In this technical blog, we are going to take a look at the past performance of XLE Elliott Wave 1-Hour Charts that we presented to our members. In which, the cycle from 12/24/2018 low took place as a zigzag structure where wave (C) in intermediate degree unfolded as an ending diagonal structure. While a rally to $65.27 high ended wave 1 and a pullback to 2/08/2019 low $61.87 ended wave 2.

Up from there, the ETF rallied higher in 5 waves structure & made new high above the prior peak at $65.27 high confirming the next leg higher. It’s important to note here that with this rally higher the cycle from 12/24/2018 became bullish & right side turned green against $61.87 low. Therefore, our strategy remains buying the dips in 3, 7 or 11 swings as far as a pivot from $61.87 low stays intact. Now let’s take a quick look at past charts below.

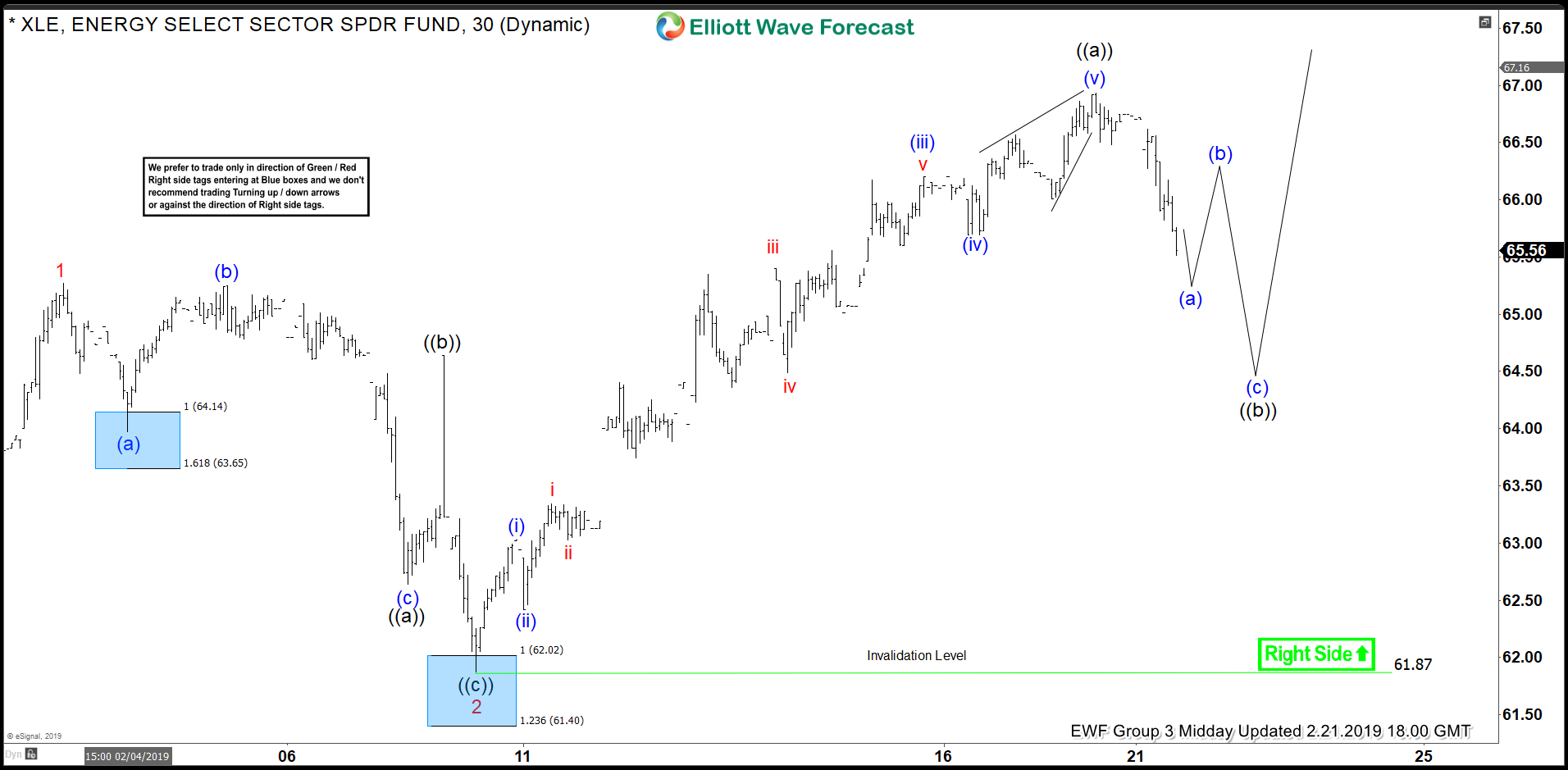

XLE 1 Hour Elliott Wave Chart From 2/21/2019

Above is the 1 hour updated Chart from 2/21/2019 Midday update, in which XLE the rally to $66.93 high ended wave ((a)) of a zigzag structure within wave 3. Down from there, ETF corrected the cycle from 2/08/2019 low $61.87 in wave ((b)) pullback & our strategy remain to buy those dips in 3, 7 or 11 swings looking for 3 wave reaction higher at least.

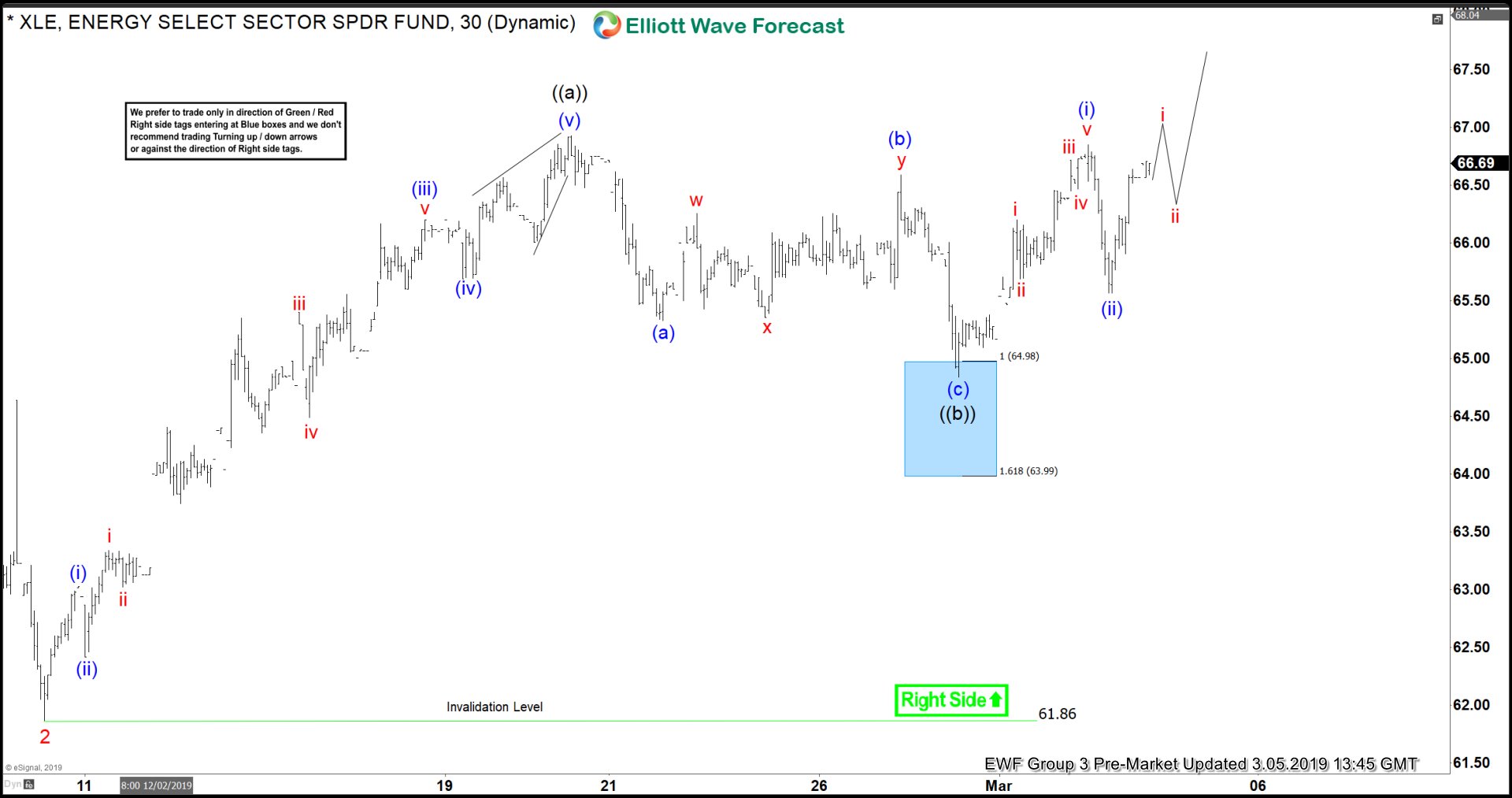

XLE 1 Hour Elliott Wave Chart From 2/28/2019

XLE 1 hour Chart from 2/28/2019 Pre-Market update, in which ETF is doing a 3 wave pullback in wave ((b)). The internals of that pullback unfolded as Elliott wave zigzag structure where lesser degree wave (a) at $65.33. Wave (b) bounce ended at $66.59 high and wave (c) of ((b)) was expected to reach 100%-161.8% Fibonacci extension area of (a)-(b) at $64.98-$63.99 blue box area before next leg higher starts. Therefore, we advised our members to buy that blue box area looking for another extension higher or for 3 wave reaction higher at least to allow them to go risk-free position.

XLE 1 Hour Elliott Wave Chart From 3/05/2019

XLE 1 Hour Chart from 3/05/2019 Pre-Market update, showing ETF reaction higher taking place from the blue box area at $64.98-$63.99 allowing members to create a risk-free position in that bounce. Blue boxes on our charts are high-frequency trading areas and are expected to produce reaction higher in 3 swings at least. The blue boxes are often referred to no-enemy areas as they have 85% probability to give us a reaction into the direction of right side tags (either Green/Red).

XLE 1 hour Elliott Wave Chart From 3/10/2019

1 Hour Chart from 3/10/2019 weekend update, showing ETF doing double correction lower & reaching another blue box area at $63.83-$62.83. Expecting ETF to make a reaction higher in 3 swings at least. Note, we have adjusted the count slightly based on distribution & pivot system.

Keep in mind that the market is dynamic and the view could change in the meantime. Success in trading requires proper risk and money management as well as an understanding of Elliott Wave theory, cycle analysis, and correlation. We have developed a very good trading strategy that defines the entry. Stop loss and take profit levels with high accuracy and allows you to take a risk-free position, shortly after taking it by protecting your wallet. If you want to learn all about it and become a professional trader. Then join our service by taking a Free Trial.

Back