Gold (XAU) topped out on the May 18/2015 high and since then it has reversed and been moving to the down side. We, at Elliottwave-Forecast, strive to keep our members on the right side of the markets and we encourage members to enter trades at precise selling/buying areas. Take a look at the charts below and see how we advised our members to SELL the bounce in 4 different areas.

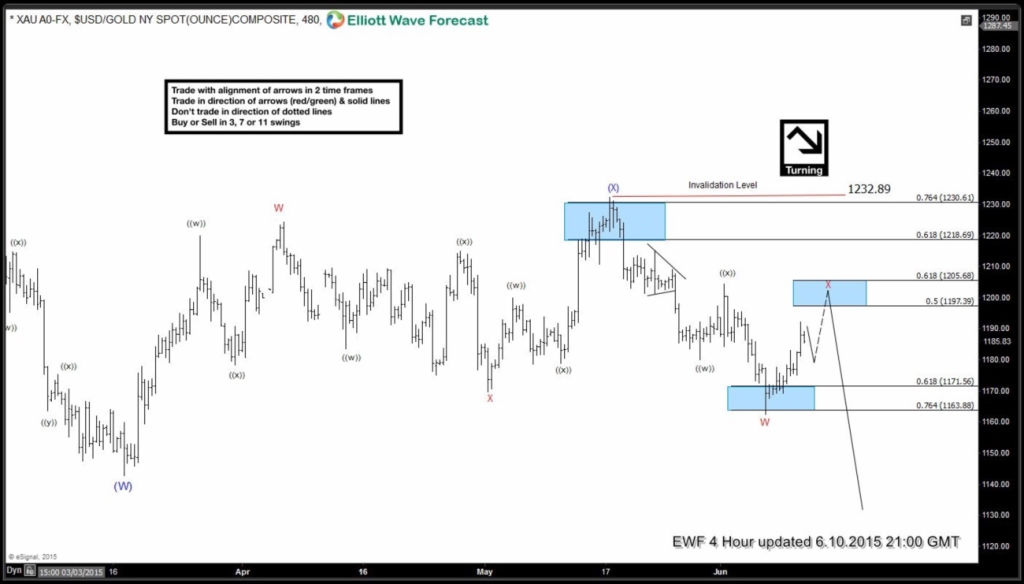

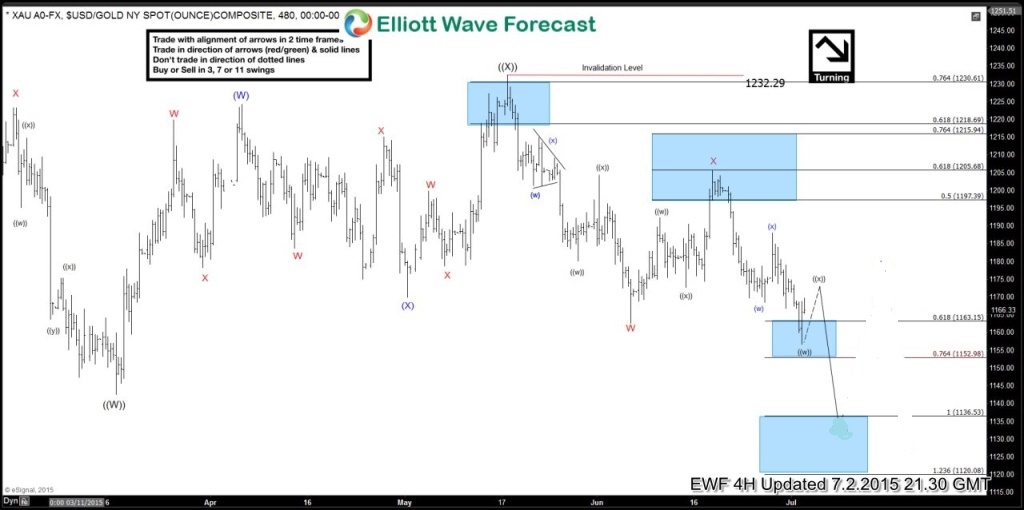

June 10/2015 4H Chart : Advising members to wait for the retrace and look to SELL the bounce at the 0.50-0.618 fib levels 1197-1205 area. We always advise our members to SELL/BUY in 3,7,11 swings.

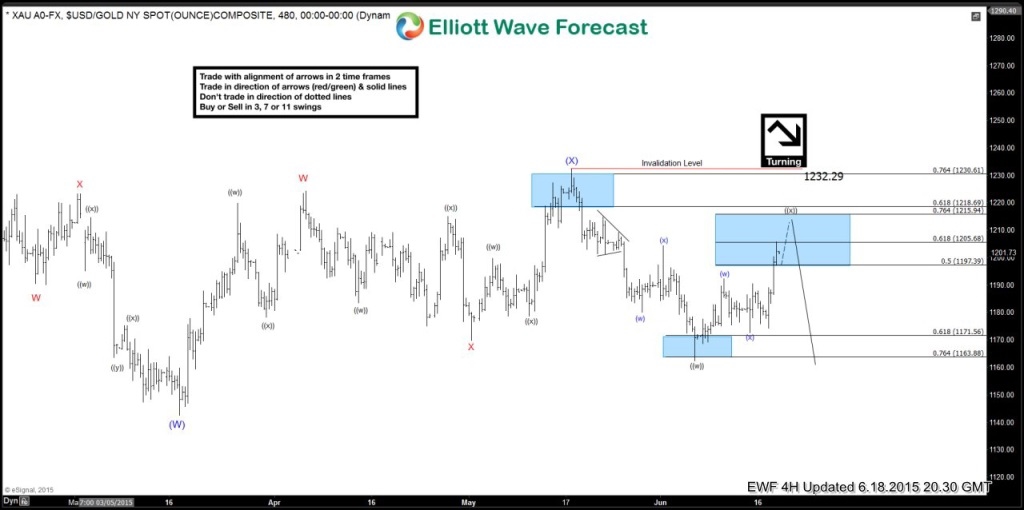

June 18/2015 4H Chart : Price retraced in 3 swings and is in the proposed selling area of 1197-1205 0.50-0.618 fib level. We advised our members to SELL Gold with a Stop Loss at the 1232.29 invalidation level.

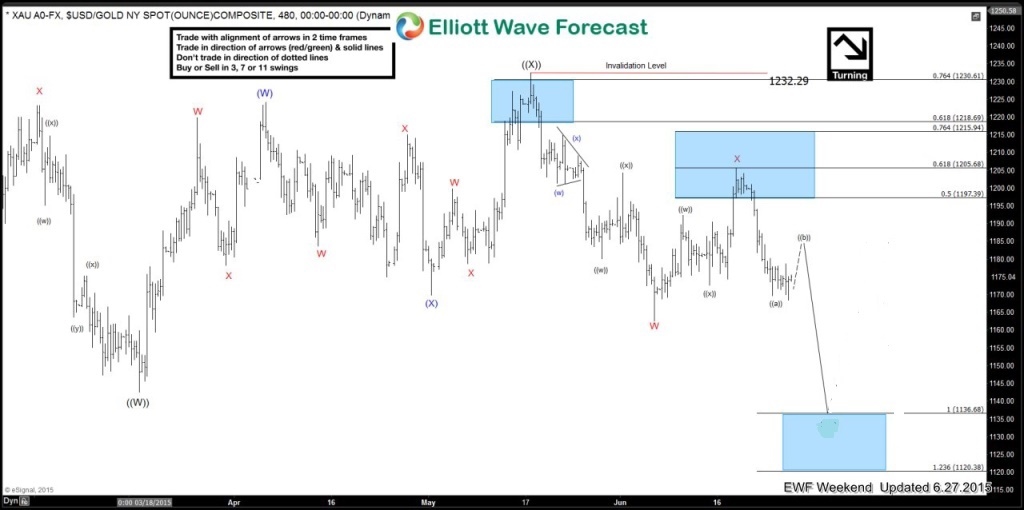

June 27/2015 4H Chart : Gold moved lower from the 1st selling area and a 2nd selling opportunity presented itself. We advised members to SELL the bounce at the 0.50-0.618 fib level of the wave ((b)) retracement. Targeting the 1136.68 equal legs level.

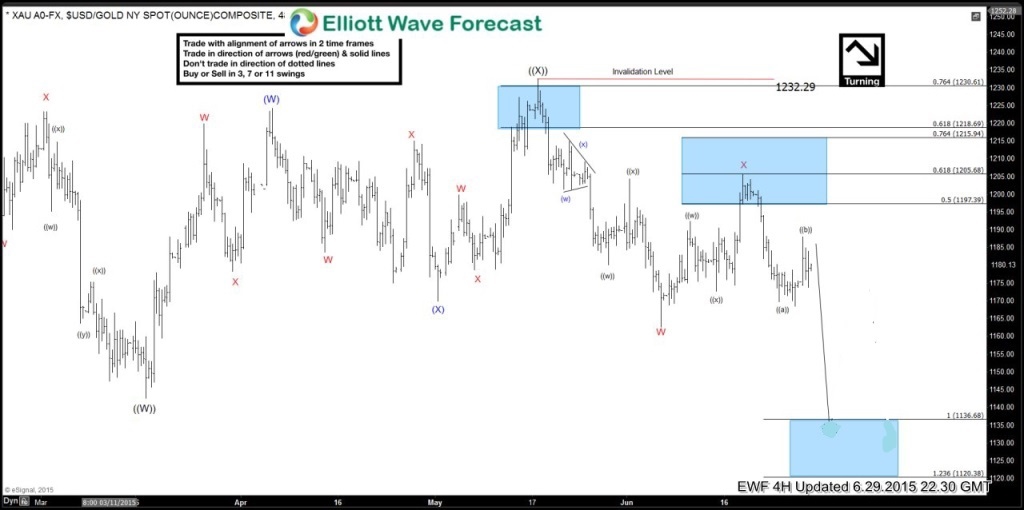

June 29/2015 1H and 4H Chart : Price retraces to the 2nd selling area at the 0.50 fib level and reverses. Stop Loss/Invalidation Level has now been lowered to 1205.93

July 2/2015 1H and 4H Chart : Gold continues lower and a 3rd selling opportunity presents itself and we advise members to again SELL the bounce at the 0.50 fib level 1177 area. Stop Loss/Invalidation Level has been lowered to 1188.20

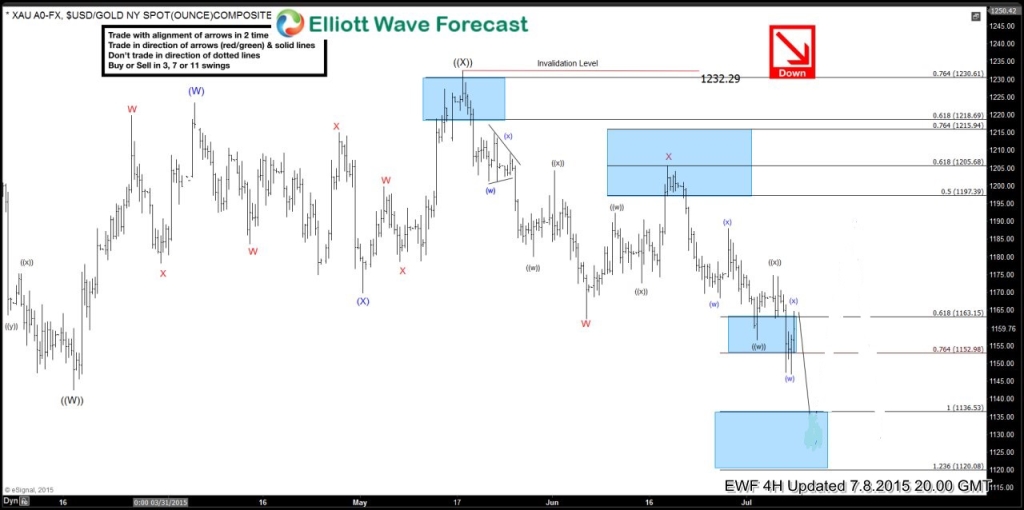

July 8/2015 1H and 4H Chart : Price moved lower from the proposed July 2 selling area. Price wants to bounce again and the 4th selling opportunity presents itself. We advised members to SELL in the 1160-1164 area 0.50-0.618 fib level. Stop Loss/Invalidation Level has been lowered to 1174.67.

Our target remains the same at 1136.68 and we believe if 1174.67 peak holds, Gold will move lower and finally hit the equal legs target we been forecasting since the 10th of June.

At EWF we update our 4H charts everyday and our 1H charts 4 times a day so our members are always in the loop for the next move.

To get access to all of our 42 instruments that we cover subscribe to a monthly plan or take the 14 day trial.

Just click here to get started -> 14 DAY TRIAL

Back