-

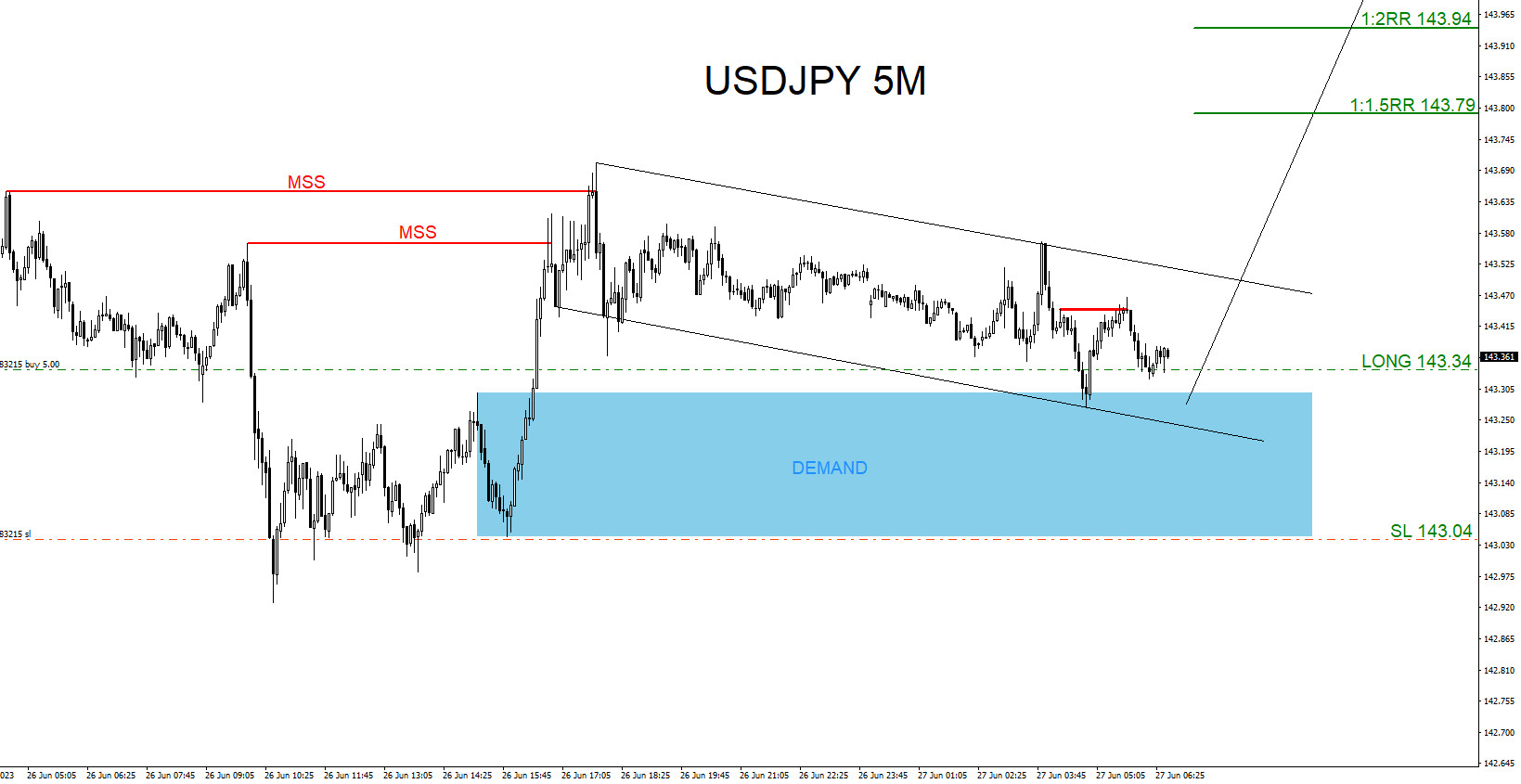

USDJPY : Buy Trade Hits Targets

Read MoreOn June 26 2023 I posted on social media @AidanFX ” USDJPY : Will be watching for buying opportunities against 142.92 low for another move higher towards 144.00.” I also posted on June 26 2023 the buy trade ” USDJPY BUY at 143.34 Stop Loss at 143.04 Target 143.79 – 143.94 area.” Buy Trade Setup […]

-

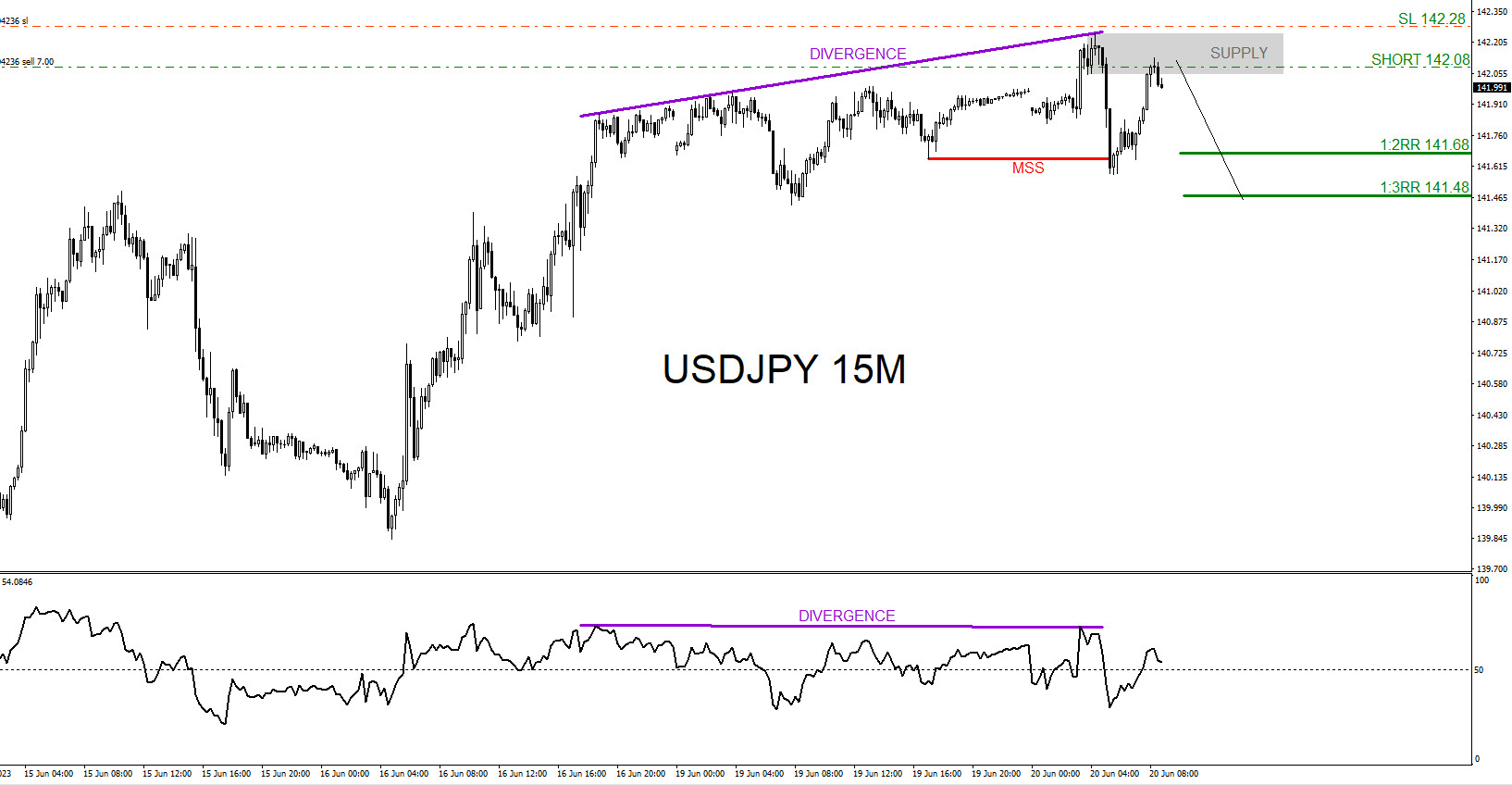

USDJPY : Catching the Move Lower

Read MoreOn June 20 2023 I posted on social media @AidanFX ” USDJPY : For now as long as price stays below 142.25 will be watching for sells for another push lower towards the 141.68 – 141.48 area.” SELL Trade Setup 1. RSI indicator and price form a bearish trend reversal divergence pattern. (Purple Line) 2. […]

-

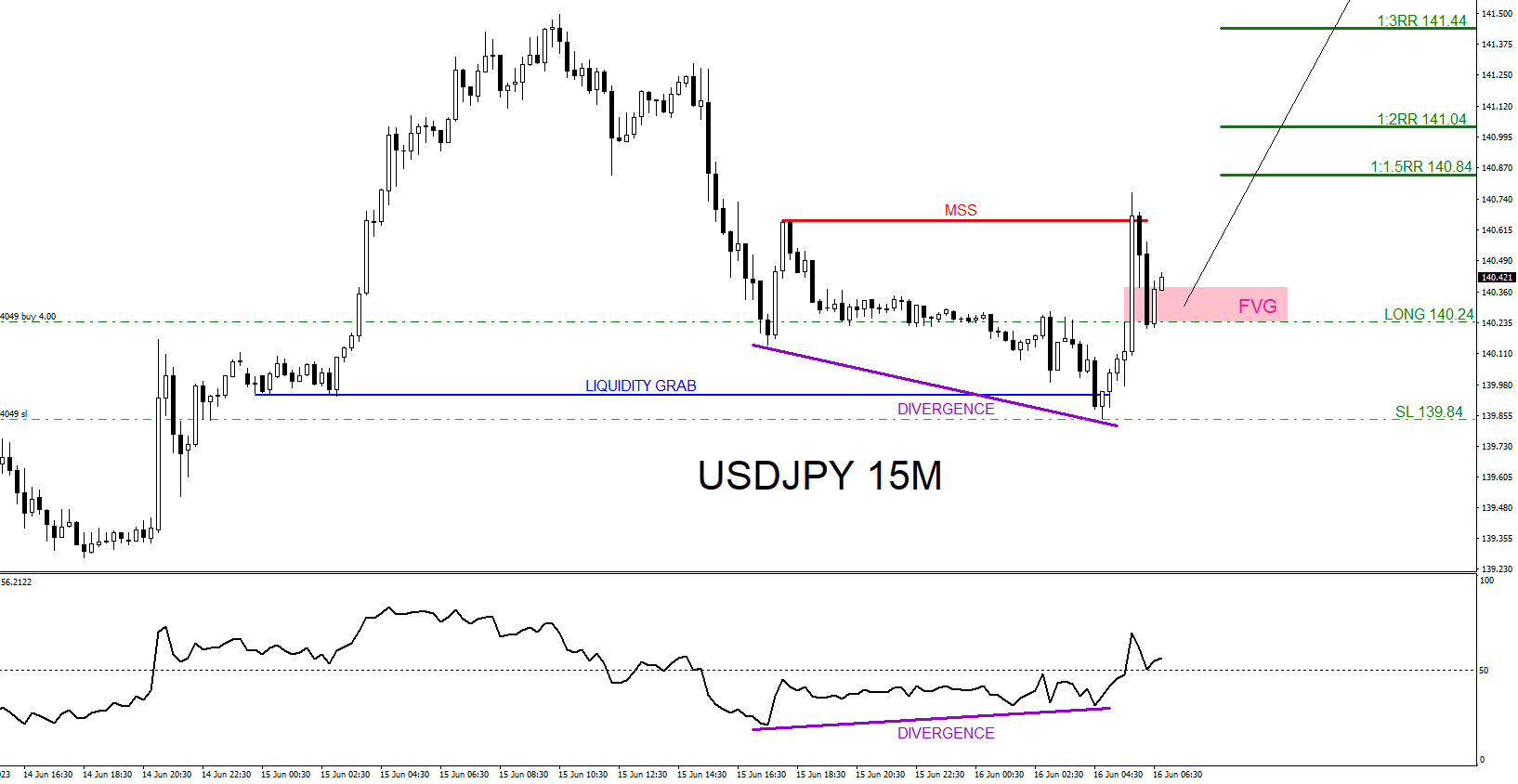

USDJPY : Buy Trade Hits Targets

Read MoreOn June 15 2023 I posted on social media @AidanFX “Bought USDJPY at 140.24 Stop Loss at 139.84 Target/TP at 140.84 – 141.04 area“ BUY Trade Setup 1. Price sweeps the previous day low for a liquidity grab fuelling the buy side. (Blue Line) 2. RSI indicator and price form a bullish trend reversal divergence […]

-

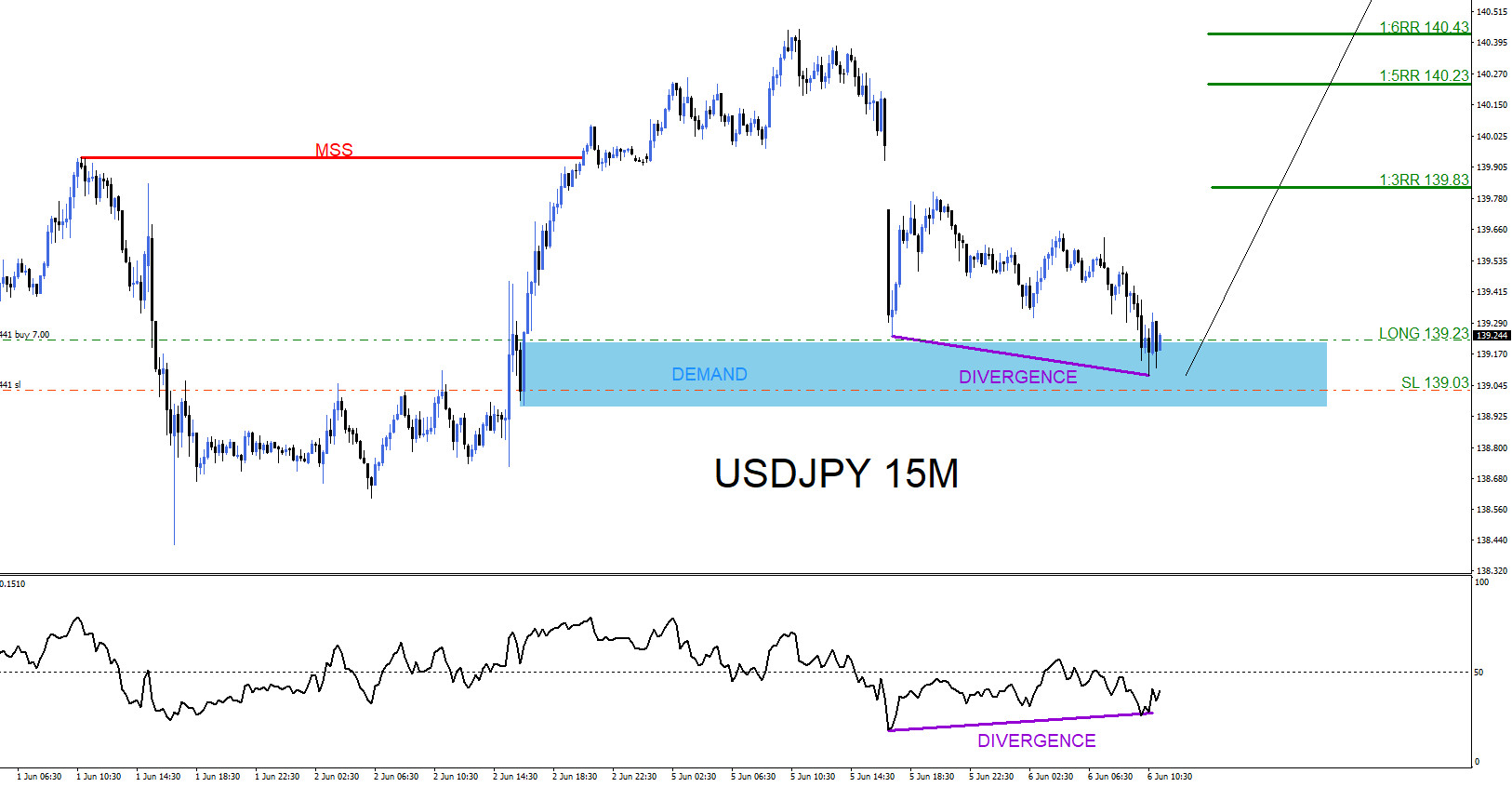

USDJPY : Buy Trade Hits Targets

Read MoreOn June 6 2023 I posted on social media @AidanFX “LONG/BUY USDJPY at 139.23 Stop Loss at 139.03 Target/TP at 139.83 (1:3RR)“ BUY Trade Setup 1. Price breaks above internal structure lower high (MSS Red Line) forming a market structure shift pattern signalling bearish weakness. 2. RSI indicator and price form a bullish trend reversal […]

-

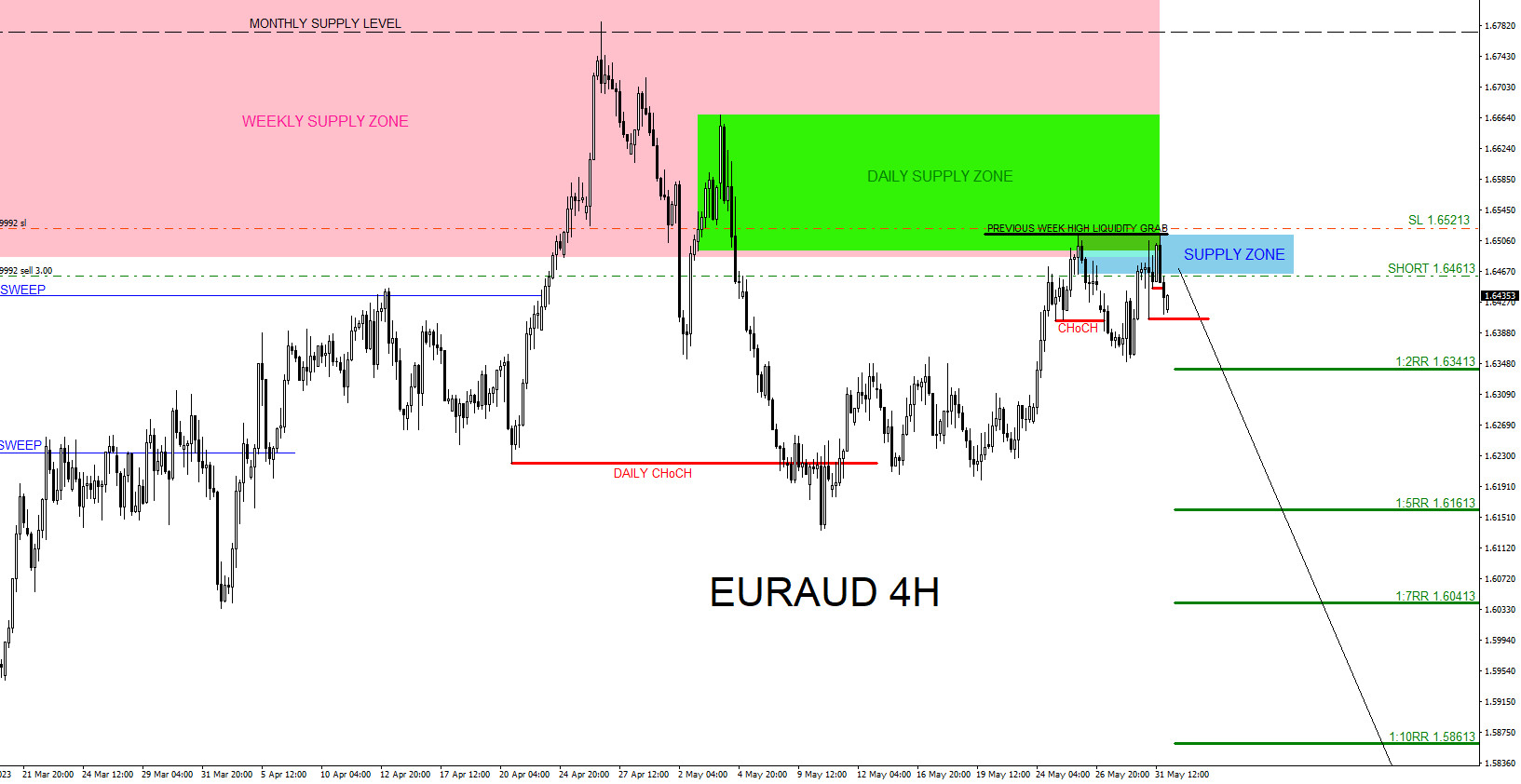

EURAUD : Catching the 420 Pip 1:7 Risk/Reward Move Lower

Read MoreOn May 29 2023 I published an article ” EURAUD : Multi Time Frame Trade Setup ” where I explained that the EURAUD pair could be signalling for a move lower using multiple time frame analysis. Using the Weekly, Daily and 4 Hour charts I showed that market structure could be starting to shift bearish. The […]

-

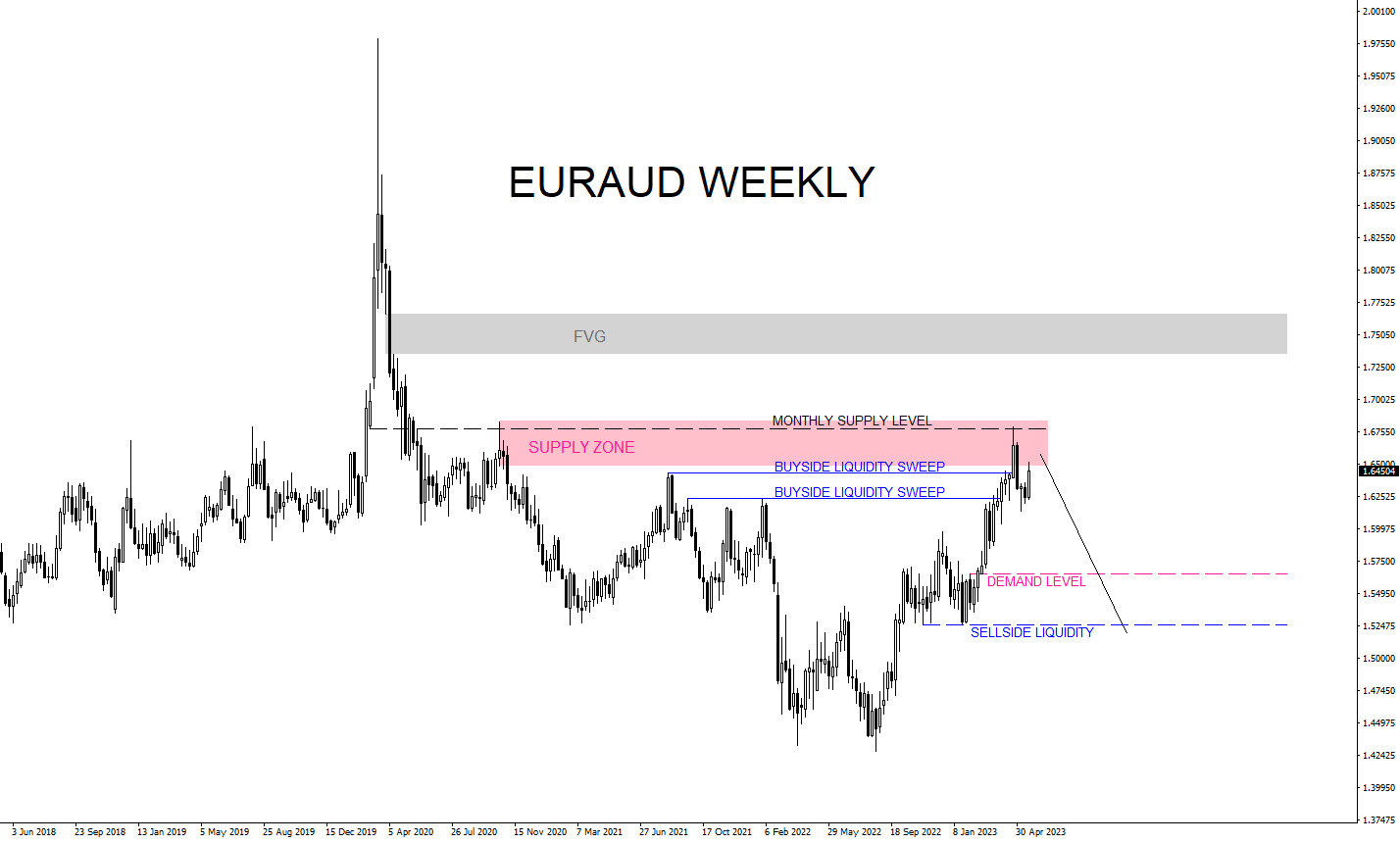

EURAUD : Multi Time Frame Trade Setup

Read MoreMarket structure on the higher and lower time frames on the EURAUD pair can be signalling for more downside in the coming new trading week. Only a break above the April 26 2023 high will invalidate the bearish scenario and could push the pair higher to the next zone where the weekly chart FVG (Gray […]