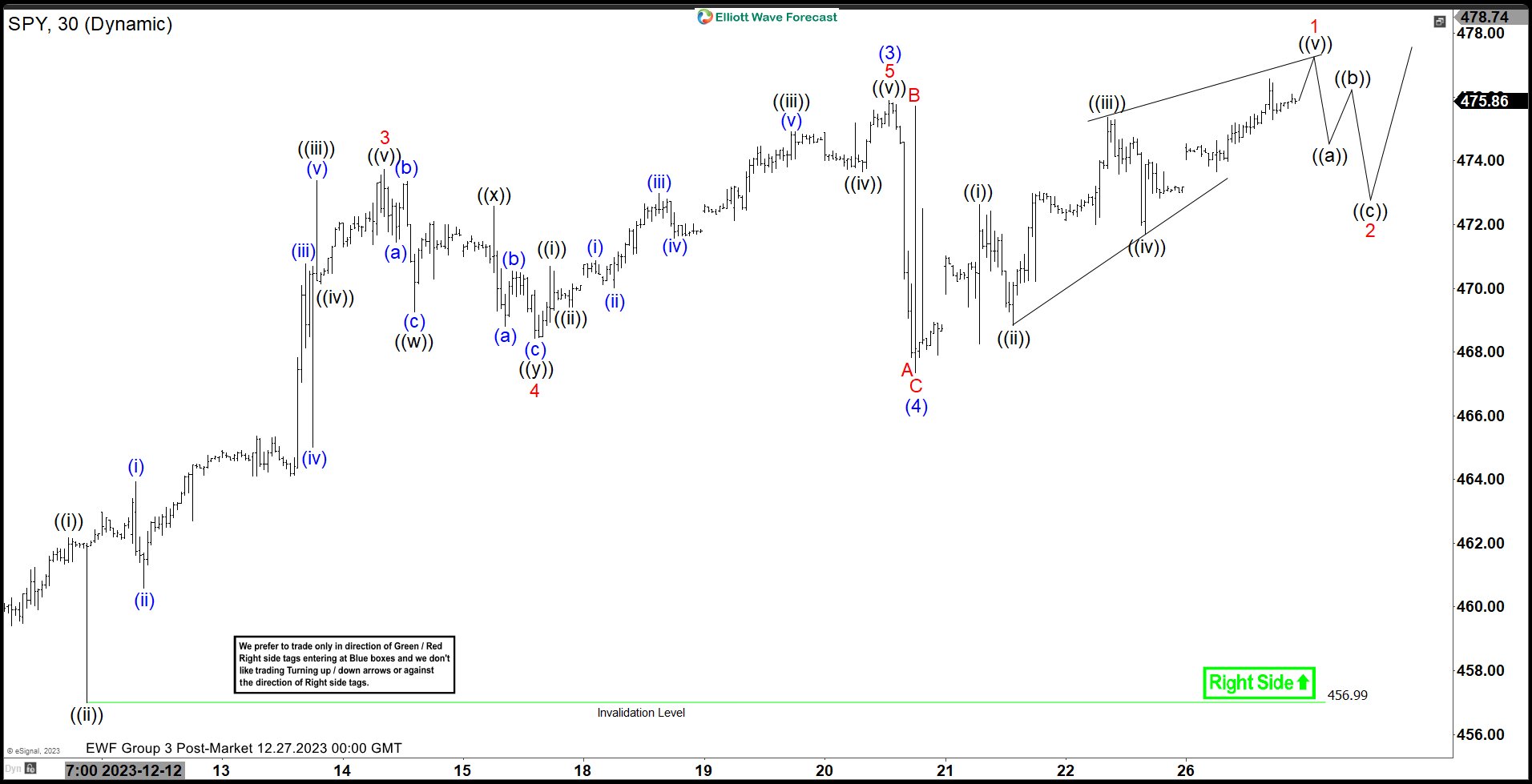

Short Term Elliott Wave View in S&P 500 ETF (SPY) shows the rally from October 28 low is in progress as a 5 waves impulse Elliott Wave structure. Up from October 28 low, wave (1) ended at 459.9 and pullback in wave (2) ended at 454.34. The ETF then rallied higher again in wave (3) towards 475.89 and dips in wave (4) ended at 467.36. Wave (5) is in progress as another 5 waves in lesser degree. The 30 minutes chart below shows the move higher to end wave (3).

Up from wave 94), wave ((i)) ended at 472.64 and pullback in wave ((ii)) ended at 468.84. The ETF extended higher again in wave ((iii)) towards 475.38 and dips in wave ((iv)) ended at 471.70. Expect the ETF to end wave ((v)) soon and this should complete wave 1 of (5) in higher degree. It should then pullback in wave 2 to correct cycle from 12.21.2023 low before the rally resumes. Near term, while above 467.36, and more importantly above 456.99, expect dips to find support in 3, 7, or 11 swing and the ETF to extend higher.