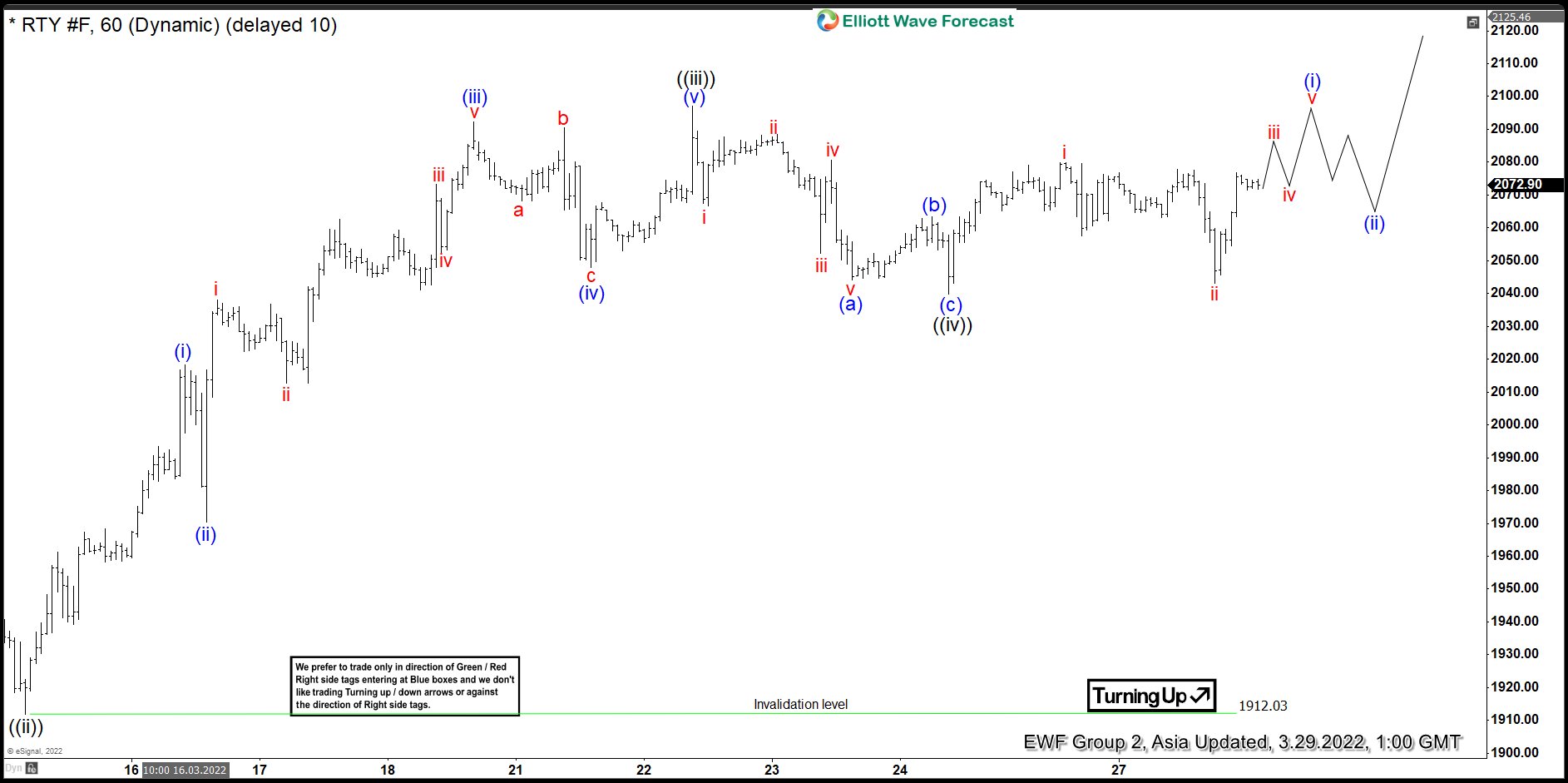

Short Term Outlook in Russell Futures (RTY) suggests the rally from February 24, 2022 low is in progress as a 5 waves diagonal Elliott Wave structure. Up from February 24 low, wave ((i)) ended at 2071.30 and dips in wave ((ii)) ended at 1911.80. From there, Index resumed higher in wave ((iii)) which ended at 2097. Internal subdivision of wave ((iii)) unfolded as a 5 waves impulse in lesser degree. Up from wave ((ii)), wave (i) ended at 2018.30 and pullback in wave (ii) ended at 1970.30. Index continued higher in wave (iii) towards 2086.90, dips in wave (iv) completed at 2047.90. Final leg higher wave (v) ended at 2097 which also completed wave ((iii)) in higher degree.

Pullback in wave ((iv)) ended at 2039.80 with internal subdivision as a zigzag Elliott Wave structure. Down from wave ((iii)), wave (a) ended at 2044.20, rally in wave (b) ended at 2063.40, and wave (c) lower ended at 2039.80. This completed wave ((iv)) in higher degree. Wave ((v)) is now in progress in 5 waves. Up from wave ((iv)), wave i ended at 2079.90 and pullback in wave ii ended at 2043. Near term, while Index stays above 2039.80, and more importantly above 1912, expect Index to extend higher in wave ((v)). As far as pivot at 1912.03 low stays intact, expect dips to find support in 3, 7, or 11 swing for more upside.