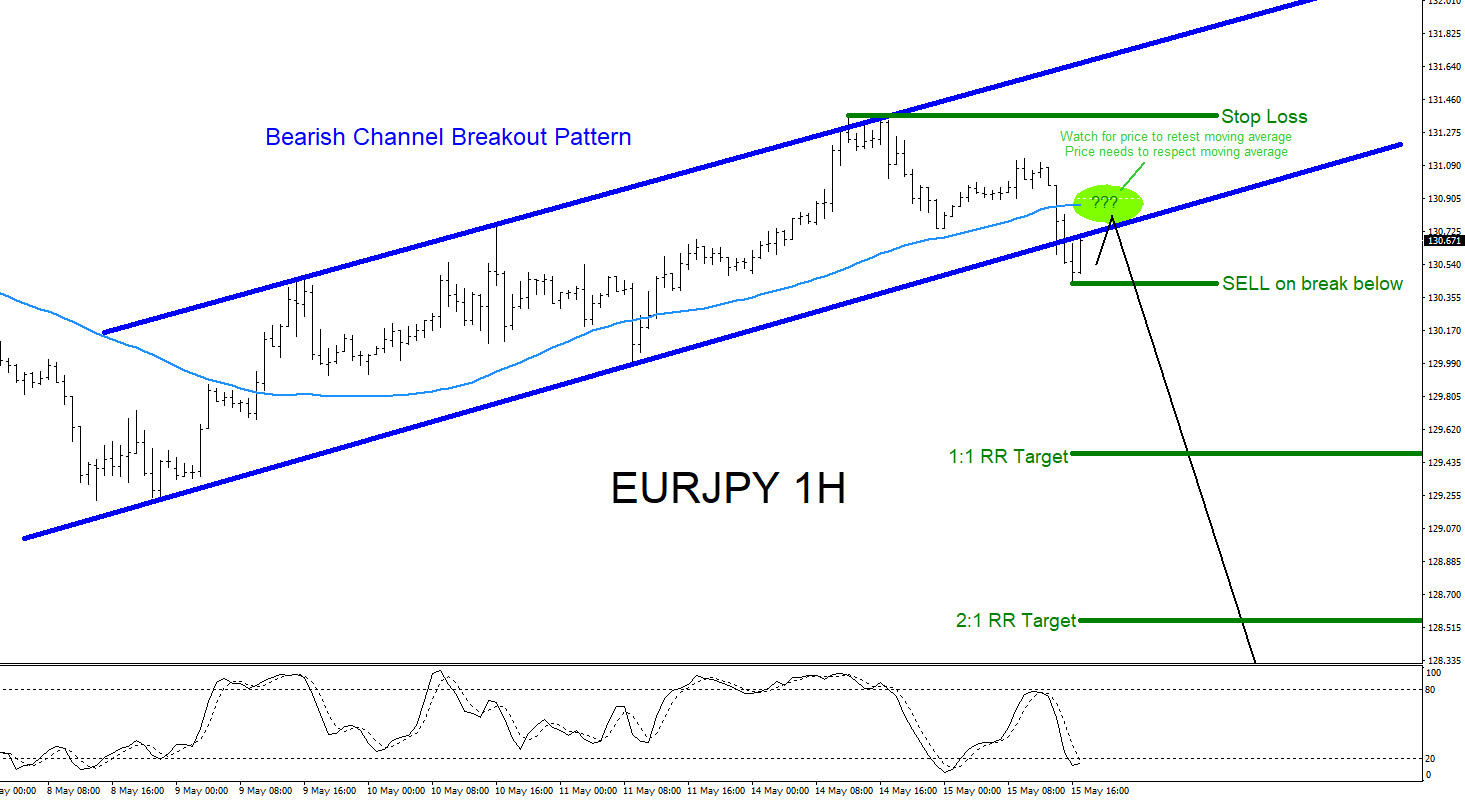

EURJPY : Will Bears Push the Pair Lower?

Read MoreEURJPY Technical Analysis 5.16.2018 EURJPY Possible SELL/SHORT Trade Setup: EURJPY on the 1 hour chart is breaking out of a possible bearish channel pattern and a Momentum Price Action Breakout Pattern can be forming where bears can potentially push the pair lower. Traders should be watching to see a retest and also watch to see […]

-

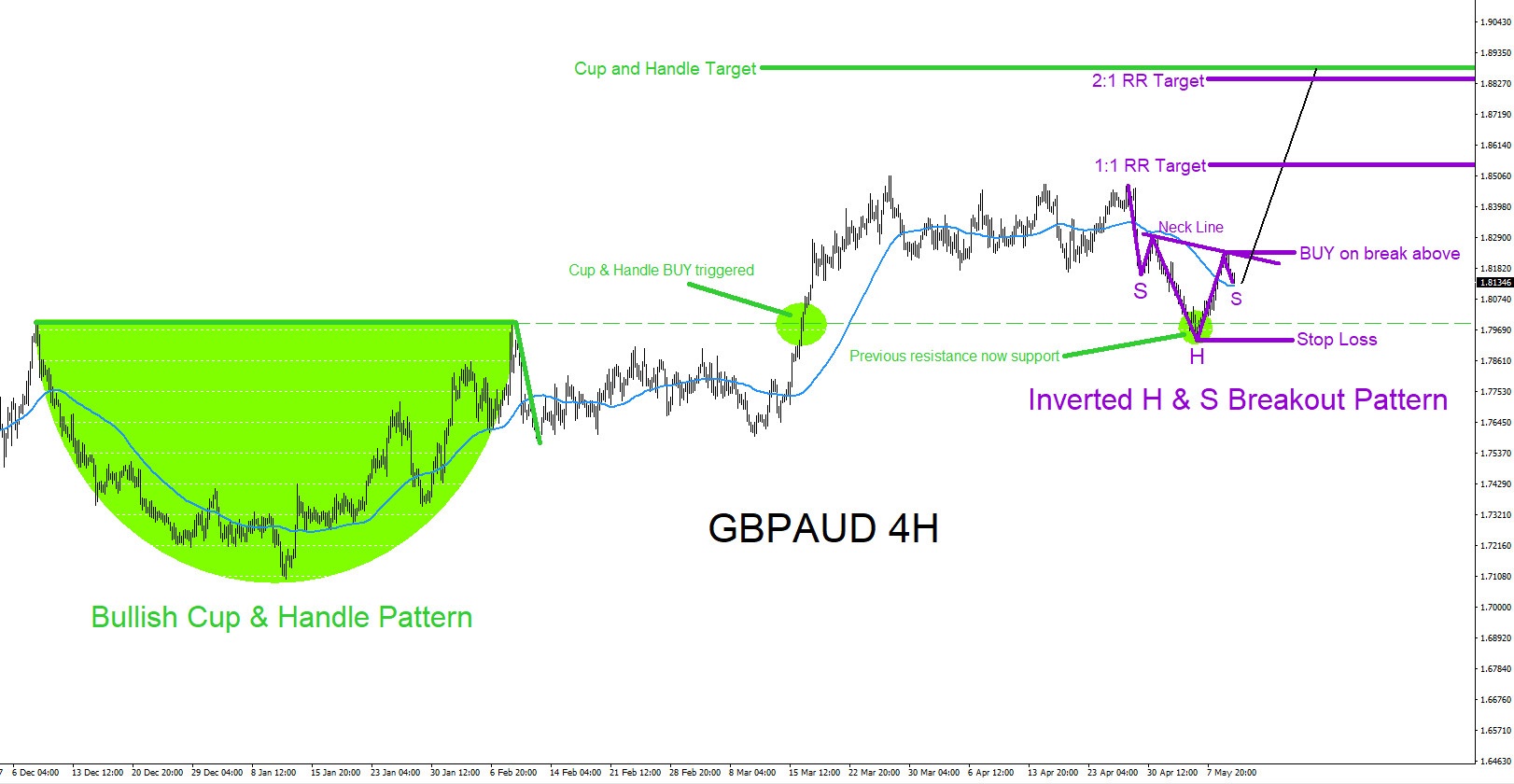

GBPAUD : Eyeing the Possible Breakout Higher

Read MoreGBPAUD Technical Analysis 5.10.2018 GBPAUD Possible BUY/LONG Trade Setup: GBPAUD is forming a possible bullish inverted Head and Shoulders pattern (Purple). Traders should watch for a good strong break above the purple BUY breakout trend line. A good break above this level will send GBPAUD higher and can extend possibly to newer highs above the March […]

-

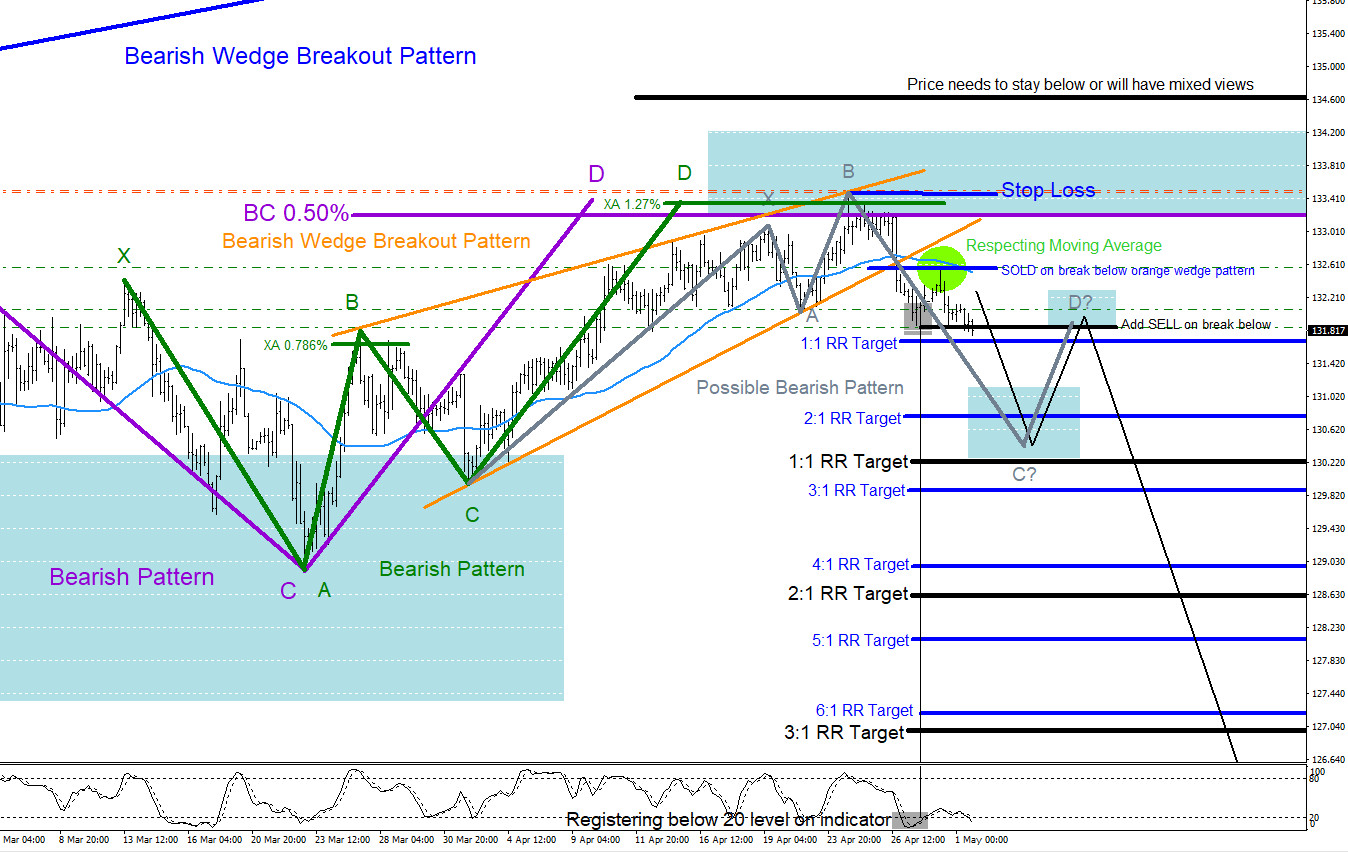

EURJPY : Possible Move Lower

Read MoreEURJPY Technical Analysis 5.1.2018 EURJPY has possibly formed a temporary top on April 24/2018 and has since reversed lower. On April 11/2018 I published this article calling for a possible reversal lower coming in the near future > EURJPY : Possible Bearish Scenarios . On the chart below there are 5 bearish pattern setups that are […]