-

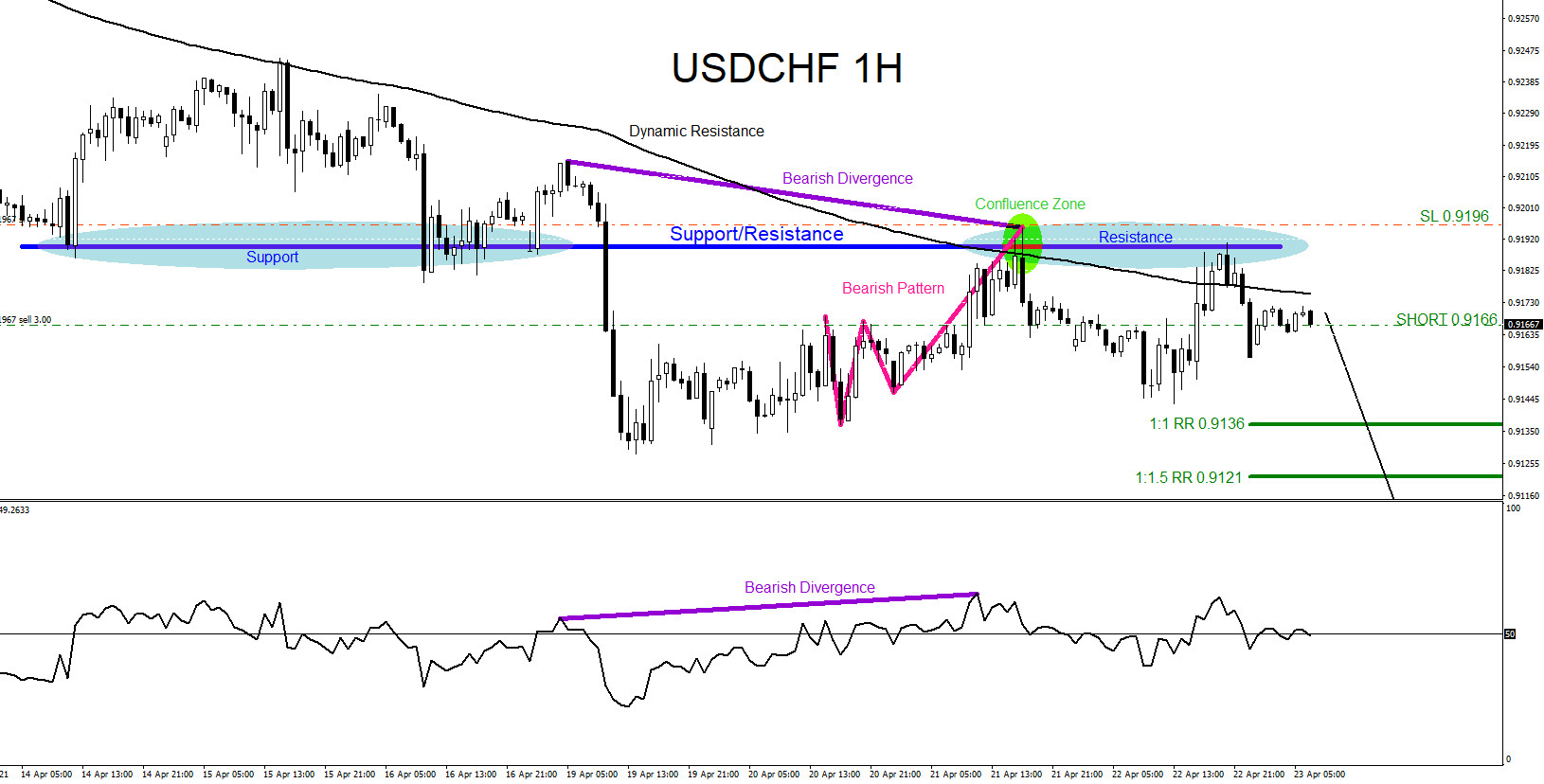

USDCHF : Moves Lower as Expected

Read MoreOn April 21 2021 I posted on social media @AidanFX “USDCHF as long as price stays below 0.9215 the pair can still make another move lower towards 0.91 handle.” The chart below was also posted on social media @AidanFX April 23 2021 showing the possible bearish patterns. Pink bearish pattern triggered SELLS perfectly in the […]

-

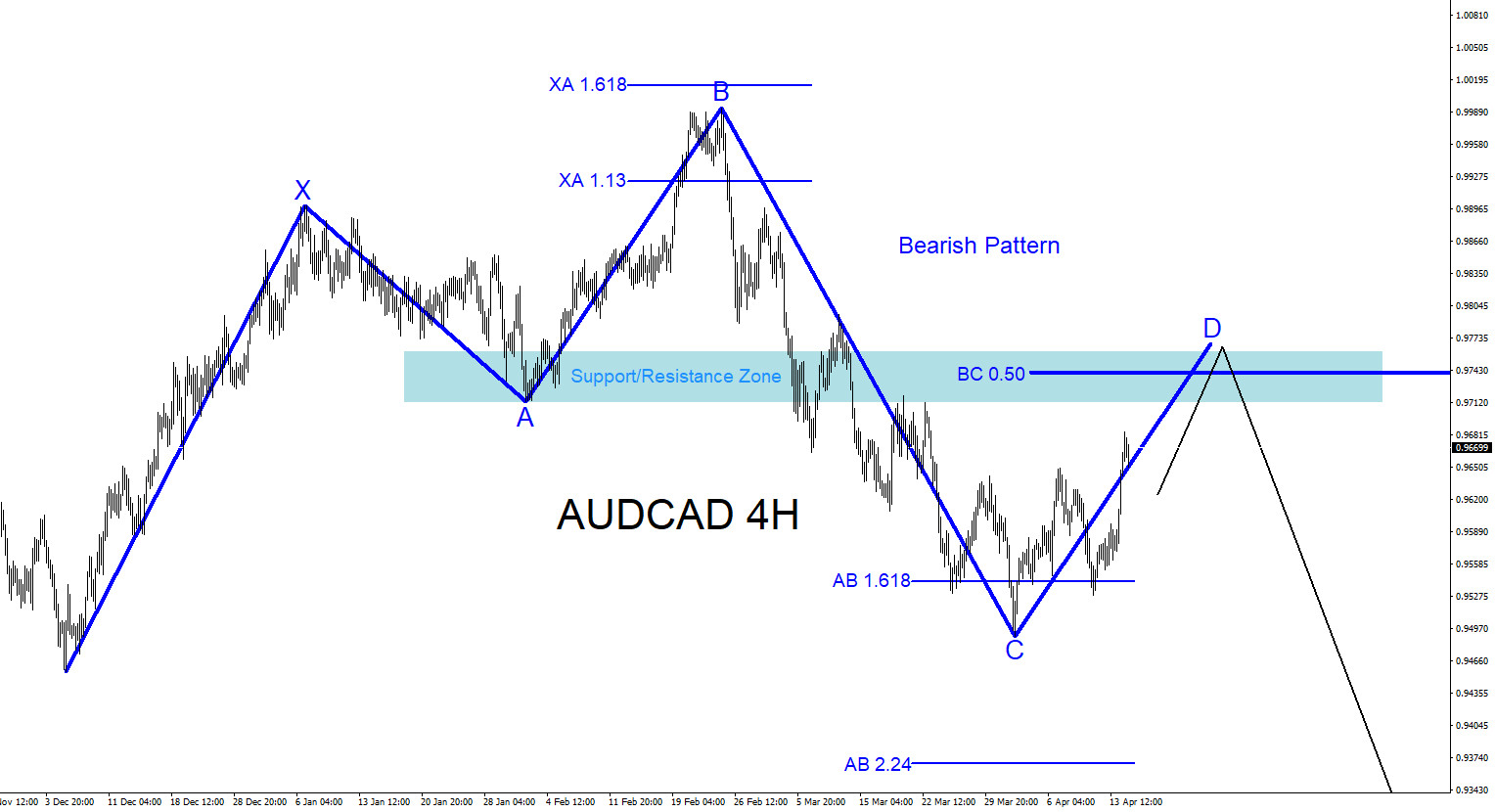

AUDCAD : Possible Bearish Pattern?

Read MoreA possible bearish pattern is visible on the AUDCAD 4 hour time frame. The blue bearish pattern still needs to make a push higher to complete point D at the BC 0.50% Fib. retracement level where AUDCAD can possibly find sellers to push the pair lower. The BC 0.50% Fib. level is also situated in […]

-

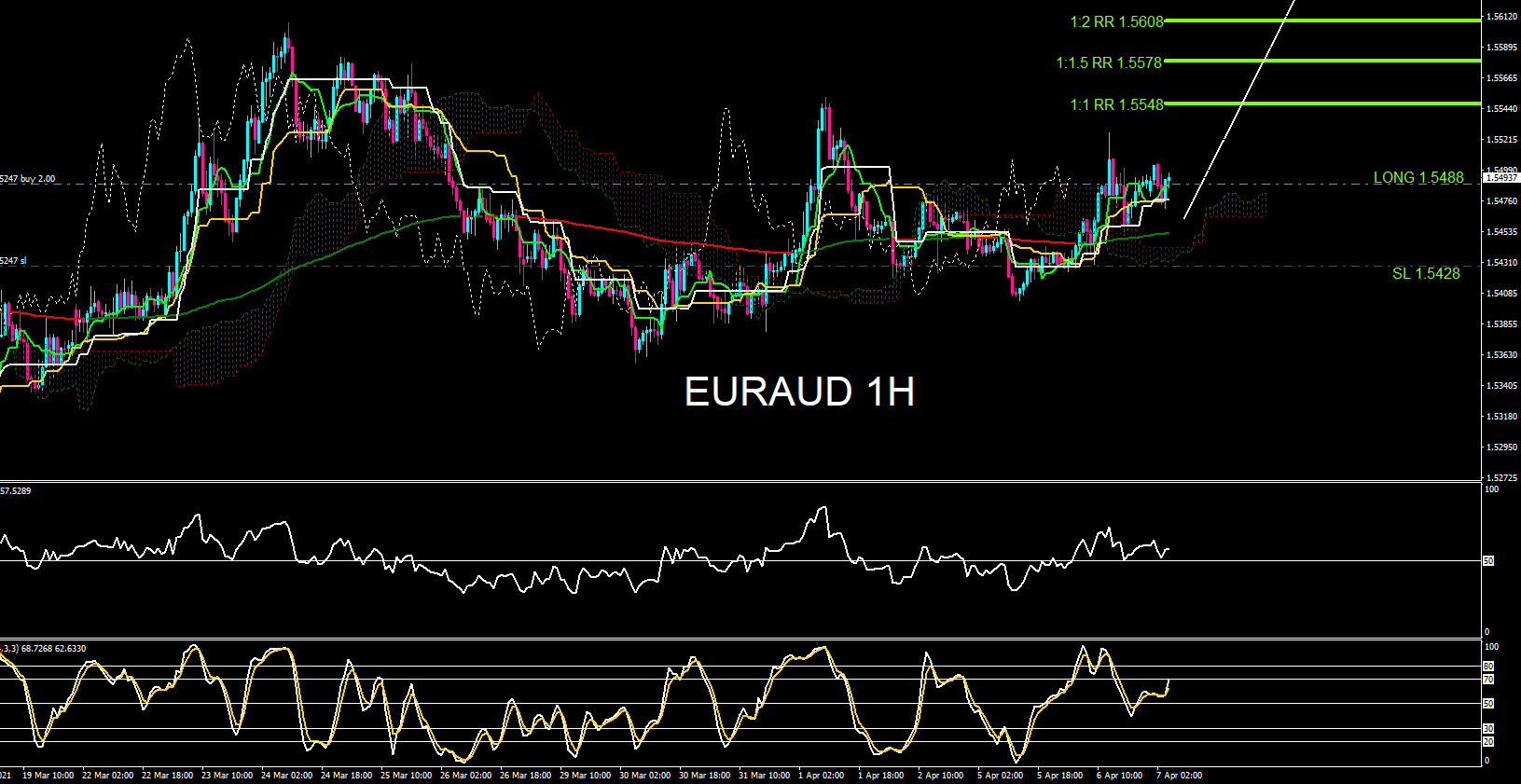

EURAUD : Rallied Higher as Expected

Read MoreTowards the end of February 2021 EURAUD seemed to have found a temporary bottom and has been trading sideways since. The pair still needs to make another move higher above the February 26 high to at least confirm a 3 wave move minimum to complete a corrective wave sequence. The overall trend on the higher […]

-

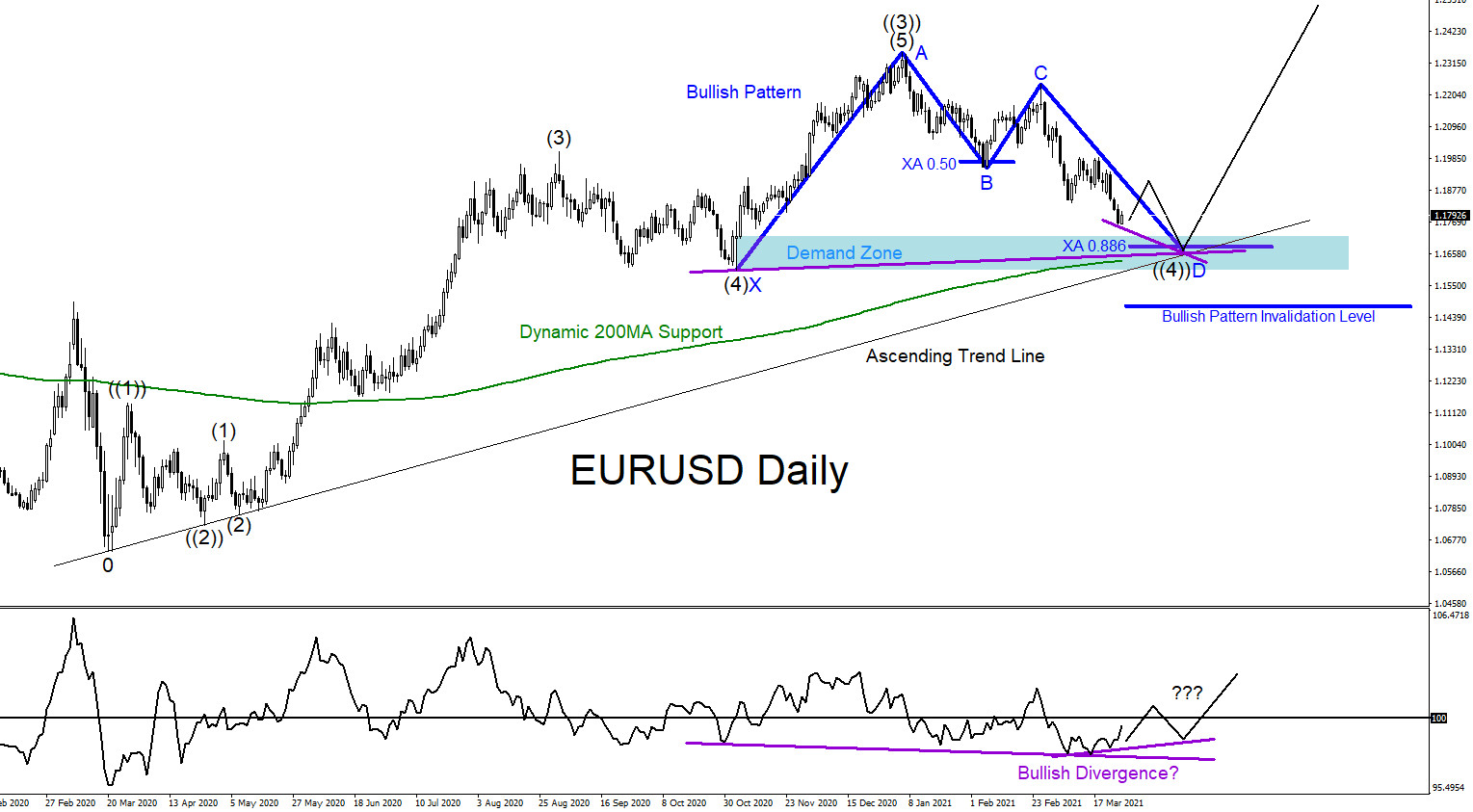

Will EURUSD Rally Higher?

Read MoreIn the chart below there are clear visible bullish market patterns that can signal for another possible move higher for the EURUSD pair. The pair still needs to do a push lower where bulls could be waiting to push the pair higher. Dark blue bullish market pattern triggers BUYS at the XA 0.886% Fib. retracement […]

-

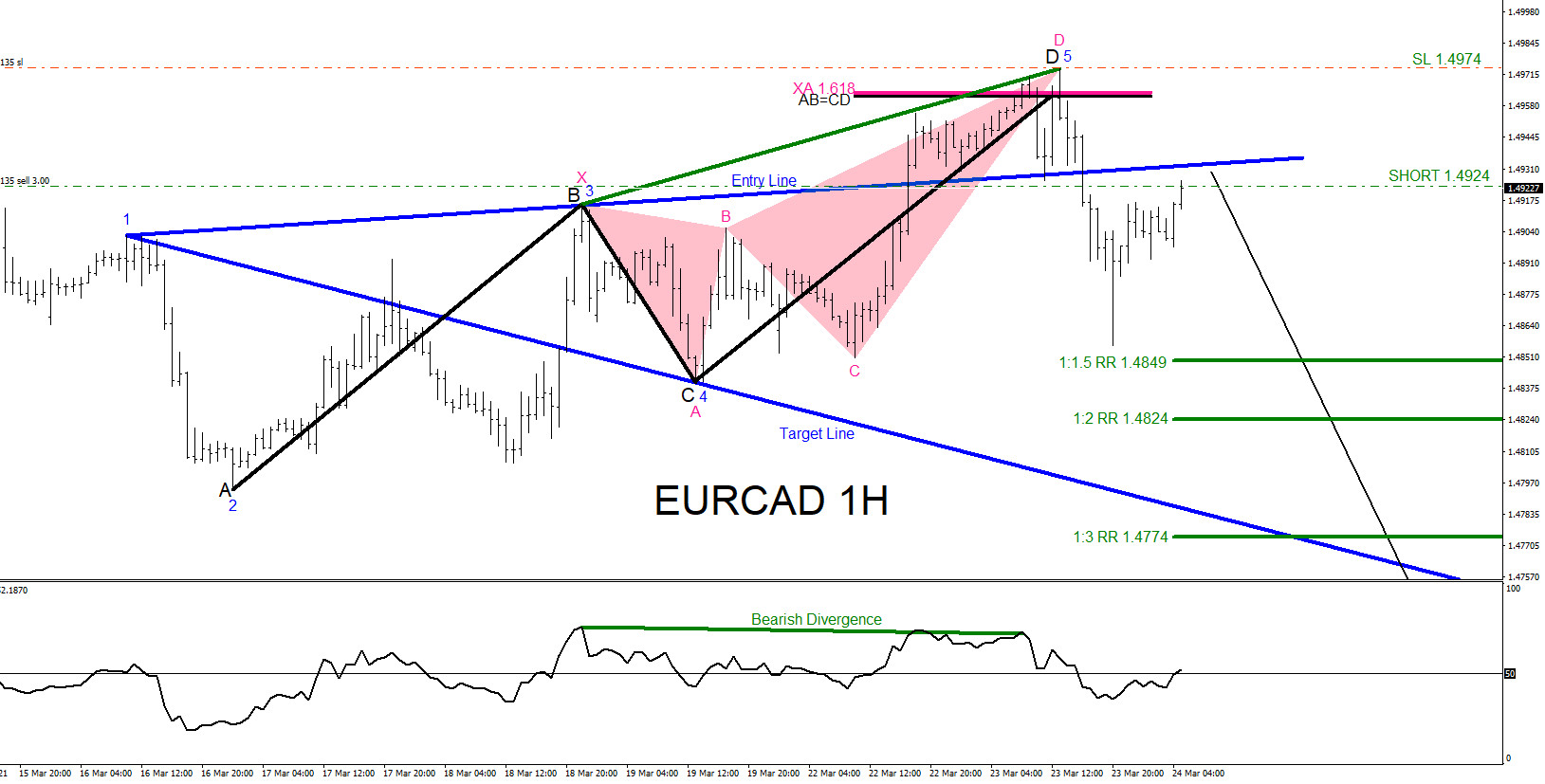

EURCAD : Bearish Market Patterns Calling the Move Lower

Read MoreOn March 23 2021 I posted on social media @AidanFX ” EURCAD as long as price stays below 1.4974 the pair can push lower to retest the 1.48 handle. Will be watching for selling opportunities.” The charts below was also posted on social media @AidanFX March 23 2021 showing several clear bearish market patterns. Black bearish […]

-

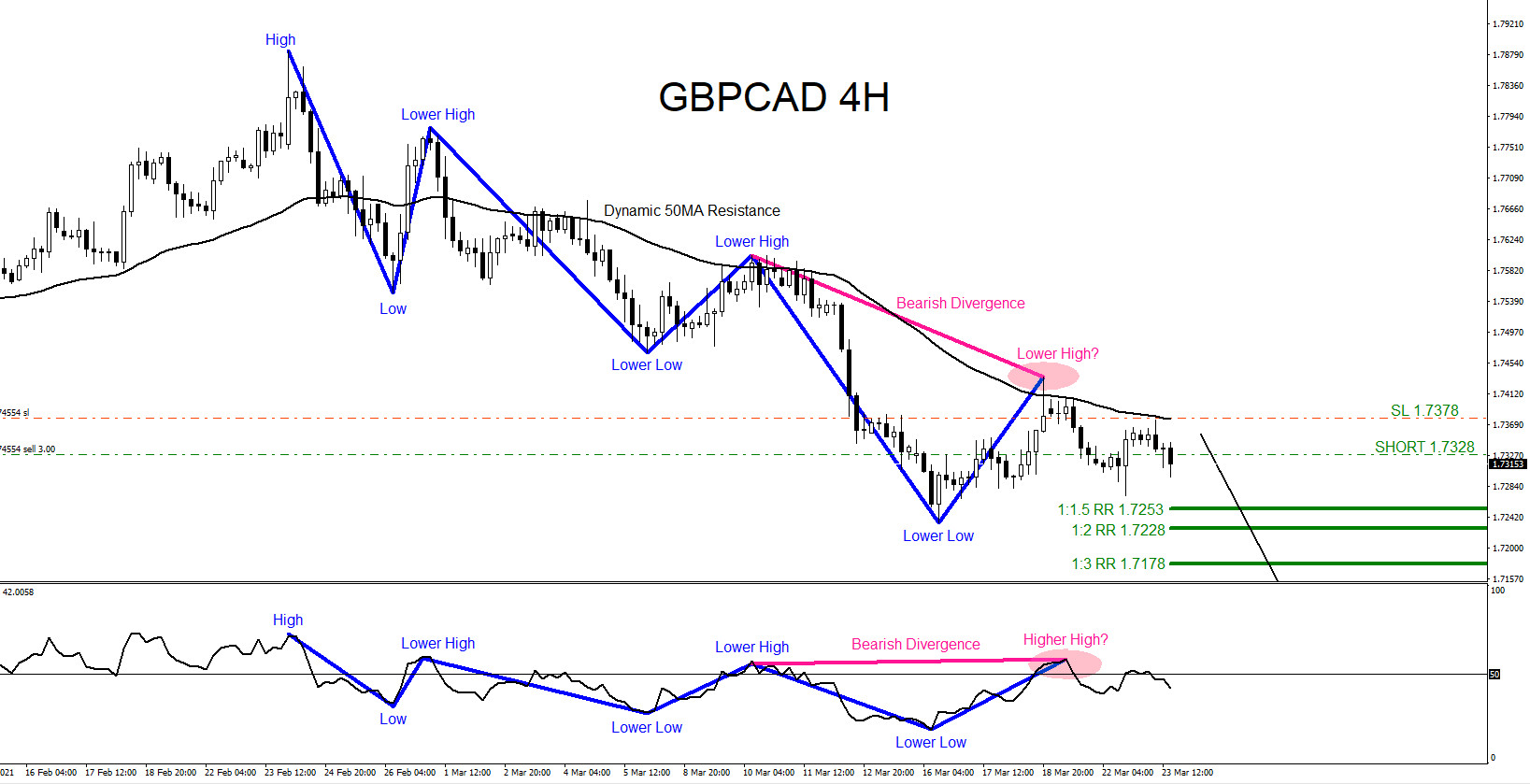

GBPCAD : Catching the Move Lower

Read MoreSince February 24/2021, GBPCAD has been trending to the downside. To determine if a market is trending, price action must be forming higher highs/higher lows in an uptrend and lower lows/lower highs in a downtrend. We at EWF always recommend our clients to trade with the trend and not against it. On March 23 2021 […]