There are 3 major key factors in Trading that every professional trader should have:

1. Ability to forecast the market

2. Good Money management

3. Good Psychology.

It’s crucial for all three factors to be included in order to succeed. If just one of these 3 mentioned factors is missing, the trader will fail.

In this blog we’re going to get through some important tips on how to improve Money Management strategy.

Before we continue, here’s a short reminder: check out New EWF blogs and Free Elliott Wave charts.

2% rule

This one is the key money management tip for Forex traders, even if it sounds quite basic. The Rule says: Don’t risk more than 2% of your trading account per each trade. That way you’ll be able to make rational decisions and trade without emotions. Let’s assume your account size is $20.000. In that case you should risk no more than $400 per trade regardless of how much your setup is strong. You never know which trade is going to be a winner and which one is going to be a loser, so always keep your risks low. Using high leverage could work in your favor but against you, as well. If you choose to risk 2% per each trade, be consistent.

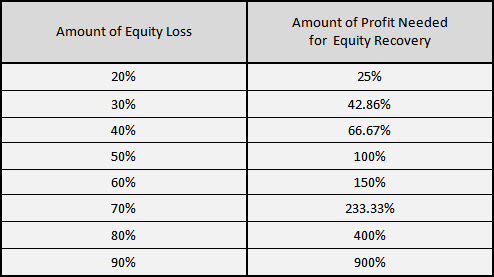

Traders who don’t follow this rule are more prone to making a huge drawdown in their equities. Once the drawdown is made, it’s harder to recover that amount than making it in the first place. For example, if you lose 20%, you will have to make 25% profit of new balance to get your equity at the starting level. So let’s say starting equity is $100000, loss of 20% is $20000. Consequently the new balance is $80000 and $20000 is now 25%. The table below shows that the bigger the loss is, the harder it is to recover.

Have goodRisk /Reward Ratio

A risk/reward ratio is a ratio used by many traders to compare the expected returns of an investment to the amount of risk put in. This ratio is calculated mathematically by dividing the amount trader stands to lose by the amount of profit the trader expects to have made when the position is closed. The higher potential reward is, the ratio is better. Let’s say you’re willing to put 2% of your trading account at risk for one particular trade, you should expect at least 4% of profit to be made. Trade only the setups with good Risk/Reward ratio at least1:2 ,even better 1:3 or 1:4…

Have a plan for each trade you make

Always use stop loss to protect your account. If you are unwilling to put stop loss and take loss early when the setup is invalid, you should not consider trading, because sooner or later you will end up blowing your account.Before entering the trade you should be aware there is a chance it could turn against you, so a level where your stop loss is going to be triggered should always be prepared in advance. That way you will be able to calculate proper position size and protect your capital in case of strong moves against your position during high volatility periods. Besides stop loss level, you should also know in advance where your potential target is in order to check the validity of Risk/Reward. Anything worse than 1:2, might not be worth trading.

Don’t trade with anything other than risk capital

You never want to use money meant for living, like money for food, rent or bills. And certainly you don’t want to trade with borrowed money. The best way to avoid getting into trouble is to trade only with a risk capital – the money you can afford to lose. Risk capital is safe to use because it is expendable and losing it won’t cause you to lose the roof over your head.

After all, have Realistic Expectations. Some brokers would like you to believe that making money by trading is easy.It’s not real to have expectations to make 30%- 50 % income every month. If you’re able to make that profit on annual basis by risking 2% per each trade, you can consider yourself a very good trader.

Elliott Wave Forecast keeps you on the right site of the Market, providing you with High probability trading Setups through Daily Elliott Wave Setup videos and Live Trading Room.

Elliott Wave Forecast

We cover 78 instruments in total. We present Official Trading Recommendations in Live Trading Room. If not a member yet, Sign Up for Free 14 days Trial now and get access to new trading opportunities. Through time we have developed a very respectable trading strategy which defines Entry, Stop Loss and Take Profit levels with high accuracy.