-

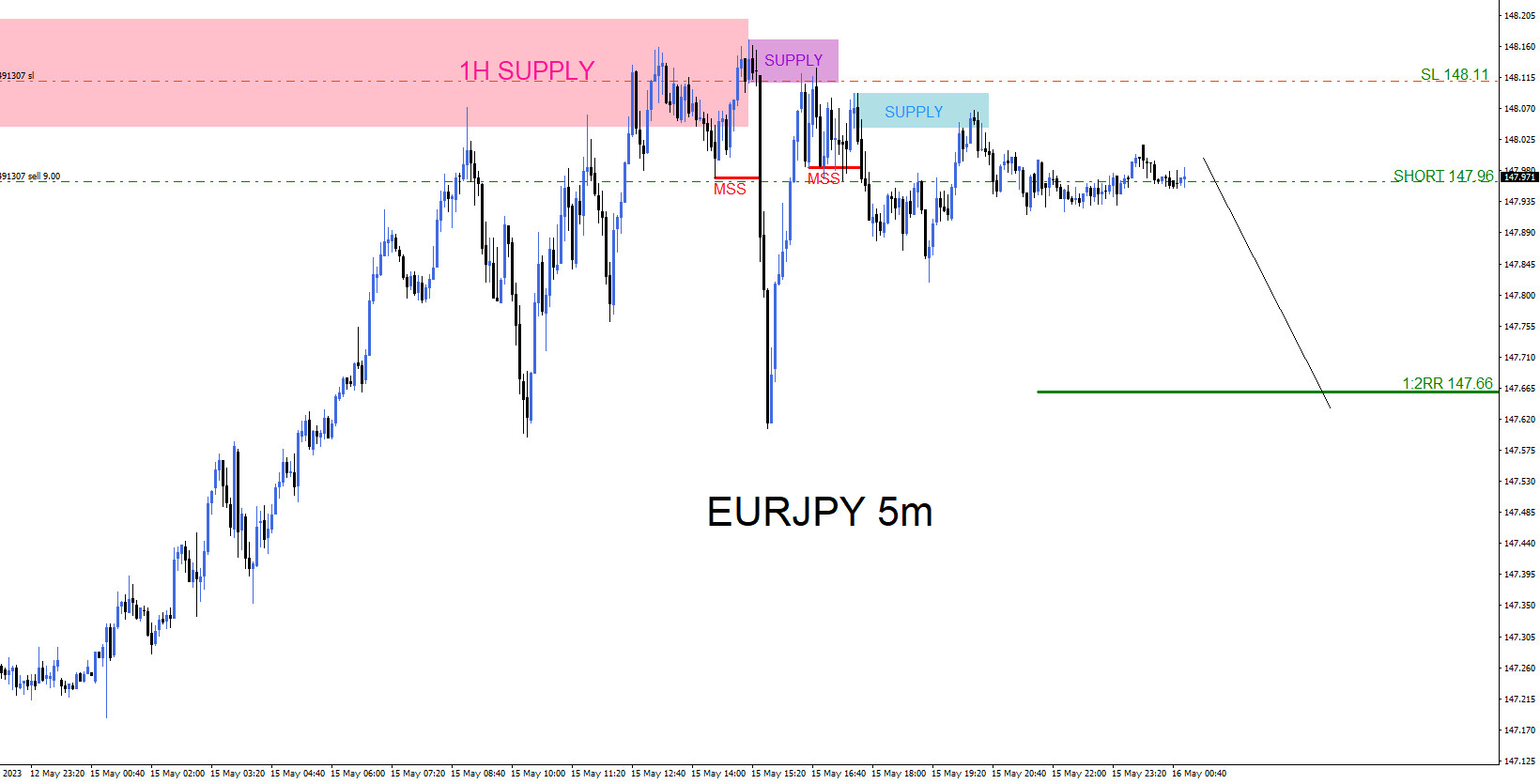

EURJPY : Sell Trade Hits Target

Read MoreOn May 15 2023 I posted on social media @AidanFX “ Sold/Short EURJPY at 147.96 Stop Loss 148.11 Target 147.66.“ SELL Trade Setup 1. Price reacted lower from the 1 hour supply zone May 15 2023. (Pink) 2. Price respected the 5 minute supply zones May 15 2023. (Purple and Blue) 3. Price respects the […]

-

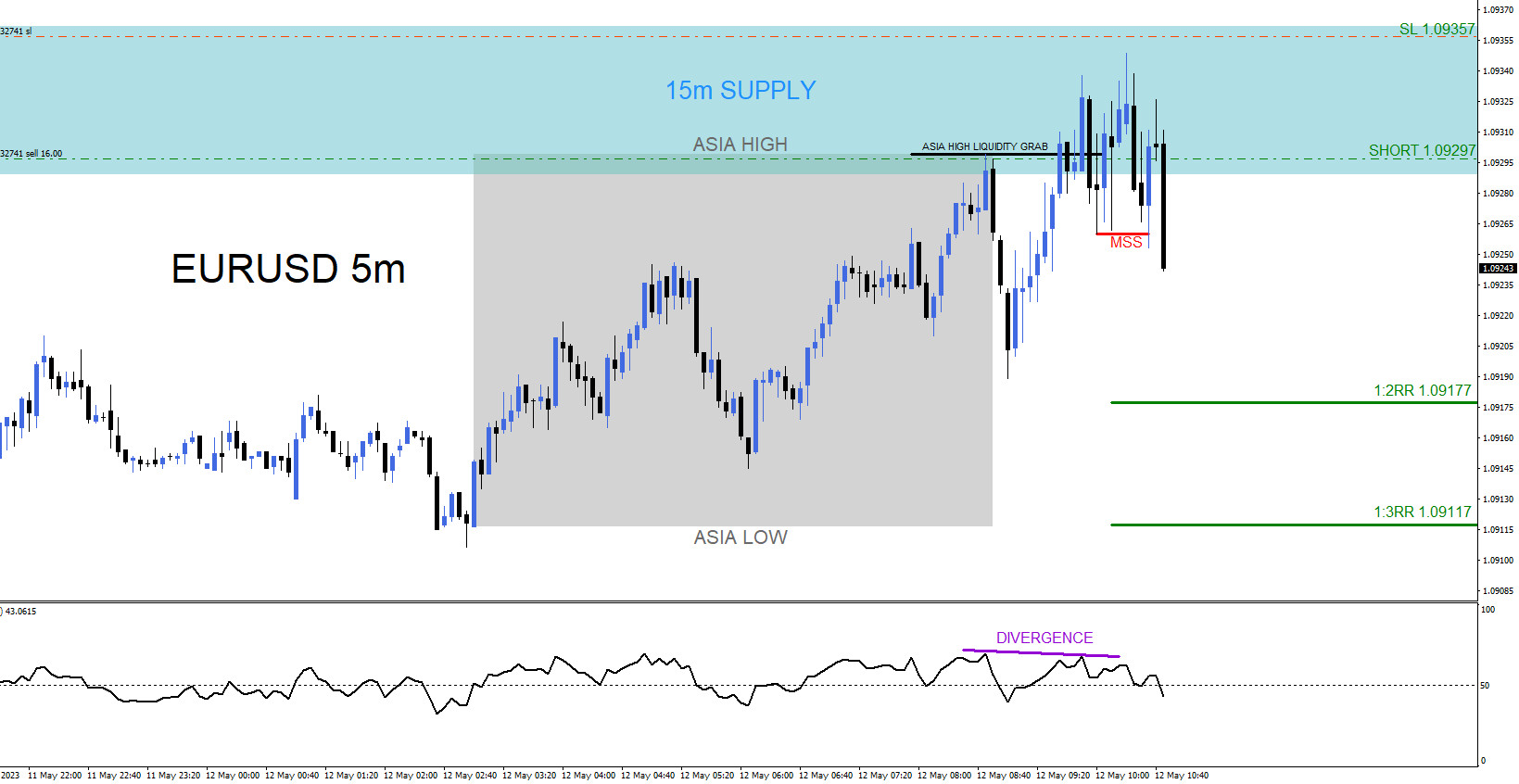

EURUSD : Sell Trade Hits Targets

Read MoreOn May 12 2023 I posted on social media @AidanFX “ Sold/Short EURUSD at 1.09297 Stop Loss 1.09357 Target 1.09177 – 1.09117 area.“ Sell Trade Setup 1. Price sweeps the Asia high for a liquidity grab fuelling the sell side. 2. Price enters the 15 minute bearish supply/selling zone. (Blue box) 3. Bearish divergence pattern […]

-

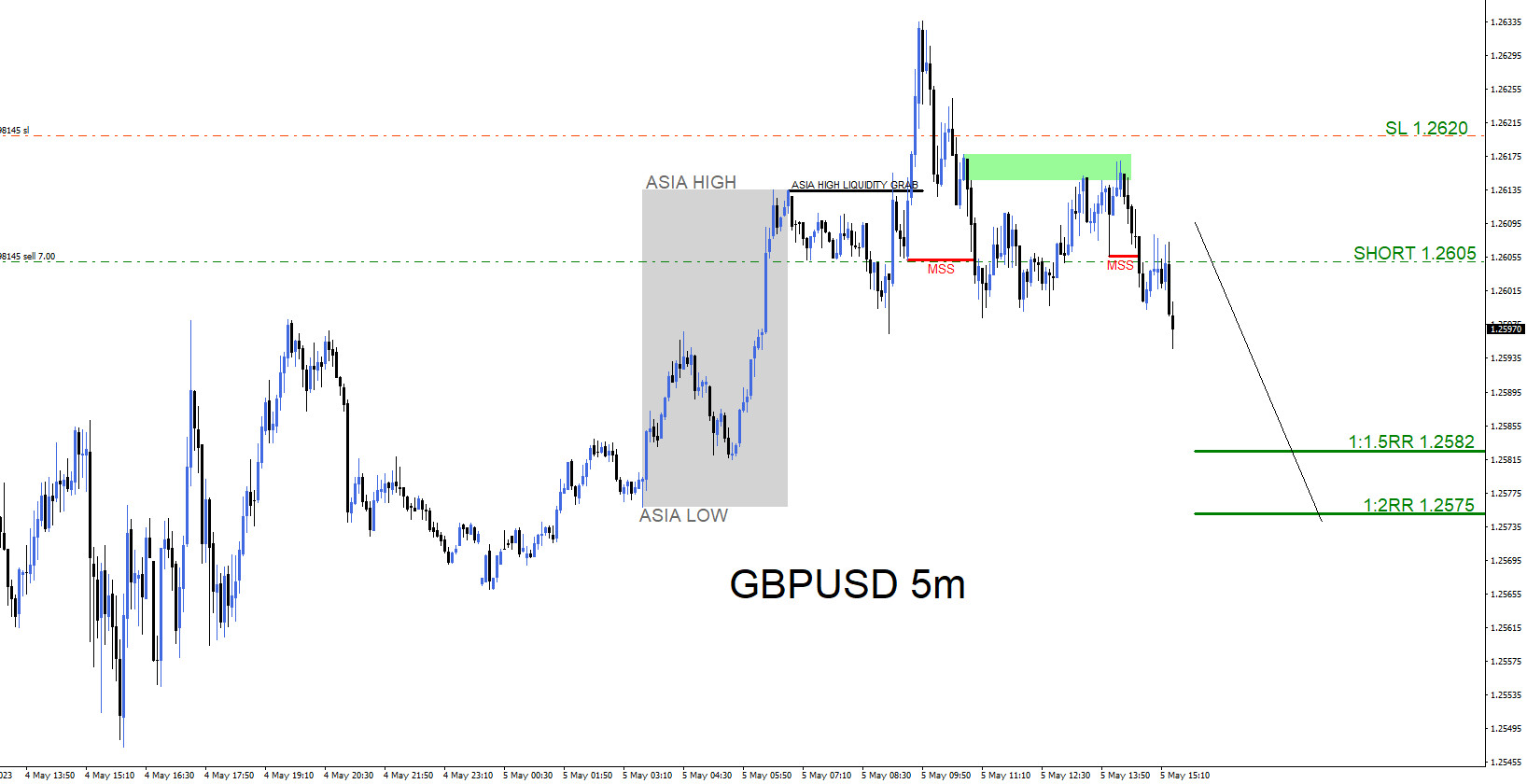

GBPUSD : Sell Trade Hits Targets

Read MoreOn May 5 2023 I posted on social media @AidanFX “ Sold GBPUSD at 1.2605 Stop Loss 1.2620 Target 1.2582 – 1.2575 area.“ Sell Trade Setup 1. Price sweeps the Asia high for a liquidity grab fuelling the sell side. 2. Price breaks below the internal structure higher low (1st MSS Red Line) signalling bearish […]

-

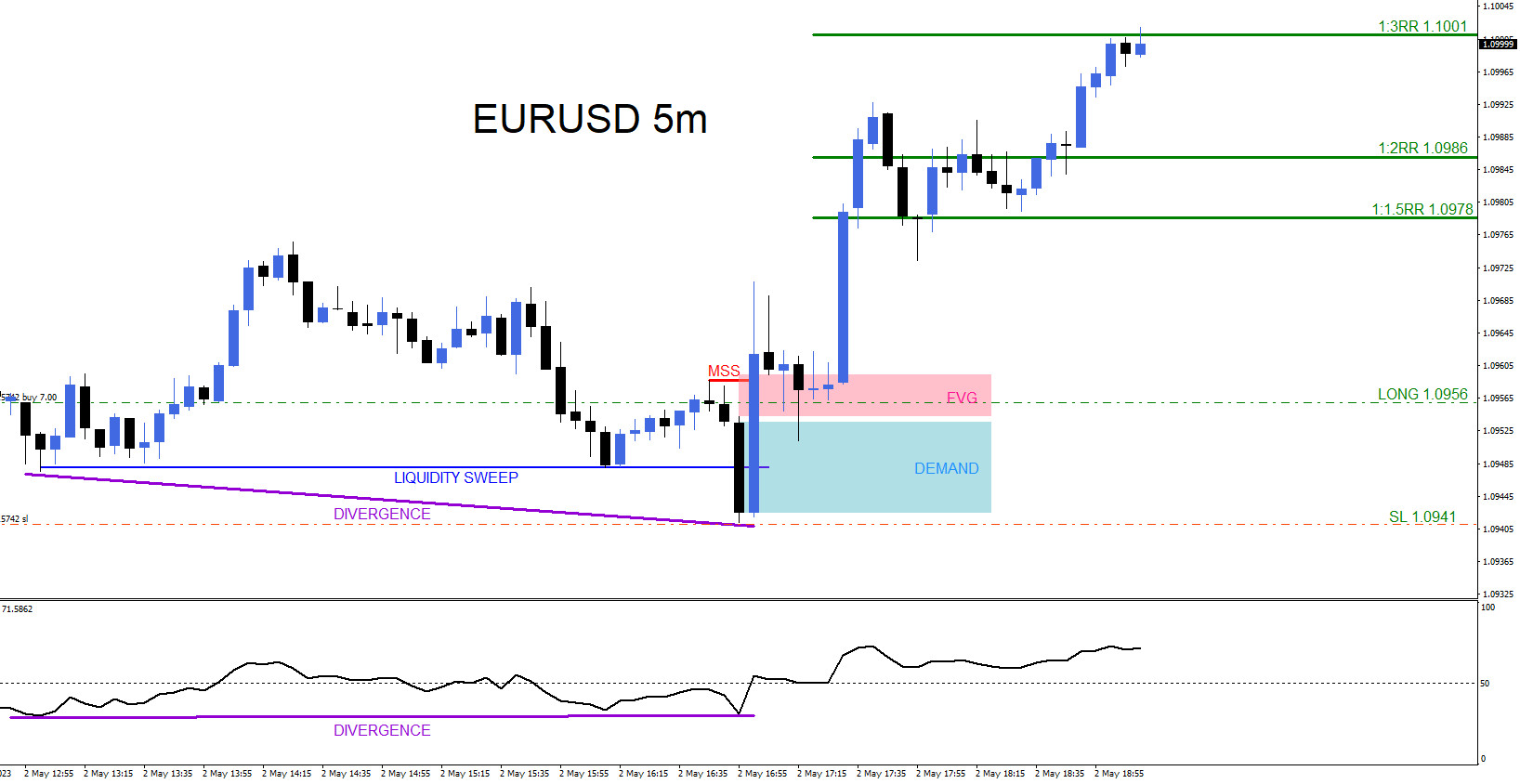

EURUSD : Buy Trade Hits Targets

Read MoreOn May 2 2023 I posted on social media @AidanFX “ LONG/BUY EURUSD at 1.0956 Stop Loss at 1.0941 Target/TP at 1.0978 – 1.0986 area.“ BUY Trade Setup 1. Price sweeps the equal level lows for a liquidity grab fuelling the buy side. (Blue Line) 2. Price breaks above internal structure lower high (MSS Red […]

-

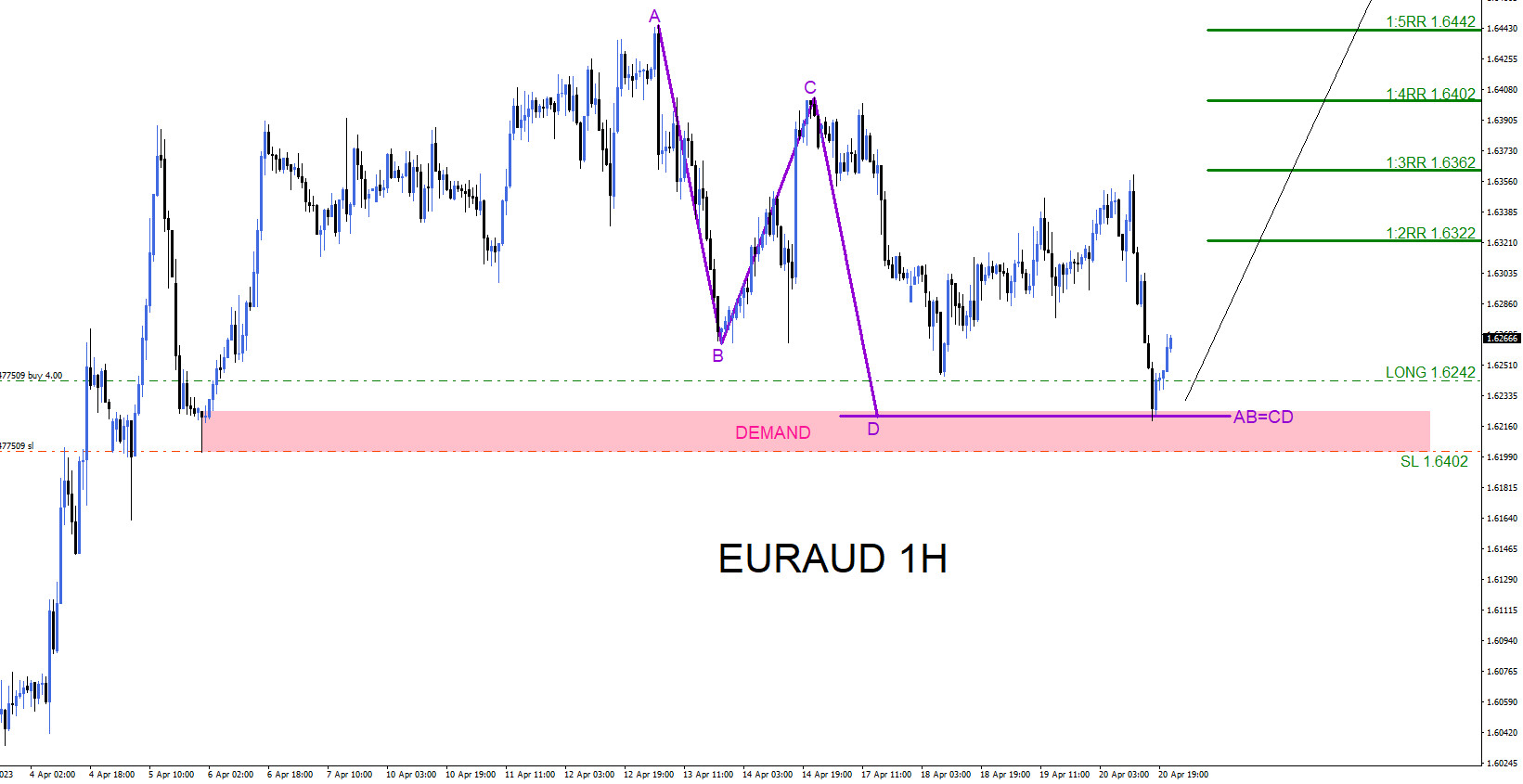

EURAUD : Buy Trade Hits Targets

Read MoreSince August of 2022 EURAUD has bounced higher and has been trending to the upside making higher highs and higher lows. We at EWF always encourage our members to trade with the trend and not against it. A trader should always have multiple strategies all lined up before entering a trade. Never trade off one […]

-

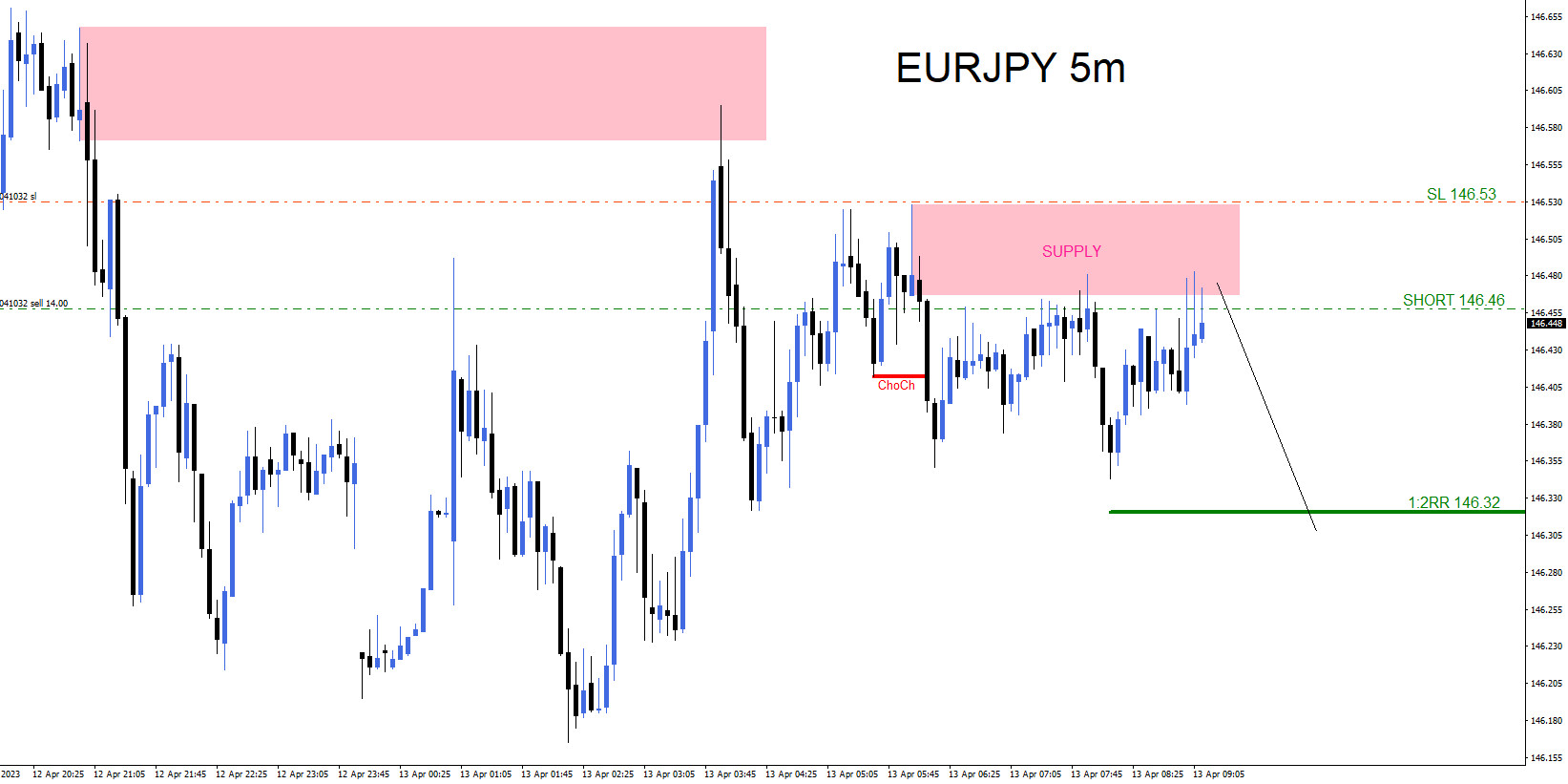

EURJPY : Scalping the Move Lower

Read MoreOn April 13 2023 I posted the EURJPY 5 Minute chart on social media @AidanFX calling for the pair to make another move lower. Sell scalp trade was entered after a clear visible rejection in the supply zone (2nd pink box) with a tight 7 pip stop. SELL Trade Setup 1. The pair attempted to […]