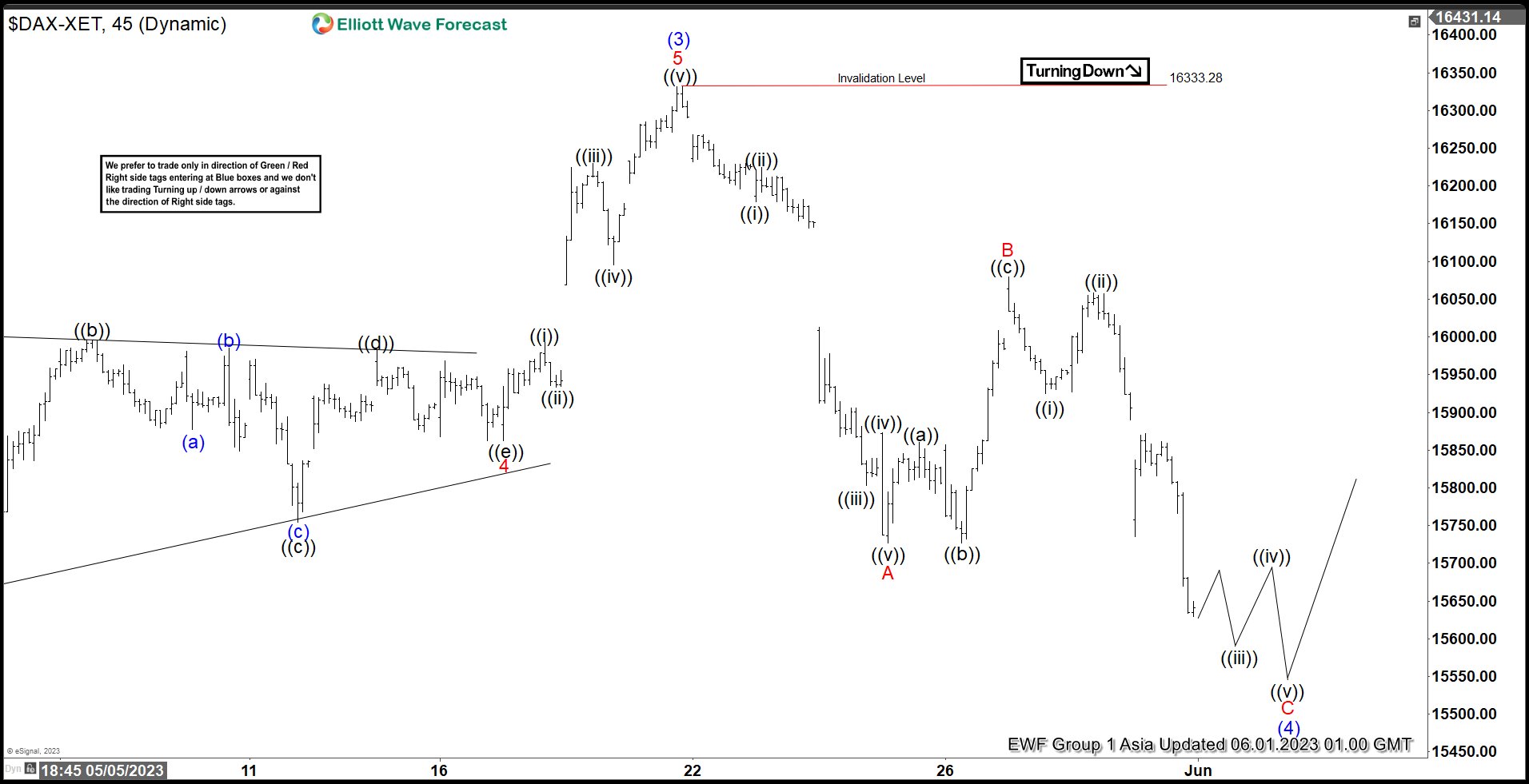

Short term Elliott Wave View in DAX shows that the Index ended wave (3) at 16333.28. It is now pulling back in wave (4). Internal subdivision of the pullback is unfolding as a zigzag Elliott Wave structure. Down from wave (3), wave ((i)) ended at 16179.14 and rally in wave ((ii)) ended at 16224.32. Index then resumes lower in wave ((iii)) towards 15802.86 and rally in wave ((iv)) ended at 15872.60. Final leg wave ((v)) ended at 15726.5 which completed wave A.

Index then did a corrective wave B rally which unfolded as another zigzag in lesser degree. Up from wave A, wave ((a)) ended at 15860.37 and pullback in wave ((b)) ended at 15726.74. Index then rallied higher in wave ((c)) towards 16079.73. This completed wave B. Index then resumes lower in wave C with internal subdivision as 5 waves. Down from wave B, wave ((i)) ended at 15925.22 and wave ((ii)) rally ended at 16058.43. Expect Index to extend lower within wave ((iii)), then rally in wave ((iv)) followed by another leg lower in wave ((v)). This should complete wave C and (4). Potential target lower is 100% – 161.8% Fibonacci extension of wave A which comes at 15103.6 – 15476.8. Near term, as far as pivot at 16333.28 high stays intact, expect rally to fail in 3, 7, or 11 swing for further downside.