Short Term Elliott wave View suggests USDJPY is correcting cycle from 2/2 peak (110.5) as an Expanded Flat Elliott Wave Structure. Flat is a corrective Elliott Wave structure with ABC label, and it has a subdivision of 3-3-5. In the case of USDJPY, Minor wave A ended at 197.9 on Feb 21 and Minor wave B ended at 105.23 on March 2.

Up from 105.23, Minor wave C rally is currently in progress as a diagonal 5 waves Elliott Wave structure. Minute wave ((i)) of C ended at 106.46, Minute wave ((ii)) of C ended at 105.43, Minute wave ((iii)) of C ended at 107.05, and Minute wave ((iv)) of C is expected to complete at 105.81 – 106.24 area. Near term, while pullbacks stay above 105.43, expect pair to extend higher towards 107.29 – 107.68 to end Minute wave ((v)) of C. The last push higher in Minute ((v)) of C should also complete Minor wave X and end correction to the cycle from 2/2 peak. Afterwards, pair should resume the decline or at least pullback in 3 waves to correct the 5 waves diagonal rally from 105.23 low.

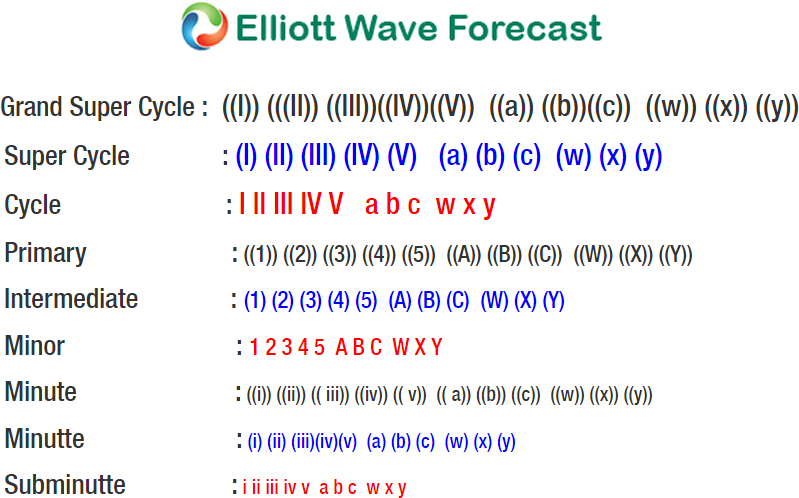

USDJPY 1 Hour Elliott Wave Chart

We provide precise forecasts with up-to-date analysis for 78 instruments. These include Forex, Commodities, World Indices, Stocks, ETFs and Bitcoin. Our clients also have immediate access to Market Overview, Sequences Report, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. In addition, we also provide Daily & Weekend Technical Videos, Live Screen Sharing Sessions, Live Trading Rooms and Chat room where clients get live updates and answers to their questions. The guidance of ElliottWave-Forecast gives subscribers the wherewithal to position themselves for proper entry and exit in the markets. We believe our disciplined methodology and Right side system is pivotal for long-term success in trading

Back