GDXJ is an ETF tracking small-cap gold and precious metals mining companies. It has a focus on smaller, more volatile firms. Thus it offers exposure to this precious metal sectors, but investors should be cautious of increased risk. In this article, we will update the Elliott Wave outlook for the ETF.

GDXJ Daily Elliott Wave View

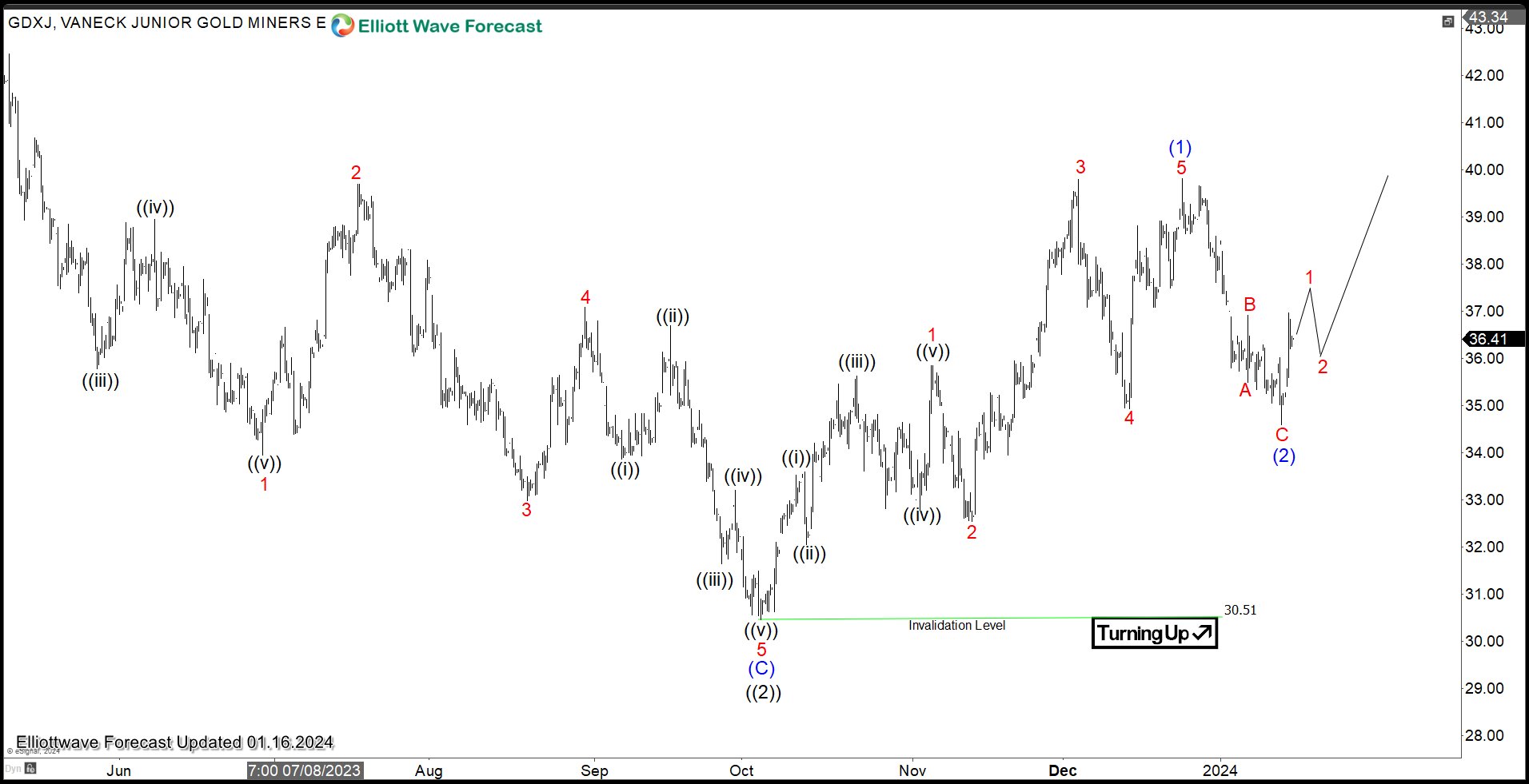

Daily Elliott Wave Chart of GDXJ above shows the ETF ended wave II at 25.96. Wave III is in progress as an impulsive structure. Wave ((1)) of 3 ended at 41.16 and wave ((2)) of 3 ended at 30.46. The ETF then resumed higher and created a nest. Up from wave ((2)), wave (1) ended at 39.82 and wave (2) pullback ended at 34.59. The ETF has resumed higher again in wave (3) of ((3)). As far as pivot at 26.13 low stays intact, expect the ETF to extend higher.

GDXJ 4 Hour Elliott Wave View

4 Hour Elliott Wave view of GDXJ above shows that the ETF may have ended wave (2) of ((3)) correction at 34.59. Near term, while it stays above there, and more importantly above 30.51, expect the ETF to extend higher. However, it still needs to break above wave (1) at 39.82 to rule out any double correction.

We do not cover GDXJ as part of our regular service. However, we cover GDX, Gold, and other commodities, stocks, forex, and crypto currencies. If you’d like to check our service, you can take our 14 days trial here –> 14 days Trial

Back