-

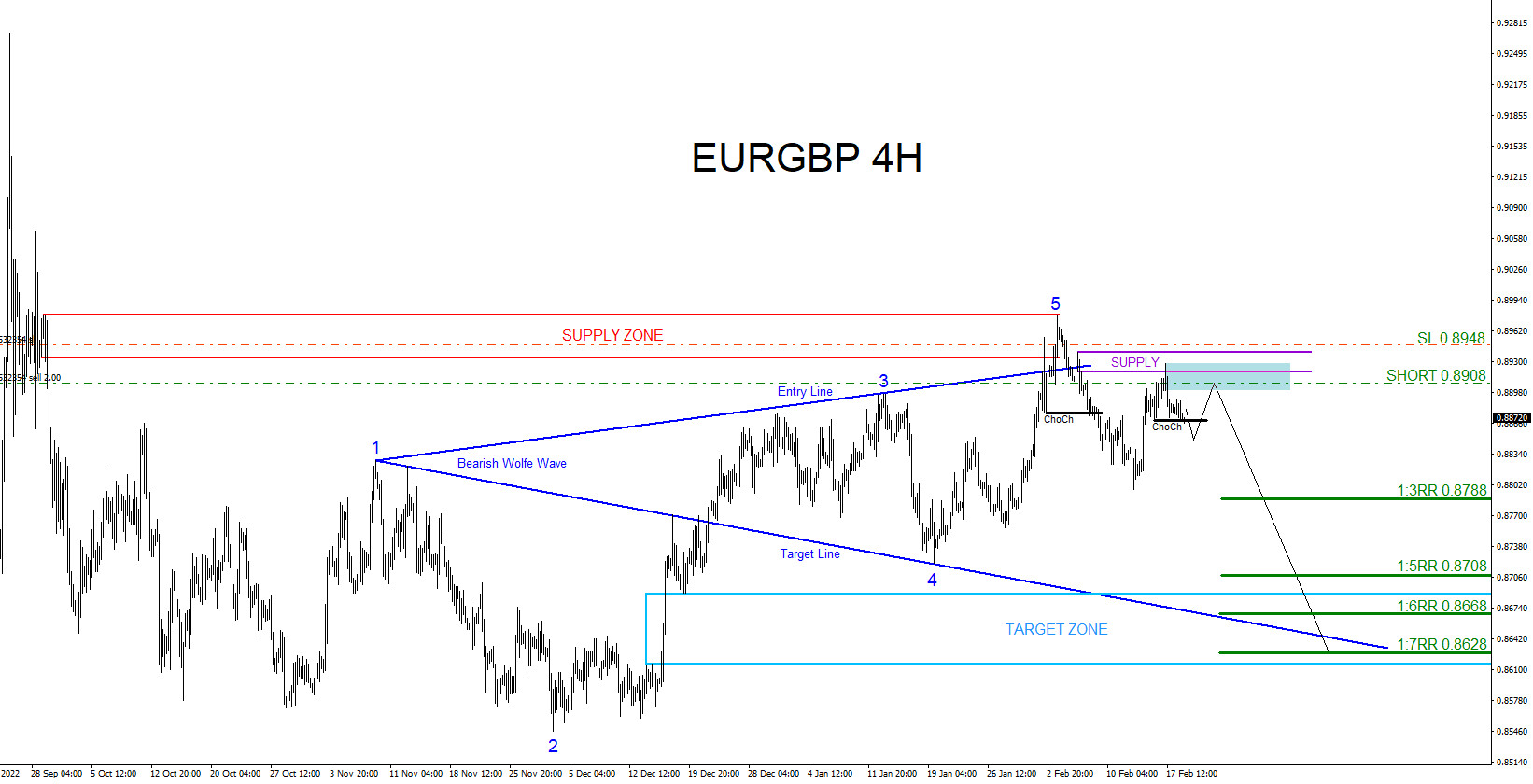

EURGBP : Will the Pair Continue to Push Lower?

Read MoreOn January 10 2023 I published an article ” EURGBP : Trading Zones ” where I gave the area on which to look for selling opportunities. In the article I wrote “if price pushes higher to the supply zone (red) then watch possible selling opportunities against 0.8980 stops.” *I also took the buy trade from […]

-

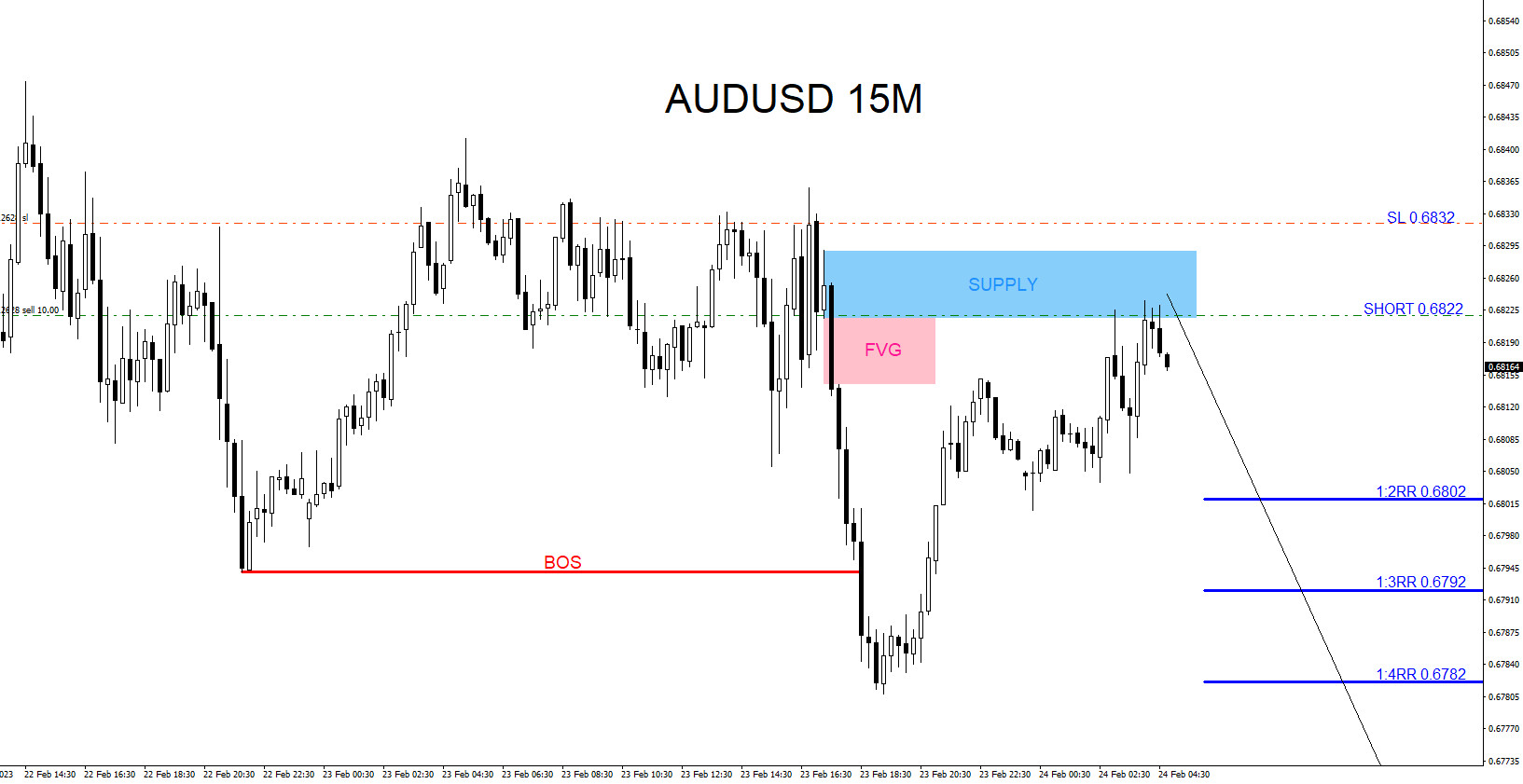

AUDUSD : Sell Trade Hits Targets

Read MoreSince the start of February 2023, AUDUSD has been trending to the downside making lower lows and lower highs. Knowing that the pair is on a down trend it would only make sense for a trader to look for possible sell trade setups. On February 23 2023 I posted the AUDUSD 15 Minute chart on […]

-

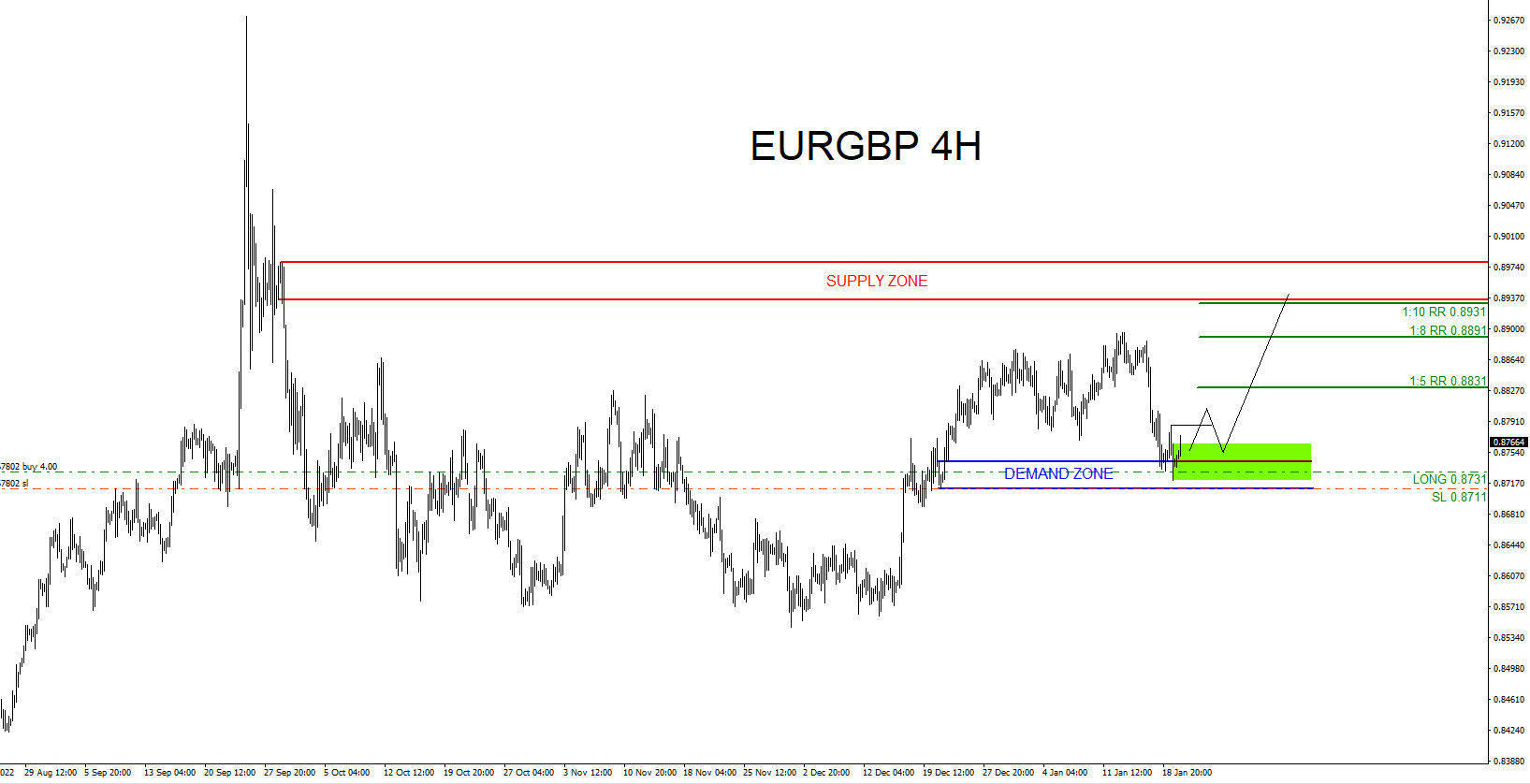

EURGBP : Catching the 200 Pip 1:10 Risk/Reward Move Higher

Read MoreOn January 10 2023 I published an article ” EURGBP : Trading Zones ” where I gave the area on which to look for buying opportunities. In the article I wrote “possible trade setups will be if price pushes lower to the demand zone (blue) then watch for possible buying opportunities against 0.8711 stops.” The […]

-

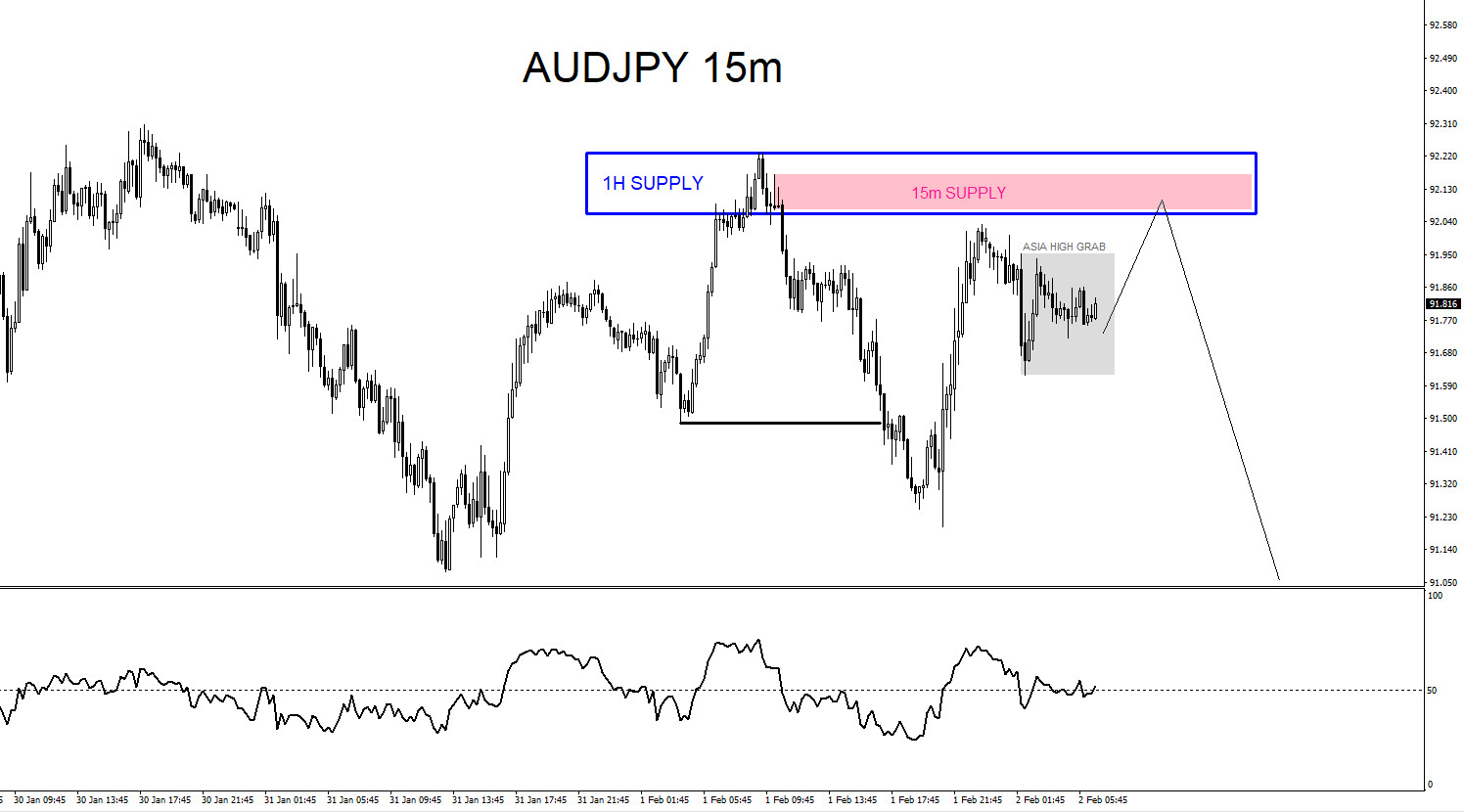

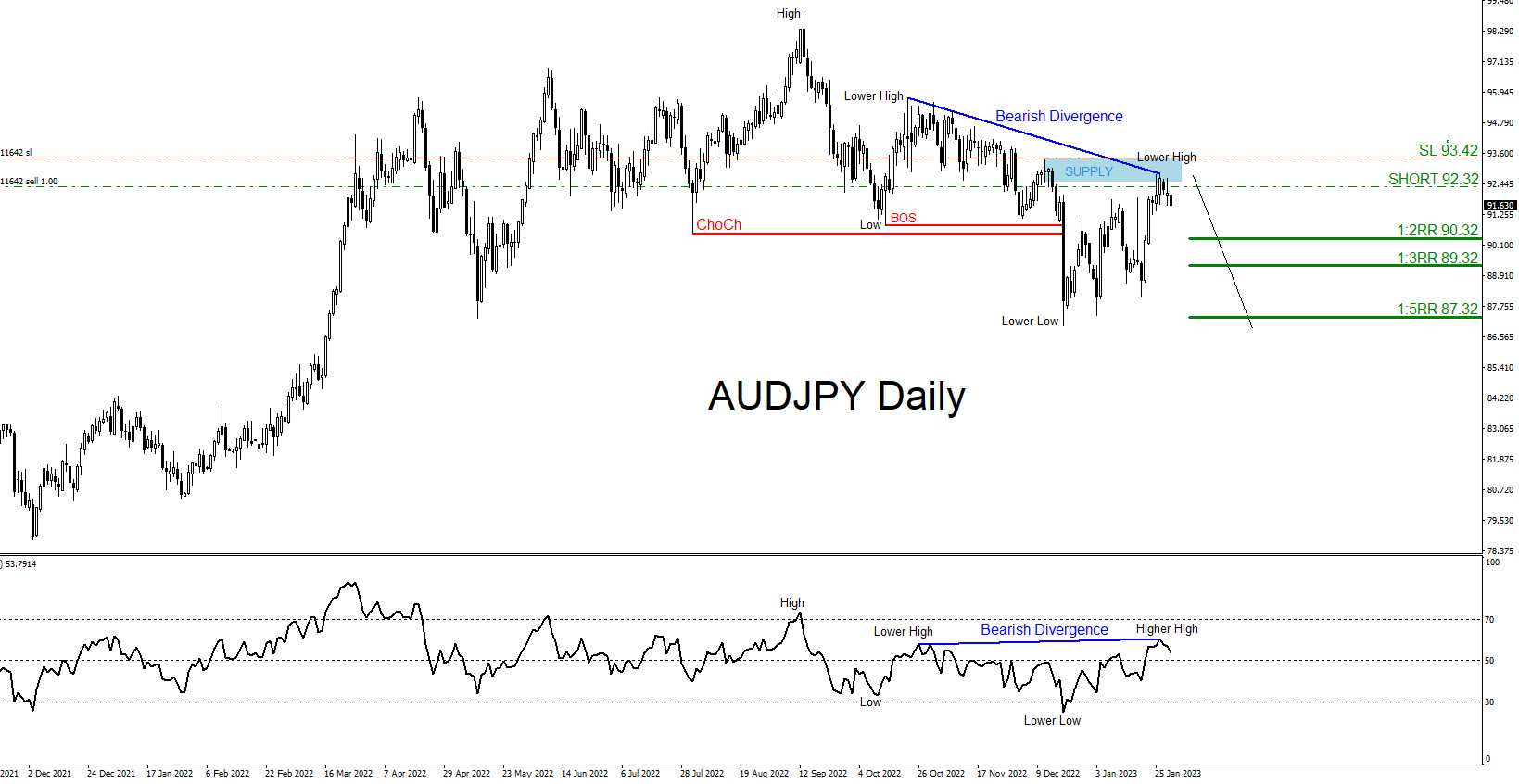

AUDJPY : Catching the Move Lower

Read MoreOn February 1 2023 I posted the AUDJPY 15 Minute chart on social media @AidanFX calling to fade and look for sells on any move higher towards the 1 Hour and 15 Minute supply zones. SELL Trade Setup 1. February 1 2023 failed to break higher signalling weakness. 2. Price breaks below internal structure lower […]

-

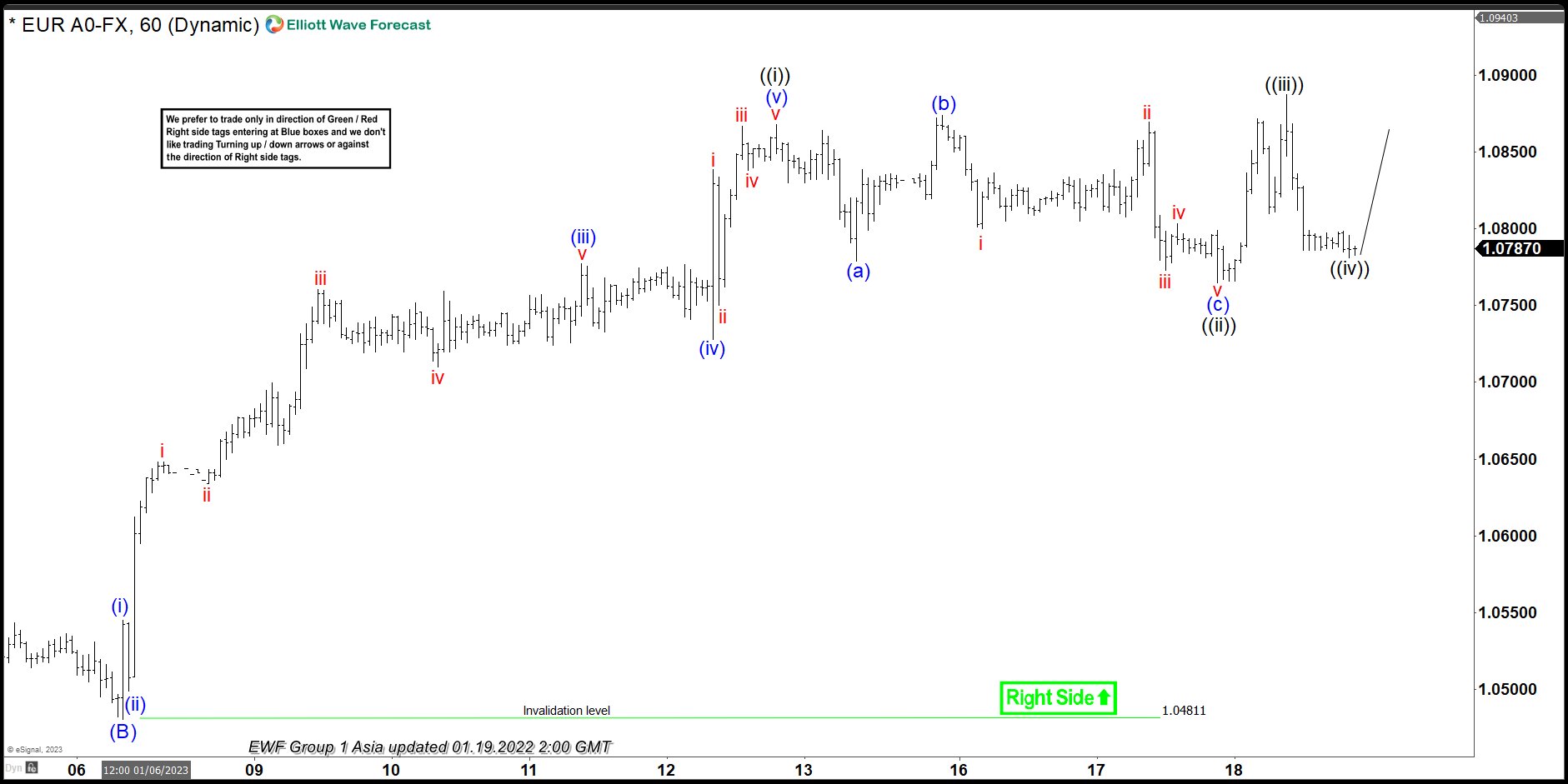

EURUSD : Buy Trade Hits Targets

Read MoreSince September 2022 EURUSD has bounced higher and has been trending to the upside making higher highs and higher lows. We at EWF always encourage our members to trade with the trend and not against it. Confluence trading is a combination of two or more trading strategies/techniques that come together and form a high probability […]

-

AUDJPY : Possible Move Lower?

Read MoreAt the moment AUDJPY is currently pushing lower from the September 13 2022 high. Looking at the Daily chart below we could still expect for the pair to continue pushing lower on reasons that the pair is currently in a lower low / lower high sequence and a visible bearish divergence pattern is forming signalling […]