On January 4 2021 we advised traders, in our members area, that EURCAD was in a position where the pair will make another move lower. Since December 22 2020, the pair has been pushing lower and has moved in a lower low/lower high sequence signalling a possible downside trend.

EURCAD 1 Hour Chart New York Update 1.4.2021

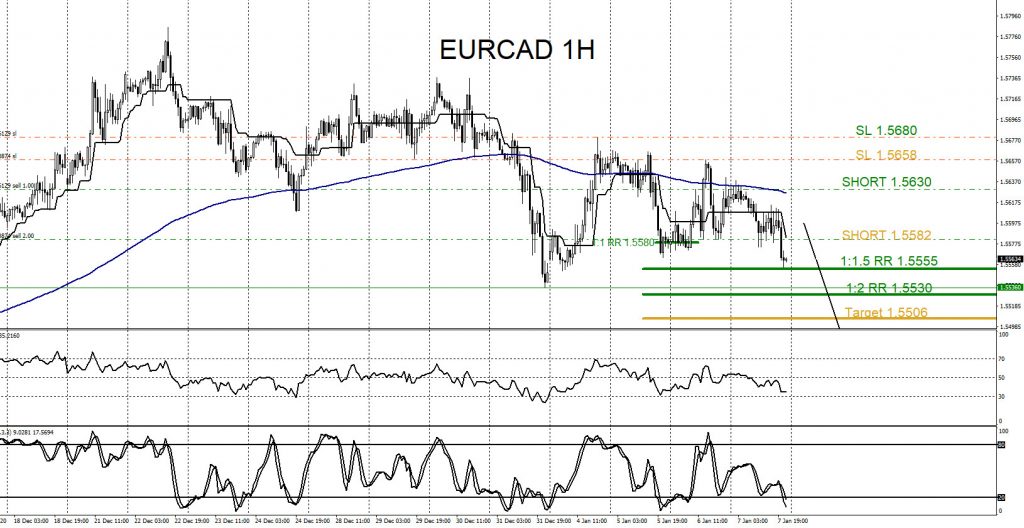

By looking at the chart above and following the 1 hour EURCAD Elliott Wave wave count a trader should wait for more confirmation that price will stall by watching out for a visible lower low/lower high sequence from the proposed black wave ((iv)) high. Once the lower low/lower high sequence was visible from the black wave ((iv)) peak, it signalled that a possible downside trend change could happen and I entered the SELL/SHORT trade with a set stop loss above the black wave ((iv)) high.

EURCAD 1 Hour Chart 1.5.2021

After the SELL/SHORT entry the pair pushed lower and hit the 1:1 RR Target. The push lower confirmed that the pair would now continue lower and will break below the black wave ((iii)) low as we expected from the January 4 2021 chart we posted to our members. I also posted another SELL/SHORT trade setup entry on social media @AidanFX on January 7 2021 “EURCAD as long price stays below 1.5658 expect another move lower towards 1.55 handle. Will be watching to add more sell/short positions on a break below 1.5574.“

EURCAD January 7 2021 Social Media Post @AidanFX

SELL/SHORT trade first entry (green) moves lower and on January 8 2021 price hits the 1:2 RR Target at 1.5530. On January 7 added SELL/SHORT second entry (gold) and on January 8 2021 price hits the the second entry target at 1.5506 where all SELL/SHORT positions were closed for +124 pips 1st entry (green) and +76 pips 2nd entry (gold). If you were a EWF member or followed me on social media @AidanFX you too could have caught the EURCAD downside move. We at EWF never say we are always right. No market service provider can forecast markets with 100% accuracy. Only thing we at EWF 100% is that we are RIGHT more than we are WRONG.

EURCAD 1 Hour Chart January 7 and 8 2021

Of course, like any strategy/technique, there will be times when the strategy/technique fails so proper money/risk management should always be used on every trade. Hope you enjoyed this article and follow me on social media for updates and questions> @AidanFX

At Elliottwave-Forecast we cover 78 instruments (Forex, Commodities, Indices, Stocks and ETFs) in 4 different time frames and we offer 5 Live Session Webinars everyday. We do Daily Technical Videos, Elliott Wave Trade Setup Videos and we have a 24 Chat Room. Our clients are always in the loop for the next market move.

Try Elliottwave-Forecast for 14 days FREE !!! Just click here –> 14 day FREE trial

Back