Trading filters/confirmations is key to determine and to signal a trader on which side to trade the market. Trading filters/confirmations are strategies used to analyze the market. A trader should never trade off one strategy and should always combine strategies together to get a better read of the market. Trading filters/confirmations allows a trader to trade only what “they” see and to trade with the momentum of the market.

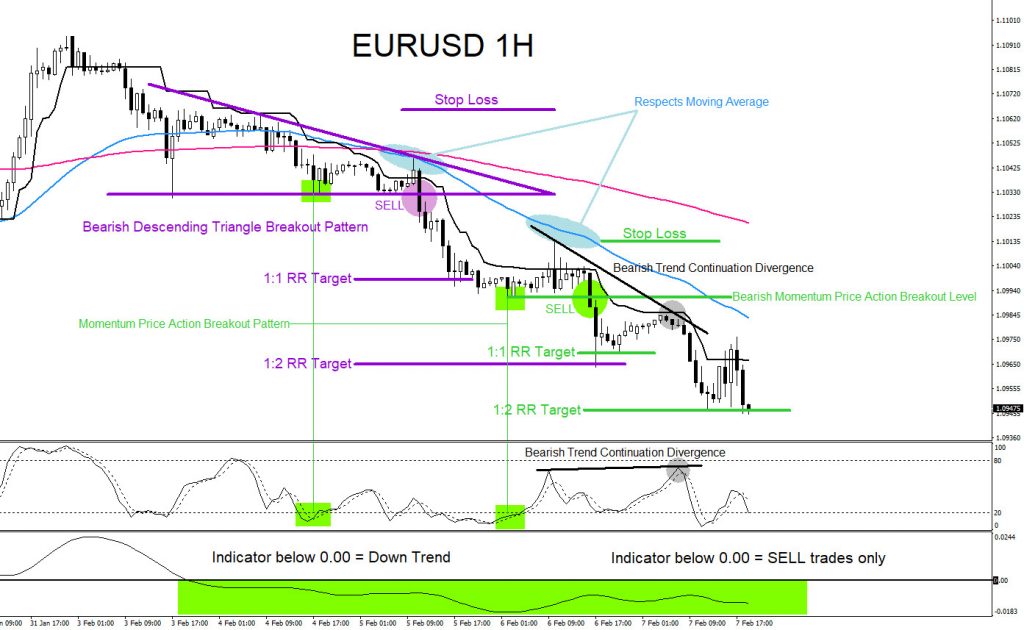

EURUSD 1 Hour Chart 2.7.2020 : (Confirmation 1) February 4/2020 price registers a temporary low on price chart and on the stochastic indicator confirming possible downside momentum. (Confirmation 2) Price crossed below the 200 (pink) and 50 (light blue) EMA and trend indicator is below 0.00 level signalling a trader to only look for possible selling opportunities. (Confirmation 3) After the February 4/2020 temporary low registered, a bearish descending triangle breakout pattern forms. (Confirmation 4) Price respects the 50 EMA (light blue) confirming the 1st momentum triangle breakout SELL entry (purple) and respects the 50 EMA again after another temporary low registered February 6/2020 confirming the 2nd momentum breakout SELL entry (green). Both SELL entries hits 1:1 RR and 1:2 RR Targets.

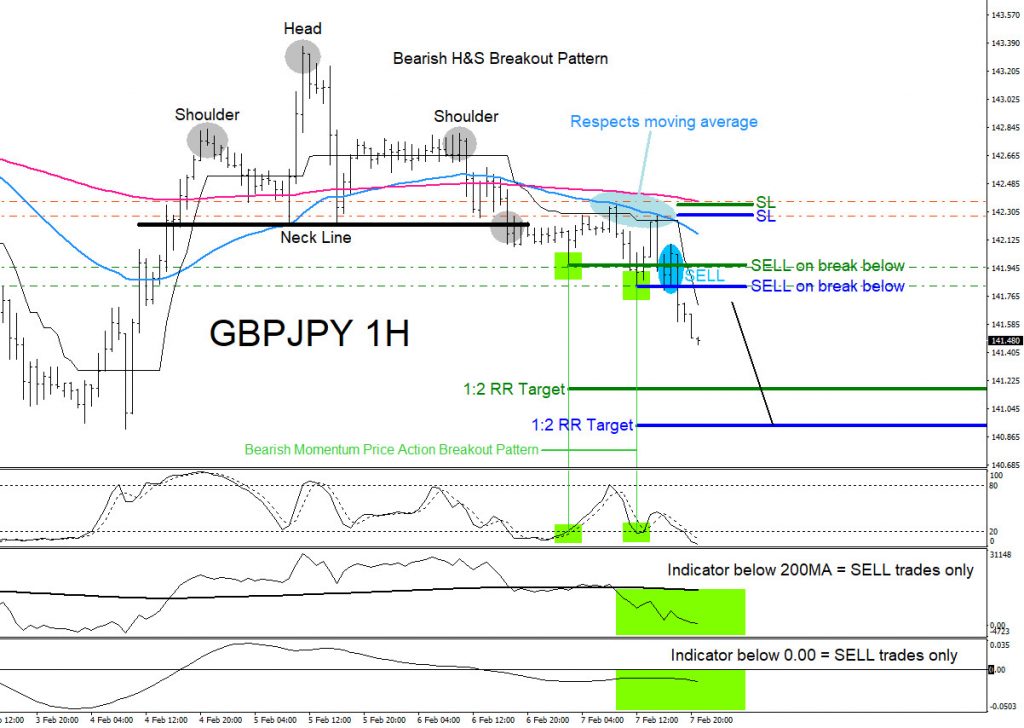

GBPJPY 1 Hour Chart 2.7.2020 : (Confirmation 1) Bearish Head and Shoulders Breakout Pattern (H&S) is visible and price broke below neck line of the pattern confirming possible downside action. (Confirmation 2) February 7/2020 price registers a temporary low on price chart and on the stochastic indicator confirming possible downside momentum. (Confirmation 3) Trend indicator 1 crossed below the 200 EMA and trend indicator 2 is below the 0.00 level signalling a trader to only look for possible selling opportunities. (Confirmation 4) Price respects the 50 EMA (light blue) confirming the 1st momentum breakout SELL entry (green) and respects the 50 EMA again confirming the 2nd momentum breakout SELL entry (blue). Both SELL entries are still active and expecting for continuation lower and hit 1:2 RR targets.

Of course, like any strategy/technique, there will be times when the strategy/technique fails so proper money/risk management should always be used on every trade. Hope you enjoyed this article and follow me on Twitter for updates and questions> @AidanFX or chat me on Skype > EWF Aidan Chan

*** Always use proper risk/money management according to your account size ***

At Elliottwave-Forecast we cover 78 instruments (Forex, Commodities, Indices, Stocks and ETFs) in 4 different timeframes and we offer 5 Live Session Webinars everyday. We do Daily Technical Videos, Elliott Wave Trade Setup Videos and we have a 24 Chat Room. Our clients are always in the loop for the next market move.

Try Elliottwave-Forecast for 14 days FREE !!! Just click here –> 14 day FREE trial

Back