-

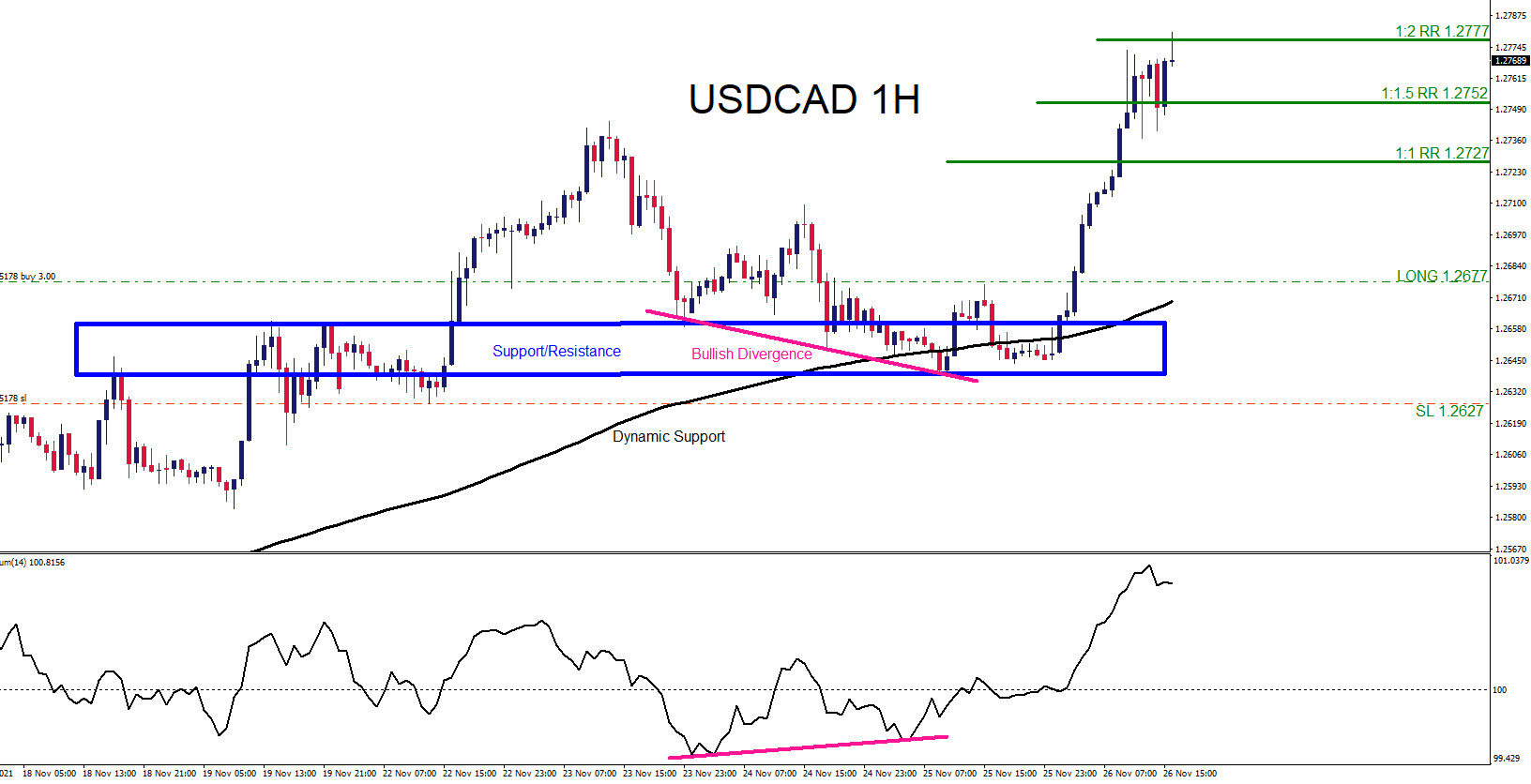

USDCAD : Trading the Move Higher

Read MoreOn November 23 2021 I posted on social media @AidanFX “USDCAD can still make another push higher as long price stays above 1.2610. Watch for buying opportunities. Bought USDCAD @ 1.2677 SL @ 1.2627 TP @ 1.2727 – 1.2752 area “ Confluence trading is a combination of two or more trading strategies/techniques that come together […]

-

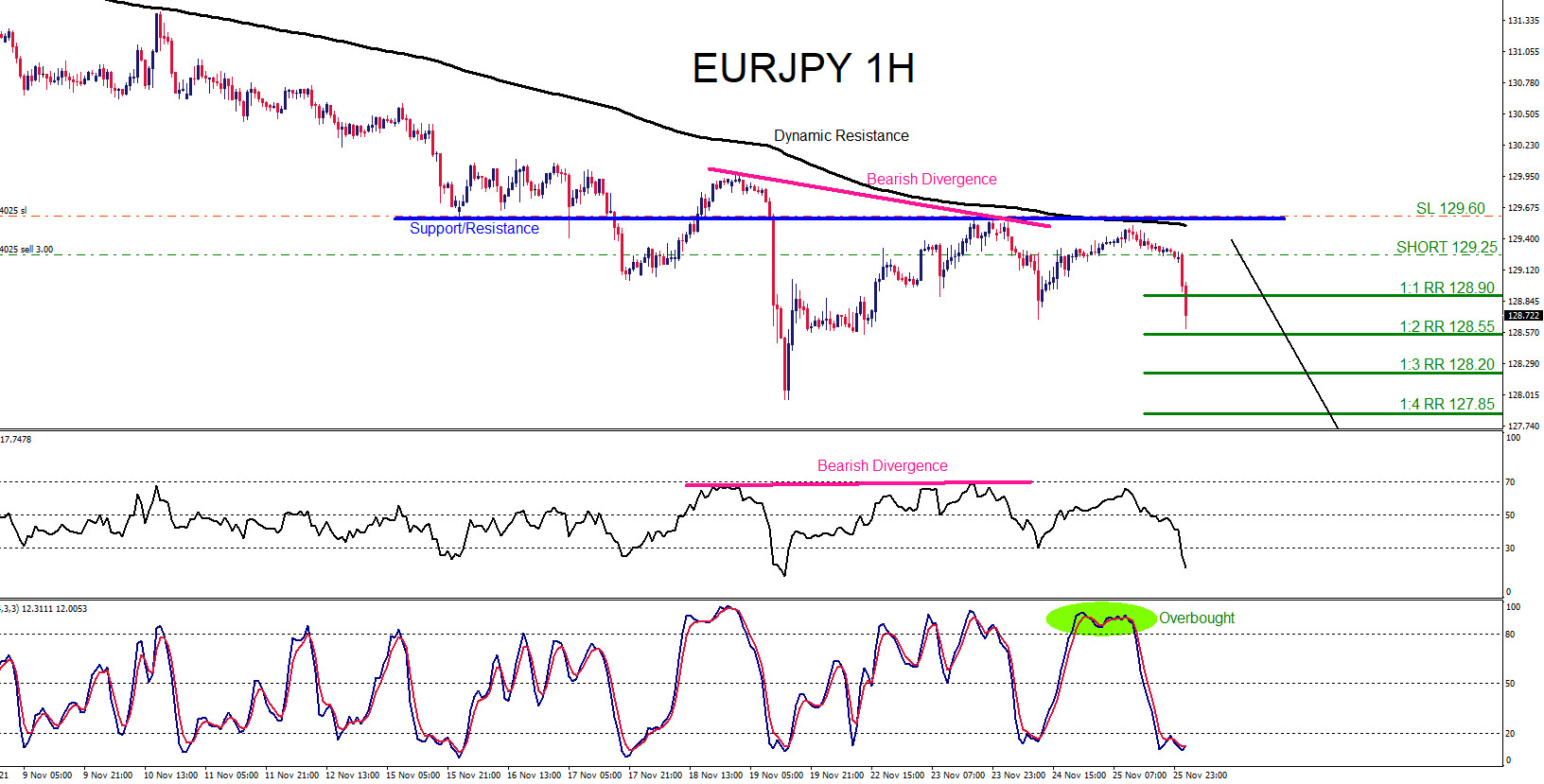

EURJPY : Trading the Move Lower

Read MoreOn November 24 2021 I posted on social media @AidanFX “ EURJPY Watch for a move lower from current prices. Watch for selling opportunities against 129.60 stop level targeting the 128.00 – 127.80 area. “ Confluence trading is a combination of two or more trading strategies/techniques that come together and form a high probability buy/sell zone […]

-

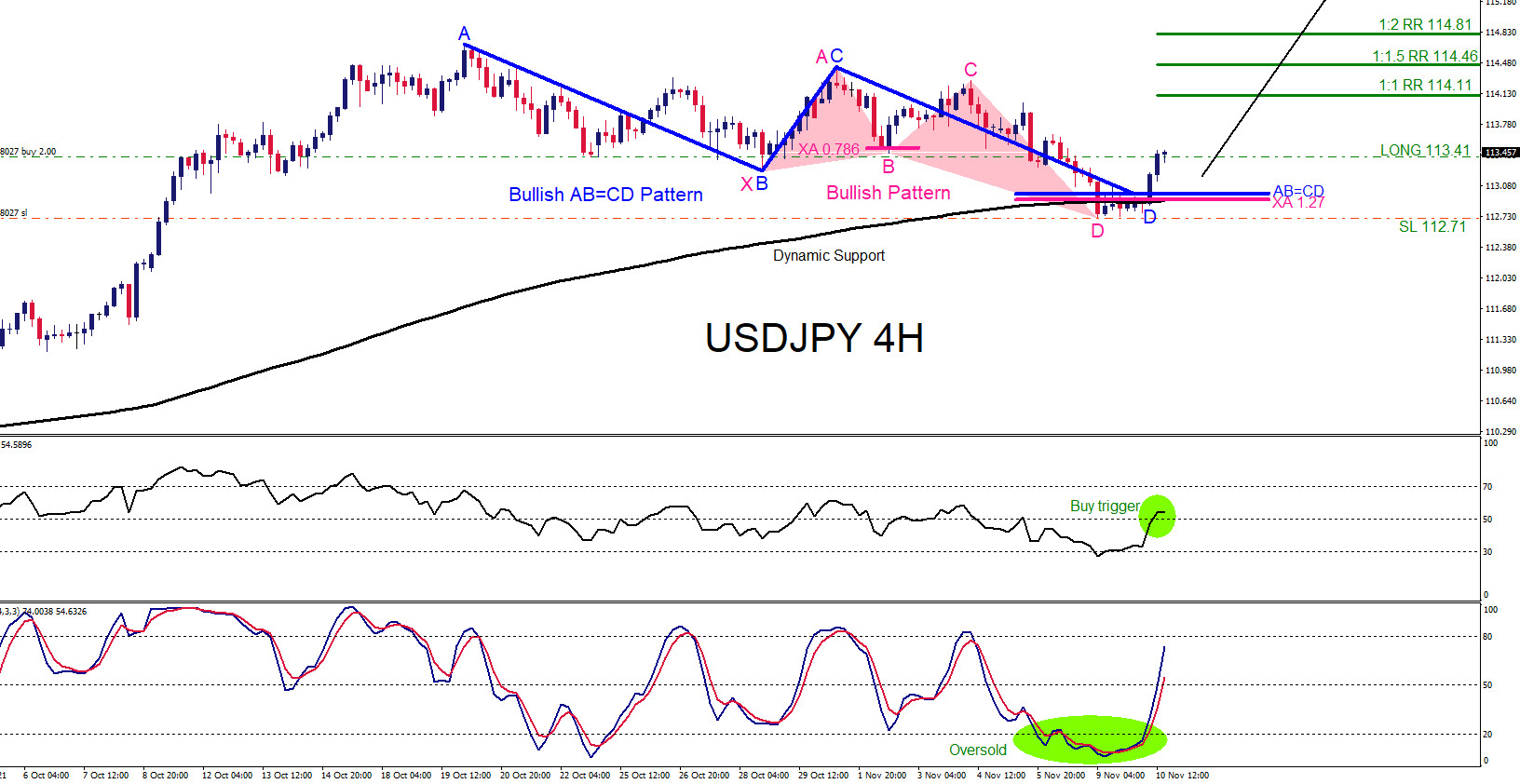

USDJPY : Market Patterns Signalled the Move Higher

Read MoreThere were several patterns that signalled the USDJPY pair would rally higher on November 10 2021. Since the start of 2021 USDJPY has been trending to the upside so it would only make sense to trade with the trend and not against it. Confluence trading is a combination of two or more trading strategies/techniques that […]

-

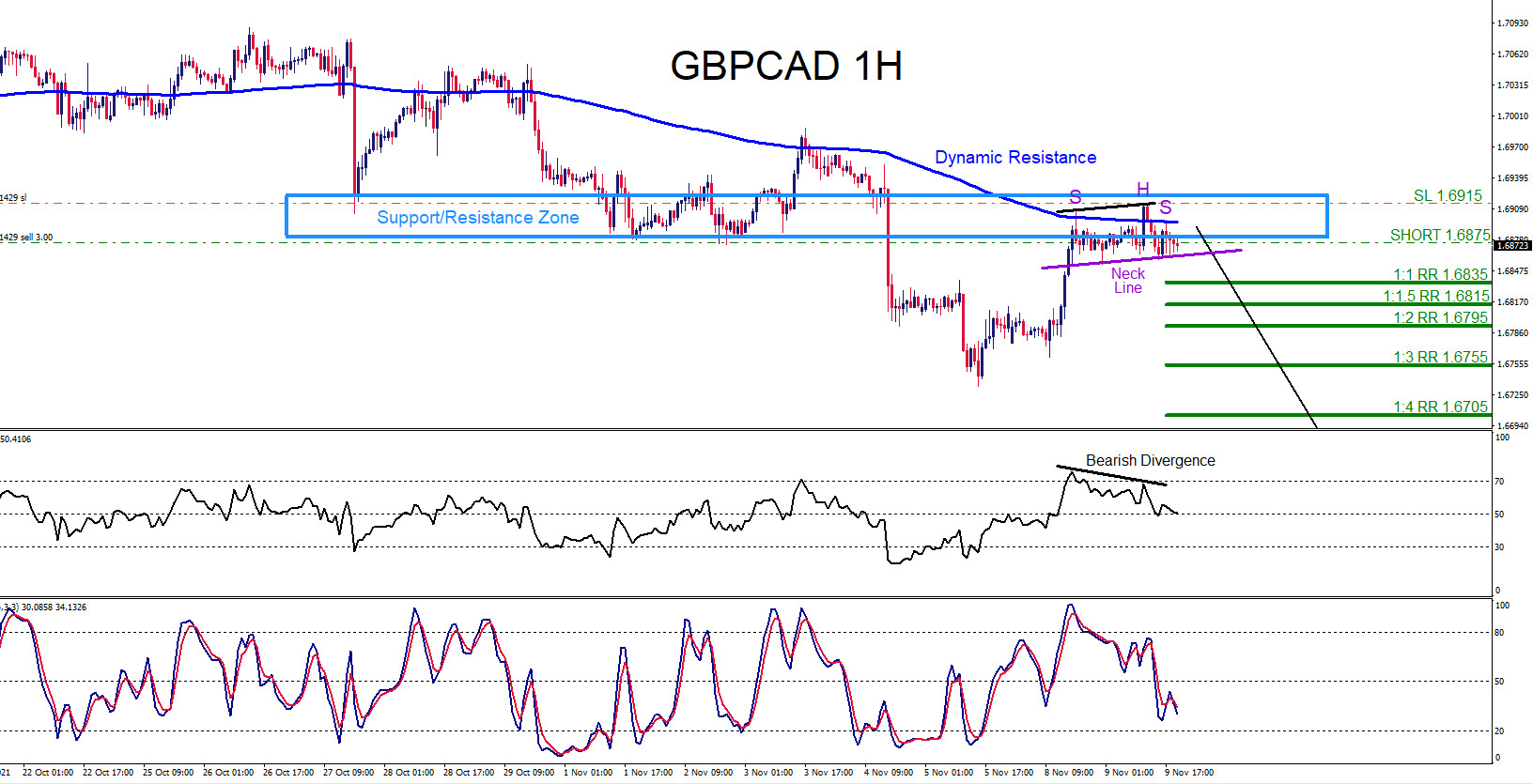

GBPCAD : Trading the Move Lower

Read MoreOn November 9 2021 I posted on social media @AidanFX “ GBPCAD can push lower towards 1.6810 area. Watch for possible selling opportunities. “ Confluence trading is a combination of two or more trading strategies/techniques that come together and form a high probability buy/sell zone in a certain area in the market. Market patterns (Elliott […]

-

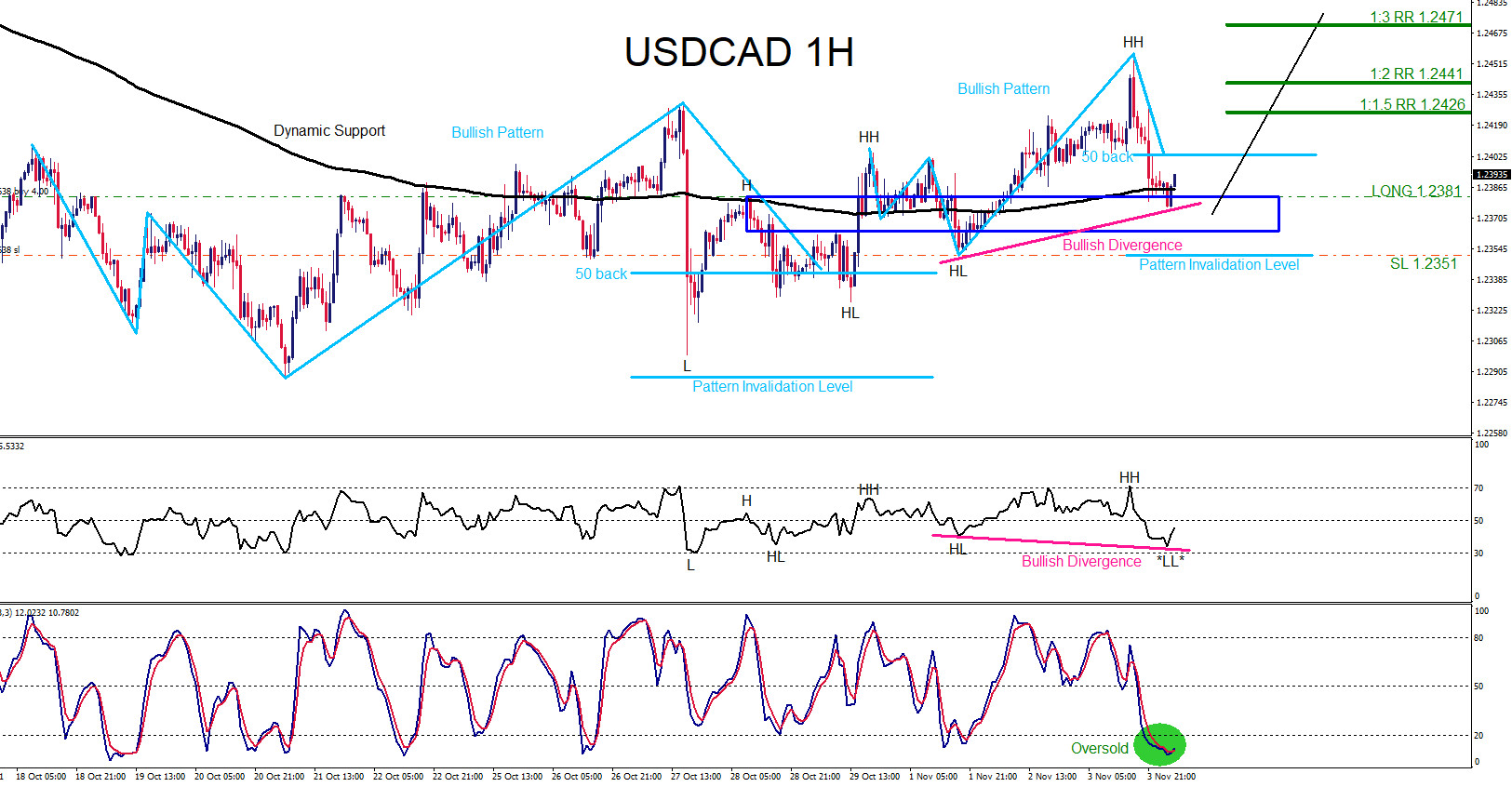

USDCAD : Trading the Move Higher

Read MoreOn November 3 2021 I posted on social media @AidanFX “ USDCAD can still push higher as long as price stays above 1.2351. Will be looking for buying opportunities. “ Confluence trading is a combination of two or more trading strategies/techniques that come together and form a high probability buy/sell zone in a certain area […]

-

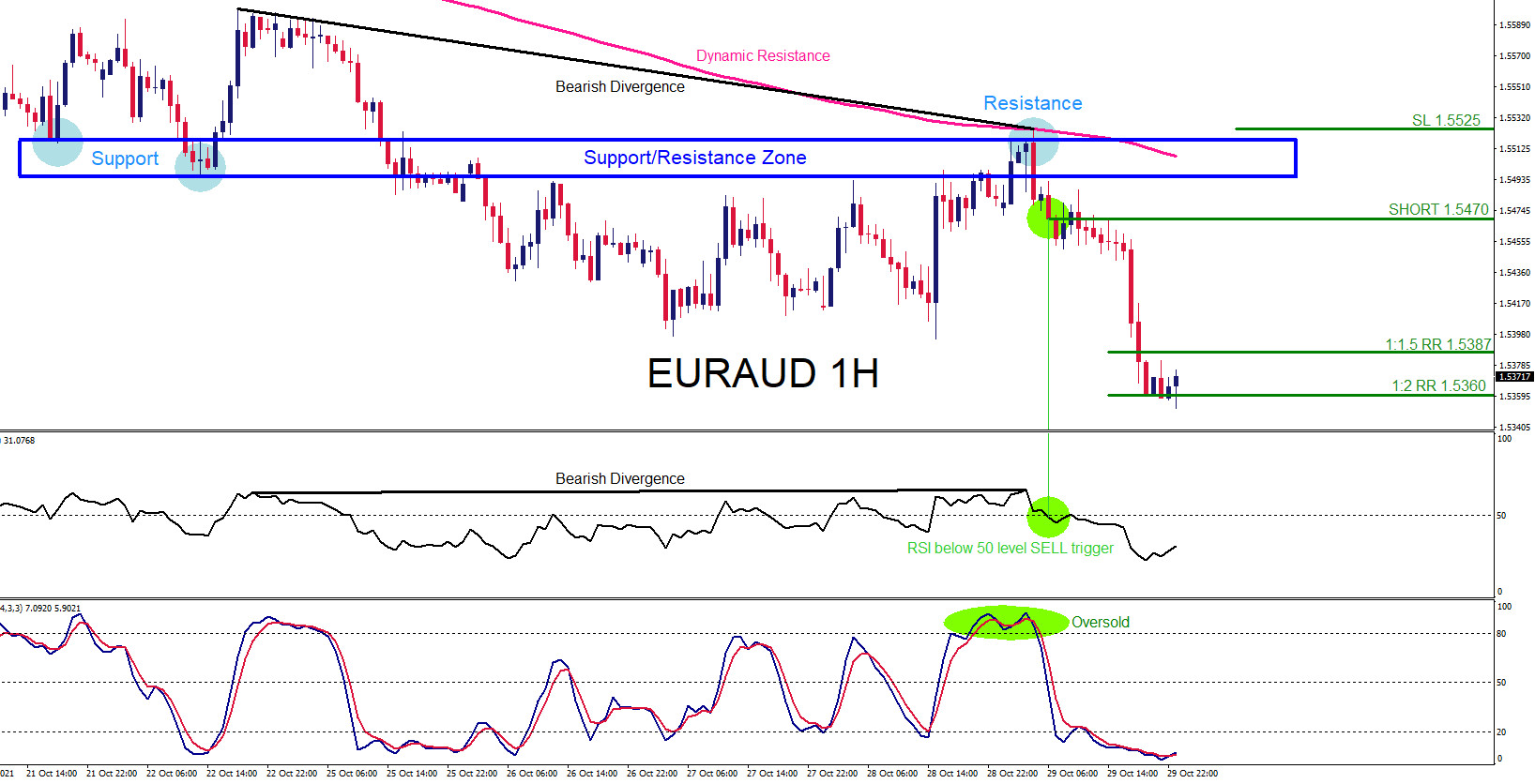

EURAUD : Confluence Trading

Read MoreConfluence trading is a combination of one or more trading strategies/techniques that come together and form a high probability buy/sell zone in a certain area in the market. Market patterns (Elliott Waves, Harmonic, Candlestick patterns etc.), price action (Support & Resistance, Supply & Demand Zones, Fibonacci retracements etc.) and indicators (RSI, Moving Average, Stochastic etc.) […]