Back in October 2019 we highlighted in this article that Yen crosses like NZDJPY and SEKJPY had reached the extreme areas down from their respective 2017 peaks and a bounce was due to take place very soon. Shortly after we published the article, we saw a strong reaction higher in the Yen pairs and we believe they are correcting the cycles from 2017 highs. Let’s take a look at the chart we shared in this article back in October 2019.

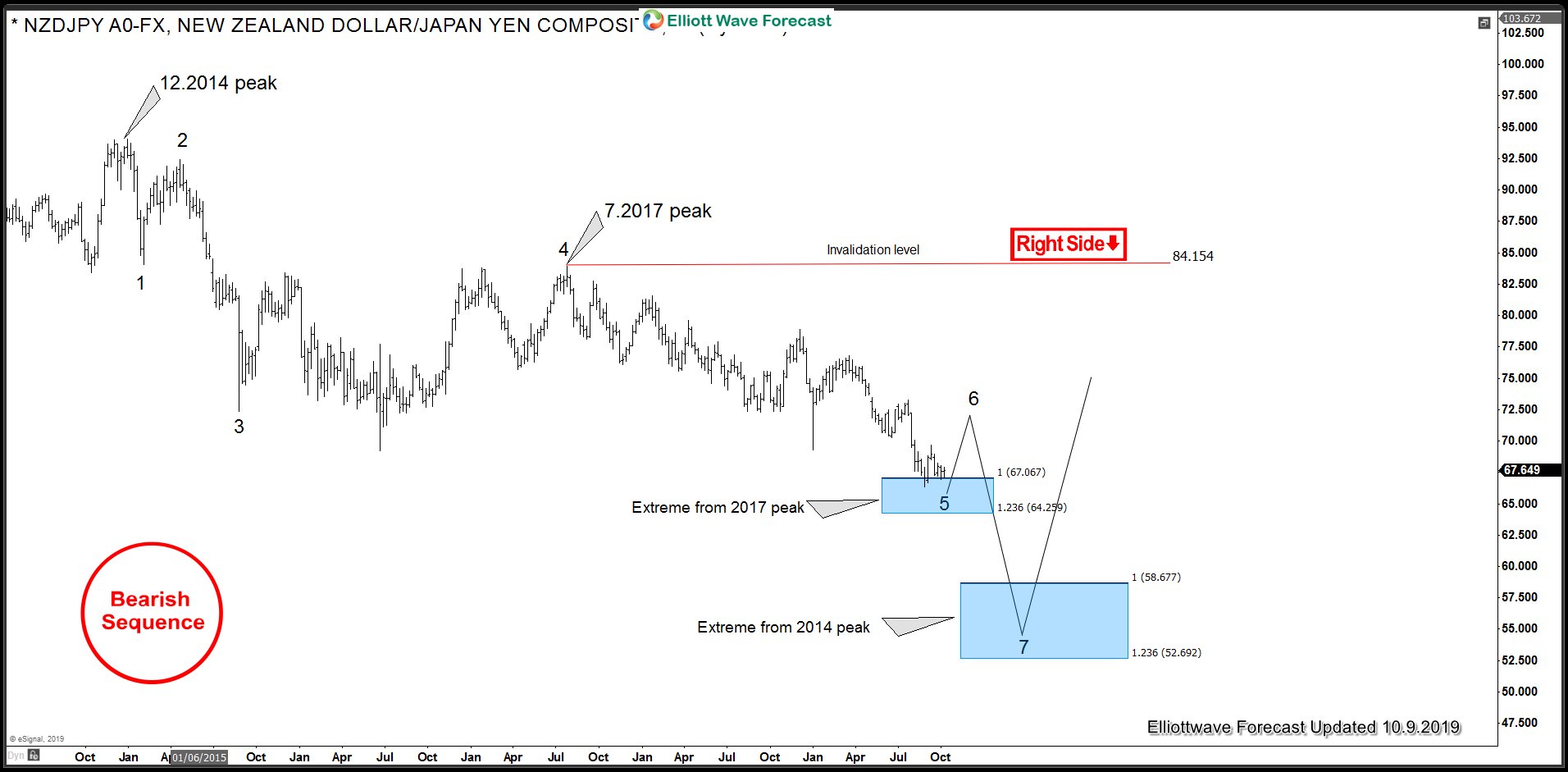

NZDJPY Weekly Chart from October 2019

Pair found a low within the blue box at 66.32 on August 26 2019 and didn’t make a new low after that. It formed a secondary low at 66.93 on October 2, 2019 and started rallying.

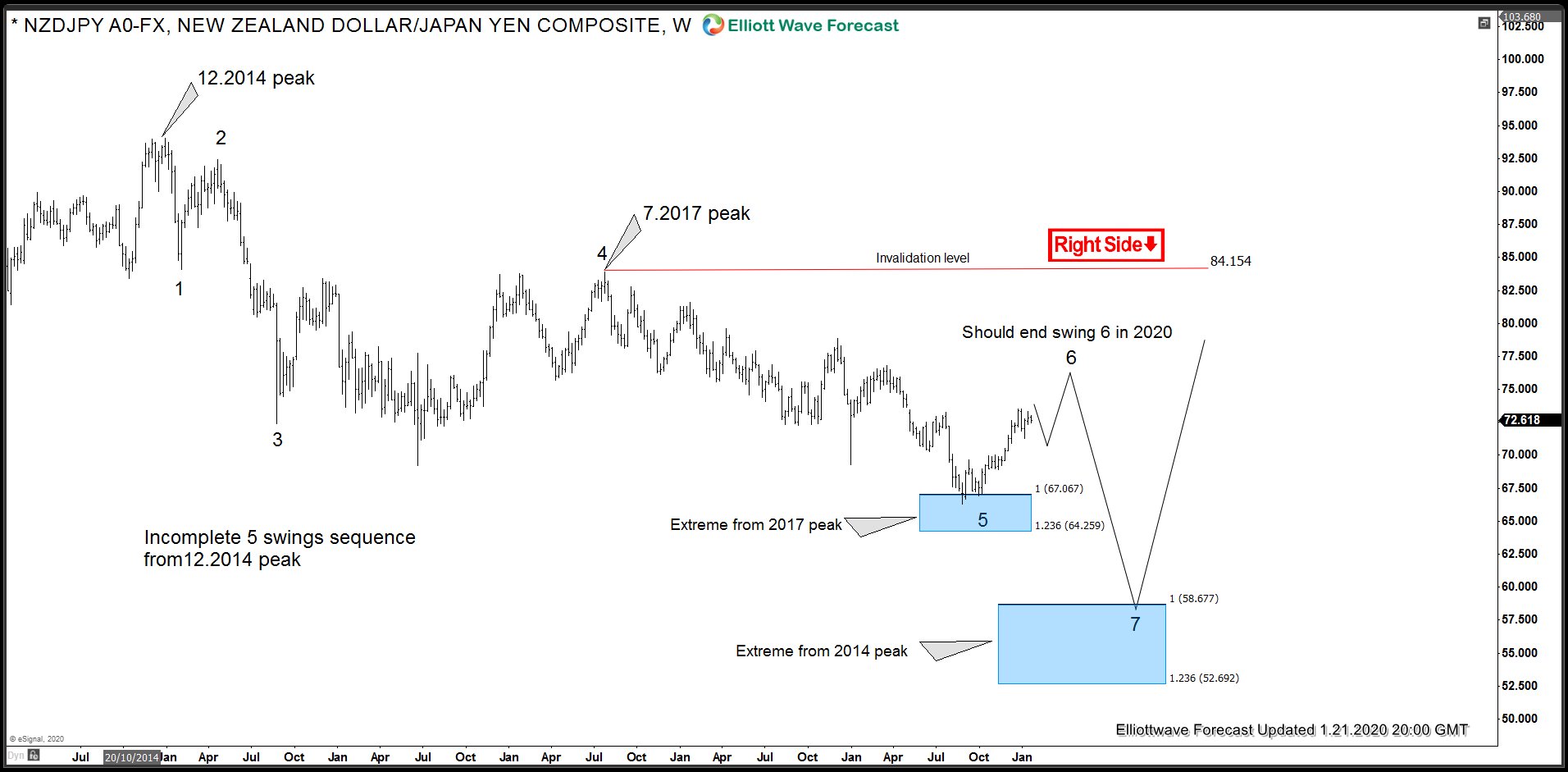

NZDJPY Latest Chart Updated 1.21.2020

NZDJPY rally from the secondary low of 66.93 on October 2, 2019 exceed 161.8 Fibonacci extension of the rally from 66.32 – 69.68 and hence hence why it has scope to make another high above 73.53 to complete 5 waves up from August 26. 2019 low before it pulls back in 3, 7 or 11 swings and makes another push higher to complete swing number 6.

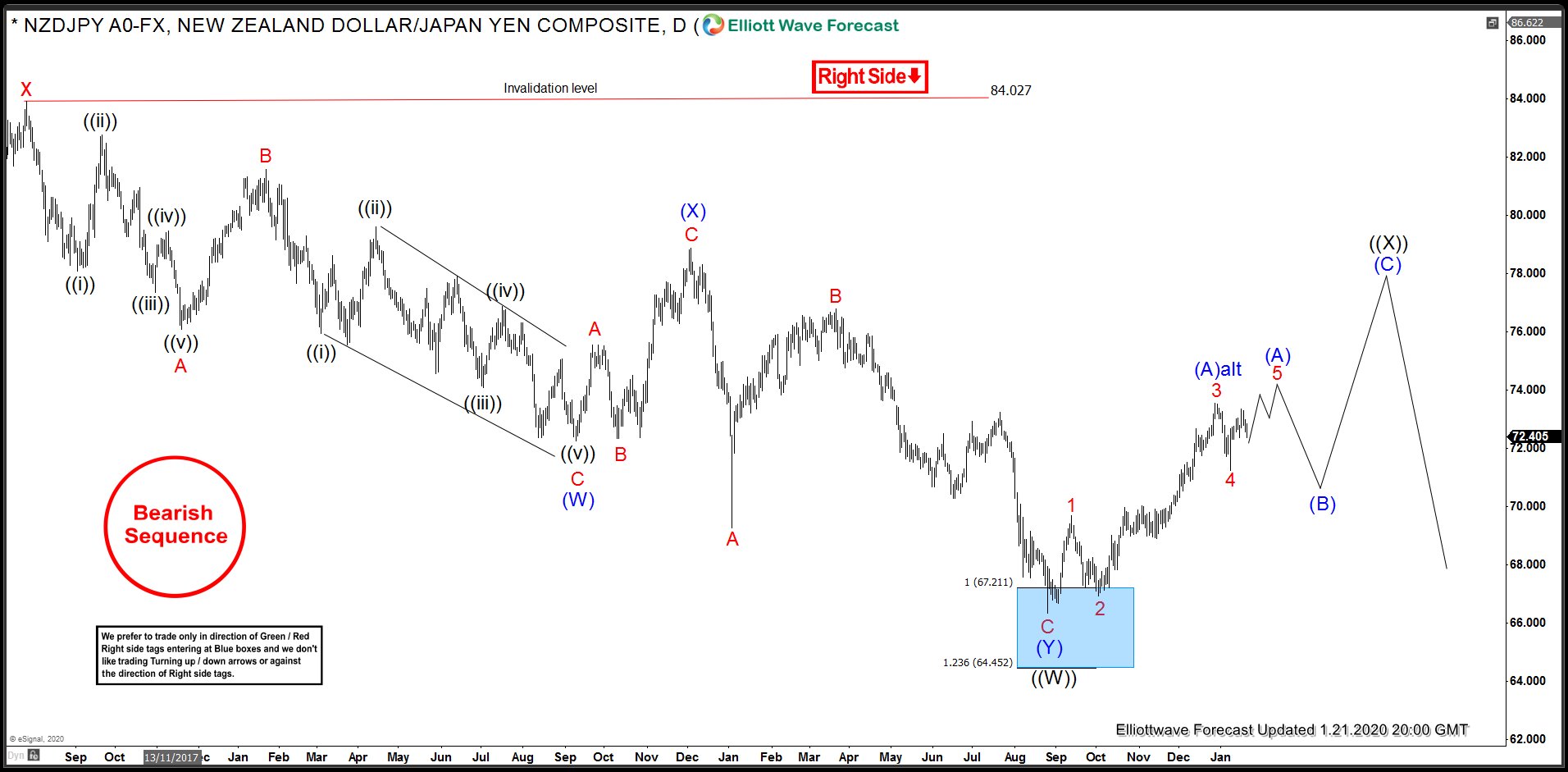

NZDJPY Daily Chart Elliott Wave Analysis 1.21.2020

Based one extension in wave 3, another high would be ideal to complete wave (A) before it makes a pull back in wave (B) which should unfold in 3, 7 or 11 swings before higher in wave (C) to complete a zigzag Elliott wave correction in wave ((X)). Alternatively, wave (A) already ended at 73.53 and pair started the pull back in wave (B) which should ideally unfold in 7 swings before it turns higher in wave (C) to complete wave ((X)). If wave (A) is already in place, then bounces should fail below 73.34 high for extension lower toward 70.98 – 69.50 area to end 3 swings down from the peak and from there it should bounce in 3 waves and turn lower again if wave (B) were to unfold in 7 swings. In either case, we expect wave (B) dips to remain supported in 3, 7 or 11 swings for another extension higher. In the higher degree, sellers should remain in control against 84.02 (July 2017) peak and after wave (C) rally higher, we expect sellers to appear to resume the decline for a new low toward 58.67 – 52.69 area or a 3 waves reaction lower at least.

Back