Last year, our live trading room provides 69% return annually across the 3 groups that we cover. In Live Trading Room, we scan the market everyday to find any tradable setup. We believe every serious traders need to have a good trading system with specific rules. A complete system must include the following: 1. Conditions […]

-

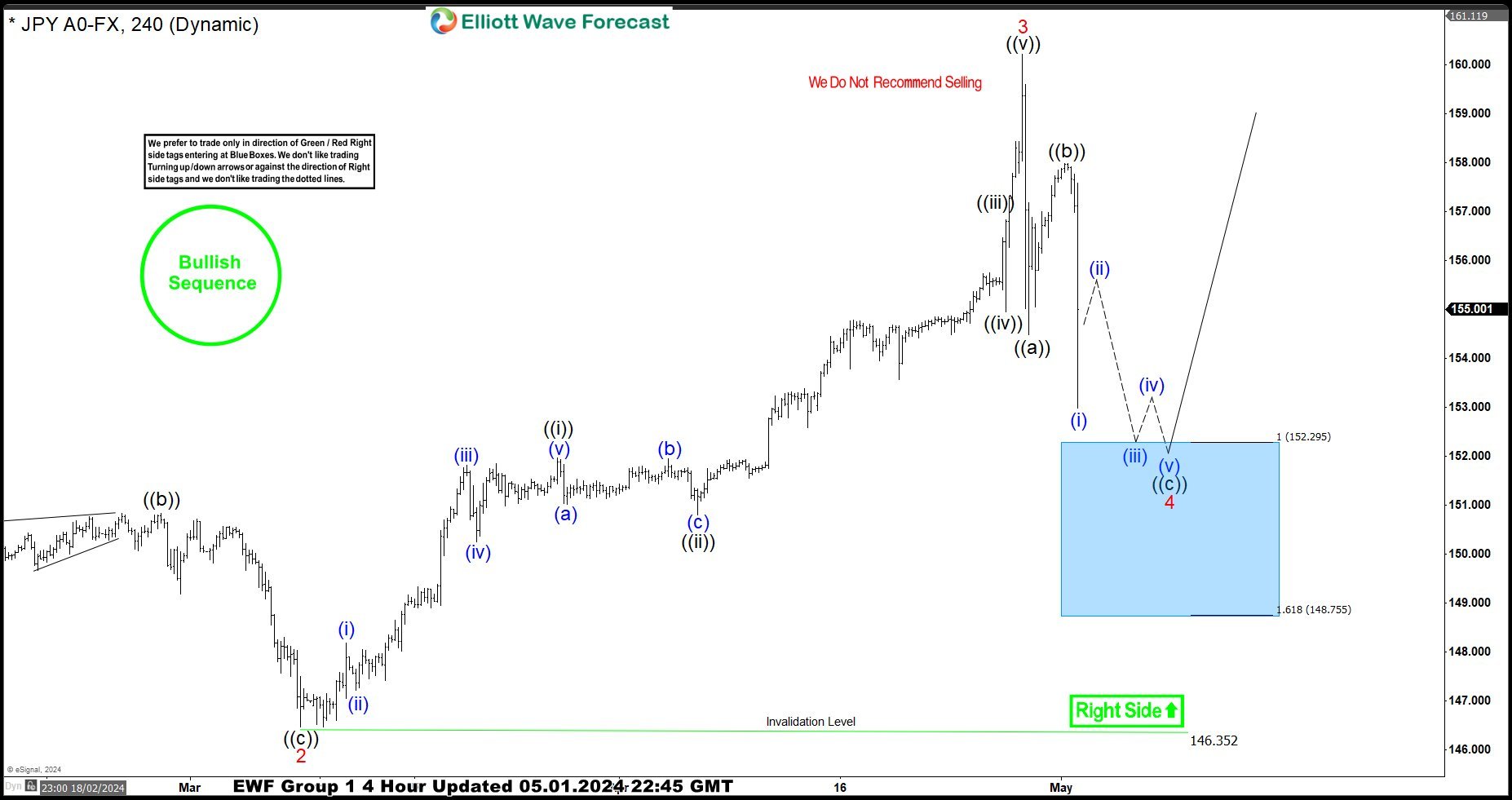

USDJPY Elliott Wave : Buying The Dips At The Blue Box Area

Read MoreHello fellow traders. In this technical article, we’re going to take a look into the Elliott Wave charts of USDJPY, exclusively presented in the members’ area of our website. As our members know USDJPY has recently made pull back that made clear 3 waves down from the April 29th peak . The pair completed correction […]

-

XME Elliott Wave : Buying The Dips at the Blue Box Area

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of XME ETF, published in members area of the website. As our members know XME is showing impulsive bullish sequences and we have been favoring the long side of the ETF. Recently, we experienced a pullback […]

-

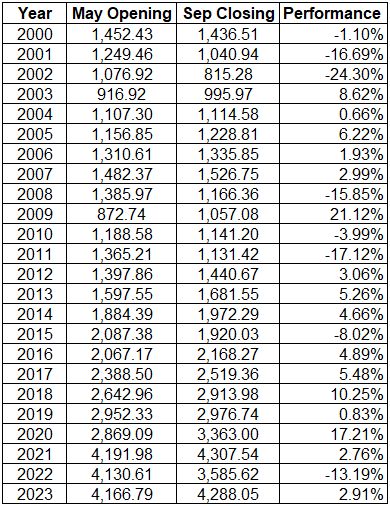

Is The Phrase “Sell in May and go away” an Urban Legend?

Read MoreThe phrase “Sell in May and go away” originated in England in 1776, more specifically in London’s financial district. The full version of the saying was “Sell in May and go away, come back on St. Leger’s Day,” referring to the St. Leger’s Day horse race (September 15th). This adage got famous in 1930s. It is […]

-

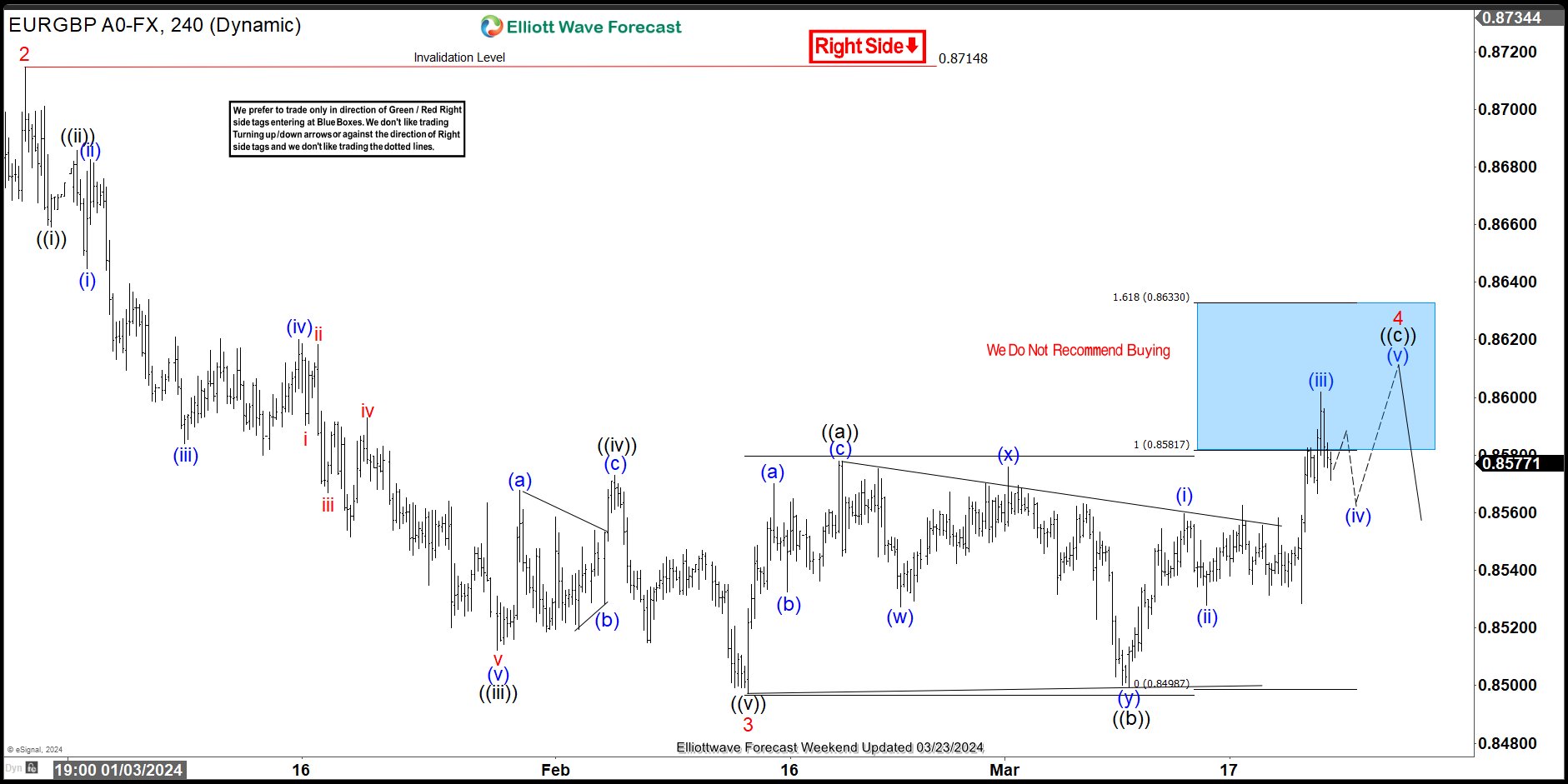

EURGBP Elliott Wave : Selling The Rallies at Blue Box Area

Read MoreHello fellow traders. In this technical article we’re going to take a quick look at the Elliott Wave charts of EURGBP published in members area of the website. Our team recommended members to avoid buying , while keep favoring the short side in the pair. Recently we got recovery that reached our selling zone. The […]

-

SPX Perfect Buying Opportunity At The Blue Box Area

Read MoreIn this blog, we take a look at the past performance of SPX charts. The index provided perfect buying opportunity at the blue box area.

-

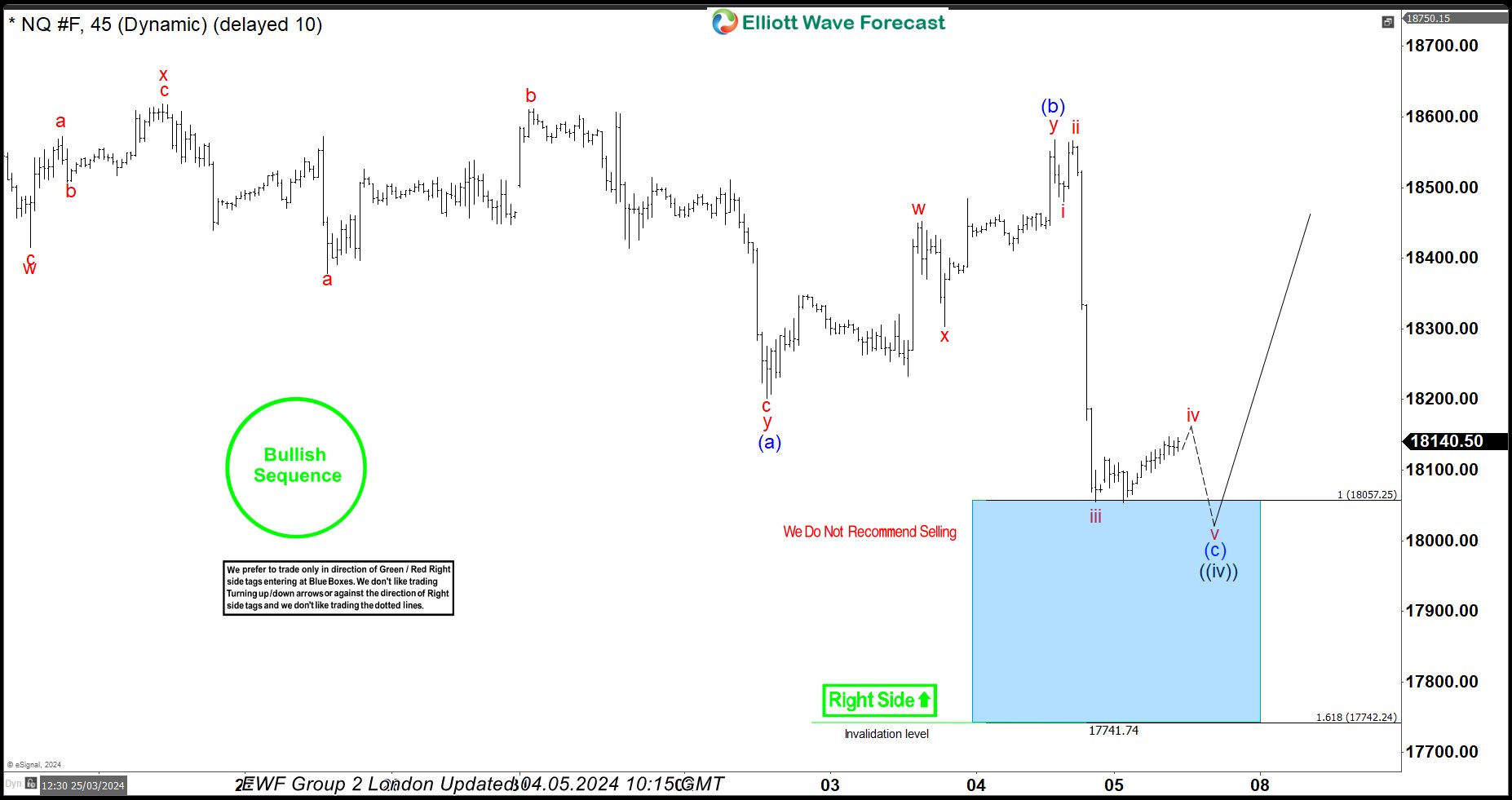

NASDAQ NQ_F: Another Ongoing Buying Setup with Partial Profits Taken

Read MoreIn this technical article, we are going to present another Elliott Wave trading setup we got in NASDAQ Futures (NQ_F) . The futures has extended pull back, giving us another buying opportunity. NQ_F completed correction at the Blue Box Area. In the next parts, we’ll explain the Elliott Wave pattern we saw and discuss the […]