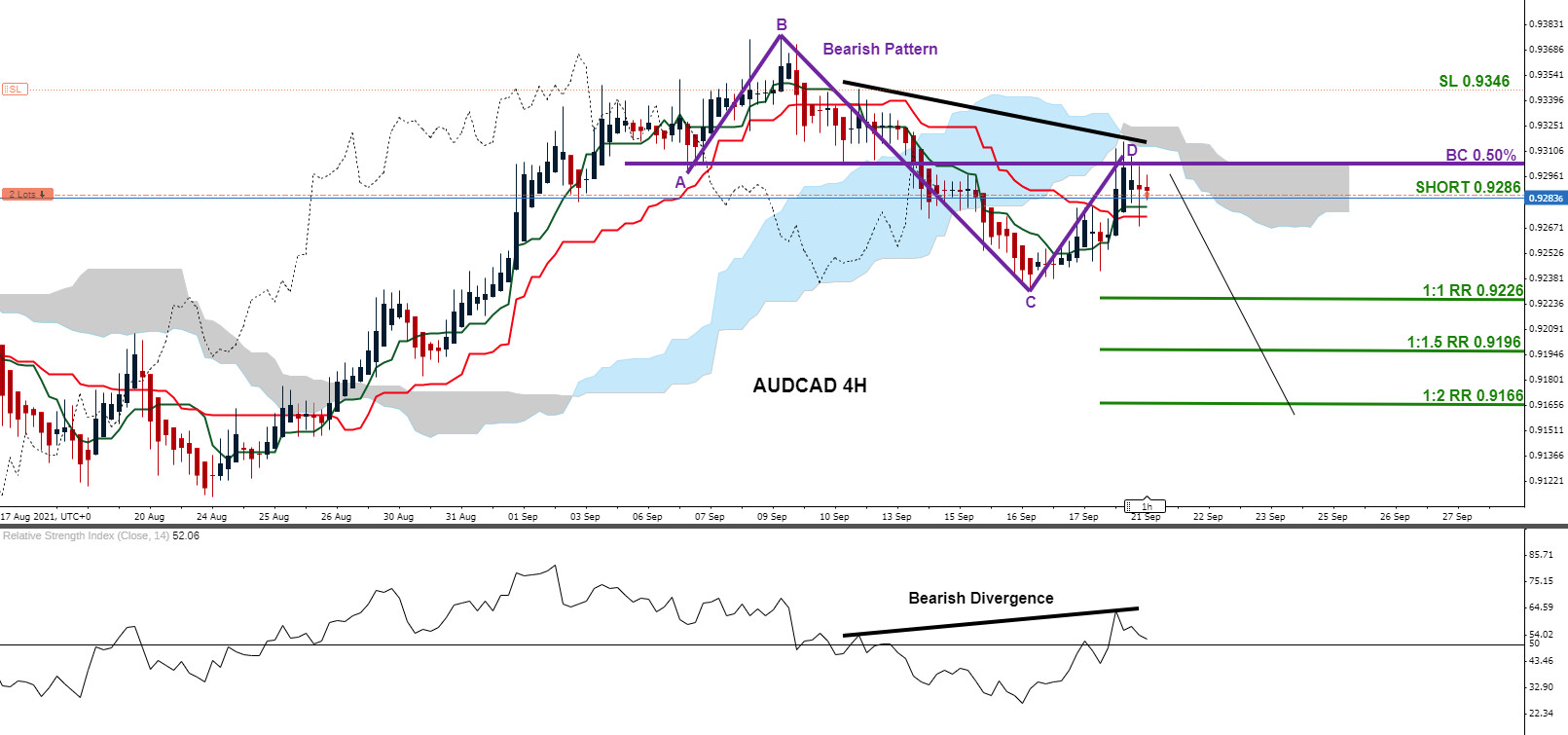

-

Confluence Trading

Read MoreConfluence trading is a combination of one or more trading strategies/techniques that come together and form a high probability buy/sell zone in a certain area in the market. Market patterns (Elliott Waves, Harmonic, Candlestick patterns etc.), price action (Support & Resistance, Supply & Demand Zones, Fibonacci retracements etc.) and indicators (RSI, Moving Average, Stochastic etc.) […]

-

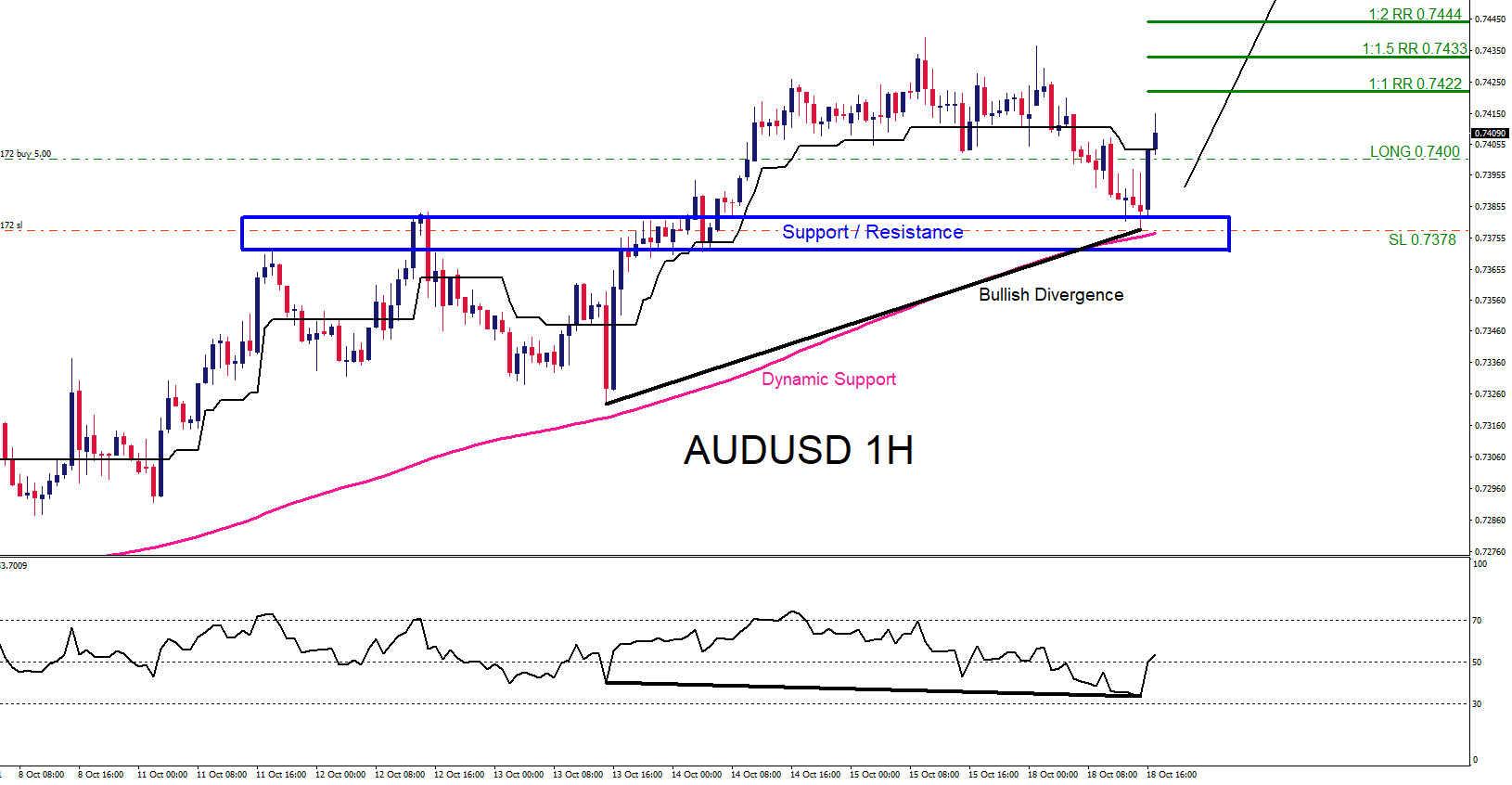

USDCAD : Watch for a Continuation Move Lower

Read MoreOn October 15 2021 I posted on social media @AidanFX “ USDCAD can be setting up for another push lower. As long price stays below 1.2415 the pair can dip lower towards the 1.2320 area. “ In the 1 hour chart below, the pair has been moving lower forming a lower low/lower high sequence signalling […]

-

NZDJPY Moves Higher as Expected

Read MoreOn October 13 2021 I posted on social media @AidanFX “NZDJPY can pop higher towards the 79.18 – 79.38 area. Watch for any buying opportunities for a in and out trade.“ The chart below was also posted on social media @AidanFX October 13 2021 showing the possible NZDJPY bullish scenario. Price formed a bullish divergence pattern […]

-

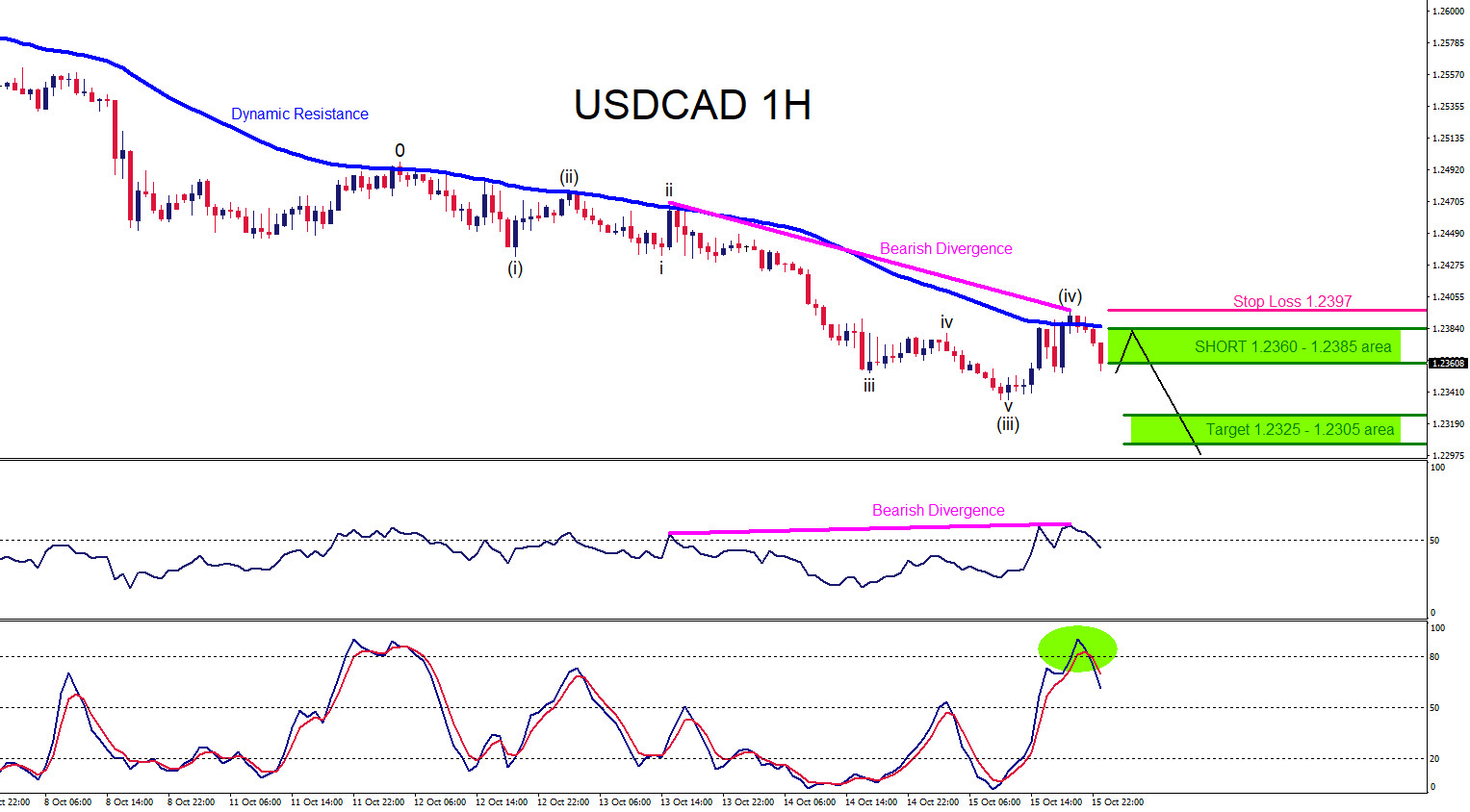

USDCAD : Trading the Move Higher

Read MoreOn September 28 2021 I posted on social media @AidanFX “USDCAD as long price stays above 1.2666 the pair can still push higher towards 1.2720 area.“ The chart below was also posted on social media @AidanFX September 28 2021 showing the possible bullish scenario. Price is in a Demand Zone (grey box) signalling traders that this […]

-

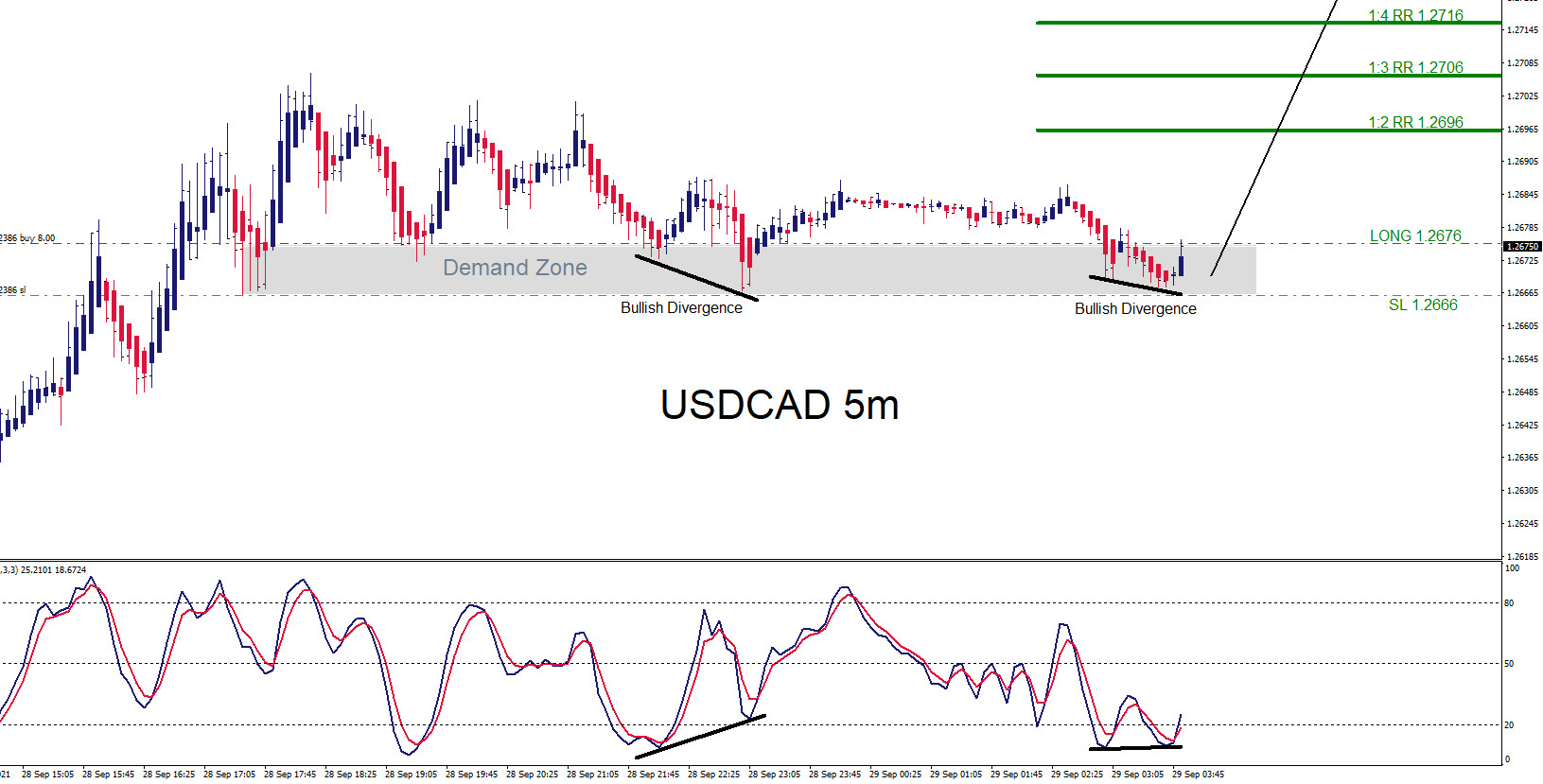

AUDCAD : Bearish Patterns Signalled the Move Lower

Read MoreThe chart below was posted on social media @AidanFX September 21 2021 showing the AUDCAD bearish scenario. Price formed a bearish divergence pattern (black) on indicator and price on September 20 2021 and was then followed with a move lower. The bearish divergence pattern (black) with the reciprocal AB=CD bearish pattern (purple) terminating point D at […]

-

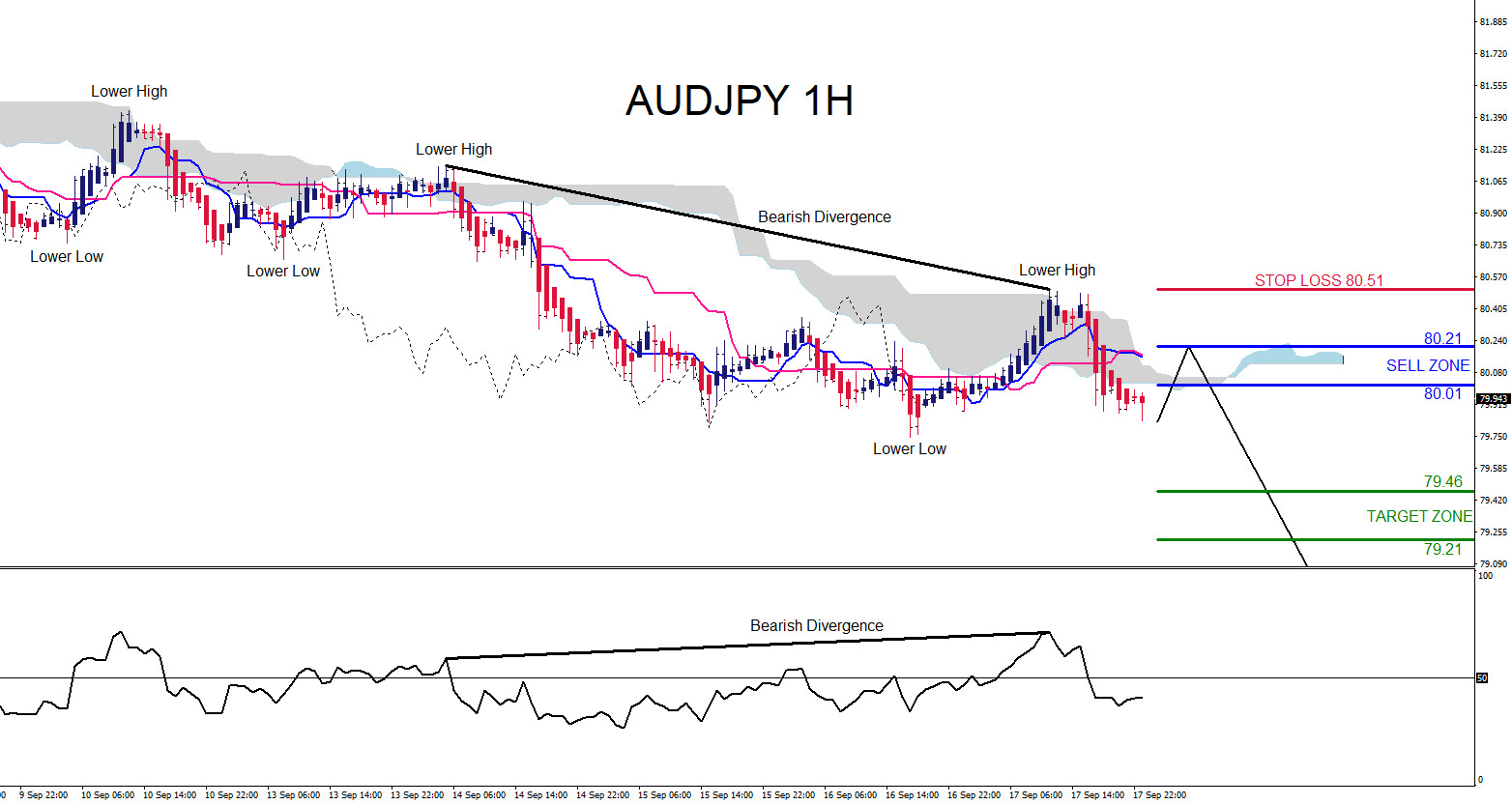

AUDJPY : Watch for a Continuation Move Lower

Read MoreOn September 19 2021 I posted on social media @AidanFX “ AUDJPY for coming trading week watch for selling opportunities as long price remains below 80.51 looking for a move lower towards 79.46 – 79.21 area. “ AUDJPY can be getting ready for another possible move lower. In the 1 hour chart below, the pair has […]