Russell Futures, today dropped below 5/13/2019 peak and now showing an incomplete sequence down from 5/6/2019 peak. In this blog, we will take a look at how our recent short-term forecasts in Russell Futures have played out and what we are expecting next. Below, we can see the short-term forecast from May 14 when we called a 3 waves decline from 5/6/2019 peak completed and called the Index futures to bounce in 3 waves at least.

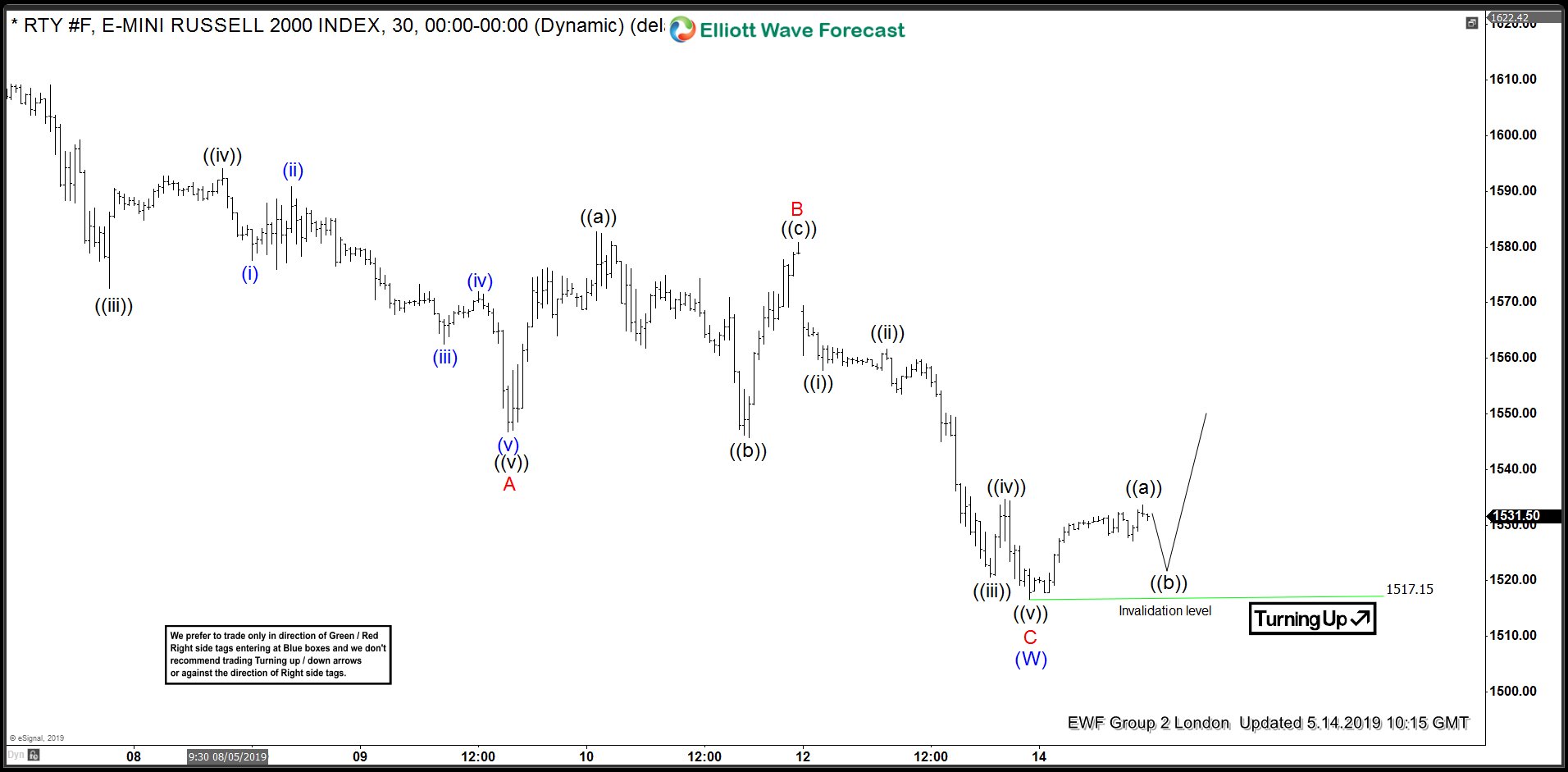

Russell Futures 5/14 1 Hour Elliott Wave Chart

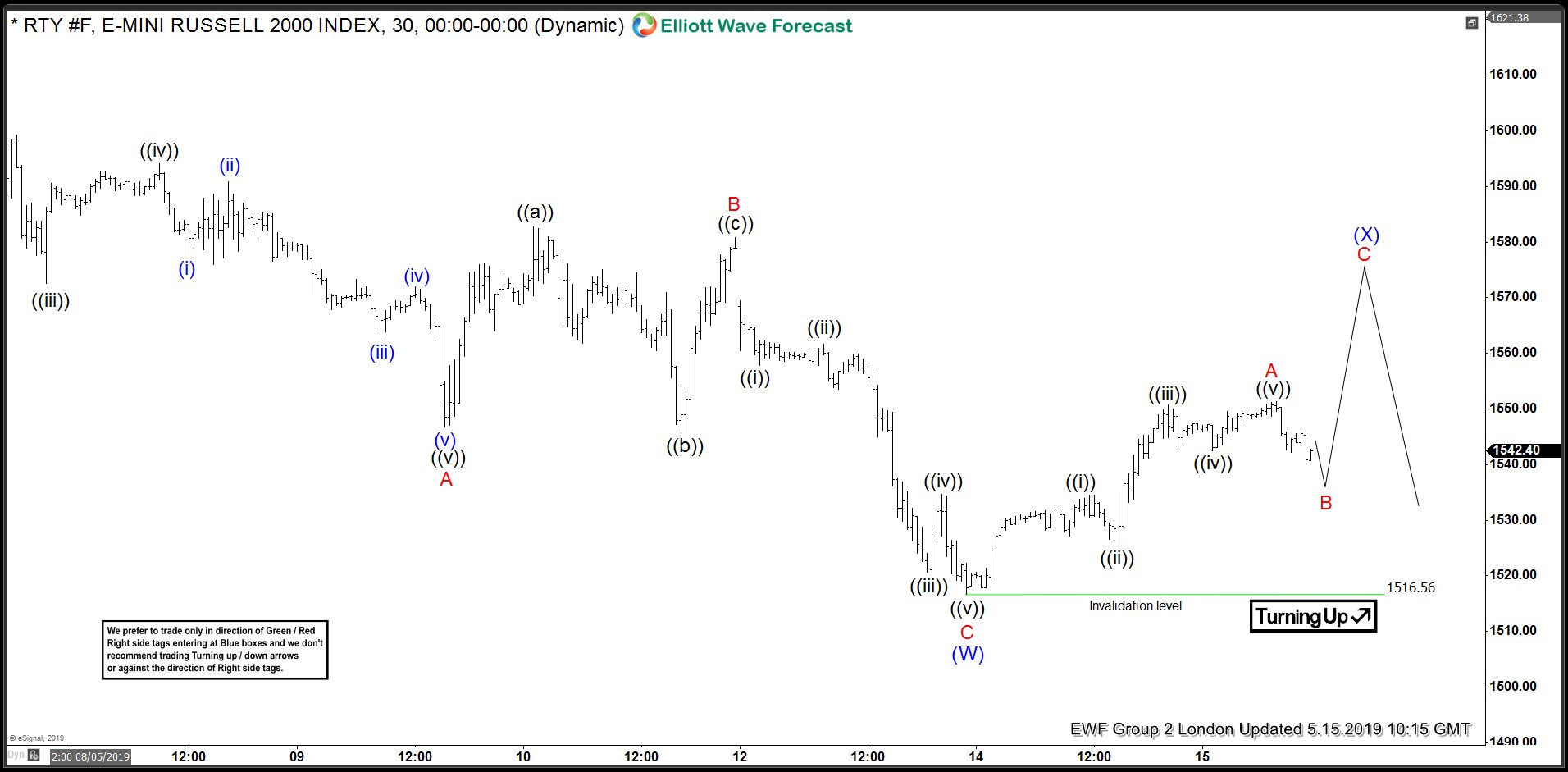

Russell Futures 5/15 1 Hour Elliott Wave Update

Rally from 1516 low was in 5 swings so we looked for a 3 waves pull back in wave B to hold above 5/13 low before another leg higher in wave C to complete wave (X) bounce. The low at 1516.56 needed to hold for this view to remain valid.

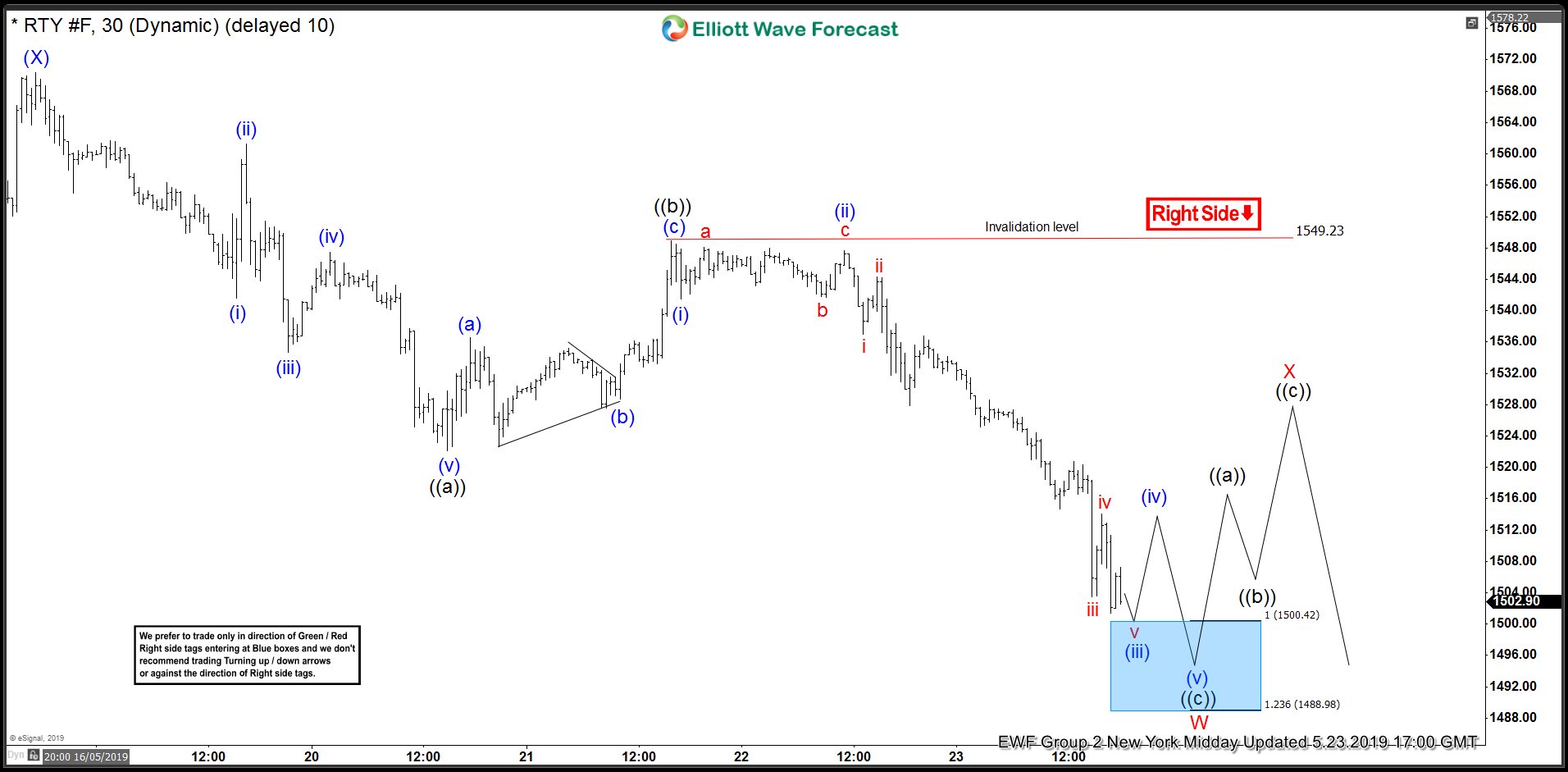

Russell Futures 17 May 1 Hour Elliott Wave Chart

Russell futures held above 1516.56 low and rallied as expected. The rally from secondary low at 5/15 unfolded in 3 waves instead of 5 waves so we adjusted the wave count for first leg up from 1516.56 low to be in 3 waves i.e. wave W and wave X connector to be an Elliott Wave FLAT. Russell Futures completed the bounce in the blue box between 1564.15 – 1585.75 and turned lower. The decline from the blue box is in 5 waves so we expect the bounce to fail below 1570.77 high for extension lower.

Russell 23 May 1 Hour Elliott Wave Update

Russell bounce in 3 waves to fail below 1570.77 high and has now broken below 5/13 low. This makes it a 5 swings incomplete sequence down from 5/6/2019 peak and calls for the next bounce to fail for more downside towards 1464 – 1398 area at least. Near-term focus is on 1500 – 1489 area to complete 3 waves down from 5/16/2019 peak. This area can produce a bounce which should fail and find sellers for another extension lower towards the above mentioned area (1464 – 1398)

Back