Chewy.com is an e-commerce company that specializes in pet food. Along with many other stocks, prices started a new cycle higher in March 2020. Chewy is now correcting that cycle. Lets take a look at the company profile and see what they do:

“Chewy, Inc. is an American online retailer of pet food and other pet-related products based in Dania Beach, Florida. In 2017, Chewy was acquired by PetSmart for $3.35 billion, which was the largest ever acquisition of an e-commerce business at the time. The company completed its initial public offering in 2019, raising $1 billion.

Following the acquisition, Cohen remained CEO and operated the business largely as an independent unit of PetSmart. Between 2017 and 2018, Chewy’s sales increased from $2.1 billion to $3.5 billion, with 66% of sales coming from customers signed up for automatic recurring shipments. In 2018, Chewy created Chewy Pharmacy, an online pharmacy providing pet-targeted prescription medications. Orders placed through the business are completed in coordination with a team of in-house veterinarians.”

Lets dig into the charts!

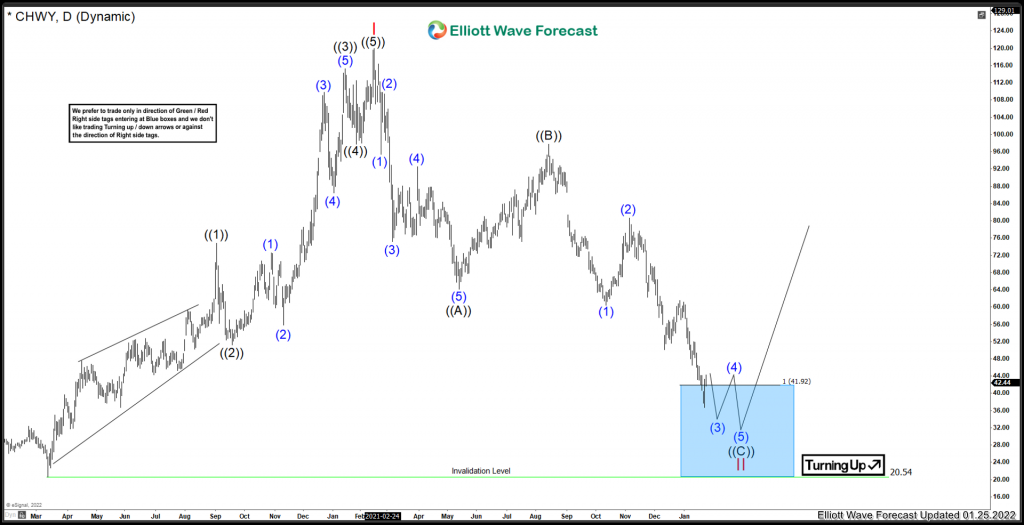

Chewy Elliottwave View:

As mentioned above, this stock made a new all time low in March 2020. After that, a new cycle higher has been established. From the all time low @ 20.54, the stock has rallied in 5 waves and peaked in February of 2021. Medium term term view from Feb 2021 peak set @ 120.00 . The pullback since the peak nearly a year ago, has been a fairly clean pullback. There is a clear 5 waves down into ((A)), bounce in ((B)). As a result, the stock is declining in the final leg before a larger bounce may take place. Currently, the momentum is suggesting that blue (3) and (4) still are needing to take place before a low can materialize.

It should be noted that there is a blue box that is present, from the 41.92 to invalidation level at 20.54. The blue boxes are areas where algos and buyers typically enter for a bounce.

In conclusion, prices absolutely have to stay above 20.54 low. Should that low get violated, then the stock would be back at all time lows erasing the rally from the March 2020 cycle low.

Risk Management

Using proper risk management is absolutely essential when trading or investing in a volatile stocks. Elliott Wave counts can evolve quickly, be sure to have your stops in and define your risk when trading.

Improve your trading success and master Elliott Wave like a pro with our 14 day trial today. Get Elliott Wave Analysis on over 70 instruments including GOOGL, TSLA, AAPL, FB, MSFT, GDX and many many more.

Back