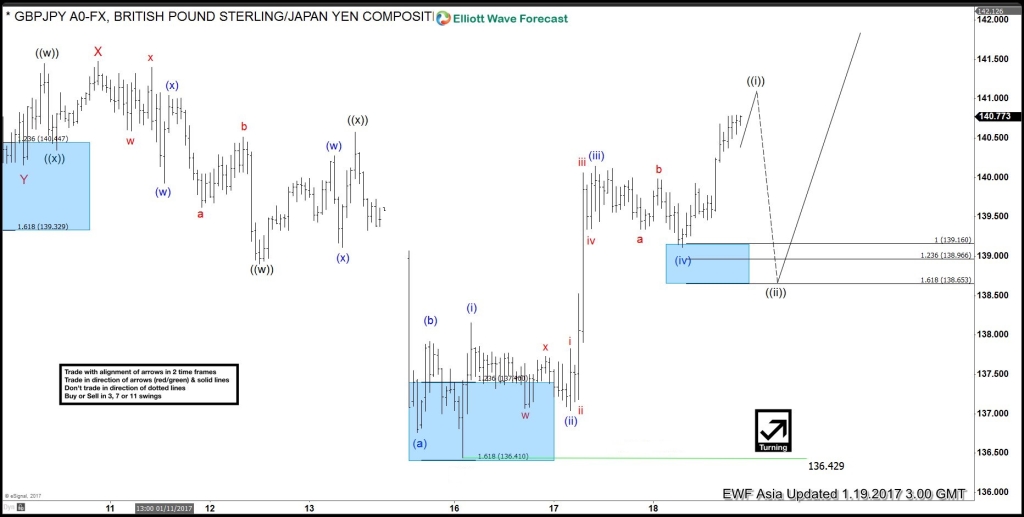

GBPJPY rally from 1/16 low (136.42) is unfolding as a 5 waves impulse which is expected to complete wave ((i)) of a Minute degree, as shown below in the 1 hour Asia chart from 1/19/2017. As far as momentum divergence is intact between wave (iii) and wave (v) of Minuette degree, the impulse structure remains valid. If RSI divergence is erased, then the structure would become a double three i.e. ((w))-((x))-((y)) and rally can extend to 142.85 – 143.73 area before cycle from 136.42 low ends and we get a pull back in the pair.

Elliott wave theory suggest that after a 5 waves move (unless 5 waves complete wave C of a FLAT structure), there should be a 3 waves pull back and another 5 waves move in the same direction higher. So after finishing the first leg higher in wave ((i)), pair should see a 3 swing pullback soon today before another extension higher happens in 5 waves as far as pivot at 1/16 low (136.42) remains intact.

GBPJPY 1 Hour Chart

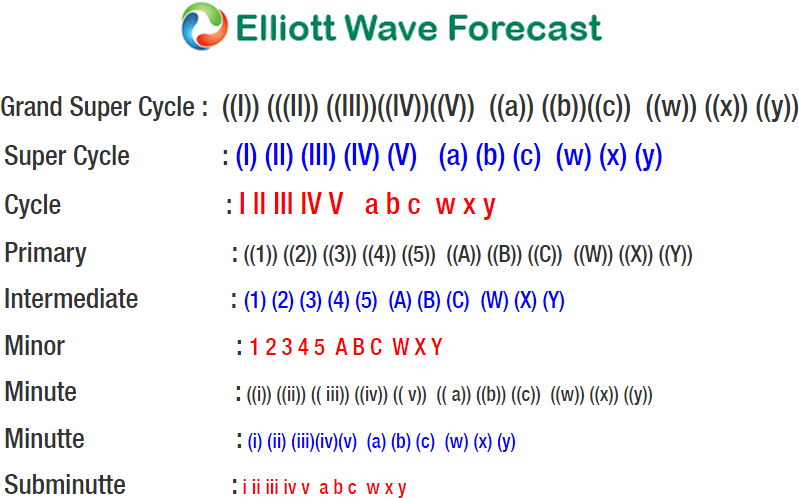

Elliott Wave Degree Reference

At Elliottwave-Forecast, we provide Elliott Wave charts in 4 different time frames, up to 4 times a day update in 1 hour chart, two live sessions by our expert analysts, 24 hour chat room moderated by our expert analysts, market overview, and much more! Try us out for free 14 day trial & starts making profits with us.

Back