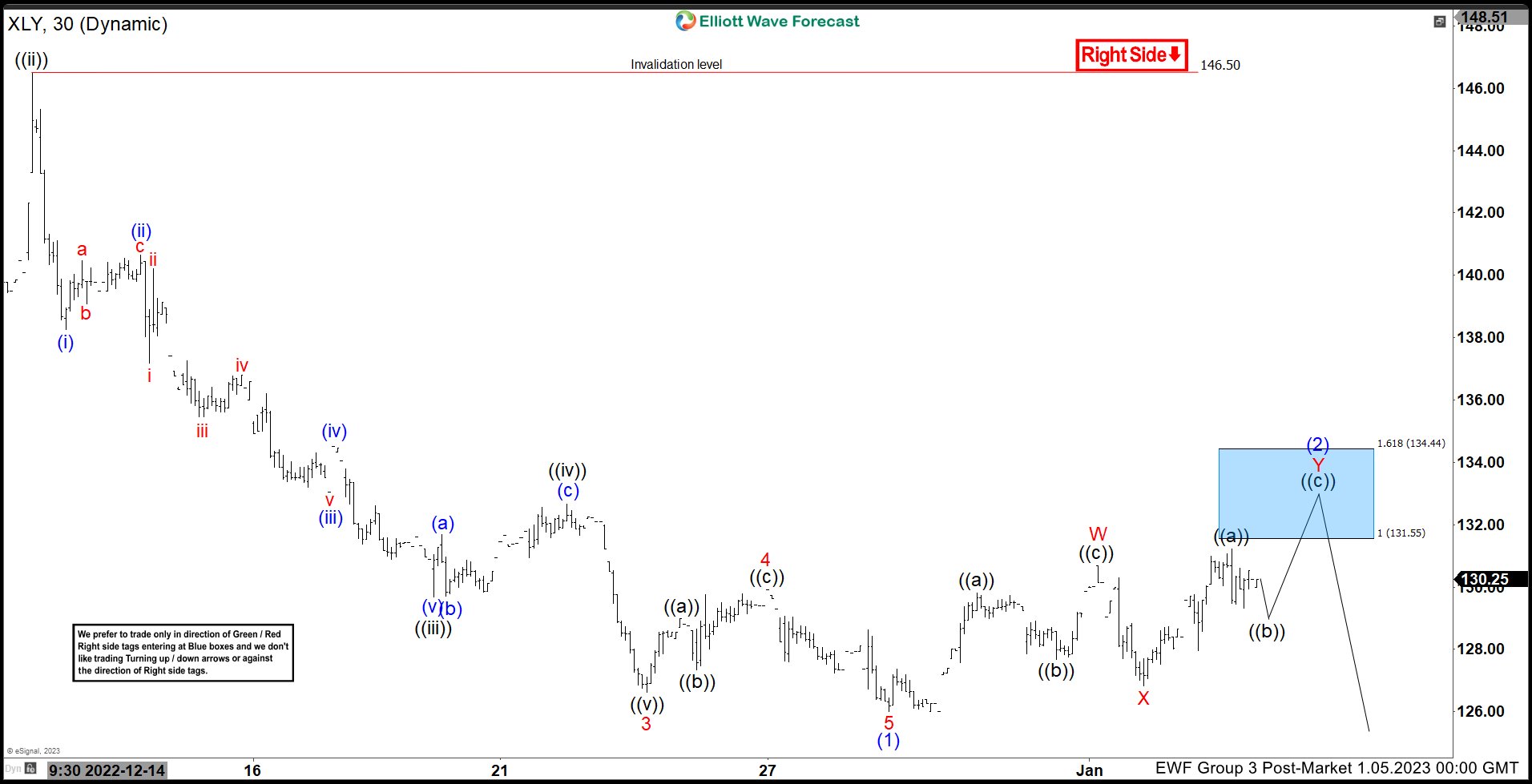

Cycle from 11.15.2022 high is proposed complete as wave (1) at 126. Down from 11.15.2022 high, wave 1 ended at 138.20 and rally in wave 2 ended at 147.32. The ETF then extends lower in wave 3 towards 126.63 and wave 4 rally ended at 129.90. Final leg lower wave 5 ended at 126 which completed wave (1) in higher degree. Wave (2) rally is currently in progress with internal subdivision as a double three Elliott Wave structure. Up from wave (1), wave ((a)) ended at 129.80, wave ((b)) ended at 127.68, and wave ((c)) ended at 130.68. This completed wave W. Pullback in wave X ended at 126.83.

Wave Y higher is in progress with internal subdivision as a zigzag. Up from wave X, wave ((a)) ended at 131.21. Expect wave ((b)) pullback to stay above wave X (126.83), and the ETF should extend higher in wave ((c)) higher. Potential target higher is 100% – 161.8% Fibonacci extension of wave W which comes at 131.55 – 134.44. From this area, the ETF should find sellers and resistance to either extend lower or pullback in 3 waves. As far as pivot at 146.50 stays intact, expect rally to fail in 3, 7, 11 swing for further downside.